Are you looking for Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit? If yes, you have stumbled upon the right place.

In this article, we share information about Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit.

You must maintain and improve your credit score in the modern world to keep and grow your money. Credit cards, loans, and places to rent are determined by it. Credit cards may be difficult to obtain for those with poor credit.

Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

Contents

- 1 Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

- 1.1 Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

- 1.2 Top 7 Guaranteed Approval Credit Cards For Bad Credit With $1000 Limits And No Deposit

- 1.3 Detailed Pros & Cons of Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

- 1.4 Video for Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

- 1.5 Guaranteed Approval Credit Cards with $1,000 Limits for Bad Credit

- 1.6 How Can I Get Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit?

- 1.7 What Do I Need to Apply for a Credit with a $1,000 Limit?

- 1.8 Factors to Consider When Applying for Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

- 1.9 Credit Cards that provide $2000, $3000 & $5000 & $10,000 Limits Guaranteed Approval

- 1.10 Credit Cards with $3000 Limits Guaranteed Approval

- 1.11 FAQs for Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

- 1.11.1 What are The Requirements For Obtaining a $1,000 Credit Card?

- 1.11.2 How Can I Raise My Credit Score to Get a Credit Card For $1,000?

- 1.11.3 Is a Credit Limit of $1000 Sufficient for a First Credit Card?

- 1.11.4 What is The Lowest Amount on a Credit Card?

- 1.11.5 What is The Best Credit Card For The First Time?

- 1.11.6 What are Some $1,000 Credit Card Limit No Deposit?

- 1.12 Conclusion

If you are looking for Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit, these are the best options:

| Credit Cards | Details |

|---|---|

| First Progress Platinum Elite MasterCard | Learn More |

| Capital One Secured Mastercard | Learn More |

| Citi Secured Mastercard | Learn More |

| First Progress Platinum Prestige MasterCard | Learn More |

| Wells Fargo Secured Card | Learn More |

| OpenSky Secured Visa Card | Learn More |

| Milestone Gold Mastercard | Learn More |

Many traditional credit card companies require a high credit score, a deposit, or both before accepting an application. However, people with bad credit still have a chance, as there are credit cards with guaranteed approval for people with bad credit and no deposit requirements.

Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

This article discusses about Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit because the difficulties associated with having bad credit, the advantages of credit cards that guarantee acceptance, and how people with bad credit can find and use credit cards with $1,000 credit limits. Furthermore, we will discuss how to take charge of our finances and gradually build our credit.

For some people, Credit cards with a $1000 limit guaranteed approval are a good option for people with bad credit who need a credit card to build their credit history. These cards typically have high-interest rates, but they can help you establish a good payment history and increase your credit score. Once your credit score improves, you can qualify for a card with a higher limit and lower interest rate.

