Are you looking for Credit Cards with $20000 Limit Guaranteed Approval? If Yes, You have stumbled upon the right place.

In this article, we are sharing all the information about Credit Cards with $20000 Limit Guaranteed Approval.

It is becoming a necessity for individuals of all ages to have a credit card. This is because it is regarded as one of the safest and most secure digital payments, and it also eliminates the hassle of carrying cash.

It prevents individuals from committing theft by allowing them to walk freely. Since the credit card is secured, it can only be used once you confirm it with your authentication. It is, therefore, more common for people to keep various credit cards.

In this article, I’m sharing My Personal Experience of getting Credit Cards with $20000 Limit Guaranteed Approval.

I had always dreamed of having a credit card with a $20,000 limit. It seemed like the ultimate symbol of financial success and freedom. I imagined using it to travel the world, buy a new car, or even start my own business. But I knew that getting a credit card with such a high limit would be difficult. I could have had a better credit score and only made a little money. But I was determined to find a way.

I started by researching different credit cards and their approval requirements. I found a few cards that offered high limits to applicants with good credit scores. But they still need to be guaranteed approval.

I was starting to feel discouraged when I came across a website that advertised credit cards with $20,000 limits and guaranteed approval. I was skeptical at first, but I decided to apply anyway.

The application process was simple. I just had to answer basic questions about my income and credit history. A few minutes later, I received an email saying I had been approved for a credit card with a $20,000 limit. I couldn’t believe it. I had finally achieved my dream of getting a high-limit credit card.

I was careful to use my new credit card responsibly. I only charged what I could afford to pay off each month. And I made sure to pay my bills on time and in full. Within a few months, my credit score had improved significantly. I could qualify for even better credit cards with even higher limits.

Overview of Credit Cards with $20000 Limit Guaranteed Approval

Contents

- 1 Overview of Credit Cards with $20000 Limit Guaranteed Approval

- 2 What is a Credit Limit?

- 3 What Is the Highest Credit Limit You Can Get?

- 4 Requirements to Get Credit Cards with $20000 Limit Guaranteed Approval

- 5 Top 5 Credit Cards with $20000 Limit Guaranteed Approval

- 6 Video Guide For Credit Cards with $20000 Limit Guaranteed Approval

- 7 The Importance of an Excellent Credit Score for High-Limit Cards

- 8 What is a Good Starting Credit Limit?

- 9 Using a High-Limit Credit Card Effectively

- 10 How To Get Approved for a High Credit Limit Balance Transfer Card

- 11 FAQs

If you are looking for credit cards with $20000 limit guaranteed approval, these are the best options:

| Credit Cards | Details |

|---|---|

| Chase Sapphire Reserve | Learn More |

| American Express Gold Card | Learn More |

| Ink Business Preferred Credit Card | Learn More |

| Capital One Venture X Rewards Credit Card | Learn More |

| Chase Sapphire Preferred Card | Learn More |

A bank or financial institution helps customers find the best credit card according to their needs. To get started, all you need to do is state what you need and get started. There are various types, some with low limits and others with a higher limit. Therefore, you will be eligible if you have a good credit score.

What is a Credit Limit?

The first step to understanding the topic is understanding a credit limit. Credit card issuers can lend cardholders a maximum amount of money according to their credit limits. The credit card boundary represents the maximum amount that can be purchased on the card. The credit limit of a credit card depends on several factors, including the credit history of the cardholder, the income of the cardholder, and the policies of the credit card issuer.

What Is the Highest Credit Limit You Can Get?

Most issuers do not publicly disclose their credit limit information, although some may provide minimums. Accordingly, First Tech Federal Credit Union’s First Tech Odyssey Rewards World Elite Mastercard has a credit limit of up to $100,000.

Some issuers’ maximum limit may exceed $100,000, but they do not disclose this information. This buying power generally requires a good credit score, little debt, and ample income. You should first determine whether the card you’re applying for will meet your needs by checking whether the issuer discloses its minimum limit.

Note – There are some credit cards with a $10000 limit guaranteed approval that you can get if you have a good credit score.

