Are you curious to know What are the Best Military Debt Consolidation Loans? You’re in the right place.

An active duty service member may have difficulty managing credit card debt, personal loans, and other unsecured debts. It may be difficult for you to handle your finances due to a lack of time. All outstanding debts can be paid conveniently through one method.

Military Debt Consolidation Loans are a financial tool for former and current military personnel. An important benefit of this debt management program is that it consolidates numerous debts into one. This makes it easier for you to pay and manage your debt. Furthermore, it allows you to focus more on important matters, such as family and work.

Military families face many financial difficulties. Military Debt Consolidation Loans can help them better manage their finances and address these challenges.

The following article provides all the information regarding the Best Military Debt Consolidation Loans without any complicated procedures.

Without further ado, let’s begin.

What is Debt Consolidation?

Contents

- 1 What is Debt Consolidation?

- 2 How Does Debt Consolidation Work?

- 3 What Are Military Debt Consolidation Loans?

- 4 How Military Debt Consolidation Loans Work?

- 5 Top Best Military Debt Consolidation

- 6 Eligibility Criteria For Best Military Debt Consolidation Loans

- 7 How To Apply For The Best Military Debt Consolidation Loans?

- 8 Advantages of Military Debt Consolidation Loans

- 9 Alternatives to Best Military Debt Consolidation Loans

- 10 Pros and Cons of Best Military Debt Consolidation Loans

- 11 Tips For Best Military Debt Consolidation Loans

- 12 Other Types of Military Financial Assistance Programs

- 13 FAQs

- 13.1 Can The Military Help You Pay Off Debt?

- 13.2 What Are Military Debt Consolidation Loans?

- 13.3 Is There Debt Forgiveness For Veterans?

- 13.4 Does The Department of Veterans Affairs offer Debt Forgiveness Programs?

- 13.5 Can Student Loan Debts Be Consolidated?

- 13.6 Can The Military Help Pay off Debt?

- 13.7 Does The Military Help With Credit Card Debt?

- 14 Conclusion

The debt consolidation strategy involves combining all your outstanding debts into one loan with just one monthly payment. There are many ways you can consolidate debt. For instance, you can combine your credit cards with student loans or mortgages. Some borrowers can pay back their debt more effectively through consolidation; however, it does not erase all debt.

A two-fold goal lies at the heart of consolidation. The first benefit of consolidation is that multiple monthly payments, often due to different lenders, are combined into one payment, which is easier to manage. A second benefit is that repayment can be made cheaper. The total interest paid over the life of a loan can be reduced by consolidating multiple balances into a single loan with a lower interest rate.

How Does Debt Consolidation Work?

The interest rate on most debt consolidation loans remains constant, and you make the same monthly payment. You can streamline your debts by settling balances from multiple credit cards with various interest rates and minimum payments, reducing your management to a single monthly payment instead of several.

What Are Military Debt Consolidation Loans?

Military Debt Consolidation Loans program is one of the many benefits of being part of the US military. It is also called a VA Consolidation Loan. Military Debt Consolidation Loans (MDCL) are special loans that provide cash as part of your repayment plan. The program can help military personnel manage their finances more effectively.

Veterans who consolidate their debt can receive more cash than they owe if they finance their current outstanding loans over what they owe. Closing costs also reduce the amount a service member receives from Military Debt Consolidation Loans.

The process of consolidating military debt is similar to the process of consolidating regular debt. Taking out a single loan through this program will consolidate your debt. Credit cards, payday loans, and medical bills are all unsecured debts that can be consolidated with Military Debt Consolidation Loans. Your finances can then be easily managed by committing to a monthly payment plan from a single lender.

How Military Debt Consolidation Loans Work?

If you are already familiar with the concept of debt consolidation, the process of military debt consolidation loans will be familiar to you. A unique aspect of this debt management program is that the money you receive is used to pay off outstanding debts instead of buying a particular service or product. Once you have consolidated your debts, you must repay the financial institution or entity that consolidated your debts with interest.

