Are you looking for Credit Cards That Pull TransUnion? If so, you have stumbled upon the right place.

In this article, we share all the information about credit cards that pull TransUnion or use TransUnion.

I was looking for a new credit card, and I wanted to make sure that I got one that would be approved. I knew that there are some credit cards that pull your credit report from TransUnion, and I wanted those cards because my TransUnion score was good.

I did some research online and found a list of credit cards that pull TransUnion. I was surprised to see that there were many good options available. I applied for a credit card and got approved.

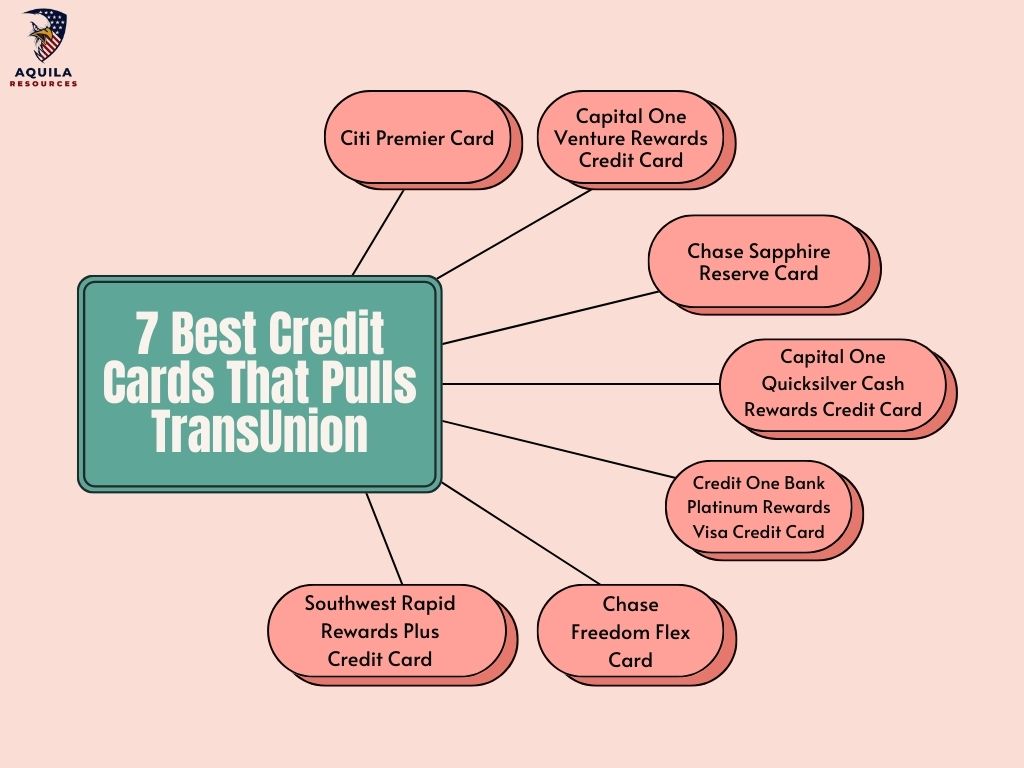

Before applying, I researched many cards but found 7 Credit Cards That Pull TransUnion that can be the best option for you. In this article, I’ll tell you about these cards, their benefits, and their pros and cons.

Credit Cards That Pull TransUnion

Contents

- 1 Credit Cards That Pull TransUnion

- 2 What is a Credit Score?

- 3 What is TransUnion?

- 4 What is TransUnion Credit Score Used For?

- 5 What are the Credit Cards That Pull TransUnion?

- 6 7 Best Credit Cards That Pull TransUnion

- 7 Video for Best Credit Cards That Pull TransUnion

- 8 Store Credit Cards That Pull TransUnion?

- 9 What is TransUnion Credit Score used for?

- 10 How Do You Know Which Card Bureau an Issuer Uses?

- 11 Credit Cards that Provide $1000, $2000, $3000, $5000, $10000 & $20000 Limits Guaranteed Approval

- 11.1 Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

- 11.2 Credit Cards with $2000 Limits Guaranteed Approval

- 11.3 Credit Cards with $3000 Limits Guaranteed Approval

- 11.4 Credit Cards with $5000 Limits Guaranteed Approval

- 11.5 Credit Cards with $10000 Limits Guaranteed Approval

- 11.6 Credit Cards that Provide $20000 Limit Guaranteed Approval

- 12 FAQs for Credit Cards That Pull TransUnion

If you are looking for Credit Cards That Pull TransUnion, these are the best options:

| Credit Card | Rewards | Annual Fee | Other Benefits | Details |

|---|---|---|---|---|

| Citi Premier Card | Earn points that can be redeemed for travel, merchandise, and gift certificates. 0% introductory APR on balance transfers and purchases for the first 18 months. | $95 | No foreign transaction fees, travel insurance, airport lounge access. | Learn More |

