Are you looking for Credit Cards with $500 Limit Guaranteed Approval? If So, you are in the right place.

In this article, We are sharing all the information about Credit Cards with $500 Limit Guaranteed Approval.

How can you improve your credit score despite your poor credit history? You have probably heard about Credit Cards with $500 Limit Guaranteed Approval but are still determining whether they are right for you.

The information in this blog post can help anyone with poor or damaged credit get some much-needed financial assistance.

This article will explain what these types of credit cards are, what they are good for, and also offer tips for how to get one.

List of Credit Cards with $500 Limit Guaranteed Approval

Contents

- 1 List of Credit Cards with $500 Limit Guaranteed Approval

- 1.1 Credit Cards with $500 Limit Guaranteed Approval

- 1.2 What are Credit Cards with $500 Limit Guaranteed Approval?

- 1.3 How to Apply for a Credit Card with $500 Limit Guaranteed Approval?

- 1.4 Best Credit Cards with $500 Limit Guaranteed Approval

- 1.5 Video Guide for Credit Cards with $500 Limit Guaranteed Approval

- 1.6 How Much Should You Spend on a $500 Credit Limit?

- 1.7 Advantages of using Credit Cards with $500 Limit Guaranteed Approval

- 1.8 Credit Cards that Provide $1000, $2000, $3000, $5000, $10000 & $20000 Limits Guaranteed Approval

- 1.8.1 Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

- 1.8.2 Credit Cards with $2000 Limits Guaranteed Approval

- 1.8.3 Credit Cards with $3000 Limits Guaranteed Approval

- 1.8.4 Credit Cards with $5000 Limits Guaranteed Approval

- 1.8.5 Credit Cards with $10000 Limits Guaranteed Approval

- 1.9 Credit Cards that Provide $20000 Limit Guaranteed Approval

- 1.10 FAQs

- 1.11 Conclusion

If you are looking for Credit Cards with $500 Limit Guaranteed Approval, these are the best options –

| Credit Cards | Details |

|---|---|

| Capital One Platinum Credit Card | Learn More |

| Milestone Gold MasterCard | Learn More |

| Surge Platinum Mastercard | Learn More |

| OpenSky Secured Visa Credit Card | Learn More |

| Indigo Unsecured MasterCard | Learn More |

Credit Cards with $500 Limit Guaranteed Approval

It is important to remember a few things when looking for the best $500 credit cards. The first thing you need to know about an unsecured credit card is that it won’t allow you to choose your credit limit, which means you aren’t guaranteed a credit line in the $500 range.

Most credit card companies also offer minimum and maximum credit limits. You can find out your initial credit limit through a little online research, even if the card issuer still needs to publicize it.

Some credit cards have guaranteed approval, which means that you will be approved for the card as long as you meet the minimum requirements. These cards typically have lower credit limits, but they can be a good option for people with bad credit or no credit history.

What are Credit Cards with $500 Limit Guaranteed Approval?

People with bad credit are offered Credit Cards with $500 Limit Guaranteed Approval to build their score and gain access to more traditional forms of credit.

A secured credit card usually has a low interest rate and minimal fees to make it more accessible, and it usually comes preloaded with a small amount of cash. It is important to have ample time to review all terms, conditions, and fees before applying, even though completing one should take a little time.

Additionally, some credit cards offer guaranteed approval, such as “Credit Cards with $10000 Limit Guaranteed Approval.” These cards may have higher interest rates and fees than other types of credit cards, but they can be a good option for people who have difficulty getting approved for a traditional credit card.

How to Apply for a Credit Card with $500 Limit Guaranteed Approval?

If you have a bad credit score, you can improve your financial situation by applying for a Credit Card with $500 Limit Guaranteed Approval. It is important to compare different credit cards available on the market before choosing the one that is right for you. You must provide accurate information to be approved. Personal information required includes your Social Security number, income, marital status, employment, and housing.

Choosing a credit card that suits your needs is the first step. You must fill out the online application and wait for the approval. If your application is approved, the credit card issuer will send you a card and information about using it. These steps will help ensure the success of your application!

Best Credit Cards with $500 Limit Guaranteed Approval

There are some Credit Cards with $500 Limit Guaranteed Approval. Several credit cards are available to people with fair credit scores between 580 and 669 and are only available to people with good credit. Additionally, you may earn reward dollars or bonus points for your eligible purchases with a score of 580 or higher.

Here is the list of 5 Best Credit Cards with $500 Limit Guaranteed Approval

Capital One Platinum Credit Card

Capital One Platinum Credit Cards have a $300 minimum credit limit for new cardholders. Capital One offers a great credit card with this card that gives you a chance to get a foot in the door with one of the best credit card companies around.

