Are you looking for Consolidate Credit Card Debt? If Yes, You are at the right place.

In this article, We are sharing all the information about Consolidate Credit Card Debt.

Credit cards are a great way to earn rewards like cash back or air miles. They can be a useful source of emergency funds and pave the way for future purchases such as a home or car. Sometimes, life happens, and you find yourself stuck with multiple credit cards with varying balances. The process of planning and implementing a plan to repay these debts is challenging, but it is achievable.

There are several ways to consolidate and pay off these debts, so the best strategy for each individual will vary. In today’s blog, we will explore some options for consolidating common and uncommon debt.

What Is Credit Card Consolidation?

Contents

- 1 What Is Credit Card Consolidation?

- 2 What Is a Credit Card Debt Consolidation Loan?

- 3 How Does Credit Card Consolidation Work?

- 4 How To Consolidate Credit Card Debt?

- 5 How to Get a Credit Card Consolidation Loan?

- 6 How to Consolidate Credit Card Debt Without Hurting Your Credit?

- 7 Pros and Cons of Credit Card Consolidation Loans

- 8 When Should You Get a Credit Card Consolidation Loan?

- 9 How Does a Credit Card Consolidation Loan Affect Your Credit Score?

- 10 Is Credit Card Debt Consolidation a Good Idea?

- 11 What Is the Difference Between Debt Consolidation and Credit Card Refinancing?

- 12 FAQs

The process of consolidating credit cards involves combining multiple credit card balances into one. As a result, it is easier to track since they are only required to make one monthly payment and pay by that date. A lower APR often comes with consolidation strategies, allowing you to pay off the balance sooner by reducing your total interest bill.

What Is a Credit Card Debt Consolidation Loan?

The purpose of credit card consolidation loans is to consolidate your existing debts by taking out a new loan. For example, let’s assume you have three credit cards with $1,000 balances each. By consolidating your debt, you would take out a loan for $3,000, pay off your three $1,000 credit cards, and now only have one loan for $3,000.

How Does Credit Card Consolidation Work?

It is generally straightforward to consolidate credit cards. You combine all the debts you want to consolidate into one payment with the assistance of a loan officer or credit counselor or on your own. Then, you’ll be set up with a plan or loan to make payments to one place, making it easier to remember due dates and having a lower APR to pay overall.

We are now going to discuss a few consolidation strategies you can utilize. It is not a comprehensive list, but it may provide some ideas you must consider.

How To Consolidate Credit Card Debt?

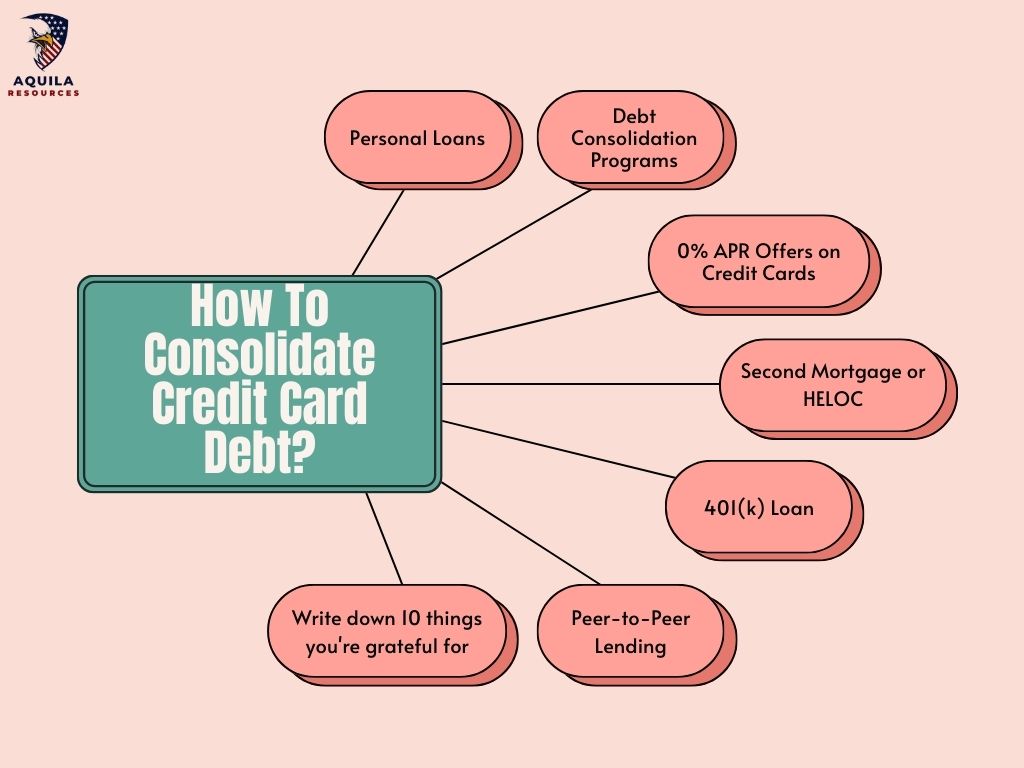

Many people consolidate credit card debt by taking out personal loans, using debt consolidation programs, or choosing a balance transfer credit card or Best Balance Transfer Cards For Bad Credit with a 0% introductory interest rate.

