Using a credit card to make purchases is convenient since you do not need cash to do so. Credit cards help people build their purchasing power and maximize their savings at the same time. The convenience of using a credit card also eliminates the need to write checks and count receipts.

A secured credit card is one of the most popular credit cards available. The bank requires a cash deposit to issue a secured credit card. It is important to consider the applicant’s creditworthiness when issuing credit cards.

Finding a credit card issuer who will approve you is almost impossible when your FICO credit score is in the lowest range – 579 or under. A credit card with one type of approval is available to almost everyone, thanks to card issuers.

The secured credit card allows consumers with bad credit to build credit, develop good credit habits, and prove their creditworthiness. For this type of credit, you must make a cash deposit to secure a line of credit. Secured credit cards are similar to traditional credit cards despite the fact you have to pay a deposit.

A number of credit cards are available on the market for people who need to build or rebuild their credit. A secured credit card is a good option for people with less than stellar credit or new to credit. Using a secured credit card is the same as using an unsecured credit card, so long as you use it responsibly.

What is a Secured Credit Card?

Contents

- 1 What is a Secured Credit Card?

- 2 How Do Secured Credit Cards Work?

- 3 How to Apply for a Secured Credit Card

- 4 When Should You Get a Secured Credit Card?

- 5 Tips for Using a Secured Credit Card

- 6 Pros & Cons of secured credit cards

- 7 How Secured Cards Can Improve Your Credit?

- 8 How to Use a Secured Credit Card to Build Credit?

- 9 Is a Secured Credit Card Good?

- 10 FAQs

Secured credit cards are credit cards that require a security deposit to open. A credit card issuer typically holds on to the one-time, refundable deposit made by the cardholder as collateral. Secured credit cards are great for those trying to establish, rebuild, or reestablish credit. Credit cards can make you more attractive candidates for mortgages and car loans if you use them responsibly.

The approval process for an unsecured credit card can be very difficult when your credit score is better; however, if you can’t find a lender willing to provide you with revolving credit, you may be unable to improve your credit over time. Getting approved for a credit card without an established credit score seems counterintuitive since you cannot build credit without a credit card. Secured credit cards can help with that.

A secured credit card is a credit card that requires a deposit of cash. There is often a 50 percent to 100 percent match between the deposit amount and the credit limit, usually equal to the initial deposit. You will likely qualify for a $500 to $1,000 line of credit if you apply for a secured credit card and deposit $1,000 as collateral.

How Do Secured Credit Cards Work?

The secured credit card works similarly to the debit card. The secured line of credit is the amount of cash you deposit, representing your cash deposit. Banks, credit unions, and credit card companies can obtain secured credit cards. While applying for a loan, the financial institution you’re working with may check your credit history.

The credit card provider should report account information to Experian, Equifax, and TransUnion to build your credit score. You must double-check with the issuing company before applying to ensure that the three main credit bureaus will receive your payment history.

You will need to deposit collateral if you are approved. A minimum of $200 is usually required, but it can range from $2,000 to $3,000. In some cases, you may also have a lower credit limit than your deposit amount since your deposit can act as your credit limit. Your credit limit may be used to make in-person or online purchases once the initial deposit is made. With secured credit cards, credit cards are accepted at places like gas stations and grocery stores.

The card can then be used for more purchases once the balance for recent purchases has been paid off. The interest on your carried balance will accrue if you do not pay your balance off each month.

How to Apply for a Secured Credit Card

The following steps will help you apply for a secured credit card if you think it’s a good option.

- Review Your Credit Report and Score. You can do both through Experian. Your credit score may be different from the one you would like, so you can take steps to improve it.

- Compare Secured Credit Cards. You can get matched with secured credit cards based on your credit profile with Experian. Among the features to consider when evaluating secured credit cards are The Credit Limit

- APRs

- An annual fee, a late fee, and an application fee

- Benefits and perks for cardholders, such as cashback, points and miles

- Card issuers must report your card activity to at least one of the three major credit bureaus (Experian, TransUnion, or Equifax). By using the card, you will be able to build credit.

- Apply for a Secured Credit Card: Online applications for credit cards are available through Experian CreditMatchTM or directly from card issuers.

- Open Your Account by Paying the Security Deposit and Any Other Fees: You may have to pay application fees, processing fees, or annual fees, for example. Using your debit or electronic bank account, you can make a payment. Ensure that you have the money to pay the entire amount.