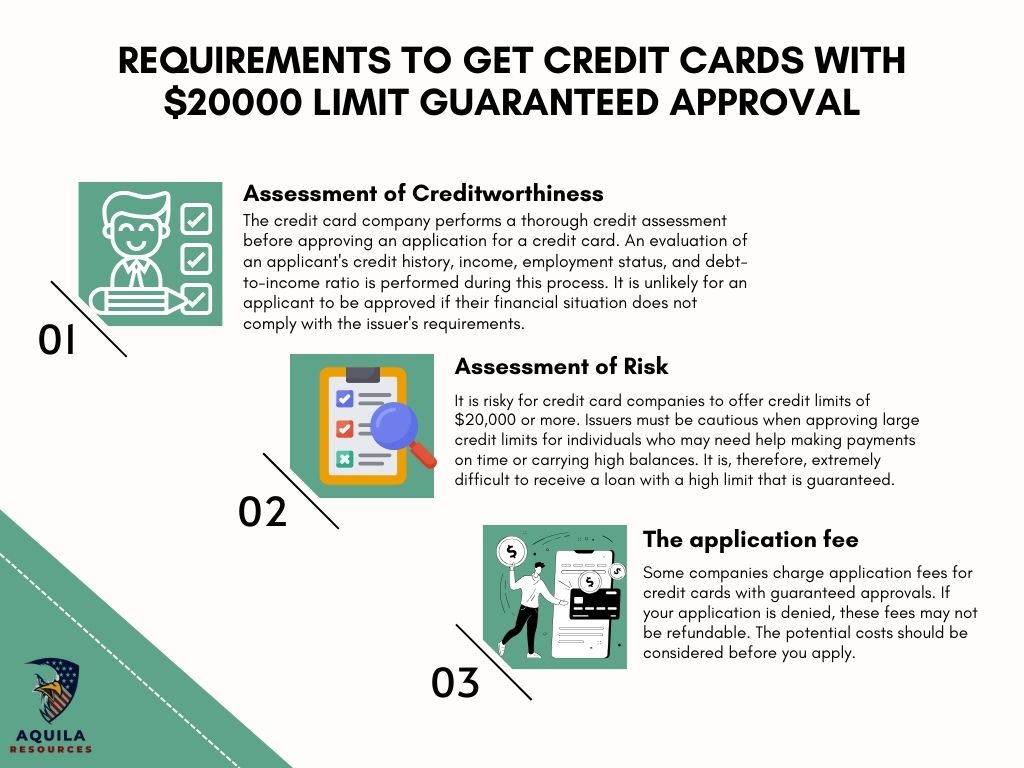

Requirements to Get Credit Cards with $20000 Limit Guaranteed Approval

There are different types of credit cards that credit card companies advertise to attract different types of customers. Some cards target individuals with excellent credit, while others target those with less-than-perfect credit. Credit cards with high limits, like $20,000, are guaranteed approvals, but this is different. The reasons are as follows:

Top 5 Credit Cards with $20000 Limit Guaranteed Approval

The following are a few well-known Credit Cards with $20000 Limit Guaranteed Approval with unique features and benefits:

Chase Sapphire Reserve

A Chase Sapphire Reserve credit card is one of the best choices if you are looking for some premium benefits. The card offers a high limit as well as additional rewards. This is a good credit card for travelers, although it has an annual fee of $550.

This is the perfect purchase if you’re considering a larger purchase. There are no delays or other pauses in the shopping process for its cardholders.

Chase Sapphire Reserve® offers a range of exceptional benefits, including premium travel rewards. The company offers a generous rewards program with points that can be redeemed for travel, Dining, and more. Cardholders can also receive an annual travel credit, airport lounge access, and travel insurance.

Benefits of Chase Sapphire Reserve

| Benefit | Description |

| Signup bonus | Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s worth up to $900 in travel when you redeem through Chase Ultimate Rewards®. |

| Annual travel credit | Get up to $300 in statement credits each year for travel purchases charged to your card. |

| Higher rewards rate | Earn 10 points per dollar on hotels and car rentals booked through Chase Ultimate Rewards®, 5 points per dollar on flights booked directly with airlines or through Chase Ultimate Rewards®, 3 points per dollar on dining at restaurants and takeout, and 1 point per dollar on all other purchases. |

| Complimentary airport lounges | Receive up to 12,000 Priority Pass Select membership points per year, which gives you and two guests access to over 1,300 airport lounges worldwide. |

| Additional benefits | Enjoy other benefits like trip cancellation/interruption insurance, lost luggage reimbursement, primary rental car insurance, purchase protection, and extended warranty protection. |

American Express Gold Card

The American Express Gold Card is one of the most popular credit cards with higher limits. As a result, you can easily purchase a large amount without having second thoughts. It’s important to remember that higher-limit cards also come with fees. There is a $250 annual fee that is payable the first year. There are, however, several benefits that make the fee worthwhile.

