Are you looking for No Credit Check Credit Cards Instant Approval No Deposit? If Yes, Then you are at the right place.

In this article, we share all the information about No Credit Check Credit Cards, Instant Approval, and No Deposit.

What are the chances of getting approved for a credit card with no deposit, or does it sound good as clickbait? All unsecured credit cards in this review are easy to qualify for, ensuring a quick decision once your application is complete.

There are also store cards or the best credit cards for groceries and gas that may be easier to obtain, regardless of your credit score. The good news is that one of these cards can help start the healing process for your damaged credit. Pay your bills on time and your balances low by paying them off on time.

No Credit Check Credit Cards Instant Approval No Deposit

Contents

- 1 No Credit Check Credit Cards Instant Approval No Deposit

- 1.1 What Are Instant Approval Credit Cards?

- 1.2 What are No Credit Check Credit Cards?

- 1.3 How Does No Credit Check Credit Cards Instant Approval No Deposit Work?

- 1.4 5 Best No Credit Check Credit Cards Instant Approval No Deposit

- 1.5 Steps to Apply for No Credit Check Credit Cards Instant Approval No Deposit

- 1.6 Video Guide For No Credit Check Credit Cards Instant Approval No Deposit

- 1.7 Pros & Cons of No Credit Check Credit Cards Instant Approval No Deposit

- 1.8 Do Credit Cards Offer No Credit Check Credit Cards Instant Approval No Deposit?

- 1.9 How Do I Use an No Credit Check Credit Cards Instant Approval No Deposit to Build Credit?

- 1.10 Best Credit Cards for Bad Credit with Instant Guaranteed Approval

- 1.11 No Credit Check Credit Cards Instant Approval No Deposit USA

- 1.12 Mistakes People Make That Affect Their Credit Score

- 1.13 Credit Cards that Provide $1000, $2000, $3000, $5000, $10000 & $20000 Limits Guaranteed Approval

- 1.13.1 Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

- 1.13.2 Credit Cards with $2000 Limits Guaranteed Approval

- 1.13.3 Credit Cards with $3000 Limits Guaranteed Approval

- 1.13.4 Credit Cards with $5000 Limits Guaranteed Approval

- 1.13.5 Credit Cards with $10000 Limits Guaranteed Approval

- 1.13.6 Credit Cards that Provide $20000 Limit Guaranteed Approval

- 1.14 FAQs about No Credit Check Credit Cards Instant Approval No Deposit

- 1.14.1 Can I Get a Credit Card Without Depositing Money?

- 1.14.2 How Long Does It Take to Approve a Credit Card?

- 1.14.3 Can You Get an Unsecured Credit Card After Bankruptcy?

- 1.14.4 Are Secured or Unsecured Credit Cards Best for Rebuilding Credit?

- 1.14.5 Are There Any $300 Credit Card Limit No Deposit?

- 1.14.6 What are Store Credit Cards with Instant Approval for Bad Credit No Deposit?

- 1.15 Conclusion

Today, credit cards are crucial to financial health because they allow people to conduct transactions, establish credit histories, and take advantage of various rewards and benefits. People with little or bad credit may need help to get a credit card or they need Guaranteed Credit Card Approval No Deposit Bad Credit.

The good news is that alternatives, such as Guaranteed Credit Card Approval With No Deposit offer fast approval without a deposit. This post outlines the characteristics and advantages of credit cards that do not require a credit check.

If you are looking for No Credit Check Credit Cards Instant Approval No Deposit, these are the best options –

| Credit Cards | Details |

|---|---|

| Aspire Cash Back Reward Card | Learn More |

| Revvi Card | Learn More |

| FIT Platinum Mastercard | Learn More |

| Fortiva Mastercard Credit Card | Learn More |

| First Access Visa Card | Learn More |

What Are Instant Approval Credit Cards?

There are instant credit card approval and use no deposit and Instant approval credit cards are credit cards where applications are processed instantly. The process usually involves an online application asking about the applicant’s income and identity. Applicants receive a decision of approval or rejection immediately after submitting.

What are No Credit Check Credit Cards?

Credit cards with no credit check are designed for people with limited or poor credit histories. People can benefit from credit cards without submitting to a traditional credit check.