When Should You Get a Secured Credit Card?

Consumers often use Secured credit cards to build their credit scores, either due to a rocky financial past or because they lack a credit history altogether. We will look at when you might be the most suitable candidate for a secured credit card, no matter which situation you relate to most.

You Want to Build Your Credit

A secured credit card allows a cardholder to access a small amount of credit in exchange for a refundable deposit. A poor credit score or no credit makes you a liability to lenders since you have no credit history to prove your creditworthiness. The lender, however, is protected if you default on your payments by putting down a security deposit.

Building credit depends on how you use the credit that you have available to you in the first place, like any credit card. It will take you only a short time to improve your credit score if you stay on top of your credit utilization and make on-time payments every month.

You Want to Graduate to An Unsecured Credit Card

When your credit score has improved, you can graduate with an unsecured credit card with a secured credit card. When you prove that you are creditworthy with on-time payments, your credit card issuer may upgrade you to a secured line of credit, or you may ask them to transfer your secured line of credit to a secured credit card.

The secured credit card account could also be transferred to a new unsecured credit card while you retain the secured credit card. When you close a credit card, you are reducing your access to credit in the first place, which is detrimental to your credit score. It is important to keep in mind that you will receive your full deposit back when you close the secured credit card account.

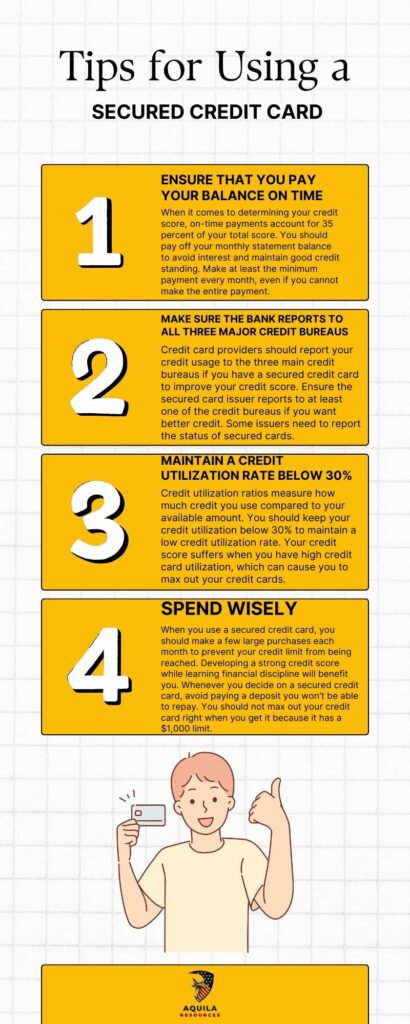

Tips for Using a Secured Credit Card

Secured credit cards have the same rules as unsecured credit cards. Keep your score in good shape by following these recommendations:

- Ensure That You Pay Your Balance on Time: When it comes to determining your credit score, on-time payments account for 35 percent of your total score. You should pay off your monthly statement balance to avoid interest and maintain good credit standing. Make at least the minimum payment every month, even if you cannot make the entire payment.

- Make Sure the Bank Reports to All Three Major Credit Bureaus: Credit card providers should report your credit usage to the three main credit bureaus if you have a secured credit card to improve your credit score. Ensure the secured card issuer reports to at least one of the credit bureaus if you want better credit. Some issuers need to report the status of secured cards.

- Maintain a Credit Utilization Rate Below 30%: Credit utilization ratios measure how much credit you use compared to your available amount. You should keep your credit utilization below 30% to maintain a low credit utilization rate. Your credit score suffers when you have high credit card utilization, which can cause you to max out your credit cards.

- Spend Wisely: When you use a secured credit card, you should make a few large purchases each month to prevent your credit limit from being reached. Developing a strong credit score while learning financial discipline will benefit you. Whenever you decide on a secured credit card, avoid paying a deposit you won’t be able to repay. You should not max out your credit card right when you get it because it has a $1,000 limit.

Pros & Cons of secured credit cards

Pros of Secured Credit Cards

You might be a good candidate for a secured credit card if you meet the following criteria:

- You Want to Establish or Build Credit: A secured credit card can greatly improve your credit score or establish a credit history. A secured credit card’s lenient approval requirements are because a deposit backs it. Hence, secured credit cards are more accessible to some borrowers.

