Are you looking for Best Debt Consolidation Loans for Bad Credit? If Yes, You are at the right place.

In this article, We are sharing all the information about Best Debt Consolidation Loans for Bad Credit.

A person with good credit has a valuable asset and is proud of it, but one with bad credit suffers from an affliction that eats away at them. You can’t buy a home or a car if you have credit card debt. Sometimes, you can even qualify for a job if you have credit card debt.

If you are having trouble paying your bills on time, taking action and looking into debt consolidation can help you restore your credit score. A debt consolidation combines all unsecured debts (typically credit card bills) into one pile to pay one payment monthly at a lower interest rate.

Debt consolidation loans with bad credit are difficult to qualify for, especially to avoid consolidating debt without hurting credit. The majority of lenders will only work with people who have good credit. Consolidation loans might only seem necessary if you have a credit problem since you wouldn’t need them. Lenders need to be able to count on their customers to repay them in full. The bank is only inclined to take your risk if you have repaid your previous loans, credit cards, and other debts.

You will still need to provide assurances to consolidation lenders that you can repay the loan if you get one. Their process involves checking your employment history, possibly requiring collateral, and demanding high-interest payments. It might be a good idea to reconsider whether you should consider debt consolidation loans with bad credit then if that’s the case.

What is Debt Consolidation?

Contents

- 1 What is Debt Consolidation?

- 2 What is a Debt Consolidation Loan?

- 3 How Do Debt Consolidation Loans Work?

- 4 What is a Debt Consolidation Loan for Bad Credit?

- 5 Where to Get a Debt Consolidation Loans for Bad Credit?

- 6 How to Get a Debt Consolidation Loan with Bad Credit?

- 7 Top 5 best bad-credit lenders for debt consolidation

- 8 How to Qualify for Best Debt Consolidation Loans for Bad Credit?

- 9 Steps to Apply for Best Debt Consolidation Loans for Bad Credit

- 10 What to Do if You Don’tdon’t Qualify for Best Debt Consolidation Loans for Bad Credit?

- 11 How We Chose Our Picks for Best Debt Consolidation Loans for Bad Credit?

- 12 FAQs

A debt consolidation strategy allows you to combine multiple debts into a single account. The most common method of consolidating debt is a debt consolidation loan, a personal loan used to pay off multiple creditors simultaneously.

What is a Debt Consolidation Loan?

Personal loans that consolidate debts into one typically have a lower interest rate than loans to pay off multiple debts at once. You may be able to pay off your debt sooner since your monthly payments will be reduced.

Most personal loans used for debt consolidation don’t require collateral, meaning they’re unsecured. The lender will determine your eligibility and interest rate primarily based on your credit score and debt-to-income ratio (DTI). Bad credit can make qualifying for a loan or getting a competitive APR difficult.

Personal loans can be obtained by borrowers who have bad credit, thanks to lenders who will work with them. Taking the estimated APR into account, which represents the total cost of borrowing, is a good idea. If you want to consolidate your debts, you should choose an APR lower than the interest rates on your current debts.

How Do Debt Consolidation Loans Work?

Various debt consolidation loans, including those from banks and credit unions, are available online. You get a loan to pay off your debt upon meeting the lender’s criteria. The lender deposits the loan into your bank account. It is often possible for lenders to send the proceeds of the loan directly to your creditors, thus saving you both time and hassle.

You only have the debt consolidation loan once you have paid off all your debts. There is a fixed payment over the course of the loan, which typically lasts between two and seven years.

What is a Debt Consolidation Loan for Bad Credit?

A debt consolidation loan is a personal loan that you take out to pay off several debts, such as credit card bills, medical bills, and unsecured loans. With a debt consolidation loan, your monthly payments will be simplified and sped up, simplifying and speeding up debt reduction.

There is a debt consolidation loan for every type of borrower, regardless of credit rating. Even though those with good or excellent credit will likely qualify for lower interest rates, there are still options for borrowers with bad credit (629 credit score or below).

Where to Get a Debt Consolidation Loans for Bad Credit?

The best consolidation loans differ from the worst, and some should be avoided entirely. The best place to start is with mainstream lenders, who typically have the most stringent qualification requirements.

