Are you looking for Consolidate Debt Without Hurting Credit? If Yes, You are at the right place.

In this article, We are sharing all the information about Consolidate Debt Without Hurting Credit.

You’re not alone if your debt is out of control. Household debt in America is steadily increasing, reaching a record $16 trillion in 2022. Many Americans rely on credit cards to pay for their expenses. The amount of credit card debt has increased 13% between mid-2021 and 2022, the highest 12-month increase since 1999, and has reached $890 billion. Sometimes, you need more cash, so you charge groceries or gas. Your balance never goes down, and you never catch up… so what do you do? Streamline!

A debt consolidation is taking out a new loan or credit card to repay an existing loan or credit card. By consolidating multiple debts into one larger loan, you can obtain more favorable payoff terms, such as lower interest rates or monthly payments.

A debt consolidation program can be implemented in various ways, likely affecting your credit score. Debt consolidation, however, can improve your credit score and financial well-being while reducing its likely negative impact on your credit score.

What Is Debt Consolidation?

Contents

- 1 What Is Debt Consolidation?

- 2 How Does Debt Consolidation Work?

- 3 Does Debt Consolidation Hurt Your Credit?

- 4 Best Options to Consolidate Debt Without Hurting Credit

- 5 The Smartest Way to Consolidate Your Debt

- 6 How Does Debt Consolidation Affect Your Credit?

- 7 Who Should Consolidate Debt and When?

- 8 How to Minimize the Impact Debt Consolidation Has on Your Credit?

- 9 Alternatives to Debt Consolidation

- 10 Monitor Your Credit as You Work to Pay Off Debt

- 11 FAQS

A debt consolidation program is exactly what it sounds like – you pay off your unsecured debt with one large monthly payment. A good debt consolidation plan will lower your interest rate and make paying off your debt easier, resulting in better credit.

A debt consolidation loan is an excellent option if you have a lot of high-interest credit cards. Consolidating your credit card debt can assist you in keeping track of your debt, making payments on time, reducing your interest rate (thus lowering your monthly payments), and more.

There are several ways to consolidate debt, including personal loans, credit card balance transfers, home equity loans, or borrowing from 401(k). It usually includes lower interest rates than consolidated debt and combines payments into one monthly bill. A debt consolidation plan that makes paying your creditors easier and less expensive is the key to its success. Your debt load should not be increased by it. Reducing it should be its purpose.

How Does Debt Consolidation Work?

Consolidating debt involves paying off high-interest debt, usually credit card debt, with a loan or credit card. Getting a lower-interest-rate loan or credit card allows you to save money and become debt-free sooner than you otherwise would.

There are several ways to consolidate debt, including:

- Personal Loans: The average interest rate on personal loans is lower than on credit cards, and repayment terms range from one to seven years. A typical unsecured loan only requires collateral so that you can apply with it.

- Balance Transfer Credit Cards: Special credit cards offer 0% annual percentage rates (APRs) for an introductory period. These introductory periods can last for 12 to 21 months. A credit card balance can be transferred from another card and paid down without incurring interest. A fee of 3% to 5% of the transferred amount will typically be added to your new account balance when you transfer a balance.

- Home Equity Loan or Line of Credit: Home equity loans and home equity lines of credit (HELOCs) can be obtained using the equity in your home as collateral. There are lower interest rates on these loans than on personal loans, but repayment can be difficult if you fail to repay the loan.

Does Debt Consolidation Hurt Your Credit?

Your credit will be temporarily damaged if you get a debt consolidation loan, but it will only last for a short time. Debt consolidation loans are subject to credit checks by the lender. Ten points will lower your credit score due to a hard inquiry. The impact of hard inquiries on your credit score only lasts one year.

If you close your credit accounts after consolidating your balances, your credit score could also be affected. It is estimated that 15 percent of your credit score is influenced by the average age of your credit accounts, with a higher credit score coming with a longer credit history. The average age of your credit history decreases when you open a new account or close an older one. So even if you never use your old cards, keeping them open is best.

Consolidating your debts can negatively impact your credit score in the short term, but you can improve over time. You will improve your credit score if you make on-time payments, which account for 35 percent of your credit score. Personal loans for debt consolidation can boost your credit score if you only have revolving credit like credit cards.

Moreover, consolidating your debt will significantly decrease your credit utilization – as much as 30 percent of your credit score. Taking your current credit card balance and dividing it by your total credit limit will give you this figure. Your credit score can decrease if your credit utilization ratio is over 10%. A personal loan can help you pay off the debt, lower your utilization percentage, and improve your credit score.