You owe $7000 in credit card debt, student loans, and the like, including credit card debt, student loans, and the like. The total cost of all of these debts can amount to thousands of dollars, and it may take years to pay them off. As soon as you start factoring in late fees, interest rates, and other fees, the final cost increases even further.

Military Debt Consolidation Loans provide you with the funding necessary to pay off all your creditors in full when you receive approval from your lender of choice. Your next step is to pay the chosen military debt consolidation lender. Due to its flexibility, convenience, and simplicity, you may save thousands of dollars with this debt relief assistance.

The military debt consolidation loan provides you with the funding necessary to pay off all your creditors in full when you receive approval from your lender of choice. Once you’ve chosen a debt consolidation lender, you must pay them. In turn, this debt relief assistance may save you thousands of dollars in the long run by providing flexibility, convenience, and simplicity to reduce your monthly payment commitments.

This program can greatly assist you if you struggle with credit card interest rates. Having one monthly payment means you won’t have to worry about paying various entities.

Top Best Military Debt Consolidation

USAA

Among the services offered by USAA are financial services for active-duty military personnel, Veterans, and their families. Those who have served in the military with an honorable discharge are eligible to join. As mentioned above, USAA debt consolidation uses personal loans. A borrower’s credit score determines the loan interest rate between $2500 and $20,000. A personal loan from them usually has an interest rate of less than 10%, similar to a traditional loan’s interest rate. You will be charged a maximum of 18.51%. The rate discount is 0.25% for autopay customers as well.

Credit card debt consolidation aims to reduce your interest payments on your cards. Even a high-interest USAA personal loan would reduce that by at least 1%. The interest rate on a 10% loan can save you hundreds of dollars.

A Navy Federal Financial Credit Union was formed in 1933 to serve the families of military personnel and veterans. It provides various financial services, including checking and savings accounts, credit cards, loans, and financial education.

Navy Federal’s personal loans are good for consolidating debt, and the credit union will pay your creditors directly. It is common for Navy Federal loans to be funded the same business day they are approved. A borrower can borrow $250 to $50,000 for 60 months with no origination fees. There is a range of APRs between 7.49% and 18%. Veterans and military families have been served by this credit union since 1933. A personal loan from this company is a good choice for consolidation.

Pentagon Federal Credit Union

A military member-only credit union, PenFed served military families for many years. The event is now open to everyone.

You can prequalify without a hard credit check for PenFed personal loans, and there are no origination or prepayment fees. The application process is open to non-members as well as members, but you must be a member to participate.

Currently, these loans are available only to borrowers who have good credit, which makes them ideal for debt consolidation. It is possible to obtain joint or cosigned loans. The loan is funded within 48 hours of approval. You can borrow between $600 and $20,000 without paying an origination fee for 36 to 60 months. There are a range of APRs between 6.49% and 17.99%. Credit unions like this used to serve only military members, but now they’re open to everyone. Prepayment or origination fees are not charged on their personal loans. Additionally, they offer joint and cosigned loans.

Service Credit Union

A New Hampshire-based credit union that primarily serves current and former military members. Members can join the credit union anywhere in the world since there is no fixed geographic area.

You can consolidate your debt with a personal loan at a competitive rate. If you’re looking for a loan, it’s worth taking a closer look at the Service Credit Union website! The National Credit Union Administration regulates and charts Service Federal Credit Union, New Hampshire’s largest credit union. More than 321,000 members worldwide are members of Service Credit Union, which had over 4.5 billion USD in assets as of Q4 2020.

Security Service Federal Credit Union

Credit Union Security Service Federal Credit Union has branches in Texas, Colorado, and Utah. Although residents of these states can only get loans in these states, they provide a good option for consolidating debts.

There are now over 2600 ways to join the credit union, which was once exclusively for military servicemen and their families.

You can consolidate your debts with Security Service Federal Credit Union by paying off your creditors and closing your accounts. It’s just a matter of making your loan payments. It is a financial cooperative operated by the Security Service Federal Credit Union. The union offers a wide range of financial solutions, including loans, investments, savings, credit cards, and online banking. Texas is the home state of the Security Service Federal Credit Union.