A no-credit-check credit card is primarily intended for individuals seeking to rebuild or build their credit history. These cards can be used responsibly to demonstrate creditworthiness to lenders and make it easier for them to obtain better credit in the future. There are credit cards for different uses. such as if you love shopping online there are the Best Credit Cards for Online Shopping. You can save money with the best cash back credit cards if you prefer cash back, and if you run a business then you can get a business credit cards for your business expenses.

How Does No Credit Check Credit Cards Instant Approval No Deposit Work?

No Credit Check Credit Cards Instant Approval No Deposit work differently than traditional credit cards. This type of credit card considers other factors, such as income, employment stability, and banking history, instead of just a person’s credit history.

No credit check credit cards are offered by lenders who use alternative methods to evaluate a person’s creditworthiness. It may be necessary to review income statements, verify employment details, and review the applicant’s banking transactions. Lenders can determine whether a person can manage credit responsibly by evaluating these factors, even if they are unfamiliar with their credit history.

Here’s How No Credit Check Credit Cards Instant Approval No Deposit Work?

No Credit Check: As the name suggests, the primary advantage of these cards is that they do not require a credit check during the application process. This is particularly beneficial for individuals with a low credit score or no credit history.

Security Deposit or Prepayment: To secure a no credit check credit card, you may need to make a security deposit or prepay a certain amount. This deposit typically becomes your credit limit. For example, if you deposit $500, your credit limit will be $500.

Credit Building: One of the main purposes of these cards is to help individuals build or rebuild their credit history. Your responsible use of the card is reported to the credit bureaus, and over time, this can positively impact your credit score (Read: Best Credit Cards for 500 Credit Score).

Usage Similar to Traditional Cards: These cards function like regular credit cards. Depending on the card’s terms and conditions, you can make purchases, pay bills, and even withdraw cash from ATMs.

Note – Guaranteed approval unsecured credit cards for bad credit are designed for people with a poor credit history. These cards typically have high interest rates and fees, but they can be a good way to start building credit if you have been denied a credit card.