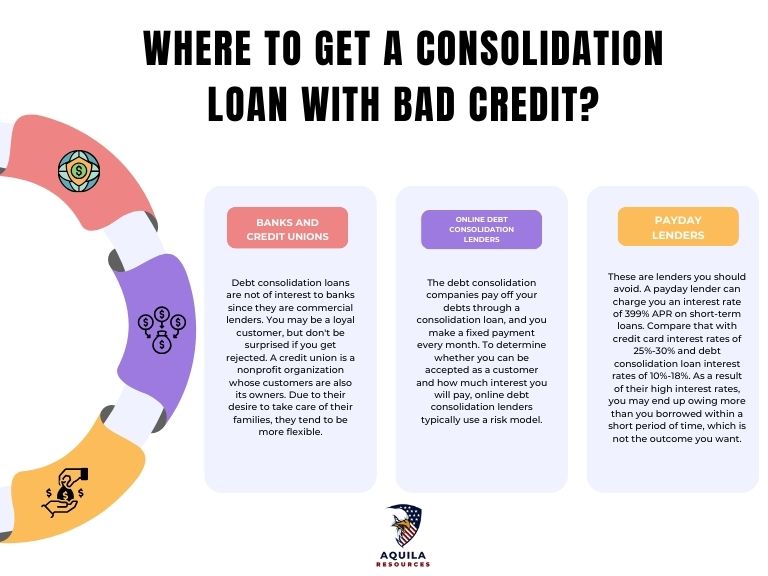

Several lenders are likely to Provide Debt Consolidation Loans for Bad Credit:

Banks and Credit Unions

Debt consolidation loans are not of interest to banks since they are commercial lenders. You may be a loyal customer but don’t be surprised if you are rejected. A credit union is a nonprofit organization whose customers are also its owners. Due to their desire to take care of their families, they tend to be more flexible.

There are strict rules and regulations governing both. Hence, they charge higher interest rates to borrowers with low credit scores because of risk-based lending models. You will pay more interest if your score is low, and you will be able to borrow less money if your score is low.

Online Debt Consolidation Lenders

The debt consolidation companies pay off your debts through a consolidation loan, and you make a fixed payment every month. Online debt consolidation lenders typically use a risk model to determine whether you can be accepted as a customer and how much interest you will pay.

There are usually several consolidation options for people with bad credit histories. A variety of loan amounts and repayment terms are available, ranging from $1,000 to $50,000. This can carry very high-interest rates – 25%-35% – so think twice before jumping in.

Payday Lenders

These are lenders you should avoid. A payday lender can charge you an interest rate of 399% APR on short-term loans. Compare that with credit card interest rates of 25%-30% and debt consolidation loan interest rates of 10%-18%. As a result of their high-interest rates, you may end up owing more than you borrowed within a short period, which is different from the outcome you want.

Consider consolidating your payday loans into a conventional personal loan if you have payday loans.

How to Get a Debt Consolidation Loan with Bad Credit?

Debt consolidation loans have the potential to help you get out of debt. If you have a poor credit score – a FICO score of 669 or a VantageScore lower than 661 – follow these steps to find the right debt consolidation loan.

Check and Monitor Your Credit Score

Credit is one of the key factors that lenders consider when making loan decisions. Generally, lenders are more likely to offer you a higher interest rate on financing if your credit score is low.

Most banks offer free tools for checking and monitoring your credit score. The more familiar you are with your credit score, the easier it may be to identify lenders willing to work with you. You can narrow down your choices by checking the credit score requirements on the websites of lenders specializing in bad credit loans.

Shop Around

If you receive a loan offer on the first page, you shouldn’t accept it. Comparing loan terms, repayment amounts, and fees from multiple sources will save you time and money. You can find these loans in several places, including local banks, credit unions, and online lenders. Even though it can take time, this process saves you hundreds of dollars.

Consider a Secured Loan

Debt consolidation loans with secured loans have a better chance of approval if you have trouble qualifying for a regular debt consolidation loan.

Unlike unsecured loans, the collateral for a secured loan is often a vehicle, home, or another asset. The lender will seize your collateral if you default on your loan. The benefit of a secured loan is that it is easier to get approved, and you may even qualify for a better interest rate than an unsecured loan.

Wait and Improve Your Credit

You should hold off and work on your credit if you have tried everything and cannot find a loan that will help you save money. Aim to pay off your debts on time every month for at least a few months. Paying off credit card balances and reducing non-essential monthly expenses are good ways to save money.