It offers unlimited 1.5% cash back on all purchases with the Bank of America® Unlimited Cash Rewards credit card. Cash rewards without rotating categories make it a good option for those who prefer straightforward cash rewards. Balance transfers are also eligible for 0% APR introductory periods.

Benefits of American Express Gold Card

| Benefit | Description |

| Signup bonus | Earn 60,000 Membership Rewards® points after you spend $4,000 on purchases on your new Card in your first 6 months of Card Membership. |

| Rewards | Get 4x rewards at U.S. supermarkets and restaurants worldwide. There is also a 3x reward on flight bookings and a 1x reward on other eligible purchases. |

| Uber’s annual cash credit | This is one of the best benefits for cardholders because it gives them $10 monthly in Uber cash credit. The money can be used for Uber Eats and rides in the United States. |

| Credits for Dining | The card gives up the flexibility to earn statement credits when dining at participating restaurants such as Grubhub and Seamless. |

| Benefits of other programs | The foreign transaction fee is not charged, and there is no secondary car rental fee. |

Ink Business Preferred Credit Card

Ink Business Preferred Credit Card is another popular option for higher-limited credit cards. Credit cards with signatures belong to this category. The Ink Business Preferred Credit Card is suitable for entrepreneurs who engage in large transactions daily.

Ink Business Preferred Credit Card is a business credit card for small business owners. It offers rewards for business expenses such as travel, advertising, and shipping. The card is great for businesses that frequently travel or incur significant operational costs. The annual fee is $95, but this card is ideal for travel and purchases.

Benefits of Ink Business Preferred Credit Card

| Benefit | Description |

| Signup bonus | Earn up to $100,000 in bonus points after spending $8,000 on purchases in the first 3 months from account opening. |

| Rewards | Earn 3x points per dollar on the first $150,000 in combined spending in these categories: |

| Additional benefits | The smartphone protection plan does not charge a foreign transaction fee, and it includes roadside assistance, trip cancellation coverage, and primary rental car insurance. |

Capital One Venture X Rewards Credit Card

This credit card falls under the premium category and is mainly suited for frequent travelers. Its benefits include some of the top luxury benefits that have prompted people to adopt and take advantage of it. The limit is $20,000.

Capital One Venture X Rewards Credit Card offers flexible redemption options for its travel rewards program. You can redeem miles for travel or transfer them to airline partners (Read: Best Airline Credit Cards for Bad Credit) if you earn miles on all purchases. As well as offering valuable travel perks, it offers travel credits as well.

Benefits of Capital One Venture X Rewards Credit Card

| Benefit | Details |

| Signup bonus | Earn 75,000 bonus miles after you spend $4,000 on purchases within 3 months from account opening. |

| Annual travel credit | Receive a $300 annual credit for bookings through Capital One Travel, where you’ll get our best prices on thousands of options. |

| High rewards rate | Earn 10x miles per dollar on hotels and car rentals booked through Capital One Travel. Earn 5x miles per dollar on flights booked through Capital One Travel. Earn 2x miles per dollar on all other purchases. |

| Airport lounge access | Complimentary access to Capital One Lounges and Plaza Premium Lounges for cardholder and up to two guests per visit. |

| Global Entry or TSA PreCheck® Credit | Receive up to a $100 credit for Global Entry or TSA PreCheck®. |

| Anniversary bonus | Earn 10,000 bonus miles every account anniversary, starting on your first anniversary (worth $100 toward travel). |

| No foreign transaction fees | There are no foreign transaction fees when you use your card abroad. |

Chase Sapphire Preferred Card

Check out the Chase Sapphire Preferred Card and its benefits when considering top credit cards with a $2000 limit. This card has a higher limit than the Visa Signature card and is rarer than the Visa Infinite card.

The Chase Sapphire Preferred Card offers more affordable travel rewards than the Chase Sapphire Reserve Card. It offers various travel benefits, especially regarding travel and Dining. The Chase Ultimate Rewards card is a great way to get started with Chase Ultimate Rewards. It is a popular choice among individuals since it costs $550 per year.