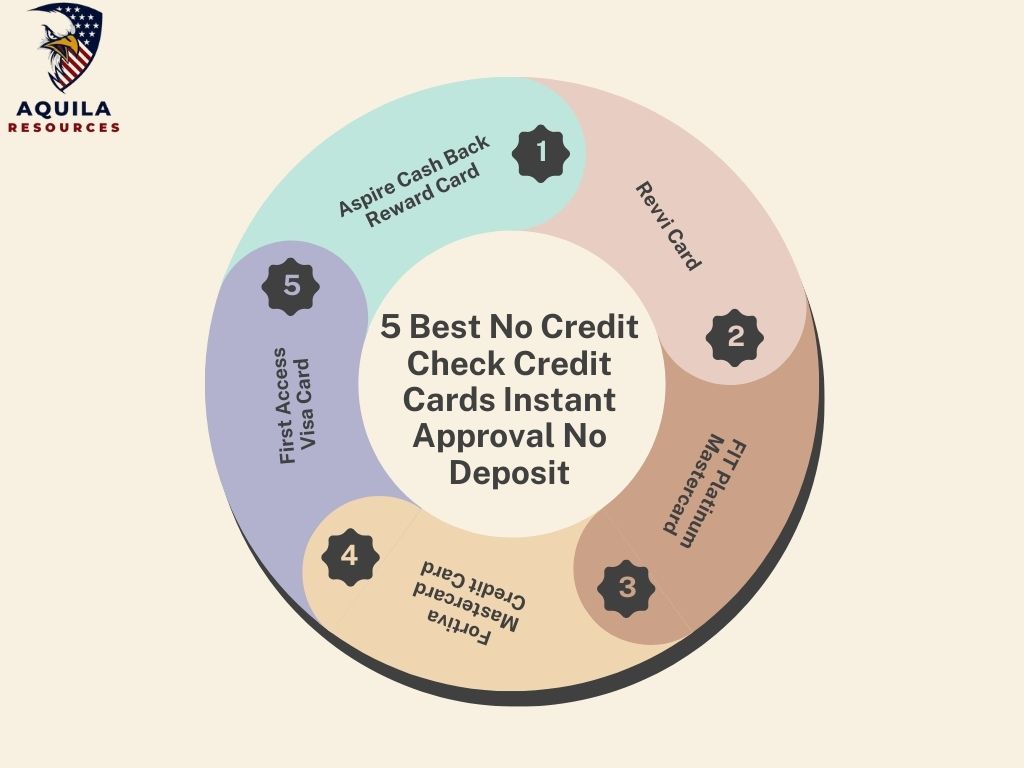

5 Best No Credit Check Credit Cards Instant Approval No Deposit

This type of credit card is in since you don’t have to have good credit or put down a security deposit to apply. They are expensive and offer meager benefits. There is no life-altering dilemma here, but it deserves some careful consideration.

They are open-loop, which means they can be used anywhere a Visa or Mastercard is accepted.

According to us, these are the 5 best No Credit Check Credit Cards Instant Approval No Deposit, and these are also credit cards for bad credit no deposit:

- Aspire Cash Back Reward Card

- Revvi Card

- FIT Platinum Mastercard

- Fortiva Mastercard Credit Card

- First Access Visa Card

Here is the Details of the 5 best No Credit Check Credit Cards Instant Approval No Deposit that are also credit cards for bad credit no deposit instant use–

Aspire Cash Back Reward Card

You can apply for the Aspire Cash Back Reward Card even with fair or poor credit. It offers a relatively high credit limit and lucrative cashback rewards and the Bank of Missouri offers it.

Equifax provides free credit scores with the card so that you can track your credit score. If you pay your entire balance each billing cycle, you can avoid the high APR it charges.

Pros & Cons of Aspire Cash Back Reward Card

Pros:

- This card has no annual fee, which can save you money in the long run.

- This means that the card is not backed by a security deposit, making it easier to get approved if you have bad credit.

- The Aspire Cash Back Reward Card has a low credit limit of $300, which can help you manage your spending and avoid debt.

- You can earn 2% cash back on all purchases, which can help you save money over time.

- The Aspire Cash Back Reward Card reports your payment history to all three major credit bureaus, which can help you build your credit.

Cons:

- The Aspire Cash Back Reward Card has a high APR of 29.99%, which means you will pay a lot of interest if you carry a balance.

- The Aspire Cash Back Reward Card also has fees associated with it, such as a late payment fee, returned payment fee, and foreign transaction fee.

- The 2% cash back reward could be more generous, and you will need to spend a lot of money to earn a significant amount of cash back.

Rates & Fees of Aspire Cash Back Reward Card

| Fee | Description |

|---|---|

| Annual fee | None |

| APR | 29.99% |

| Late payment fee | Up to $40 |

| Returned payment fee | Up to $35 |

| Foreign transaction fee | 3% |

| Cash advance fee | 5% of the amount of the cash advance, plus $10 |

| Balance transfer fee | 3% of the amount of the balance transfer, plus $5 |

Revvi Card

Revvi Card users can earn cashback rewards on eligible purchases. Your initial credit limit is $300, and if you pay your monthly bills on time, you may request an increase after your first year.

No credit check is required, and subprime consumers are allowed to apply. This card has high interest rates and fees, so be sure to read the terms and conditions before using it.

Pros & Cons of Revvi Card

Pros:

- You do not need to make a security deposit to get this card, which can be helpful if you have bad credit.

- This means that the card is not backed by a security deposit, making it easier to get approved if you have bad credit.

- The Revvi Card has a low credit limit of $300, which can help you manage your spending and avoid debt.

- You can earn 1% cash back on all purchases, which can help you save money over time.

- The Revvi Card reports your payment history to all three major credit bureaus, which can help you build your credit.

Cons:

- The Revvi Card has a high APR of 35.99%, which means you will pay a lot of interest if you carry a balance.

- Other fees are associated with the Revvi Card, such as a late payment fee, returned payment fee, and foreign transaction fee.

- The 1% cash back reward could be more generous, and you will need to spend a lot of money to earn a significant amount of cash back.