Personal Loans

The most common method of consolidating your credit card debts is obtaining a bank or credit union loan. It is often possible to complete the application process over the phone or online. These loans have the advantage of offering flexible terms (typically 12-60 months) and establishing a consistent monthly payment due, so budgeting is easier. Furthermore, some financial institutions make payments straight to creditors, so you don’t have to worry about collecting payments.

Knowing that your credit score and loan term likely determine your interest rate is important. There is also the possibility of origination fees, which may add to the overall cost of the loan.

Lending often considers Four major metrics: income, credit score, assets, and debts. Some underwriters’ loan approval process, such as Upstart, includes nontraditional metrics. Educational levels, length of residence, and even job histories can be considered during underwriting, leading to a loan approval that a bank might not approve. It is especially useful for borrowers who are just starting out and still need a substantial credit history.

The downside is that origination fees are possible, and fewer loan terms are available. A good credit score can result in comparable rates, but if your credit score is unfavorable, your rates could be much higher.

Debt Consolidation Programs

Credit card debt consolidation programs are usually designed to help borrowers consolidate their debt or you can Negotiate Credit Card Debt. A single payment is then made to the program, which forwards the payment to your creditors. This is not the same as a debt consolidation loan, where the loan pays off your existing debt. Even though your existing debts remain, they may be easier to manage.

If you make all of your payments individually, your monthly program payment should be less than the monthly payment for your program. Also, your debts will be paid off faster because more of your payment is going towards them. Although debt consolidation programs guarantee neither interest rate reduction nor late fee elimination, these programs are designed to help you reduce your debts. If you want to keep your cards, double-check debt consolidation programs to ensure they won’t require you to close some or all of them.

The National Foundation for Credit Counseling (NFCC), a nonprofit credit counseling organization, can help you get a free credit report and score if you’re experiencing debt repayment challenges. These programs aim to create a payment plan that works for you. However, some charge an extra setup fee or a monthly fee. If you decide which company to choose, you should consider this.

0% APR Offers on Credit Cards

Several credit cards offer 0% introductory APR for a limited period after a balance transfer. Balance transfers are still associated with fees (typically 3% to 5% of the consolidated balance). Still, you do not have to worry about interest accruing on your balance during the twelve to eighteen-month introductory period.

The Citi Diamond Preferred Card is an excellent choice if you are considering this route. This card has no annual fee and an intro APR of 0% for 21 months on balance transfers and 12 months on purchases from the account opening date. You will be charged an APR of 18.24% – 28.99%. It is necessary to transfer balances within four months of opening an account. You’ll be charged a fee of $5 or 5% of the amount of each balance transfer, whichever is greater.

There are some downsides to balance transfer credit cards such as Best Balance Transfer Cards for Fair Credit, such as the credit limit and the introduction period before interest starts to accrue. Some people may find it more beneficial to spread payments over a longer period, even if they have to pay some interest. Credit cards with 0% introductory rates are recommended for people with good or excellent credit.

Second Mortgage or HELOC

Using your home for debt consolidation could be an option if you have appreciated it over time or paid the balance fairly. A home equity line of credit (HELOC) or a second mortgage can be viewed as using your residence as collateral to pay off other loans.

These loans are often lower interest rates than personal loans since they have an underlying asset, making monthly payments smaller or avoiding higher interest rates with other methods. You can pay the balance off more quickly because the interest rate is lower. When taking this route, it would help if you inquired directly with your lender about additional mortgage-related expenses. Tax implications may also apply.

401(k) Loan

Taking money out of retirement savings is recommended only if it is urgent. You may not want to consider a 401(k) loan for debt consolidation as your first option, but it does have some benefits.

If you borrow against your employer-sponsored 401(k), you can get a lower interest rate than if you took out a personal loan, which is generally good for your credit score. Your 401(k) loan won’t affect your credit score or require an adequate credit score because there won’t be a credit check. You may also improve your credit rating over time due to paying off your debts with the loan.

You may be subject to heavy fees if you cannot repay the loan. If you decide to leverage your retirement fund, keep in mind that it will reduce the value of your retirement fund. You could also accelerate your payback time if you lost your job or changed jobs.