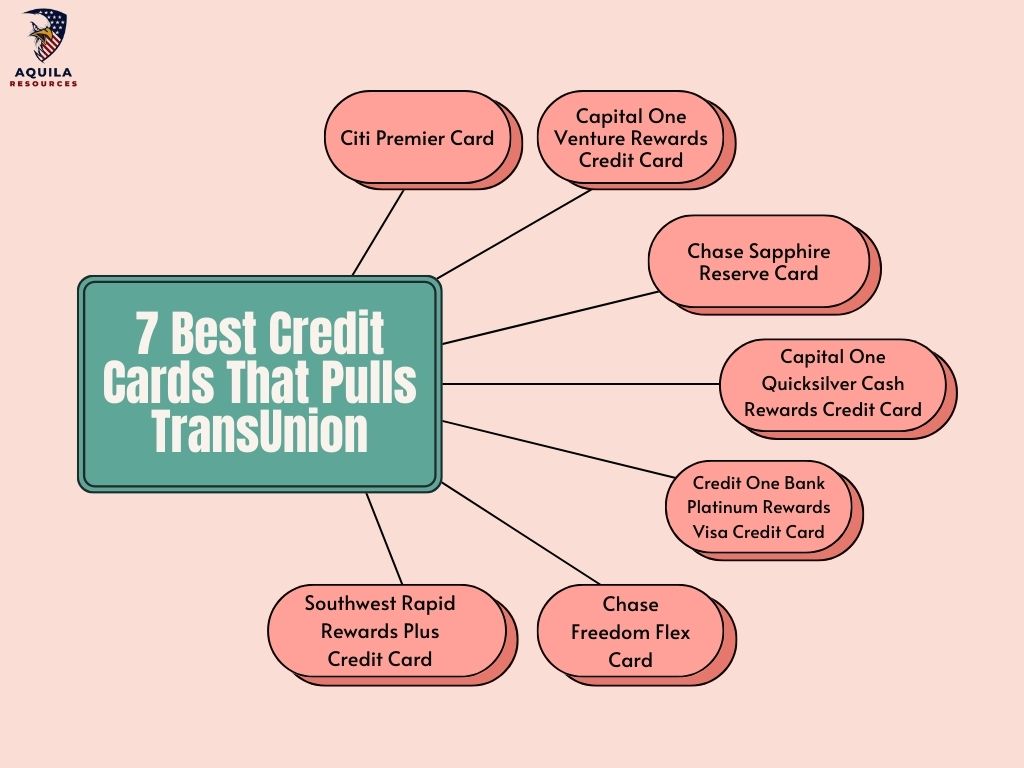

Top 7 Guaranteed Approval Credit Cards For Bad Credit With $1000 Limits And No Deposit

The Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit that does not require a credit check or a down payment. In other words, a person with any credit score will likely be accepted for the card.

Here are the 7 Best Credit Cards With $1000 Limits For Bad Credit And No Deposit –

First Progress Platinum Elite MasterCard

First Progress Platinum Elite MasterCard offers a $2000 credit limit and does not require a minimum credit score. In contrast to other credit cards that require high credit scores, this card provides everyone with a credit line. The down payment of $200 is refunded after six months.

It is available online, provides fast funding, and is accepted worldwide. There is a 3% cash advance fee and no minimum credit score requirement.

Pros & Cons of First Progress Platinum Elite MasterCard

Pros:

- No credit check is required to be approved, even with a poor credit history.

- This card reports to all three major credit bureaus can help you build your credit history.

- Low annual fee of $29.

- Potential for a high credit limit, up to 100% of your deposit.

- This card gives you opportunity to graduate with an unsecured card after 6 months of on-time payments.

Cons:

- No sign-up bonus or rewards program.

- High APR of 25.24%.

- Requires a security deposit, which is typically equal to your credit limit.

- Foreign transaction fees of 3%.

Capital One Secured Mastercard

The Capital One Secured Mastercard is designed for people with bad credit. The credit limit on this card is typically between $200 and $3000, depending on the deposit amount. The credit limit may be increased depending on the creditworthiness and payment history of the applicant.

After responsible use, you may be able to upgrade to a Best Unsecured Credit Cards for Bad Credit with No Deposit. Capital One may convert the card to a non-secured card after five months and refund the deposit.

Pros & Cons of First Progress Platinum Elite MasterCard

Pros:

- No annual fee: This is a great way to save money, especially on a tight budget.

- No foreign transaction fees: This can be helpful if you travel internationally. (Read: Best Travel Credit Cards with No Annual Fee)

- Flexible security deposit requirements: You can choose to make a security deposit of anywhere from $200 to $4,900. This gives you more flexibility than some other secured credit cards.

- Potential for credit limit increases: If you use your card responsibly and make your payments on time, Capital One may increase your credit limit. This can help you build your credit even further.

- Reports to all three major credit bureaus are important for building your credit history.

Cons:

- High-interest rate: The interest rate on the Capital One Secured Mastercard is 26.99%, which is high. However, you can avoid interest charges by paying your balance in full each month.

- Low initial credit limit: The initial credit limit for the Capital One Secured Mastercard is $200. This can be a challenge if you need to make a large purchase.

- No rewards: No rewards or cash back are offered with the Capital One Secured Mastercard.

Citi Secured Mastercard

Citibank issues the Citi Secured Mastercard. To build credit, you can receive a revolving credit line with a security deposit ranging from $200 to $2,500. Citibank reports payment history to the major credit bureaus. Building good credit through responsible use of your credit card will allow you to obtain a Citi unsecured credit card.

The card works as a Mastercard in millions of stores worldwide. With a variable APR of 22,49%, it reports to three major credit bureaus, is approved worldwide, and reports to three major credit agencies.

Pros & Cons of Citi Secured Mastercard

Pros:

- No annual fee: This is a major advantage over other secured credit cards, which typically charge an annual fee of $30-$50.