- There is No Problem with Paying a Refundable Deposit: A secured credit card requires you to put up a cash deposit upfront; however, the deposit is generally returned to you after closing the account, provided you’ve kept up with your monthly payments.

- Eventually, You Want an Unsecured Credit Card: The utilization of secured credit cards is often used as a stepping stone to approval for an unsecured credit card. Credit cards on which you don’t have a security deposit may be available once you’ve improved your credit scores and proven to financial institutions that you can responsibly use credit.

- A period of good credit history can result in your secured credit card account being converted to an unsecured account. A secured credit card may have less stringent approval criteria, but it still has the potential to affect your credit rating if you default on payments negatively. Your credit card funds may be secured, but you should use them wisely and pay your balance on time even if they are secured.

Cons of Secured Credit Cards

A secured card comes with risks like any other credit card type. A secured credit card usually has the following features:

- The Fees and Interest Rates are High: A secured credit card may charge high fees for application, processing, and annual use. In addition, these types of credit cards usually come with hefty interest rates because credit card issuers anticipate that people with lower credit scores are more likely to default on their loans.

- Low Credit Limits: Credit limits are typically determined by security deposits, so they can be quite low, which can be a drawback if you plan to make large purchases.

- The use of credit compared to your available credit can also increase when you have low credit limits. The credit utilization rate represents the use of credit compared to the total credit available. Your credit score can be improved if your credit utilization rate is 30% or less.

- A favorable credit utilization rate is achievable by keeping your monthly spending under $100 if you pay a $300 deposit and your credit limit is $300.

- Cash will be Needed Up Front. One benefit of having a credit account is that it gives you access to funds you couldn’t afford without it. The deposit-secured credit cards required may not be affordable if you are short of cash.

How Secured Cards Can Improve Your Credit?

Secured cards, when responsibly used and repaid on time and in full, are reported to the three major credit bureaus, Experian, Equifax, and TransUnion, helping to boost your credit score and helping you qualify for unsecured cards in the future.

The most important factor affecting your credit score is your payment history, so you must pay your monthly bills on time. The credit bureaus will report positive information if you consistently make timely payments with your secured card. This assists you in building credit.

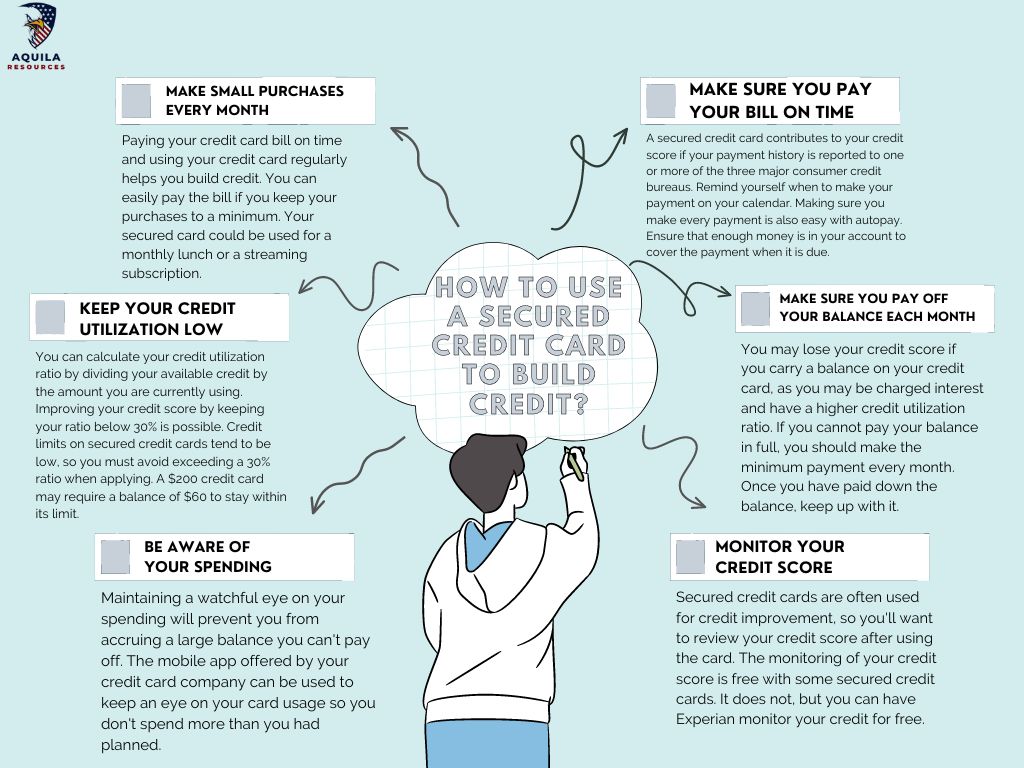

How to Use a Secured Credit Card to Build Credit?