Rates & Fees of Revvi Card

| Fee | Description |

|---|---|

| Annual fee | $75 first year, $48 after |

| Program fee | $95 (one-time fee) |

| Monthly servicing fee | $8.25 per month, waived for the first year |

| Late payment fee | Up to $40 |

| Returned payment fee | Up to $35 |

| Foreign transaction fee | 3% |

| Cash advance fee | 5% of the amount of the cash advance, plus $10 |

| Balance transfer fee | 3% of the amount of the balance transfer, plus $5 |

| Credit limit increase fee | 25% of the amount of the credit limit increase |

FIT Platinum Mastercard

When you apply for the FIT Platinum Mastercard, you will receive an instant approval decision. The card is accepted everywhere Mastercard is accepted.

If you keep your bills up to date for six consecutive months after activating your account, your credit limit will be doubled. It has a lower APR than other subprime cards but charges high fees.

Pros & Cons of FIT Platinum Mastercard

Pros:

- The FIT Platinum Mastercard has no credit score requirement so you can be approved even with bad credit.

- The annual fee is $99, which is lower than many other credit cards for people with bad credit.

- You may be eligible for a credit limit increase after six months of on-time payments.

- The FIT Platinum Mastercard reports your payment history to all three major credit bureaus, which can help you build your credit.

Cons:

- The APR is 29.99%, higher than many other credit cards.

- The FIT Platinum Mastercard does not offer a rewards program, so you will not earn cash back or points for your purchases.

- Other fees are also associated with the FIT Platinum Mastercard, such as a late payment fee, returned payment fee, and foreign transaction fee.

Rates & Fees of FIT Platinum Mastercard

| Fee | Description |

|---|---|

| Annual fee | $99 |

| Monthly maintenance fee | $6.25 (waived for the first 12 months) |

| Late payment fee | Up to $40 |

| Returned payment fee | Up to $35 |

| Foreign transaction fee | 3% |

| Cash advance fee | 5% of the amount of the cash advance, plus $10 |

| Balance transfer fee | 3% of the amount of the balance transfer, plus $5 |

Fortiva Mastercard Credit Card

A Fortiva Mastercard Credit Card allows you to qualify for a credit limit of up to $1,000 based on your creditworthiness and income. This is yet another card that rewards you with cashback.

It’s possible to build credit over time if you pay on time consistently, and you don’t need good credit to apply. However, its annual fee and high APR should be noted.

Pros & Cons of Fortiva Mastercard Credit Card

Pros:

- Reports to credit bureaus, helping build credit scores.

- Offers cashback (3% for specific categories, 1% otherwise).

- No security deposit needed

- Can qualify with poor credit

Cons:

- Annual fees are $49 to $175 for the first year and $0 to $49 each following year.

- This unsecured credit card charges account maintenance fees between $5 and $12.50 monthly after the first year.

- Not all applicants qualify for the rewards program.

Rates & Fees of Fortiva Mastercard Credit Card

| Fee | Description |

|---|---|

| Annual fee | $49 - $175 for the first year and $0 - $49 after that, depending on the applicant's creditworthiness. |

| APR | 24.99% - 35.99% |

| Late payment fee | Up to $40 |

| Returned payment fee | Up to $35 |

| Foreign transaction fee | 3% |

| Cash advance fee | 5% of the amount of the cash advance, plus $10 |

| Balance transfer fee | 3% of the amount of the balance transfer, plus $5 |

| Credit limit increase fee | $25 per authorized user |

First Access Visa Card

The First Access Visa Card can be used anywhere Visa cards are accepted. To apply, you must be at least 18 years old and have an active checking account.

Applicants receive a decision within a minute or less. There is a fee for new cardholders to pay to access their account. First Access waives its monthly servicing fee for the first year after account opening.