Benefits of Chase Sapphire Preferred Card

| Category | Rewards |

| Travel | 5x points on all travel reservations |

| Peloton | 5x points on Peloton purchases of $250 or more |

| Dining | 3x points on dining |

| Travel and purchases related to travel | 2x points |

| Annual credits | $50 annual hotel credit |

| Complimentary Instacart | 6 months of complimentary Instacart |

| Transfer of points | 10% bonus points when points are transferred to Chase travel partners |

| Other benefits | No foreign transaction fees, card protection plan, insurance, and travel assistance |

Video Guide For Credit Cards with $20000 Limit Guaranteed Approval

The Importance of an Excellent Credit Score for High-Limit Cards

Credit cards with high limits also come with generous rewards, so in most cases, you’ll need an excellent or very good credit score to qualify. However, there are some unsecured credit cards for bad credit with no deposit that may offer lower credit limits, but can still be a good way to build your credit history.

What is the importance of this? Your credit score can drop up to five points every time you apply for a credit card. It helps to know where you stand before applying for credit cards you don’t have a good chance of getting approved for. Your score is also protected.

Paying all your bills on time and keeping your credit card balances low can improve your credit score. The more credit card debt you pay off, the better your score will be. Your score should increase with persistence and patience.

What is a Good Starting Credit Limit?

People with good to excellent credit would find a good starting limit woefully inadequate for people with bad or fair credit. It is safe to assume that starting credit limits within each range will be lower than the average limit shown in the previous chart.

If your credit is bad, you can begin with a Credit Cards with $3000 Limit Guaranteed Approval for both secured and unsecured credit cards. The credit limit on some secured cards can be raised by increasing your deposit (say, up to $1,000).

If you have reasonably good credit, your initial credit limit may be four to five digits based on your credit history, income, other debts, and other factors.

Using a High-Limit Credit Card Effectively

When you make all your purchases on your high-limit credit card, you can keep track of your spending. A new card with a high limit could lead to more credit card debt; however, if you carry a balance frequently or are tempted to spend less, create a budget before you use your credit card.

Using a balance transfer credit card instead of a high-limit card might be a more cost-effective option if you plan to transfer balances from other accounts. If you transfer balances to cards with 0% introductory APRs, you can pay them off without interest for at least one year. Fees are often charged for balance transfers.

How To Get Approved for a High Credit Limit Balance Transfer Card

Once you’ve identified the credit cards that meet your requirements, it’s important to determine whether you will qualify for them. To do this, you should look at your credit first.

You can almost always expect that a credit card issuer will check at least one of your credit reports and your credit score when you apply for a new balance transfer credit card. Therefore, requesting a copy of your credit report from Equifax, Experian, and TransUnion (7 Best Credit Cards That Pull TransUnion) is wise before applying for credit cards.

You won’t automatically qualify for your first credit card with a good FICO score (Read: Best Credit Cards for 600 Credit Score), but you’re probably out if your score could be better or more fair. If you need to improve your credit, knowing your credit information beforehand is helpful.

FAQs

Is It Possible to Get Credit Cards with $20,000 Limit Guaranteed Approval?

No, no credit cards with $20,000 limit guaranteed approval. Credit limits are determined by various factors, including your credit history, income, and the credit card issuer’s policies. However, the cards mentioned in this article are known for offering high credit limits to applicants with strong credit profiles.

Do These Credit Cards Charge Annual Fees, and Are They Worth It?

Some of the credit cards mentioned have annual fees ranging from $95 to $550. Whether the annual fee is worth it depends on your spending habits and the benefits the card offers. Cards with annual fees often provide valuable perks like travel credit cards, rewards, and insurance coverage. Evaluate these benefits against the annual fee to determine if they fit you well.

Are There Any High-Limit Credit Cards For Average Credit?

If you have less-than-stellar credit but want a chance to raise your score and increase your credit limit, credit cards are available to you. A secured credit card is also worth considering if you are beginning your credit journey or are re-establishing your credit.

What is a High-Limit Credit Card?

A high-limit credit card has a higher spending limit than the average. Credit cards with a limit of $10,000 or higher qualify as high-limit credit cards, even though there is no standard definition.

Add Comment