Peer-to-Peer Lending

Among the options for getting funds for a consolidation loan is peer-to-peer lending. Using Peerform, investors can find those looking for loans as well as those looking for investments. It is important to create a win-win situation. Investing to earn a steady and worthwhile return on investment by consolidating debts into a single, easy monthly payment.

Equity in Owned Vehicles

This option may interest people who have paid off their vehicles or have a lower balance than their value. Paying down your other creditors could be accomplished by taking out a loan using your vehicle as collateral. This gives you a much lower auto loan rate than an unsecured personal loan.

Limiting the loan to the vehicle’s value would have the drawback. Additionally, most lenders require that you carry full auto insurance when obtaining an auto loan, which could increase monthly expenses if you carry personal liability and property damage (PLPD) insurance. Therefore, this is another method of obtaining a lower interest rate by leveraging an asset.

How to Get a Credit Card Consolidation Loan?

Credit card consolidation loans are available from a variety of lenders. When applying, you must still follow the following steps:

- Do a Credit Check: If you’re looking for a consolidation loan, check your credit score to know which lenders you may qualify for and what interest rates to expect. If you submit your application early, you will have time to improve your score.

- Prequalify: Some lenders allow you to prequalify without affecting your credit score. Before applying formally, you can know the interest rates and terms you might be eligible for.

- Compare Lenders: You should compare interest rates, fees, and repayment terms offered by lenders once you have identified those who may qualify for your loan. Depending on your goals, A lender offering the lowest monthly payment, the best rates, or the easiest repayment process may be the best option.

- Gather the Necessary Documents: It is usually necessary to submit documentation showing your employment, income, and bank account information. This information is helpful so that approvals and funding can be expedited.

- Submit a Formal Application: The process must still be completed with your chosen lender, even if you prequalify. An acceptable lending risk is determined with the help of information you submit to the loan underwriters.

- Await Approval: A majority of online lenders promise the approval of a loan within 24 hours, and some even guarantee funding on the same day or the next day. The approval process can take several business days, especially if additional documentation is required to verify your identity or income. Make sure you continue to pay your credit card during this time.

- Consolidate Credit Card Balances: You can use the loan funds to pay off your credit card balances immediately if they are deposited into your bank account. Alternatively, you can pay your cards off directly if you work with a credit consolidation lender.

How To Get Credit Card Consolidation Loans for Bad Credit?

There are options available for people with bad credit who want a credit card consolidation loan. It is best to find debt consolidation loans with low credit score requirements; some deals require a score of less than 600.

A co-signer who meets the lender’s requirements will be able to help you qualify for a debt consolidation loan if you need help to qualify. It is important to remember that your co-signer will be responsible for repaying the loan if you fail to.

Another option to qualify for a debt consolidation loan is to take out a secured loan. When you take out a secured loan, you’re backing the debt with collateral like your home or savings. The lender can take your collateral if you fail to repay the loan. These loans have many advantages over unsecured loans, including an easier qualification process.

How to Consolidate Credit Card Debt Without Hurting Your Credit?

When Consolidate Debt Without Hurting Credit, it’s best to act sooner rather than later and stop any debt accumulation from increasing. When you can shape a repayment plan to pay down your balance before the end of an introductory period, you can take advantage of a balance transfer offer to avoid interest for some time.

However, these offers usually require good credit. You should avoid closing any accounts you transfer a balance from if you plan on transferring a balance, as this will reduce your overall available credit and negatively impact your credit.

Those not eligible for a balance transfer may consider a personal loan with the lowest interest rate and fees possible. The personal loan can be used to pay off credit cards and ensure all payments are made on time. The most important factor in determining your credit score is your payment history.

Pros and Cons of Credit Card Consolidation Loans

The debt consolidation loan can be useful for paying off your debt quickly but has some drawbacks. If you’re considering these loans, consider the pros and cons of each:

| Pros | Cons |

| Getting rid of credit card debt faster | A possible origination fee |

| Interest can be paid less | There may be a higher monthly payment |

| Make a single loan out of multiple debts | Overspending on credit cards is possible |

| A possible rise in credit scores | A co-signer may be required |

| Payments that are fixed and steady | Obtaining low-interest rates can be challenging |

When Should You Get a Credit Card Consolidation Loan?

The benefits of consolidating credit card debt include saving money and making monthly payments easier. The strategy, however, needs to be corrected for every borrower. You may want to consolidate your credit cards if you:

- Be Able to Cover Payments Consistently: Debt consolidation works best when you have the funds to make the new monthly payment. You won’t benefit from credit card consolidation when you don’t have enough money to cover your monthly expenses.