Eligibility Criteria For Best Military Debt Consolidation Loans

Military Debt Consolidation Loans require you to meet several requirements. It must still meet minimum eligibility requirements for borrowers to qualify for a debt consolidation loan, even though it is relatively flexible. The following requirements are provided for your convenience:

COE (Certificate of Eligibility)

Your lender receives this form as confirmation that you are eligible for the loan benefit. The necessary background information must be gathered before you request a COE. Veteran veterans need a copy of their DD214. Military debt consolidation loans can only be obtained by active Reserve members or former Reserve members with discharge papers.

Loans Attached To Homes

Military members frequently move, which might confuse applicants. A primary residence is essentially required to apply for this loan. All correspondence from the lender will be mailed to this address. An appraisal and a pest inspection are also required.

550+ Credit Score

An army debt consolidation loan requires a good credit score. Based on their three-digit number, an individual’s credit score varies between 300 and 850. Taking the necessary steps to improve your credit score requires understanding the factors that affect it.

Income Proof

Like any other loan, Military Debt Consolidation Loans require proof that you can make the payments. The payment slip from your bank or credit union or your financial statements can provide this information.

Military Service and Relationships

How do I apply for Military Debt Consolidation Loans? This benefit is not available to everyone in the military community. You can consolidate your military debt if you fall into one of these categories:

- A veteran

- Soldiers on active duty

- Members of the National Guard (current and former)

- Members of the Reserve

- Survivors of veterans who died in active duty military service or suffered service-related disabilities

How To Apply For The Best Military Debt Consolidation Loans?

You will need to follow different steps depending on whether you are applying for a VA cash-out refinance loan or a conventional personal loan. The following is the general process for applying for Military Debt Consolidation Loans

- Compare refinancing offers with a lender.

- Check your eligibility with the Certificate of Eligibility (COE). Your lender will need to see this certificate to verify your eligibility.

- You must provide the lender with the necessary documentation, such as pay stubs, W-2 forms, income tax returns, and any other records they require.

- The VA funding fee and other closing costs may be charged at the closing of your loan. You can access your loan funds by following the lender’s closing process.

- Online application processes may be available for personal loans. As soon as you find a lender, you’ll typically need to complete an online application and upload documents such as your identification proof, proof of residence, pay stubs, and tax returns. The lender will review your credit report and application, and if approved, the loan will be funded the next business day.

Advantages of Military Debt Consolidation Loans

When you obtain Military Debt Consolidation Loans, your outstanding debt will finally be paid off. A monthly payment-free lifestyle is far more relaxing than worrying about it every month. However, it is important to remember that getting a military debt consolidation loan does not only have these benefits.

The following are some benefits of Military Debt Consolidation Loans:

Paying Multiple Bills At Once

Debt consolidation has the benefit of saving you from getting overwhelmed by your debts from multiple creditors. Your existing debts can be effectively consolidated through a debt consolidation loan. You’ll only have to deal with one debt each month, which is easier than dealing with multiple creditors.

Achieving More For Less

Military Debt Consolidation Loans generally have lower closing costs and interest rates. Applying and getting approved for a military debt consolidation loan, however, may result in better terms and expenses. The ability to purchase more items increases your purchasing power. Financial emergencies are also well protected by this measure.

Competitive Rates

Military debt consolidation loans offer more manageable payment terms than most Military Debt Consolidation Loans. The interest rates on these loans are usually lower than those on payday loans or debt relief options. Imagine you are a member of the active duty military. You may then be eligible to benefit from the Servicemembers Civil Relief Act, which limits interest rates to 6%.

Increased Credit Score And Financial Stability

Paying your bills on time or before the designated due date can improve your credit scores. However, military members’ busy schedules and other commitments often prevent them from adhering to this. The flexibility of consolidation loans can also improve your credit score and increase your chances of getting approved for future loans.

