Are you looking for Buy Now Pay Later No Credit Check Instant Approval Websites? If Yes, You are at the right place.

In this article, We are sharing all the information about Buy Now Pay Later No Credit Check Instant Approval Websites.

Do you often find yourself declined for a loan or credit card due to your credit history? Especially if you have been rejected for credit cards or loans because of your credit history, finding catalogs with instant credit or Catalog Credit Cards Guaranteed Approval can be a game changer. Do you feel your bad credit prevents you from achieving your goals? Now, you can shop online for free without worrying about your credit score. These online stores offer no credit check installments, so you can buy in installments without a credit check and get instant approval.

A great deal, discount, or promo is always going on nowadays, but it only lasts a while. It has become so common for us to receive things quickly and easily that we have become impatient. There is a desire for things to be delivered instantly, and marketers are aware of it. Thus, we can only accept ordering stuff online whenever we see a sign offering a 20% discount.

What is Buy Now Pay Later?

Contents

- 1 What is Buy Now Pay Later?

- 2 How Does Buy Now Pay Later Work?

- 3 Buy Now Pay Later Instant Credit

- 4 What is Buy Now Pay Later No Credit Check Instant Approval Websites?

- 5 How Do Buy Now Pay Later No Credit Check Instant Approval Websites Work?

- 6 Top 9 Best Buy Now Pay Later No Credit Check Instant Approval Websites

- 7 Video Guide for Buy Now Pay Later No Credit Check Instant Approval Websites

- 8 Pros and Cons of Buy Now Pay Later

- 9 How Are Buy Now Pay Later Websites, Apps & Catalogues Useful?

- 10 Some Alternatives to Buy Now and Pay Later

- 11 FAQs

The concept of a buy now, pay later deal is exactly what it sounds like. The option of making a purchase now and paying for it later, usually in installments, is available. If you need better credit or have no credit history, finding buy now and paying later sites that offer no credit checks and instant approvals is also helpful also there are Buy Now Pay Later Jewelry available.

This type of online credit shopping site is so powerful due to a few key reasons. The company allows you to purchase without paying right away. When you’re short on cash or need to make an emergency purchase, it can free up cash flow in the short term.

The BNPL deals don’t require you to pay interest on your purchases. Your credit card balance typically accrues interest if you don’t pay it off each month. There is usually a set timeframe for repayment with BNPL deals, so you know exactly when to expect the funds. While credit card (whether Secured Credit Cards or Unsecured Credit Cards) companies usually charge interest on balances after 21-25 days, they may grant you grace periods of up to 31 days.

How Does Buy Now Pay Later Work?

There are new players in the consumer financing payment method game. To provide solutions to customers who previously needed access to credit, modern lenders interpret a different set of data than traditional credit metrics.

The Buy Now Pay Later (BNPL) system, instant approval websites, and apps allow customers to pay back payments in installments without worrying about their credit score. Payment terms range from one month for smaller transactions to several years for larger ones with no annual fees.

Digital net terms are an option for customers who require or want BNPLs in B2B transactions. The Resolve solution is an example of a B2B solution that offers net terms. Businesses can request discreet credit checks through Resolve, and Resolve informs them about credit limits and net terms they should offer to their customers (or potential customers).

Net terms are critical to setting up BNPL for B2B transactions. No interest or financing charges should be charged to customers for purchases they make for 30 days, 60 days, or even 90 days. Resolve provides businesses with a customer-facing payment platform where customers can make payments easily. However, the biggest advantage of this solution may be its ability to secure advanced payments on invoices without using an invoice factoring service.

Invoices approved by Resolve are paid in full within one day into the bank account of each business. Paying the business upfront and receiving the net terms the customer needs to pay on their timeline benefits them. There is a true win-win situation here.

Buy Now Pay Later Instant Credit

The use of ‘Buy Now Pay Later’ solutions is on the rise both in the B2B and B2C worlds, as more and more people purchase online. The e-commerce sector offers instant credit and low monthly payments everywhere—from buying concert tickets on a laptop through Ticketmaster to any of the millions of products and services offered by Amazon to B2B transactions.

It’s no secret that consumers are hurrying regarding purchases, whether B2B or B2C and even in everyday life. We have been experiencing instant gratification from B2C e-commerce for years. The Internet allows you to search for anything you need, which can be delivered in just one click. Vendors offering this service are light years ahead of competitors who must provide guaranteed approval and easy payment options.

What is Buy Now Pay Later No Credit Check Instant Approval Websites?