Pros & Cons of First Access Visa Cards

Pros:

- No security deposit required

- Can be approved with bad credit

- Reports to all three credit bureaus

- Offers a first-year welcome bonus of $50 cash back

- Offers a 1% cash-back rewards program

- Has a Visa logo so that it can be used anywhere a Visa is accepted

Cons:

- High annual fee of $75 in the first year, then $48 annually

- High APR of 35.99%

- Low credit limit of $300

- A short grace period of 21 days

- Multiple fees for late payments, returned payments, and more

Rates & Fees of First Access Visa Cards

| Fee | Description |

|---|---|

| Program fee | $95 one-time fee charged within 60 days of approval |

| Annual fee | $75 for the first year, then $48 annually |

| Monthly servicing fee | $8.25 per month, waived for the first year |

| Late payment fee | Up to $40 |

| Returned payment fee | Up to $35 |

| Foreign transaction fee | 3% |

| Cash advance fee | 5% of the amount of the cash advance, plus $10 |

| Balance transfer fee | 3% of the amount of the balance transfer, plus $5 |

| Credit limit increase fee | 20% of the amount of the credit limit increase |

Here is the table of No Credit Check Credit Cards Instant Approval No Deposit-

| Feature | Aspire Cash Back Reward Card | Revvi Card | FIT Platinum Mastercard | Fortiva Mastercard Credit Card | First Access Visa Card |

| Annual fee | $0 | $39 | $75 | $95 | $0 |

| APR | 22.99% – 27.99% variable | 29.99% variable | 26.99% variable | 26.99% variable | 26.99% variable |

| Rewards | 2% cash back on gas and groceries, 1% cash back on all other purchases | 1% cash back on all purchases | 1% cash back on all purchases | 1% cash back on all purchases |

1% cash back on all purchases

|

| Welcome bonus | N/A | N/A | N/A | N/A | N/A |

| Sign-up bonus | N/A | N/A | N/A | N/A | N/A |

| Credit score required | Fair | Bad | Bad | Fair | Bad |

| Initial credit limit | Up to $3000 | $300 | $300 | $1,000 | $300 |

| Foreign transaction fees | Yes | Yes | Yes | Yes | Yes |

| Late payment fee | Up to $40 | Up to $40 | Up to $40 | Up to $40 | Up to $40 |

| Other fees | None | Application fee, monthly fee after the first year | Annual fee, monthly fee | Annual fee, monthly fee | Application fee |

| Benefits | Free Equifax credit scores, no late payment fees for the first 12 months | No credit check, instant approval | Instant approval, doubled credit limit after 6 months of on-time payments | No credit check, instant approval |

No credit check, instant approval

|

Steps to Apply for No Credit Check Credit Cards Instant Approval No Deposit

Here are the steps to apply for a No Credit Check Credit Cards Instant Approval No Deposit:

- Choosing a Credit Card Issuer: You can find several credit card companies that offer instant approval credit cards without a credit check.

- Eligibility Check: You should check your eligibility for the card you want before applying. The next step is to enter your information into the pre-qualification tool on the card issuer’s website. By doing this, you’ll be able to determine whether or not you’ll be approved for a credit card.

- Collect Your Documents: To complete your application, you will need the following documents: your Social Security Number, your driver’s license or other state-issued identification, and proof of your income (for example, a pay stub or bank statement).

- Submit the Application: The application can be completed online or by phone. You will need to provide personal information, financial information, and employment information on the application.

- Wait for the Decision: After completing an application, you should receive a decision within minutes. If you’re approved, your card will be available immediately.

Additional tips for applying for No Credit Check Credit Cards Instant Approval No Deposit:

- Provide Accurate Information: Ensure that your application does not contain any false information. As a result, your application may be denied, or your account may be closed.

- Getting One or Two Credit Cards at a Time: If you apply for too many credit cards quickly, your credit score will be negatively affected.

- Pay Your Bills on Time: Improving your credit score starts with paying your bills on time.

The interest rates and fees on No-Credit-Check Credit Cards, Instant Approval, and No-Deposit are usually higher than those on traditional credit cards. Before applying, you should compare the terms of different credit cards.

Video Guide For No Credit Check Credit Cards Instant Approval No Deposit

Pros & Cons of No Credit Check Credit Cards Instant Approval No Deposit

Here are the Pros & Cons of Credit Check Credit Cards Instant Approval No Deposit or easy approval credit cards with no deposit.