This card can help build your credit history and eventually allow you to upgrade to an even better credit card since a major card issuer issues it with various credit card options.

Pros & Cons of Capital One Platinum Credit Card

Pros:

- No annual fee

- No foreign transaction fees

- Chance to earn a higher credit limit after making on-time payments in as little as six months

- Available to those with fair credit

- Offers travel-friendly advantages, such as no foreign transaction fees (Read: 5 Best Travel Credit Cards for Travelers)

Cons:

- High APR (26.99%-29.99%)

- No rewards program

- Low starting credit limit (typically $300)

- Late payment can damage your credit score

Milestone Gold MasterCard

Ensure you stay current with all payments due, including any finance charges, by receiving pre-approval for up to a $500 limit and a $250 initial deposit. If you have used your account responsibly and paid all balances owed on time for 12 consecutive months, you may be eligible for an automatic upgrade. Additional benefits include free minutes over the provider’s cellular network and free access minutes throughout the duration.

Pros & Cons of Milestone Gold MasterCard

Pros:

- No security deposit required

- Low starting credit limit (typically $300)

- No annual fee for some applicants

- 0% introductory APR for 12 months on purchases

- Late payment fee of $39

- Returned payment fee of $40

Cons:

- High APR

- No rewards program

- Foreign transaction fee of 3%

- Balance transfer fee of 3% (Read: 5 Best Balance Transfer Cards For Bad Credit)

- Late payment can damage your credit score

Surge Platinum Mastercard

Surge Platinum Mastercard features basic perks such as free credit scores, no fraud liability, and cash advances available 95 days after account opening. The annual fee initially reduces the credit limit, which is modest to moderate. This unsecured card has numerous fees, including annual and monthly maintenance after the first year, foreign transaction fees, additional cards, and penalty fees.

Pros & Cons of Surge Platinum Mastercard

Pros:

- No credit check is required

- Potential for a credit limit of up to $1,000

- The credit limit may double after 6 months

- Monthly reporting to all three major credit bureaus

- No annual fee

- Late payment fee of up to $41

Cons:

- High APR

- No rewards program

- Foreign transaction fee of 3%

- Balance transfer fee of 3%

- Potential for high fees

OpenSky Secured Visa Credit Card

The OpenSky Secured Visa Credit Card does not require a credit check and has an approval rate of 85%. Your credit limit will be $1,000 once you deposit $1,000, minus the annual fee. If you pay off your credit card balance in full before the due date, you can avoid paying an ongoing interest rate altogether.

Pros & Cons of OpenSky Secured Visa Credit Card

Pros:

- No credit check is required

- Potential for a credit limit of up to $1,000

- Monthly reporting to all three major credit bureaus

- No annual fee

- Late payment fee of up to $38

Cons:

- High deposit requirement ($200 or $300)

- High APR

- No rewards program

- Foreign transaction fee of 3%

- Balance transfer fee of 3%

Indigo Unsecured MasterCard

Compared to many other types, the unsecured version does not require a down payment or collateral, so it is ideal for people who do not wish to take risks or lack funds or resources. Unlike other types of loans, all decisions are based on review verification obtained through survey reports collecting information about income stability and employment status characteristics, resulting in greater chances of approval regardless of one’s current financial situation.

Pros & Cons of Indigo Unsecured MasterCard

Pros:

- No credit check is required

- Potential for a credit limit of up to $1,000

- Monthly reporting to all three major credit bureaus

- No annual fee

- Late payment fee of up to $39

Cons:

- High APR

- No rewards program

- Foreign transaction fee of 3%

- Balance transfer fee of 3%

- Potential for high fees

Here is the Table of Best Credit Cards with $500 Limit Guaranteed Approval-

| Credit Card | Annual Fee | Credit Limit | Rewards | Other Features |

| Capital One Platinum Credit Card | $0 | $300 | None |

0% APR for 6 months on purchases and balance transfers, no foreign transaction fees, free credit monitoring, automatic credit line reviews

|

| Milestone Gold MasterCard | $0 | Up to $500 | 2% cash back on gas and groceries, 1% cash back on all other purchases |

$250 initial deposit, free minutes over the provider’s cellular network, free access minutes throughout the duration

|

| Surge Platinum Mastercard | $95 | Up to $1,000 | None |

Free credit scores, no fraud liability, cash advances available 95 days after account opening

|

| OpenSky Secured Visa Credit Card | $35 | $1,000 (based on deposit amount) | None |

No credit check required, 85% approval rate, 0% APR for the first 6 months on purchases and balance transfers

|

| Indigo Unsecured MasterCard | $75 | Up to $1,000 | 2% cash back on all purchases |