There is a way to take a loan within a short period and repay it quickly. There are some situations when it is not a loan, although similar to one. The buy-now-pay-later method is known as Buy Now Pay Later. Several buy now, pay later applications and websites allow users to borrow money to pay for items they need over a predetermined period. Several terms and conditions are always attached to these buy now and pay later platforms.

It is a common term and condition for buy now pay later users to meet certain credit requirements. Most people cannot use these platforms because they need more credit. This article is for those with bad or poor credit since these buy now, pay later platforms do not require a credit check before you can be approved. Many platforms will approve you even if you have bad credit.

A poor credit score can often inhibit your ability to take advantage of buy now, pay later schemes or easy, flexible installment plans when shopping online. It is possible to improve your credit score overnight with options like Dovly, but there are few guarantees. With no credit check and instant approval schemes, modern lenders and merchants now consider your credit score and offer you the opportunity to buy now and pay later without having your credit checked.

The best feature of these websites is that you can pay for items over time by making installment payments. You can pay in equal installments over two weeks or choose a payment plan that fits your budget. Furthermore, progressive leasing suppliers accept no-credit-check websites, making them ideal for shoppers with a bad credit history.

How Do Buy Now Pay Later No Credit Check Instant Approval Websites Work?

Many of these services provide instant decisions based on the information you provide (e.g., your employment status). Immediately after you click the buy now button, you will see a detailed description of your spending limit and payment plan. You will likely be approved for financing if you have a credit card. Some providers require a one-time payment, or down payment, of up to 25% to be approved, but others do not. Researching and comparing options before applying is important, as interest rates and fees can vary significantly.

Additionally, several Best Online Shopping Sites with Credit Lines, allowing you to transfer your payments without needing a separate loan or credit card. These sites often partner with lenders to provide this service, and you can typically be pre-approved for a specific amount before you start shopping.

Top 9 Best Buy Now Pay Later No Credit Check Instant Approval Websites

As no credit check apps do not report to credit bureaus, the buy now pay later apps provide a means for you to lower your credit score over time. However, they are very useful for most borrowers who wish to avail of flexible installment plans.

Here are Best Buy Now Pay Later No Credit Check Instant Approval Websites or or Buy Now Pay Later Guaranteed Approval Website-

Fingerhut

It is one of the most popular websites that lets you buy now and pay later. The application process is quick and easy. You only need to create an account and a profile to use Fingerhut. The advantage of Fingerhut is that you can apply for an account despite needing approval for a traditional credit card.

Shoppers at Fingerhut can purchase products in one go or in monthly installments. Three consumer credit bureaus are reported to the website to assist in building credit histories. Fingerhut charges a late fee and interest, but if you pay in full before the due date, you won’t be charged either.

Afterpay

The Afterpay platform is one of the most reliable buy now, pay later options in the United States. Using Afterpay without a credit check and getting instant approval is the perfect solution for people with poor credit.

The maximum purchase on Afterpay is $1,500, and the maximum account balance can be $2,000, but you can borrow with every transaction. You don’t have to worry about your credit score or rating with Afterpay since it doesn’t affect it.

Klarna

The Klarna platform is one of the most reliable buy now pay later providers in the United States, regardless of credit score. The program is open to everyone, even low-income earners, who need a quick loan to buy whatever they want, especially during the festival. Klarna is one of the very few companies that offers several types of repayment options. When writing this article, Klarna offers four types of repayments.

Klarna Pay in 4

Pay in 4 is Klarna’s first repayment plan, which offers interest-free repayment and requires its users to repay their loans four times every two weeks. The first payment and late fee of $7 must be paid at checkout.

Klarna Pay in 30

Klarna’s second repayment method is Pay in 30. You have to pay in 30 if you choose this repayment option. There is no interest if you choose this repayment plan and pay the amount at one time within 30 days. You get $0 at checkout. The possibility of being in default exists if you delay your payment.

Klarna Pay Now

This third Klarna payment option requires you to pay the full balance immediately, and there is no interest-free period.

Klarna Financing

This is the last payment plan, which varies between six and 36 months. There is an APR of 0% to 29.99%, however. There may be a 19.99% charge for standard purchases. You will be charged a $35 late fee if you don’t pay at checkout.

Affirm

The buy now pay later company Affirm is also one of the best and most reliable in the U.S.. The company offers several services to help people buy whatever they need when they need it and pay when it’s convenient for them.

It is possible to take out quick loans using this incredible buy now, pay later platform with simple repayment terms and conditions. Credit scores aren’t required for Affirm loans, but you must have a credit score of 640 or higher.

You can’t increase your credit limit with Affirm, and it’s good for those who need help keeping track of expenses.