Top 5 best bad-credit lenders for debt consolidation

Avant

The Avant debt consolidation program is a good choice if you need to consolidate a small to midsize debt load. A maximum loan amount of $35,000 is the lowest on our list. You may receive funds the next day if your application is approved. Additionally, Avant offers a mobile app for managing your loan.

Pros & Cons of Avant

Pros

- A quick funding process

- A mobile application

- There is no prepayment fee

Cons

- Maximum rates are high

- Fees for administration

- The loan amount is set at a lower level

Avant Details

| Minimum credit score | 580 |

| APR | 9.95% – 35.95% |

| Loan length | 12 to 60 months |

| Loan amount | $2,000 to $35,000 |

| Origination fee | Up to 4.75% |

Best Egg

The Best Egg debt consolidation system allows you to send funds directly to your creditors, streamlining the debt consolidation process. Most Best Egg personal loans cost $35,000, but a special offer code allows you to borrow $50,000. The funds can be received as soon as the next business day after your application is approved.

Pros & Cons of Best Egg

Pros

- Creditors are directly paid

- The option to prequalify

- There is no penalty for prepayment

Cons

- Fees for origination

- Rates at the maximum

- There is no autopay discount

Best Egg Details

| Minimum credit score | 600 |

| APR | 8.99% – 35.99% |

| Loan length | 36 to 60 months |

| Loan amount | $2,000 – $50,000 |

| Origination fee | 0.99% – 8.99% |

Happy Money

Happy Money’s website provides easy access to its debt consolidation loan requirements. A Happy Money loan approval requires no delinquent payments and a credit score of 640 or higher. A Happy Money loan is designed to consolidate credit card debt and does not charge late or application fees.

Pros & Cons of Happy Money

Pros

- Transparency in loan requirements

- There are no application or late payment fees

- Loans designed specifically for credit card consolidation

Cons

- The funding process typically takes three to six business days

- There are no joint applications

- There are no loans available in Massachusetts or Nevada

Happy Money Details

| Minimum credit score | 640 |

| APR | 11.72% – 24.67% |

| Loan length | 24 to 60 months |

| Loan amount | $5,000 to $40,000 |

| Origination fee | 1.50% – 6.25% |

Upgrade

Upgrade personal loans are great for borrowers with low credit scores who want to consolidate their debts while building credit.

Upgrade leads across a variety of credit ranges. Still, it has a lower minimum credit score, less stringent credit history requirements, and lower debt-to-income ratios than lenders that prefer borrowers with good or excellent credit (690 or higher).

Pros & Cons of Happy Money

Pros

- Funds are available within 24 hours of approval

- The highest maximum loan amount on the list

- A joint application and secured loan are available

Cons

- There is a high maximum APR

- Fees are charged for origination

- Fees for late payments

Upgrade Detailed

| Minimum credit score | 580 |

| APR | 8.49% – 35.99% (with autopay) |

| Loan length | 24 to 84 months |

| Loan amount | $1,000 to $50,000 |

| Origination fee | 1.85% – 9.99% |

Upstart

The Upstart option may be a good choice if you have a thin credit profile – you can have a low credit score to qualify. Your education and employment may also be considered in addition to your credit score. If you are approved, it may be possible to receive funds as soon as the next business day.

Pros & Cons of Happy Money

Pros

- Analyzes nontraditional factors

- Requirement for a low credit score

- A fast funding process

Cons

- Origination fees may apply

- Fees for late payments

- Repayment terms are limited

Upstart Details

| Minimum credit score | 300 |

| APR | 6.40% – 35.99% |

| Loan length | 36 and 60 months |

| Loan amount | $1,000 to $50,000 |

| Origination fee | 0.00% – 12.00% |

How to Qualify for Best Debt Consolidation Loans for Bad Credit?

Debt consolidation loans are offered by lenders who have their requirements. The following are some of the most common requirements to get approval:

- You must be a U.S. citizen or a permanent resident.

- You must be at least 18 years old.

- Be exempt from bankruptcy or foreclosure proceedings.

- Maintain a debt-to-income ratio of below 45 percent.

- An average credit score of 600 or higher.

Your credit score may still qualify you for a loan even if it falls below that threshold. However, you will probably pay more in interest and fees. Therefore, if that happens, you may not be able to save money by applying for a debt consolidation loan.