No credit check required, 70% approval rate, 0% APR for the first 6 months on purchases and balance transfers

|

Video Guide for Credit Cards with $500 Limit Guaranteed Approval

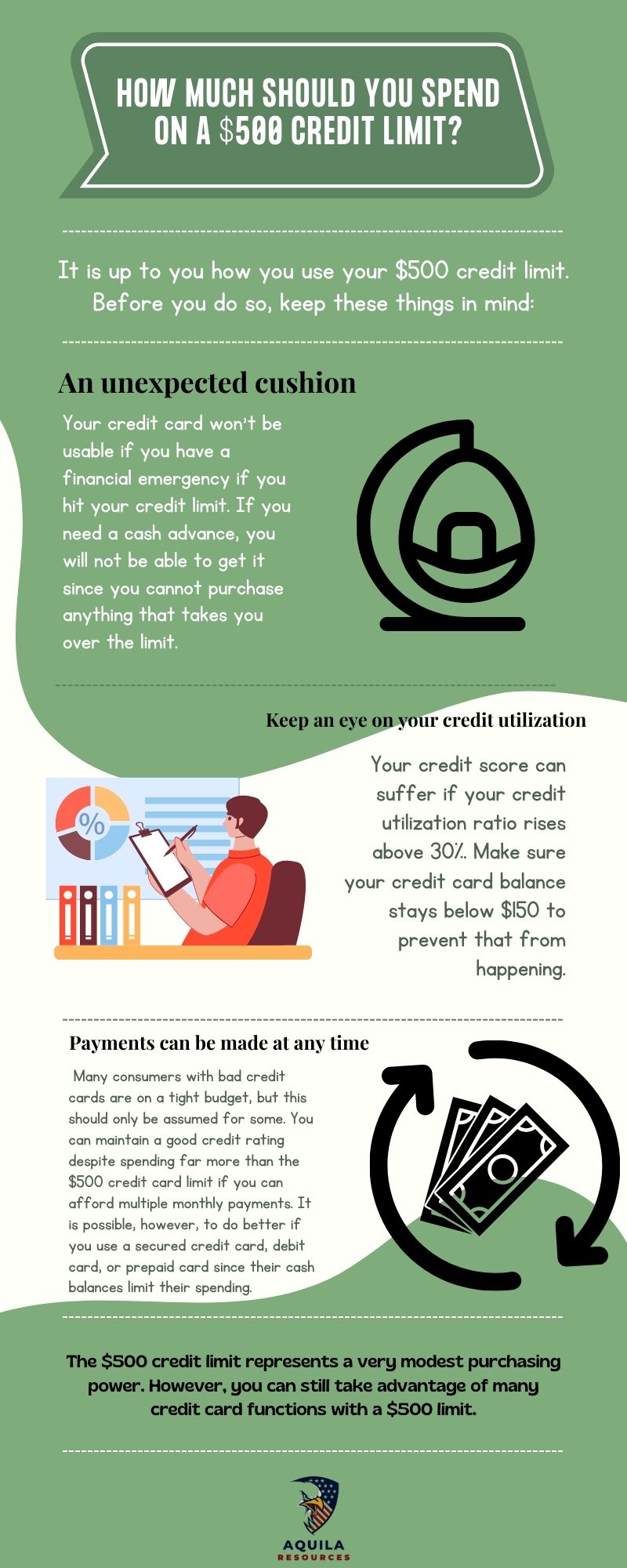

How Much Should You Spend on a $500 Credit Limit?

It is up to you how you use your $500 credit limit. Before you do so, keep these things in mind:

- An unexpected cushion. If you hit your credit limit, your credit card won’t be usable if you have a financial emergency. You will not be able to get a cash advance since you cannot purchase anything that takes you over the limit.

- Keep an eye on your credit utilization. Your credit score can suffer if your credit utilization ratio rises above 30%. Make sure your credit card balance stays below $150 to prevent that from happening.

- Payments can be made at any time. Many consumers with bad credit cards are on a tight budget, but this should only be assumed for some. If you can afford multiple monthly payments, you can maintain a good credit rating despite spending far more than the $500 credit card limit. It is possible, however, to do better if you use a secured credit card, debit card, or prepaid card since their cash balances limit their spending.

The $500 credit limit represents a very modest purchasing power. However, you can still take advantage of many credit card functions with a $500 limit. It is possible to charge purchases instead of paying in cash, accumulate rewards where they are available, and finance purchases over time. An ATM can also provide you with a cash advance.

Credit or debit cards are also required for some services. If you do not have a debit card, you can only book a hotel or rent a car with a credit card.