Secured credit cards are an excellent way to establish credit responsibly. You can accomplish this by taking the following actions.

- Make Small Purchases Every Month: Paying your credit card bill on time and using your credit card regularly helps you build credit. You can easily pay the bill if you keep your purchases to a minimum. Your secured card could be used for a monthly lunch or a streaming subscription.

- Keep Your Credit Utilization Low: You can calculate your credit utilization ratio by dividing your available credit by the amount you are currently using. Improving your credit score by keeping your ratio below 30% is possible. Credit limits on secured credit cards tend to be low, so you must avoid exceeding a 30% ratio when applying. A $200 credit card may require a balance of $60 to stay within its limit.

- Be Aware of Your Spending: Maintaining a watchful eye on your spending will prevent you from accruing a large balance you can’t pay off. The mobile app offered by your credit card company can be used to keep an eye on your card usage so you don’t spend more than you had planned.

- Make Sure You Pay Your Bill on Time: A secured credit card contributes to your credit score if your payment history is reported to one or more of the three major consumer credit bureaus. Remind yourself when to make your payment on your calendar. Making sure you make every payment is also easy with autopay. Ensure that enough money is in your account to cover the payment when it is due.

- Make Sure You Pay Off Your Balance Each Month: You may lose your credit score if you carry a balance on your credit card, as you may be charged interest and have a higher credit utilization ratio. If you cannot pay your balance in full, you should make the minimum payment every month. Once you have paid down the balance, keep up with it.

- Monitor Your Credit Score: Secured credit cards are often used for credit improvement, so you’ll want to review your credit score after using the card. The monitoring of your credit score is free with some secured credit cards. It does not, but you can have Experian monitor your credit for free.

Is a Secured Credit Card Good?

Credit cards with a secured feature are more expensive but can also be very useful for building credit.

Secured cards also have several other costs that make them expensive borrowing options. Currently, secured cards have a high annual percentage rate (APR) of over 20%, which aligns with the national average of 20.68% as of Jan 2024. However, if you apply for a secured card, you will presumably not qualify for the best rates since your credit score could be better. You may not have to pay more for credit by 20% or more than other options.

The secured credit card can, however, be an excellent choice for borrowers who are seeking to improve their credit scores. The secured credit card is designed for people who need a good credit history or have little credit history- those who could not qualify for a regular credit card. They put up a deposit to compensate the card company for extending their credit at a higher risk.

FAQs

Can I Switch Between a Secured and an Unsecured Credit Card?

Secured credit cards enable you to gradually build credit scores that will enable you to apply for unsecured credit cards. Switching to a secured credit card is possible if you already have an unsecured credit card.

Can I Get My Deposit Back on a Secured Credit Card?

Secured credit cards usually require a deposit, which is usually refundable. Refunds are handled differently by card issuers, depending on their policies. There are two ways to get your security deposit back if you have a Capital One card. Using your card responsibly can earn you a statement credit in return for your deposit. Capital One may refund your deposit when you close your account and pay off your balance.

What’s the Difference Between Secured Credit Cards, Prepaid Cards, and Debit Cards?

Secured credit cards are credit lines lenders provide to cardholders after a one-time, refundable security deposit has been paid. You can load money onto a prepaid card before you use it. Debit cards are generally connected to checking accounts.

The credit you build with prepaid and debit cards may be stronger than the credit you build with secured credit cards. The Consumer Financial Protection Bureau doesn’t report activity on those accounts to credit bureaus. Many security features must be added to prepaid credit or debit cards.

What Happens if I Fail to Repay Bills on My Credit Card?

According to the usual repayment protocol, the lender will handle an individual whose repayments are due defaults. Secured credit cards may require the lenders to liquidate your FD to recover pending repayments. It is their mission to work with you to come up with the best possible solution, but at all times, they will make every effort to communicate with you.

Add Comment