FlexShopper

This site offers a free Personal Shopper service to consumers searching for specific items. The most popular and wide-ranging consumer electronics products are gaming consoles, computers, and televisions.

The company does not use national credit bureaus to determine whether or not to accept your application, but they urge you to pay on time to avoid being reported. The Flexshopper program accepts applicants with good and bad credit histories. Among the few online marketplaces offering iPhone financing for people with bad credit, FlexShopper is one of the best.

Video Guide for Buy Now Pay Later No Credit Check Instant Approval Websites

Pros and Cons of Buy Now Pay Later

Pros of Buy Now Pay Later

A growing number of companies offer Pay now, pay later services. Consumer Financial Protection Bureau reports that the number of BNPL loans from five popular lenders increased by 970% between 2019 and 2021. They enjoy the convenience of paying on their own time, purchasing online or in stores, and getting low-cost or free financing. Benefits of buying now and paying later include:

Splitting Payments

It’s important to note that BNPL services offer the advantage of breaking up payments into smaller, more manageable amounts. Having optionally on hand is unnecessary when making a big purchase.

Most buy now, pay later services split the cost into several payments between two and four weeks apart. It is sometimes possible to match this payment cycle with biweekly pay schedules to ensure that your bank account remains replenished before the next payment is due.

0% Financing

When you pay your BNPL bills on time, you will typically not be charged interest. It is appealing to most users of buy now, pay later to get 0% financing. The BNPL arrangement can work if you want to break up your payments without paying any service fees or interest.

No Credit Check Financing

The approval process for some buy now, pay later services does not check your credit score. It may be possible to obtain financing through BNPL even if you do not have a credit history or are rebuilding your credit.

Cons of Buy Now Pay Later

It could be more secure for your finances to buy now and pay later because it makes spending easier. The convenience offered by buy now, pay later services can come at the expense of financial risks. The following are some cons of BNPL:

Fees and Interest

Your BNPL balance may be subject to a late fee or interest if you fail to pay. There can be a significant difference between the fees charged by the BNPL lender and the structure of these fees.

Your account can be turned over to a collection agency if you stop making payments. Your credit score could also be affected during this period, in addition to additional fees and interest.

Overdrafts are Possible

You can experience bank account overdrafts if you make frequent, automatically scheduled payments.

You should make sure you have sufficient funds in your checking account if you set up BNPL payments to be automatically deducted from your account. Make sure you mark these dates on your calendar and allow enough time to meet the next payment date after each paycheck deposit.

Finances are Easy to Overextend

BNPL services can cause you to overextend your finances, which is one of their biggest dangers. It may not be easy to register an item’s full cost by only looking at the cost of each payment. The bills can pile up when you make multiple buys now and pay later purchases, and it can be challenging to manage them all.

Rewards are Missed

The downside of using buy now, pay later is losing the rewards and other benefits you receive from credit cards. It can deter shoppers with great rewards cards from using BNPL services since they do not offer rewards like credit cards. Additionally, you won’t be able to benefit from other credit card benefits, such as purchase protection.

If you can’t pay off your credit card bill in full, you can pay off the balance with a buy now, pay later bill to earn rewards points. However, this could be too complicated for some and lead to you paying a higher interest rate.

Returns Can Be Difficult

There may be a wait and a difficult process if you need to return a BNPL purchase. The BNPL lender will receive the funds (assuming the return is approved) instead of the merchant when purchasing with a credit card. Returns are then passed on to you by the lender. The BNPL plan still requires you to make payments, or you will be subject to late fees and penalties. There may be weeks or months involved in completing the return if there are disputes over the purchase.

The amount you return to the merchant must be repaid on your BNPL plan if the merchant gives you cash or store credit.

How Are Buy Now Pay Later Websites, Apps & Catalogues Useful?

You can find it difficult to take advantage of a good buy now, pay later scheme, or pay for your purchases with easy, flexible installments when you shop online with poor credit scores.

It is possible to improve your credit score overnight with options like Dovly, but there are few guarantees With no credit check and instant approval schemes, modern lenders and merchants now consider your credit score and offer you the opportunity to buy now and pay later without having your credit checked.

The most valuable part of these websites is that they allow you to pay over time for items through installments. Sometimes, depending on your provider, you can pay in two equal installments every two weeks or even on a more flexible schedule.

Furthermore, progressive leasing suppliers accept no-credit-check websites, making them ideal for shoppers with a bad credit history.