Advantages of using Credit Cards with $500 Limit Guaranteed Approval

When applying for traditional credit cards, your application can be rejected because of bad credit. The Credit Cards with $500 Limit Guaranteed Approval for Bad Credit, so you can rest assured that your application will never be denied. This option has many advantages, including easy acceptance and the possibility of establishing or rebuilding credit.

- These cards can be used carefully to make on-time payments and improve your credit score, which will help you access better mortgage and car loan terms in the future.

- A cash or debit card does not offer as much convenience, safety, or fraud protection as a credit card.

- The advantages of guaranteed approval credit cards make them the perfect solution for people with bad credit histories looking to increase their financial freedom.

Credit Cards that Provide $1000, $2000, $3000, $5000, $10000 & $20000 Limits Guaranteed Approval

Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

Here are the 7 Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

- Initial Step Platinum Premier is Mastercard

- CapOne Secured Mastercard

- Citigroup Protected Card

- Early Step Platinum Premium Mastercard

- Wells Fargo Secured Card

- OpenSky Protected Visa Card

- Milestone Gold Mastercard

Note – Read Our Detailed Article on Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit, which will help you choose the best card.

Credit Cards with $2000 Limits Guaranteed Approval

Here are the 5 Credit Cards with $2000 Limits Guaranteed Approval

- Capital One Platinum Credit Card

- Surge Platinum Mastercard

- OpenSky Secured Visa Credit Card

- Capital One Quicksilver Secured Cash Rewards

- Reflex Platinum Mastercard

Note – Read Our Detailed Article on credit cards with a $2000 limit guaranteed approval, which will help you choose the best card.

Credit Cards with $3000 Limits Guaranteed Approval

Here are some credit cards with a $3000 limit guaranteed approval:

- Capital One Secured Mastercard

- OpenSky Secured Visa Credit Card

- First Progress Platinum Elite Mastercard Secured Credit Card

- Total Visa Unsecured Credit Card

- Milestone Gold Mastercard

Note – Read Our Detailed Article on credit cards with a $3000 limit guaranteed approval, which will help you choose the best card.

Credit Cards with $5000 Limits Guaranteed Approval

Here are the 4 Credit Cards with $5000 Limits Guaranteed Approval

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Capital One Venture Rewards Credit Card

- Capital one venture X Credit Cards

Note – Read Our Detailed Article on credit cards with a $5000 limit guaranteed approval, which will help you choose the best card.

Credit Cards with $10000 Limits Guaranteed Approval

Here are the Best 5 Credit Cards with $10,000 Limits Guaranteed Approval

- American Express Platinum Card

- Ink Business Cash Credit Card (Read: 5 Best Business Credit Cards for Business Owners)

- Bank of America Premium Rewards Credit Card

- Chase Sapphire Reserve

- Chase Freedom Unlimited

Note – Read Our Detailed Article on credit cards with a $10000 limit guaranteed approval, which will help you

Credit Cards that Provide $20000 Limit Guaranteed Approval

Here are some credit cards with a $20000 limit guaranteed approval:

- Chase Sapphire Reserve

- American Express Gold Card

- Ink Business Preferred Credit Card

- Capital One Venture X Rewards Credit Card

- Chase Sapphire Preferred Card

Note – Read Our Detailed Article on Credit Cards with $20000 Limit Guaranteed Approval, which will help you choose the best card.

FAQs

What is the Usual Credit Limit for a First Credit Card?

It depends on the card you get, but the average credit limit for your first credit card is between $100 and $500. Your first credit card could cost you as little as $100 if you get one from a store or as much as $500 if you get one from a bank or credit union.

What is the Highest Credit Card Limit You Can Get?

Several credit card holders have anecdotal evidence that you can obtain a credit card limit of over $100,000. However, the maximum spending limit on a credit card will be listed only in its terms, just like it is with most credit cards. A high-limit credit card offers spending limits of at least $10,000.

Can I Increase My Credit Card Limit?

Yes. Your credit limit can be increased if your income has recently increased by submitting a copy of your last income statement to the bank that issued your card. Your maximum credit card limit can also be increased by applying for a new credit card.

How to Find the Credit Limit of a Credit Card?

It is possible to find out what your credit card limit is in several different ways. The card arrived with a welcome kit that you can inspect. Your credit card statement usually contains information regarding your credit limit and your credit card account. Your credit card limit can also be checked by logging into your account. It is also possible to contact the card-issuing company’s customer service.

Conclusion

People with bad credit need to rebuild their credit score with the help of a Credit Cards with $500 Limit Guaranteed Approval. You can use it to repair your credit score and meet short-term cash flow needs. You should, however, be aware that it will come with some restrictions, including a higher interest rate and a lower spending limit than usual.

Add Comment