- Low minimum security deposit: The minimum security deposit is $200, lower than other secured cards.

- Reports to all three credit bureaus: This is important because it helps you build your credit history.

- No foreign transaction fees: This can save you money if you travel internationally.

- 0% introductory APR on purchases for 12 months: This can help you save money on interest if you pay your balance in full each month during the introductory period.

Cons:

- High APR: The regular APR is 27.74%, higher than other secured credit cards.

- This card offers no rewards, such as cashback or points.

- Potential for late fees and other fees: This card is associated with some fees, such as a late fee of $41.

- The credit limit is based on security deposit: Your credit limit will equal the amount of your security deposit.

First Progress Platinum Prestige MasterCard

The First Progress Platinum Prestige MasterCard allows a 3% cash advance. Most secured cards require a deposit of between 10 and 20%. The lack of a minimum credit score makes it ideal for credit builders.

The card has a $2000 limit. When your credit improves, you must cancel the existing card and apply for a new one. Increasing the card’s limits may make it more difficult to upgrade it.

Pros & Cons of First Progress Platinum Prestige MasterCard

Pros:

- No credit check is required: You can be approved for this card even with a poor or limited credit history.

- Low ongoing APR: The card has a variable APR of 15.24%, lower than the average APR for secured credit cards.

- 1% cash back rewards: You can earn 1% cashback on all purchases, which can help you save money over time.

- No annual fee: This card has no annual fee, which can save you money in the long run.

- Rebuilt credit even with past bankruptcy or bad credit: This card is a good option for people who have had financial problems.

Cons:

- A high-security deposit is required: The minimum security deposit for this card is $200, which is higher than some other secured credit cards.

- Low credit limit: This card’s starting credit limit is $200, but it may need to be higher for all your needs.

- No welcome bonus: It does not offer a welcome bonus, a common perk of other credit cards.

Wells Fargo Secured Card

It is possible to build credit slowly with the Wells Fargo Secured Credit Card for customers with poor or no credit. There is no annual fee, 1.5% cashback on all eligible purchases, and points for every dollar spent (up to $1,000).

The credit line has been extended to $25,000 with a $500 minimum. The no-annual-fee card is an excellent choice for organizing or starting a savings account.

The Wells Fargo Secured Credit Card offers a cashback offer of up to 5% on qualified purchases. As a result, customers can save money and improve their credit scores.

Pros & Cons of Wells Fargo Secured Card

Pros:

- No credit history is required to be approved.

- Your credit limit is based on the amount of your security deposit.

- You can get your deposit back once your credit improves.

- Offers Visa benefits, such as purchase protection and extended warranty.

- Access to an FICO score.

- Ability to request a credit limit increase.

Cons:

- There is an annual fee of $25.

- Foreign transaction fees apply.

- No rewards program.

- Interest rates are higher than average.

Also, See: Small Payday Loans Online No Credit Check

OpenSky Secured Visa Card

Compared to an unsecured credit card for individuals with poor credit, the OpenSky Secured Visa Credit Card offers a low variable interest rate. An annual fee is charged. A $200 deposit is required for this card, but you may deposit up to $3,000 to match your credit limit.

Pros & Cons of OpenSky Secured Visa Card

Pros:

- No credit check is required, so you can get the card even if you have a bad credit history.

- Reports account activity to all three major credit bureaus, so responsible use can help you build your credit score.

- Low variable APR of 22.39% (subject to change).

- High credit limit of up to $3,000 (matching your security deposit).

- No annual fee for the OpenSky Secured Visa Credit Card.

Cons:

- Requires a security deposit of at least $200.

- There is a $35 annual fee for the OpenSky® Secured Visa® Credit Card.

- No rewards program.

- Foreign transaction fees of 3%.

- Late payment fees of up to $38.

- Returned payment fees of $25.

Milestone Gold Mastercard

The Milestone Gold MasterCard is another unsecured credit card that offers guaranteed approval. Consider this credit card if you want a great credit card with a low spending limit. Your credit score and needs determine the Milestone $700 credit limit.