Pros of No Credit Check Credit Cards Instant Approval No Deposit

These are the Pros of Credit Check Credit Cards Instant Approval No Deposit.

| Pros of No Credit Check Credit Cards Instant Approval No Deposit | |

| Pros | Details |

| Accessibility | No credit check credit cards are widely accessible to individuals with poor or no credit. This inclusivity allows people to start their credit journey or recover from past financial mistakes. |

| Credit Building | Using a no credit check credit card responsibly can help establish or improve your credit score, which is essential for accessing better financial opportunities in the future. |

| Financial Discipline | Since these cards require a security deposit or prepayment, they promote responsible financial behavior. Users are less likely to overspend or accumulate debt beyond their means. |

| Instant Approval | Many cards offer instant approval, meaning you can access a credit card quickly, providing financial security. |

Cons of No Credit Check Credit Cards Instant Approval No Deposit

These are the Cons of Credit Check Credit Cards Instant Approval No Deposit–

| Cons of No Credit Check Credit Cards Instant Approval No Deposit | |

| Cons | Details |

| Fees and Charges | No credit check credit cards often come with fees, such as annual fees, activation fees, and monthly maintenance fees. These can eat into your available credit and make the card less cost-effective. |

| Limited Credit Limit | Your credit limit usually equals your security deposit or prepaid amount. This may limit your ability to make large purchases or cover unexpected expenses. |

| No Rewards | Unlike traditional credit cards, most no credit check credit cards do not offer rewards programs or cashback benefits. |

| Lack of Trust | Some merchants or service providers may need more time to accept prepaid cards, potentially limiting your purchasing options. |

Do Credit Cards Offer No Credit Check Credit Cards Instant Approval No Deposit?

A credit card does not always approve all applicants, even if some have a high acceptance rate. Consumers under 18 or who need help verifying their identity will not be approved for cards by card issuers.

You may own a maximum number of cards with certain issuers. Capital One credit cards are limited to two per person. If your application is denied, the credit card issuer should send you an Adverse Action Notice. You can use this information to correct your credit deficiencies before reapplying.

The issuer may only accept your application based on correct information on your credit report. If this is the case, it is a good idea to repair your credit reports on your own or with the help of a credit repair company. If you correct each credit report, you can reapply for a credit card.

Many credit cards offer a pre-qualification step that allows you to determine whether you qualify for the card. The pre-qualification process does not affect your credit score or guarantee final approval. It is unlikely that you will be denied approval unless unexpected circumstances arise when you apply.

If you need quick cash, you can easily get small payday loans online with no credit check. Many lenders offer these loans, and you can apply online in just a few minutes. You must provide basic information, such as your name, address, and income, and the lender will assess your eligibility. If approved, you will receive the money in your bank account within 24 hours.