Best Options to Consolidate Debt Without Hurting Credit

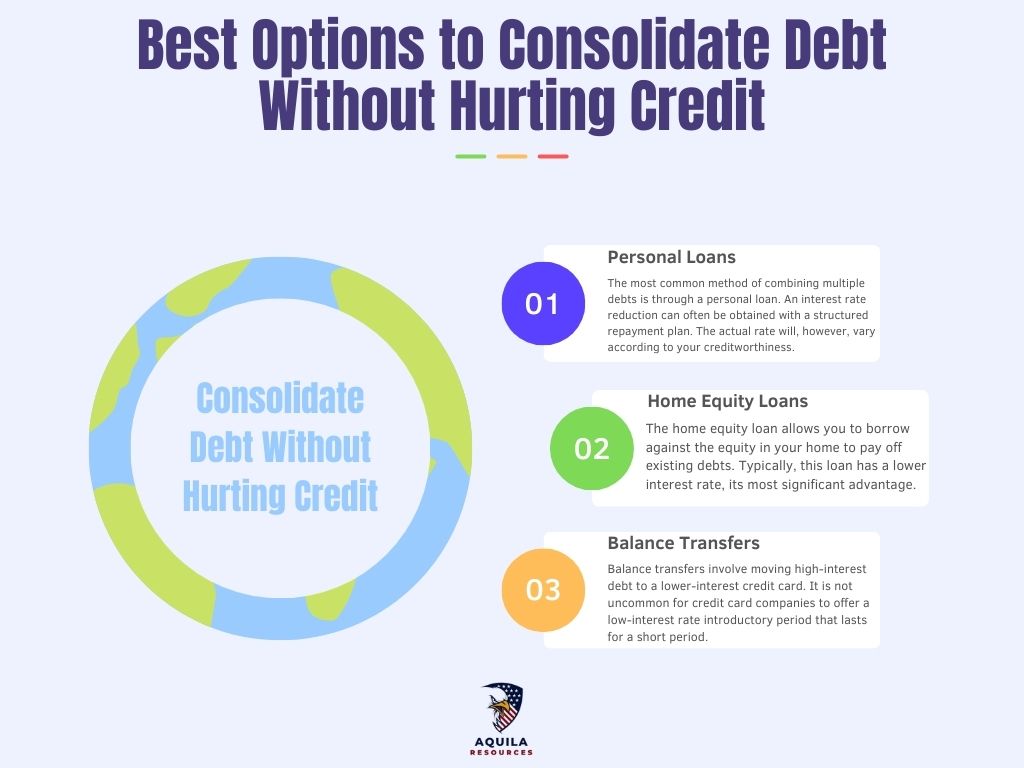

Consolidating debt offers three main options that could leave your credit intact and improve it if done appropriately.

Personal Loans

The most common method of combining multiple debts is through a personal loan. An interest rate reduction can often be obtained with a structured repayment plan. The actual rate will, however, vary according to your creditworthiness.

Home Equity Loans

The home equity loan allows you to borrow against the equity in your home to pay off existing debts. Typically, this loan has a lower interest rate, its most significant advantage.

Balance Transfers

Balance transfers involve moving high-interest debt to a lower-interest credit card. It is not uncommon for credit card companies to offer a low-interest rate introductory period that lasts for a short period.

However, it is usually the case that the interest rate will increase once the introductory period has expired. Therefore, paying off the debt within the specified time frame is important to maximize the benefits. Debt could become even worse if you don’t take action.

The Smartest Way to Consolidate Your Debt

You can consolidate your debt most efficiently by listing all your loans and credit cards. The remaining balance, interest rate, minimum payment, and monthly payment total should be included.

The next step is to determine what type of debt consolidation option you prefer, whether a personal loan, equity loan, or balance transfer credit card. Comparing APRs, terms, and total interest paid from different lenders is a good idea.

If you want to avoid multiple hard inquiries on your credit report, apply within two weeks of receiving the loan or credit card. The debt consolidation calculator can help you determine which lender to choose once you have all your offers.

How Does Debt Consolidation Affect Your Credit?

You can negatively or positively impact your credit as a result of debt consolidation in several ways, including:

- Getting a New Loan or Credit Card: Whenever you apply for credit from a lender, your credit score may be temporarily affected, as a hard inquiry is run on your credit reports.

- Opening a New Credit Account: Getting approved for and opening a new credit card or loan will reduce the average age of your credit accounts, which affects your credit score.

- Changes in Credit Utilization Rate: Credit utilization rates, or how much of your credit card limit is being used at a given moment, influence your FICO® Score. The utilization rate on a new credit card may be higher when you transfer a balance to it, lowering your credit score until you pay off the balance. A balance transfer may be beneficial if it produces a lower utilization rate across your credit cards or if you use a loan to pay off your credit cards completely.

- Making Payments: The credit score could be negatively impacted if you miss a payment on your old debt consolidation accounts or the new debt consolidation loan or card after consolidation. A good credit score can be established over time by making on-time payments.

As you eliminate debt, your budget will have more cash flow, which makes managing your expenses easier and avoiding more debt easier.

Who Should Consolidate Debt and When?