Pros & Cons of Milestone Gold Mastercard

Pros:

- No security deposit required

- No annual fee for some applicants

- 0% introductory APR for 12 months on purchases

Cons:

- High APR (26.99%-29.99%)

- No rewards program

- Foreign transaction fee of 3%

- The balance transfer fee of 3%

- Late payment can damage your credit score

- Late payment fee of $39

- Returned payment fee of $40

- Low starting credit limit (typically $300)

Detailed Pros & Cons of Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

| Credit Card | Pros | Cons |

| First Progress Platinum Elite MasterCard | * No credit check required * Low annual fee * Potential for high credit limit * Opportunity to graduate with an unsecured card after 6 months of on-time payments | * High APR * Requires a security deposit * Foreign transaction fees |

| Capital One Secured Mastercard | * No annual fee * No foreign transaction fees * Flexible security deposit requirements * Potential for credit limit increases * Reports to all three major credit bureaus | * High-interest rate * Low initial credit limit * No rewards |

| Citi Secured Mastercard | * No annual fee * Low minimum security deposit * Reports to all three credit bureaus * No foreign transaction fees * 0% introductory APR on purchases for 12 months | * High APR * No rewards * Potential for late fees and other fees |

| First Progress Platinum Prestige MasterCard | * No credit check required * Low ongoing APR * 1% cash back rewards * No annual fee * Rebuilt credit even with a past bankruptcy or bad credit | * A high-security deposit is required * Low credit limit * No welcome bonus |

| Wells Fargo Secured Card | * No credit history is required to be approved * Your credit limit is based on the amount of your security deposit * You can get your deposit back once your credit improves * Offers Visa benefits, such as purchase protection and extended warranty * Access to an FICO score * Ability to request a credit limit increase | * There is an annual fee of $25 * Foreign transaction fees apply * No rewards program * Interest rates are higher than average |

| OpenSky Secured Visa Card | * No credit check required * Reports account activity to all three major credit bureaus * Low variable APR * High credit limit of up to $3,000 (matching your security deposit) * No annual fee | * Requires a security deposit of at least $200 * There is a $35 annual fee * No rewards program * Foreign transaction fees of 3% * Late payment fees of up to $38 * Returned payment fees of $25 |

| Milestone Gold Mastercard | * No security deposit required * No annual fee for some applicants * 0% introductory APR for 12 months on purchases | * High APR (26.99%-29.99%) * No rewards program * Foreign transaction fee of 3% * The balance transfer fee of 3% * Late payment can damage your credit score * Late payment fee of $39 * Returned payment fee of $40 * Low starting credit limit (typically $300) |

If you are not getting $1000 limit credit card approval then Guaranteed approval unsecured credit cards for bad credit are a great option for you to build their credit but have yet to be denied credit cards.

These cards typically have high interest rates and fees, but they can help you establish a credit history and improve your credit score over time. When choosing a guaranteed approval unsecured credit card, compare interest rates, fees, and rewards programs to find the best card for your needs.

Video for Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

Guaranteed Approval Credit Cards with $1,000 Limits for Bad Credit

You can still find guaranteed approval credit cards with $1,000 limits even if you have bad credit, but it may be difficult. Many credit cards for people with bad credit offer guaranteed approval. Once you meet the added requirements of these cards, a secured credit card with a $1,000 limit is typically easier to approve because a security deposit sets the card’s limit. Even if you have poor credit or have been bankrupt in the past, they are a good way to build credit.

The Above cards are the best options for Guaranteed Approval Credit Cards with $1,000 Limits for Bad Credit.