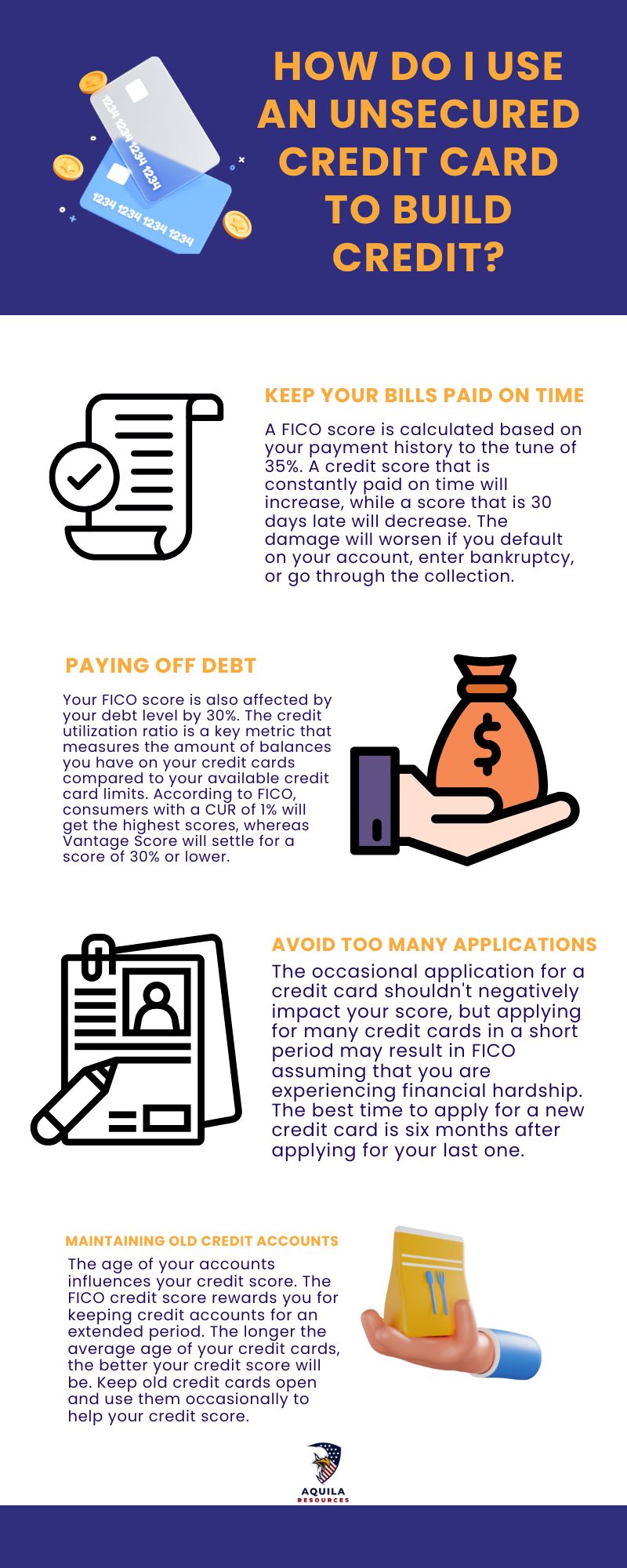

How Do I Use an No Credit Check Credit Cards Instant Approval No Deposit to Build Credit?

Credit history can be established just by owning a credit card. People can only build credit once they consistently pay their bills on time and responsibly manage their accounts. The result is:

Credit cards can increase your credit mix and score if you start with a loan and still need to get one. You can also improve your score by adding a store credit card. However, you’re better off only opening credit accounts if needed—diversified credit mixes are less impactful than diversifying your credit mix.

Best Credit Cards for Bad Credit with Instant Guaranteed Approval

There are many ways to build a good credit score, and you may have heard of or read about credit cards before. There are even credit cards that build credit scores offered by many banks. A credit card is only available to people with a good credit score, an irony that needs to be addressed. There may be a reason for this poor credit score, such as defaults on previous loans or non-payment of credit cards.

A person may default on a credit card or loan payment for many reasons, including job loss due to the recession, family emergencies, negligence, etc. It does not matter why the default occurred; the credit bureaus will note it, and it will be accessible to banks when they perform a credit check.

No Credit Check Credit Cards Instant Approval No Deposit USA

When it comes to applying for credit cards in the United States, finding those that do not require a credit check or do not require a deposit can take time and effort. An individual’s creditworthiness is generally assessed by a credit check on traditional credit cards, and those with a poor or limited credit history may need to deposit a security deposit.

Some companies advertise no credit check cards with instant approval, but you should proceed cautiously when considering such offers. Many cards have higher fees, lower credit limits, and less favorable terms. Several reliable options for establishing or rebuilding credit include secured credit cards, prepaid debit cards, and credit builder loans. To improve one’s creditworthiness, one must manage their finances responsibly.

The above credit cards are the best options for No Credit Check Credit Cards Instant Approval No Deposit USA.

Mistakes People Make That Affect Their Credit Score

Many people are only aware of the importance of having a good credit score once they try to borrow money and are declined.

You might have a bad credit score for the following reasons:

- Late payments of EMIs or loan installments.

- Credit card payments that are consistently late.

- Taking out multiple loans or credit cards within a short period.

- You’re getting close to or over your credit limit.

Credit Cards that Provide $1000, $2000, $3000, $5000, $10000 & $20000 Limits Guaranteed Approval

Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

Here are the 7 Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

- Initial Step Platinum Premier is Mastercard

- CapOne Secured Mastercard

- Citigroup Protected Card

- Early Step Platinum Premium Mastercard

- Wells Fargo Secured Card

- OpenSky Protected Visa Card

- Milestone Gold Mastercard

Note – Read Our Detailed Article on Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit, which will help you choose the best card.