Steps to Apply for Best Debt Consolidation Loans for Bad Credit

A debt consolidation loan requires you to complete an application and submit information about your finances and yourself. A few days is usually all it takes if you prepare all the documents in advance. After applying, your debt will likely be consolidated within the next week or two, and you’ll pay your new lender.

The steps for applying for Best Debt Consolidation Loans for Bad Credit are as follows:

- Gather Info on Your Current Debts: Create a spreadsheet listing your current debts, including principal balances, amounts owed, interest rates, terms, and creditors. This information will be crucial during the application process.

- Research Lenders: Explore options from banks, online lenders, and credit unions to find the right fit for your needs. Each has its advantages and eligibility requirements.

- Prequalify with Multiple Lenders: Utilize prequalification to assess the rates and terms offered by various lenders without impacting your credit score. Compare offers to identify the most favorable terms.

- Choose a Lender and Apply: Select the lender that offers the best terms for your situation and complete a full application. You’ll need to provide proof of identity, income, and documentation of your current debts.

- Receive Funds and Start Making Payments: Once approved, your lender will provide funds to consolidate your debts. You can either have your lender pay your creditors directly or do it yourself. Begin making payments on your new loan, following the provided amortization schedule.

It is important to act promptly to avoid accruing additional interest on your debts and to ensure a smooth consolidation process.

What to Do if You Don’tdon’t Qualify for Best Debt Consolidation Loans for Bad Credit?

The following strategies can help you reach your financial goals if your loan application needs approisn’tval.

Debt Management Strategies

It may be possible for you to pay off your existing debt on your own with discipline and a sensible debt repayment plan. You can use extra money to pay off debt by creating a budget, reining in some expenses, and reining in some expenses. The most effective debt payoff method is to pay off debts with the highest interest rate (debt avalanche) or the smallest balance (debt snowball).

Improve Your Credit Score

Boosting your credit score is the best way to increase your chances of getting a new loan. You may have to wait a while to improve your score, especially if you have missed payments in the past, but steady, responsible use of credit can help. Pay your bills on time, improve your credit utilization ratio, and dispute possible errors.

Debt Settlement

The company will also encourage you to avoid contacting creditors and miss payments while negotiating. This will result in a significant drop in your credit score. The creditors don’t don’t work with them; even if they do, you’ll have to pay a percentage of the initial debt as fees. They can reduce your debt burden, but creditors are optional when aren’tworking with them.

Bankruptcy

If bankruptcy is the only option you have left, it is only a last resort to discharge certain types of debts in certain circumstances, some of which may allow creditors to repossess assets. You will also have a hard time borrowing money in the future if you file for bankruptcy.

How We Chose Our Picks for Best Debt Consolidation Loans for Bad Credit?

To determine the best debt consolidation lenders for bad credit, we reviewed more than 25 lenders that offer personal loans. A competitive annual percentage rate (APR) is a requirement for making our list. The following factors are used to prioritize lenders:

- Accessibility: The ranking of lenders is higher if their loans are available to more people and have fewer requirements. As a result, credit requirements can be lower, funding may be available in a wider geographical area, and the application and prequalification processes can be easier and more transparent.

- Rates and Terms: There are fewer fees, lower interest rates, and greater repayment options with lenders with competitive fixed rates.

- Repayment Experience: As a first step, we consider each lender’s reputation and business practices. As well as reporting to all three major credit bureaus, offering reliable customer service, and providing free wealth coaching, we favor lenders who report to all three major credit bureaus.

FAQs

How Can I Consolidate All My Debt with Bad Credit?

A debt consolidation loan aims to consolidate multiple unsecured debts – such as credit cards, medical bills, and payday loans – into one monthly payment. You can get a debt consolidation loan if you have bad credit, but you may need to shop around.

Are Debt Consolidation Loans Bad for Your Credit?

The credit score of a person who complies with their loan payments can be used for debt consolidation loans. The more you pay off your debt, the lower your debt-to-income ratio will be, demonstrating to creditors that you can make timely payments. Credit scores can be improved over time if you do this.

Can I Apply for Debt Consolidation with Bad Credit?

Some debt consolidation lenders specialize in helping borrowers with bad credit get consolidated loans.

What Credit Score is Needed for a Consolidation Loan?

There are different credit score requirements for different lenders. Some companies require good credit scores, while others accept fair credit. Your APR rate may increase if you have a low credit score.

Add Comment