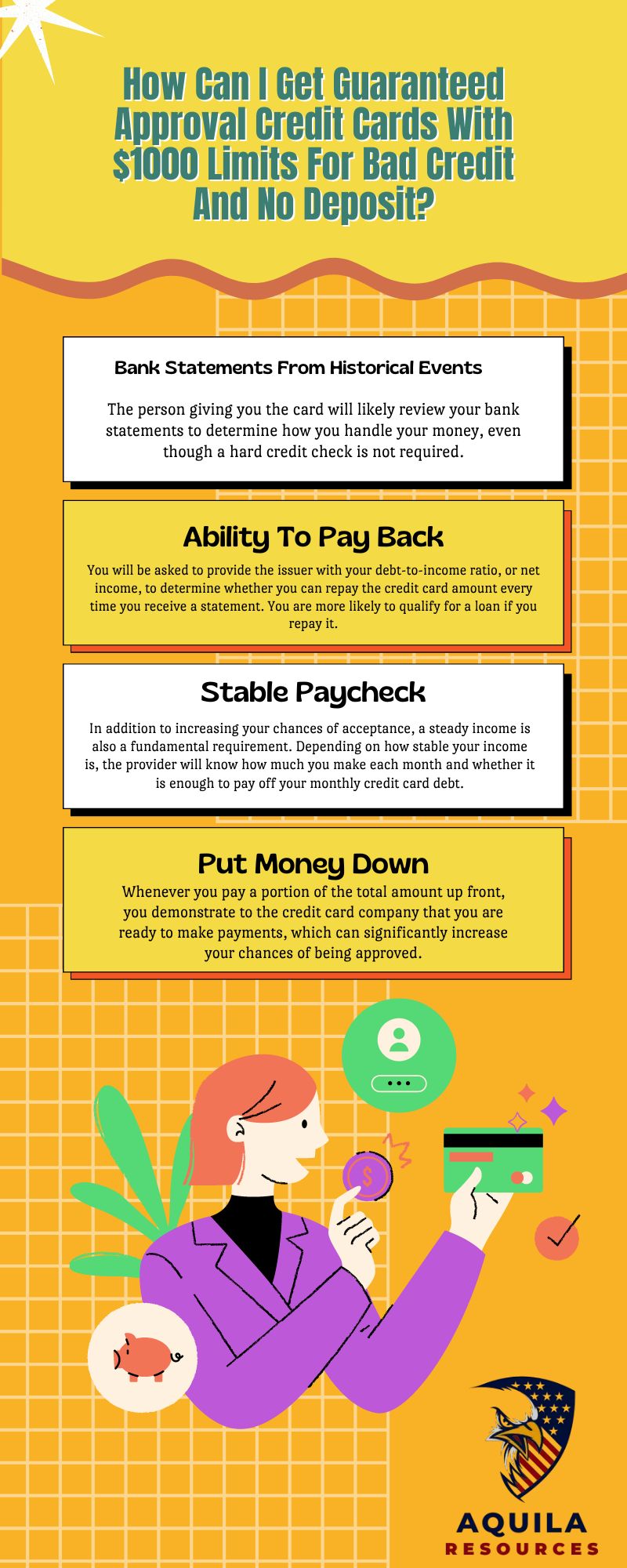

How Can I Get Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit?

Bank Statements From Historical Events

The person giving you the card will likely review your bank statements to determine how you handle your money, even though a hard credit check is not required.

Ability To Pay Back

You will be asked to provide the issuer with your debt-to-income ratio, or net income, to determine whether you can repay the credit card amount every time you receive a statement. You are more likely to qualify for a loan if you repay it.

Stable Paycheck

A steady income is a fundamental requirement for acceptance. Depending on how stable your income is, the provider will know how much you make each month and whether it is enough to pay off your monthly credit card debt.

Put Money Down

Whenever you pay a portion of the total amount up front, you demonstrate to the credit card company that you are ready to make payments, which can significantly increase your chances of being approved.

Note – Need some quick cash? You can easily get small payday loans online with no credit check. There are many lenders who offer these loans, and you can apply for one in just a few minutes. Just be sure to compare rates and terms before you choose a lender, and make sure you can afford to repay the loan on time

What Do I Need to Apply for a Credit with a $1,000 Limit?

In summary, depending on the card type, you may need a deposit of $1,000 or a decent credit score and a decent job.

In addition to the apparent first option, consider the second as well. You may need to figure out what to do regarding credit and scores.

- Find out more about scores. In many cases, these scores are calculated using the following formula: borrow money, spend it, and either repay it on time or not. You will receive a positive or negative score based on the latter.

- Take a look at your results. Your first step should be to conduct a credit inquiry with the credit reporting bureaus associated with your credit card. Your reports will be available there.

- Enhance your credit score by making timely payments, increasing your card limit, and providing accurate information.

- Get ready to answer the questions that will be asked. If you apply for an unsecured credit cards, you may be asked to demonstrate your reliability. Provide a truthful and concise response.

- Be cautious when applying. When applying for a card, you must consider where, when, and how you will use it. Ensure you conduct a thorough background check and review all relevant information before fleeing.

- Now that you have all these recommendations, it is time to implement them. Be aware of the minor details, regardless of when you apply or if the application is secured.