Credit Cards with $2000 Limits Guaranteed Approval

Here are the 5 Credit Cards with $2000 Limits Guaranteed Approval

- Capital One Platinum Credit Card

- Surge Platinum Mastercard

- OpenSky Secured Visa Credit Card

- Capital One Quicksilver Secured Cash Rewardse

- Reflex Platinum Mastercard

Note – Read Our Detailed Article on credit cards with a $2000 limit guaranteed approval, which will help you choose the best card.

Credit Cards with $3000 Limits Guaranteed Approval

Here are some credit cards with a $3000 limit guaranteed approval:

- Capital One Secured Mastercard

- OpenSky Secured Visa Credit Card

- First Progress Platinum Elite Mastercard Secured Credit Card

- Total Visa Unsecured Credit Card

- Milestone Gold Mastercard

Note – Read Our Detailed Article on credit cards with a $3000 limit guaranteed approval, which will help you choose the best card.

Credit Cards with $5000 Limits Guaranteed Approval

Here are the 4 Credit Cards with $5000 Limits Guaranteed Approval

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Capital One Venture Rewards Credit Card

- Capital One Venture X Credit Cards

Note – Read Our Detailed Article on credit cards with a $5000 limit guaranteed approval, which will help you choose the best card.

Credit Cards with $10000 Limits Guaranteed Approval

Here are the Best 5 Credit Cards with $10,000 Limits Guaranteed Approval

- American Express Platinum Card

- Ink Business Cash Credit Card

- Bank of America Premium Rewards Credit Card

- Chase Sapphire Reserve

- Chase Freedom Unlimited

Note – Read Our Detailed Article on credit cards with a $10000 limit guaranteed approval, which will help you

Credit Cards that Provide $20000 Limit Guaranteed Approval

Here are some credit cards with a $20000 limit guaranteed approval:

- Chase Sapphire Reserve

- American Express Gold Card

- Ink Business Preferred Credit Card

- Capital One Venture X Rewards Credit Card

- Chase Sapphire Preferred Card

Note – Read Our Detailed Article on Credit Cards with $20000 Limit Guaranteed Approval, which will help you choose the best card.

FAQs about No Credit Check Credit Cards Instant Approval No Deposit

Can I Get a Credit Card Without Depositing Money?

Unsecured credit cards do not require a security deposit, but the first thing that comes to mind when people think of credit cards is an unsecured card. Secured credit cards, however, require a security deposit.

How Long Does It Take to Approve a Credit Card?

The approval process can take as little as a week, though most companies take around two weeks to approve a credit card application. During this period, a credit card company will analyze your borrowing history to determine your creditworthiness.

Can You Get an Unsecured Credit Card After Bankruptcy?

If you recently filed for bankruptcy, applying for a second-chance credit card will likely be difficult. However, even if you have been discharged from bankruptcy, it may still be possible. Even if approved for an unsecured credit card, you will probably be charged high fees and APRs.

Are Secured or Unsecured Credit Cards Best for Rebuilding Credit?

You can rebuild your credit with either type of credit card if you use them responsibly. Your bills must be paid on time, and you should carry very little debt, if any. An annual fee is less likely to be charged on secured credit cards since a refundable security deposit is required for account opening.

Are There Any $300 Credit Card Limit No Deposit?

Yes, credit cards with $300 limits and no deposit requirement are available, especially for individuals with fair to poor credit. These cards are often called unsecured credit cards for bad credit or low-limit credit cards.

What are Store Credit Cards with Instant Approval for Bad Credit No Deposit?

Store credit cards are accessible to consumers who have no credit history, particularly closed-loop cards. The majority of them will provide instant approval if you apply online, but none guarantee approval.

Conclusion

No Credit Check Credit Cards Instant Approval No Deposit can be a valuable financial tool for individuals looking to build or repair their credit histories. While they offer accessibility and a path to financial recovery, carefully reviewing the terms and fees associated with these cards is essential.

Additionally, consider them a stepping stone to traditional credit cards with more favorable terms and rewards once you have improved your creditworthiness. Responsible use of these cards can lead to better financial stability and future credit opportunities.

Add Comment