- Carry High-Interest Debt: When you carry a balance on your credit card, you are likely to pay a high-interest rate. There are sometimes charges of 27% or more. It is typical for a personal loan to have an interest rate ranging from 3% to 36%. A consolidation loan with a lower interest rate may enable you to pay off your debt more quickly and for less money.

- Have Good Credit: A consolidation loan can be obtained at the best rates and terms if you have a strong credit score. Those with a credit score of 720 or higher have the best chances of securing a competitive loan. Qualifying with bad or fair credit is still possible, but rates will likely be higher.

- Pay off Your Debt in at Least Six Months: Consolidating your debt with a loan may not be the best option if you have a small amount of debt. A consolidation loan is generally recommended for those with debts of at least $5,000 and a repayment schedule of at least six months.

- Have a Plan to Avoid Future Debt: Even though consolidation can save you monthly money, it will not help if you rack up new debt instead. If you keep your spending habits the same, you will likely be in the same situation a few years after consolidating your credit card debt. Establish a budget and only spend what you can afford to avoid this.

How Does a Credit Card Consolidation Loan Affect Your Credit Score?

There are several ways in which credit card consolidation loans affect your credit score:

- Credit Utilization is Lower: A revolving line of credit, such as a credit card, affects your credit utilization ratio, determining your credit score. Credit card debt consolidation can help you improve your credit score by decreasing your utilization rate.

- Streamlined Payments: Paying a single monthly loan is much simpler than paying several loans simultaneously. When you consolidate your debts, you can manage on-time payments and protect your credit score by maintaining a positive payment history.

- Lower Interest Rate: You may have a better credit score if your interest rate is lower because more of your monthly payments go towards principal rather than interest. The lower the loan balance, the faster the debt is paid off.

- New Inquiry on Your Credit Report: The lender runs a hard credit check when you apply for a loan. This hard inquiry temporarily affects your credit score and is reflected on your credit report. As a result, the inquiry will be removed from your report in two years, and the impact on your score will last approximately one year.

Is Credit Card Debt Consolidation a Good Idea?

A credit card debt consolidation program usually aims to consolidate high-interest credit card debts into one easy monthly payment. Regardless, they provide a clear path to debt-free living as the paydown periods are usually fixed. There may be no setup or origination fees, but a structured feel is what you need to become debt-free.

What Is the Difference Between Debt Consolidation and Credit Card Refinancing?

A credit card refinance involves transferring a credit card’s balance to a credit card with a lower interest rate. Credit card refinancing is the process of transferring debt between credit cards. Keeping a few things in mind before choosing one over the other is important.

Credit card refinancing is most effective when you have a low overall balance on your cards. The reason is that refinancing usually comes with a lower APR for a shorter period (usually 12 to 18 months). The APR may return to what it was before refinancing after this period. The good part is that you’ll only be stuck with the monthly minimum payment, which is lower than the minimum payment on a consolidation loan. To make this a more short-term solution, your best option would be to pay off the balance during the promotional period.

The consolidation loan would have a fixed interest rate, consistent monthly payments, and a defined maturity date. It may be necessary to pay an origination fee, but everything is determined when the loan is removed, so all guesswork is removed. The consolidation loan rate could be higher than a credit card promotional rate. Still, if the balance is carried beyond this period, you will likely pay less than the credit card’s average interest rate.

FAQs

Is Credit Card Consolidation Right for You?

The benefits of credit card consolidation may be worth considering if you need help keeping track of multiple monthly debts. You can manage your finances more easily if you only have to make one payment each month. During the consolidation process, you could save money on interest if you get a lower rate on a new card or loan.

However, there are some risks associated with credit card consolidation. A consolidation could cost you more if you cannot find a better interest rate. Additionally, consolidating credit card debt frees up space on your existing cards, which some people need help to avoid using, further worsening their debt problems.

How Long Does Credit Card Consolidation Stay on Your Credit Report?

Consolidating your credit cards involves consolidating several outstanding balances into one new account and paying them off under the new terms. A consolidation can affect your credit report depending on how all the accounts are consolidated, what type of account you open to pay down the consolidated balance, and other factors. You will have to wait seven years for the closed accounts on your credit report to disappear if you consolidate debt and close any settled accounts.

Should You Consolidate Your Credit Card Debt?

If you consolidate your credit card debt, you can pay down your debt more quickly. Streamlining your payment schedule may simplify the process of repaying the debt and reduce interest payments in some cases. It would help if you plan to repay your loan before consolidating your debt. Using a debt consolidation calculator, you can determine your monthly payment options and see if they make sense for your budget.

Your debt consolidation loan payments may exceed the minimum credit card payments. A debt consolidation loan can free up your credit card balance, but if you don’t plan to manage your spending in the future, you might end up overspending. This can ultimately lead to further debt.

Add Comment