A debt consolidation loan can save you from multiple high-interest debts if you’re juggling multiple debts simultaneously. With good credit, you could qualify for the best consolidation loan rate using this strategy. However, if you have too much debt or a low credit score, you may need to qualify for higher interest rates. You may explore other options for debt relief in this case.

Therefore, consolidating your debt today is the best time to do so. You will inevitably end up paying more interest if you wait too long. Missed payments and lowered credit scores can result from juggling multiple creditor repayments every month.

How to Minimize the Impact Debt Consolidation Has on Your Credit?

The following are a few steps you can take to minimize the negative impacts on your credit of consolidating debt:

- Keep Old Credit Cards Open: It is possible to have a low utilization rate across all your credit cards, even after transferring debt from one or more cards to another. At least until you have paid down your balance on your old cards, you should keep them open.

- Repay a Balance Transfer Quickly: There may be more than a year for you to pay off your debt without interest, but the faster you pay down the balance, the faster you’ll be able to lower your credit utilization rate.

- Avoid Applying for Multiple Loans or Credit Cards: The multitude of loans you apply for in a short time can be seen as a red flag by lenders and damage your credit rating. Keep credit to a minimum unless you have a real need for it. When you receive a rejection, wait to apply for something else until you understand the reasons for the rejection and have the opportunity to improve your credit.

- Pay on Time: Don’t let late payments ruin your credit score. Whenever a payment is late, pay it as soon as possible—late payments aren’t reported to the credit bureaus until 30 days have passed.

Alternatives to Debt Consolidation

A debt consolidation loan may not be right if you already have bad credit or live paycheck to paycheck. Fewer options make financial sense if your credit score is low.

However, it is possible to get rid of debt through alternative methods. Although some will improve your credit score in the long run, others may do more harm than good, even while solving your immediate debt problem.

The following are debt relief options that go beyond debt consolidation:

- Debt Management: Credit card debt interest rates can be reduced to around 8% by working with a nonprofit credit counseling agency. There is no loan involved. Your credit cards are paid down by an agency, which requires you to make one monthly payment. A debt consolidation program usually takes 3-5 years to pay off and will help your credit score in the long run by reducing your debt and making payments on time.

- Nonprofit Debt Settlement: The program is also known as credit card debt forgiveness, and if you qualify, you pay 50%-60% of your debt without paying interest for 36 months. The program is relatively new, so not all banks are on board, which may make finding a fit difficult.

- Debt Settlement: The company negotiates with your creditors on your behalf, and you pay less than what you owe. The negotiating process usually takes 2-3 years, and you won’t pay your credit cards during this time, resulting in higher fees and damage to your credit. Seven years remain on your credit report after this negative entry.

- Bankruptcy: There is only one option left: nuclear. 100-200 points will lower your credit score, and your unsecured debt will be eliminated. However, your credit history will remain on your credit report for 7-10 years.

Monitor Your Credit as You Work to Pay Off Debt

The impact your actions have on your credit will be important to consider when consolidating debt. Suppose you sign up for Experian’s free credit monitoring service. In that case, you’ll get access to your FICO® Score and Experian credit report, which are essential tools for paying off debt and improving your financial situation.

Keeping track of your progress toward rebuilding your credit score is important if consolidating debt impacts it. Maintaining good credit can also help you avoid future mistakes that could damage your credit.

FAQS

When Does It Make Sense to Consolidate Your Debt?

Consolidating your debt is most commonly done to save money on interest. You could save hundreds or even thousands of dollars in interest if you consolidate your debt and get a lower interest rate.

Consolidating debt simplifies monthly payments, which is another reason people consolidate debt. You can manage your finances more easily if you consolidate your bills because they are due at different times.

What Is a Credit Card Debt Consolidation Loan?

The purpose of credit card consolidation loans is to consolidate your existing debts with a new loan. If you have three credit cards, each with a balance of $1,000, let’s take the example of having three credit cards. Consolidation involves taking out a loan for $3,000, paying off three credit cards with $1,000 balances, and then having just one loan for $3,000.

How Does Debt Consolidation Affect Your Credit?

Consolidating credit card debt (Read: How to Negotiate Credit Card Debt?) from two or more accounts to one will at least add a new account to your report. Opening a new revolving credit account, such as through a balance transfer or series of balance transfers, can help reduce your credit utilization by raising your available credit.

You’ll reduce your overall available credit if you close the accounts you transfer balances from, and your credit utilization will increase if you fail to pay down existing balances in proportion.

How Can You Get a Debt Consolidation Loan with Bad Credit?

A debt consolidation loan will likely be unprofitable for borrowers with FICO scores below 580. The best action may be a settlement, but speaking with a professional financial advisor before taking any action is a good idea. There are still options available to those with fair credit ratings of 580 to 669. A lower credit score generally entails a higher interest rate

Add Comment