Budgeting Made Simple

Consolidating your debts will enable you to establish more feasible monthly budgets. Your only responsibility would be to pay off a single debt each month. As a result, debt consolidation allows you to allocate your budget for other essentials, such as food and utilities.

Alternatives to Best Military Debt Consolidation Loans

There are other options for debtholders looking for relief from their debts apart from consolidation. Here are some alternatives to consider:

A Debt Management Plan

Some non-profit credit counseling organizations provide debt management programs in which counselors work directly with creditors to reduce interest rates and payments. This approach may allow you to avoid taking out a new loan, but there are some drawbacks. A debt management plan will also prevent you from opening new credit accounts.

Refinancing Credit Cards

Refinancing your credit card debt involves moving your outstanding balance to a new card that offers a 0% interest rate on balance transfers, particularly for those seeking Best Debt Consolidation Loans for Bad Credit. These cards are challenging to obtain without a good credit score due to the introductory rate.

Bankruptcy

The bankruptcy process is for individuals and businesses that cannot pay their debts. The court examines the assets and liabilities of the bankruptcy filer during bankruptcy proceedings. The court may discharge borrowers’ debt if they cannot cover their debts with their assets, meaning they are no longer legally liable to pay them back.

Although filing for bankruptcy may be the best choice in some extreme situations, it is not a simple one. Bankruptcy proceedings can severely affect credit scores and remain on your credit report for up to 10 years. There is generally no need to consider bankruptcy as a last resort.

Pros and Cons of Best Military Debt Consolidation Loans

Pros

- Your revolving credit utilization ratio to your total credit limit contributes to your credit score. A high credit utilization ratio (usually higher than 30%) is a warning sign by lenders. You will have a low credit score if you have several open credit cards with large balances on each, so having several credit cards will result in a high credit utilization ratio.

- Your credit score can quickly drop if you owe high-interest debt and miss payments. Obtaining lower interest rates and lower payments can reduce your monthly obligations and prevent a negative impact on your credit scores if you consolidate your debt.

Cons

- A hard inquiry is generated when a potential lender examines a borrower’s credit report when applying for a loan, including debt consolidation loans. It is useful for lenders to know how often you apply for new credit accounts by hard inquiries. You want to make sure that you only apply for loans that you’re likely to be approved for since every new inquiry may lower your credit score a few points.

- The average age of your accounts heavily influences credit scores. Adding a new account will indeed reduce the average age of your accounts, potentially leading to a corresponding drop in your credit score. This effect is similar to that of closing credit accounts that have been paid off.

Tips For Best Military Debt Consolidation Loans

No matter what branch of the military you belong to or whether you’re active duty or a veteran, it’s important to know what perks you’re entitled to. The Servicemembers Civil Relief Act, for example, reduces your credit card bills.

Here are some tips to help you manage your debts better:

Stop Using Credit Cards

Using credit cards instead of debt consolidation will result in more debt, regardless of how low the interest rate is. Debt reduction and elimination require a change in your budget management.

Reduce Your Interest Rates

Before signing, you must ensure that your lender abides by the provisions of the SCRA. Your interest rate should be no higher than 6%.

Consult A Credit Counselor Before Choosing A Lender

The best way to obtain military debt consolidation loans is to consult with a credit counselor. Applying for military debt consolidation can be confusing and confusing if you don’t understand the implications.

Establish A Special Power of Attorney

A financial manager should be designated if you are deployed in service or away for some other reason. It is possible for the designated person to adjust payment allocations under a Special Power of Attorney.