Factors to Consider When Applying for Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

Competence in Repayment

If you previously had terrible credit limitations and today have playback capability, you cannot obtain a credit card. Moreover, a decent credit score can be overlooked without a payback potential. To be considered for allocating credit cards to other clients, you must present yourself well to banks or financial institutions.

Visit the Account Bank

It is always advisable to use a bank where you have an existing account and have been using its services for some time. They can locate your record quickly and provide the amount after analyzing it.

What Is Your Source Of Income?

It affects your ability to repay. A guarantee of approval for unsecured credit cards for bad credit begins with a record check based on the sources you intend to disclose to creditors for repayment. Several sources, including your company and your job, are incorporated into this report.

If the information is kept confidential, it is considered history. According to official sources and expected trends, individuals with two to three years of job stability are likely to have a high credit card balance.

Credit Cards that provide $2000, $3000 & $5000 & $10,000 Limits Guaranteed Approval

Credit Cards with $2000 Limits Guaranteed Approval

Here are the 5 Credit Cards with $2000 Limits Guaranteed Approval

- Capital One Platinum Credit Card

- Surge Platinum Mastercard

- OpenSky Secured Visa Credit Card

- Capital One Quicksilver Secured Cash Rewardse

- Reflex Platinum Mastercard

Note – Read Our Detailed Article on credit cards with a $2000 limit guaranteed approval, which will help you choose the best card.

Credit Cards with $3000 Limits Guaranteed Approval

Here are some credit cards with a $3000 limit guaranteed approval:

- Capital One Secured Mastercard

- OpenSky Secured Visa Credit Card

- First Progress Platinum Elite Mastercard Secured Credit Card

- Total Visa Unsecured Credit Card

- Milestone Gold Mastercard

Note – Read Our Detailed Article on credit cards with a $3000 limit guaranteed approval, which will help you choose the best card.

Credit Cards with $5000 Limits Guaranteed Approval

Here are the 4 Credit Cards with $5000 Limits Guaranteed Approval

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Capital One Venture Rewards Credit Card

- Capital one venture X Credit Cards

Note – Read Our Detailed Article on credit cards with a $5000 limit guaranteed approval, which will help you choose the best card.

Credit Cards with $10000 Limits Guaranteed Approval

Here are the Best 5 Credit Cards with $10,000 Limits Guaranteed Approval

- American Express Platinum Card

- Ink Business Cash Credit Card

- Bank of America Premium Rewards Credit Card

- Chase Sapphire Reserve

- Chase Freedom Unlimited

Note – Read Our Detailed Article on credit cards with a $10000 limit guaranteed approval, which will help you choose the best card.

Note: – If you are a Canadian citizen or staying in Canada, you can get Guaranteed Approval Credit Cards with $1000 Limits for Bad Credit Canada or you can also check out Best Credit Cards for Bad Credit in Canada.

FAQs for Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

What are The Requirements For Obtaining a $1,000 Credit Card?

In general, you must have a steady source of income, a good credit history, and a high credit score to qualify for a credit card.

How Can I Raise My Credit Score to Get a Credit Card For $1,000?

To improve your credit score, you should pay your bills on time, eliminate any debt you may have, and limit how often you ask for new credit. You can also improve your credit score by checking and disputing any errors in your credit report.

Is a Credit Limit of $1000 Sufficient for a First Credit Card?

It is a good idea to start with a credit limit of $1,000 when applying for your first credit card.

What is The Lowest Amount on a Credit Card?

There are different credit card limits depending on the credit score and the company that issued the credit card.

What is The Best Credit Card For The First Time?

To find the best credit card for people with bad credit, compare the fees, interest rates, and other terms and conditions of several guaranteed approved credit cards.

What are Some $1,000 Credit Card Limit No Deposit?

The above credit cards are some of the best options for $1,000 Credit Card Limit No Deposit.

Conclusion

A person with a low credit score may need help obtaining a Guaranteed Approval Credit Card with $1000 Limits For Bad Credit And No Deposit. However, do not be alarmed. Despite low credit scores, you may find a credit card that fits your budget and meets your needs if you put in the effort.

Some secured credit cards require a security deposit, although they usually offer lower interest rates and are easier to obtain. If you are patient and diligent, you can increase your credit limit and credit score. Therefore, you should stop allowing your credit rating to prevent you from achieving financial security. Get a Guaranteed Approval Credit Card with $1000 Limits For Bad Credit And No Deposit and take control of your financial future.

Add Comment