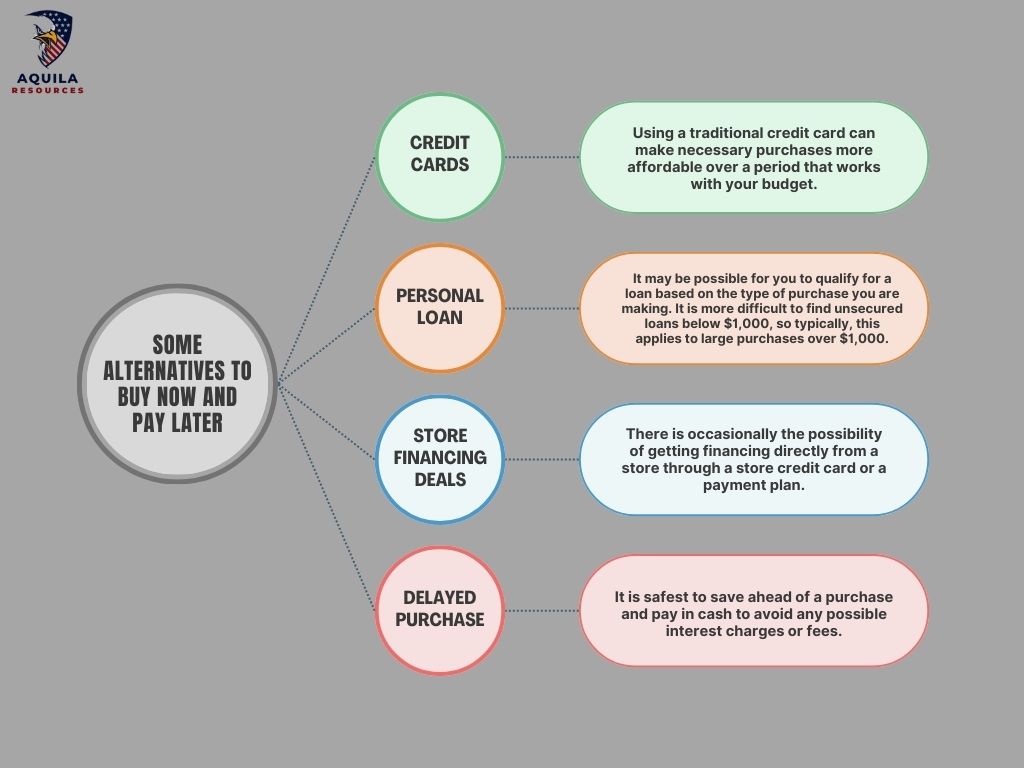

Some Alternatives to Buy Now and Pay Later

The following alternatives may be more suitable for your needs than buy now, pay later:

- Credit Cards: Using a traditional credit card can make necessary purchases more affordable over a period that works with your budget. A 0% interest introductory credit card may let you defer interest for up to 21 months before you must begin paying interest. Having this kind of breathing room for unexpected, large purchases can be helpful.

- Personal Loan: It may be possible for you to qualify for a loan based on the type of purchase you are making. It is more difficult to find unsecured loans below $1,000, so typically, this applies to large purchases over $1,000. Shop for the best interest rates if you’re considering a personal loan. Credit card interest rates are often higher than those on loans.

- Store Financing Deals: There is occasionally the possibility of getting financing directly from a store through a store credit card or a payment plan. Taking advantage of these deals when purchasing can help you make affordable payments.

- Delayed Purchase: It is safest to save ahead of a purchase and pay in cash to avoid any possible interest charges or fees. It may be possible to avoid difficult financial situations by skipping buy now, pay later services when it is possible to delay a purchase.

FAQs

Where Can I Find Buy Now Pay Later with Bad Credit?

A great place to start looking for buy-now and pay-later loans for people with bad credit is CashUSA.com.

Do Stores Offer Instant Credit?

The department stores offer customers instant credit via cards affiliated with some stores or you can get Instant Credit Online Shopping No Down Payment. You can use it to get approval instantly.

What are Some Reliable Websites That Let You Buy Now and Pay Later and Do Not Do Credit Checks?

You can buy products you need online and pay for them later through installments at many online stores like Fingerhut and FlexShopper. The other options discussed above have been described in detail.

What are Some Apps for Instant Credit Online Shopping No Down Payment?

Because credit check apps do not report to credit bureaus, they will not assist borrowers in improving their credit scores. However, the Buy Now Pay Later apps come in handy if borrowers want flexible installment plans. Using these apps makes managing purchases and payments easier.

Here are 4 Apps for Instant Credit Online Shopping with No Down Payment that provides instant credit approval online shopping:

- Afterpay

- Klarna

- Affirm

- Prepay

Add Comment