Other Types of Military Financial Assistance Programs

The good news is that military personnel who are concerned about the high-interest debt they accrued can consider other options to offset the high-interest debt. You can choose from the following options:

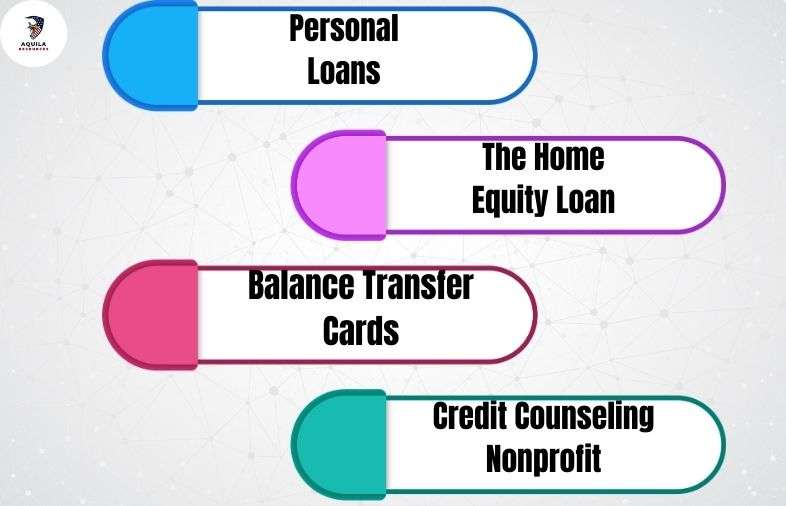

Personal Loans

The amount of debt you need to pay off can be discussed with a bank, credit union, or online debt consolidation lender. You would then be required to provide your credit score and payment history to your chosen institution. Depending on their decision, your loan will either be approved or denied.

The Home Equity Loan

You are putting up your home as collateral for this type of loan, which has one of the lowest interest rates. A house or property might be lost if you fail to make several payments. A credit card interest rate can be as high as 17.92% but with a low interest rate of 6%.

Balance Transfer Cards

An advantage of this option is that you won’t have to pay any interest throughout the introductory period, usually between 6 and 18 months. However, 0% interest credit cards may be difficult to qualify for for people with existing credit card problems. Additionally, your debt will skyrocket to 20% or higher after the introductory period if you do not pay it off.

Credit Counseling Nonprofit

A nonprofit credit counseling agency may be an alternative to debt consolidation loans if you believe they are not right for you. Their credit counseling department offers two services: providing you with feasible options for debt relief and helping you set up a monthly budget. They may also offer a debt management program that doesn’t require a loan or consider your credit score.

FAQs

Can The Military Help You Pay Off Debt?

You can manage your debts with the help of the Servicemembers Civil Relief Act and Military Lending Act. Through special loan repayment programs, some military branches may assist you with your student loans.

What Are Military Debt Consolidation Loans?

It is a personal loan that combines multiple debt payments into one. You can choose from different debt consolidation loans offered by different financial institutions.

Is There Debt Forgiveness For Veterans?

Depending on what you owe, there are different types of debt. If you can’t repay VA benefits or don’t have the means to do so, you can request a waiver from the VA. Certain requirements must also be met to qualify for veteran debt relief grants. Those in financial hardship can also seek grants from other nonprofit organizations.

Does The Department of Veterans Affairs offer Debt Forgiveness Programs?

No matter your status as a veteran, the government won’t pay your debts or forgive them. Those with VA-backed home loans can take advantage of forbearance or deferment. However, if you cannot repay the loan, it will eventually be foreclosed. Those who owe private lenders money can usually consolidate their debts, take on debt management plans, settle debts, or file for bankruptcy if they are unable to pay.

Can Student Loan Debts Be Consolidated?

Many types of debt, including federal student loans, can be consolidated. However, consolidation might not be your best option in this case, as you might end up paying more and miss out on student loan forgiveness programs.

Can The Military Help Pay off Debt?

The military can manage your outstanding debt by lowering your interest rates. However, you cannot settle your debt with the military.

Does The Military Help With Credit Card Debt?

Currently, former military members receive assistance in managing credit card debt. If you are protected by the SCRA, a 6% interest rate should not be charged to you.

Conclusion

It is possible to consolidate military debt in a number of different ways, including refinancing to consolidate credit card debt. It is important to ensure you understand all the terms involved before applying for any loan. Additionally, you must be proactive in your debt management efforts to be debt-free. Fortunately, It is possible to manage challenges better using resources like Military Verification.

Add Comment