| Capital One Venture Rewards Credit Card | Earn 2 miles per dollar on all purchases. Miles can be redeemed for statement credits on travel purchases at one cent per mile. | $95 | No foreign transaction fees. | Learn More |

| Chase Sapphire Reserve Card | Earn 3 points per dollar spent on travel and dining, 1 point per dollar spent on every other purchase. 50,000 point sign-up bonus after spending $4,000 within 3 months. | $550 | No foreign transaction fees, travel insurance, airport lounge access. | Learn More |

| Capital One Quicksilver Cash Rewards Credit Card | Earn 1.5% cash back on all purchases. $150 sign-up bonus after you spend $500 in the first three months. | $0 | No annual fee. | Learn More |

| Credit One Bank Platinum Rewards Visa Credit Card | Earn 1% cash back on all eligible purchases. Get a free copy of your Experian credit score. | $0 | No annual fee. | Learn More |

| Chase Freedom Flex Card | Earn 5% cash back on rotating categories up to $1,500 quarterly and additional bonuses on other categories, such as dining and travel. $200 bonus for new cardholders in the first three months. | $0 | No foreign transaction fees. | Learn More |

| Southwest Rapid Rewards Plus Credit Card | Earn 2 points for every dollar you spend on Southwest purchases and 1 point for every dollar you spend on other eligible purchases. 40,000 points if you spend $1,000 within the first three months after joining. | $95 | No foreign transaction fees. | Learn More |

Your credit report is an important factor lenders and credit card issuers consider when extending your credit and determining your repayment capacity. It is important to keep an eye on your credit reports, regardless of whether they come from TransUnion or another bureau.

When you apply for a credit card, you will likely have your credit report pulled by one of three major credit bureaus, such as TransUnion, Equifax, or Experian. All credit card issuers do not use TransUnion data, but it’s difficult to predict which ones will. You must understand what information is contained in your credit reports and how it affects your ability to obtain credit.

What is a Credit Score?

It is a number used by lenders to determine whether they will lend you money and at what interest rate. There are a variety of credit scores, but TransUnion’s is one of the most widely used. It ranges from 300 to 850. A higher credit score means a better credit rating. You are more likely to get approval for a loan at a lower interest rate if you have a good TransUnion credit score.

What is TransUnion?

TransUnion, one of three major US credit bureaus, provides accurate and reliable credit information. It can be very helpful for you to monitor your credit report from TransUnion if your credit card issuer pulls credit reports from this bureau specifically.

What is TransUnion Credit Score Used For?

Transunion credit scores are calculated by analyzing the information in a credit report. A Transunion credit card lender may use this number to determine your creditworthiness. Credit Card issuers can get a quick idea of a person’s credit history based on the final score calculation. The best Transunion credit cards may offer lower APRs to consumers with higher credit scores.

TransUnion offers a free credit score (Read: Unsecured Credit Cards for 500 Credit Score) check on its website. The customer service department can also help you if there are any items on your report you need help understanding. TransUnion credit scores are important for receiving a low-interest loan approval. By understanding these things, you can improve your chances of approval. Additionally, there are many No Credit Check Credit Cards Instant Approval No Deposit available that you can consider.

What are the Credit Cards That Pull TransUnion?

Several credit card companies routinely use TransUnion or credit card companies that use TransUnion data to evaluate applications. Transunion is often the primary credit reporting agency, although there is no guarantee that an application will use only Transunion data.

Credit cards are more likely to be approved if you have an excellent TransUnion credit history. Here are some of the most popular credit cards that use TransUnion data for approval and credit cards that check TransUnion.

7 Best Credit Cards That Pull TransUnion

These might be a good option if you’re looking for a Credit Cards That Pull TransUnion or credit cards that use TransUnion.

1. Citi Premier Card

The Citi Premier Card is one of the top credit cards that pull TransUnion data. The Citi Premier Card offers users a variety of rewards, including travel, merchandise, and gift certificates, for earning points.

Citi Premier credit cards also offer 0% introductory APR on balance transfers and purchases for the first 18 months, making them an excellent option for those who want to save on interest. The Citi Premier Card is also free of annual fees, making it an excellent choice for a zero-fee credit card.

Pros & Cons of Citi Premier Card

Pros:

- Earns 3 points per dollar on airfare, hotels, gas stations, dining, and supermarkets.

- You get a welcome bonus of 60,000 points after spending $4,000 in the first 3 months.

- No foreign transaction fees.

- No annual fee for the first year, then $95 per year.

- Travel insurance benefits, including trip cancellation/interruption insurance, baggage delay insurance, and rental car insurance.

- You can access airport lounges through Priority Pass Select.

Cons:

- The points you earn from the Citi Premier Card can only be redeemed for travel through the Citi ThankYou Rewards program.

- The annual fee is $95 per year after the first year.

- The welcome bonus requires you to spend a significant amount of money in a short period.

2. Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card allows cardholders to earn and redeem rewards easily. All purchases earn consumers two miles per dollar, which they can redeem for statement credits on travel purchases at one cent per mile.

Pros & Cons of Capital One Venture Rewards Credit Card

Pros:

- You can earn 2 miles per dollar with this card on all purchases.

- You can redeem your points for statement credits on travel purchases at one cent per mile.

- No foreign transaction fees.

- No annual fee.

- Travel insurance benefits, including trip cancellation/interruption insurance, baggage delay insurance, and rental car insurance.

Cons:

- The miles you earn with the Capital One Venture Rewards Credit Card can only be redeemed for travel through the Capital One Venture Rewards program.

- You can only get a welcome bonus when you spend a significant amount of money quickly.

3. Chase Sapphire Reserve Card

Many travel rewards credit cards are available on the market today, but the Chase Sapphire Reserve Credit Card is one of the most popular. The card offers 3 points per dollar spent on travel and dining, 1 point per dollar spent on every other purchase, and a 50,000 point sign-up bonus after spending $4,000 within 3 months.

The first 15 months of the credit card are interest-free, and there are no foreign transaction fees. This card gives you access to airport lounges and travel insurance coverage, so it’s a great choice if you want to earn great travel rewards and perks.

Pros & Cons of Chase Sapphire Reserve Card

Pros:

- You can earn 3 points per dollar on travel and dining, 1 point per dollar spent on every other purchase.

- You can earn a 50,000-point sign-up bonus after spending $4,000 in the first 3 months.

- No foreign transaction fees.

- Travel insurance benefits, including trip cancellation/interruption insurance, baggage delay insurance, and rental car insurance.

- You can get access to airport lounges through Priority Pass Select.

- DoorDash DashPass membership included.

Cons:

- The annual fee is $550.

- The welcome bonus requires you to spend a significant amount of money quickly.

- The points you earn with the Chase Sapphire Reserve Card can only be redeemed for travel through the Chase Ultimate Rewards program.

4. Capital One Quicksilver Cash Rewards Credit Card

Those looking for a credit card that earns cash back on their everyday spending should consider the Capital One Quicksilver Cash Rewards Credit Card.

There is no limit to the amount of cashback you can earn with this card. It offers 1.5% back on all purchases. You also get a $150 sign-up bonus after you spend $500 in the first three months. The annual fee is $0, making this an enticing option for people looking for a simple cashback credit card.

Pros & Cons of Capital One Quicksilver Cash Rewards Credit Card

Pros:

- Earns 1.5% cash back on all purchases.

- No annual fee.

- No foreign transaction fees.

- Easy to redeem rewards for statement credits or direct deposit.

- No limit to the amount of cash back you can earn.

Cons:

- The cashback you earn with this Card is not as high as some other cards.

- The welcome bonus is not as generous as some other cards.

5. Credit One Bank Platinum Rewards Visa Credit Card

A Credit One Bank Platinum Rewards Visa credit card with No Annual Fee can be a great option for people with average or poor credit looking to rebuild their credit.

This card has no annual fee, and you can earn 1% cash back on all eligible purchases. You can also get a free copy of your Experian credit score.

Pros & Cons Credit One Bank Platinum Rewards Visa Credit Card

Pros:

- No annual fee.

- 1% cash back on all purchases.

- Free FICO score access.

- Late payment fee is waived for the first 6 billing cycles.

- No foreign transaction fees.

Cons:

- High APR: 28.99% Variable.

- Low cashback rate.

- High late payment fees: $41.

- Credit One Bank is a subprime lender, so it may be difficult to get approved if you have bad credit.

6. Chase Freedom Flex Card

The Chase Freedom Flex card offers consumers multiple rewards on a single card. The card offers 5% cash back on rotating categories up to $1,500 quarterly and additional bonuses on other categories, such as dining and travel. The first three months of card membership are also accompanied by a $200 bonus for new cardholders.

Pros & Cons Chase Freedom Flex Card

Pros:

- You can earn 5% cash back on rotating quarterly categories up to $1,500 quarterly and additional bonuses on other categories, such as dining and travel.

- $200 bonus for new cardholders in the first three months.

- No annual fee.

- No foreign transaction fees.

- Easy to redeem rewards for statement credits or direct deposit.

- There is no limit to the amount of cash back you can earn.

Cons:

- The cashback you earn with the Chase Freedom Flex Card is lower than some other cards in non-bonus categories.

- The welcome bonus requires you to spend a significant amount of money quickly.

- The rotating quarterly categories may not be relevant to your spending habits.

7. Southwest Rapid Rewards Plus Credit Card

Southwest Rapid Rewards® Plus Credit Cards are great for Southwest frequent flyers. You can earn 2 points for every dollar you spend on Southwest purchases and 1 point for every dollar you spend on other eligible purchases. You can earn 40,000 points if you spend $1,000 within the first three months after joining.

Pros & Cons Southwest Rapid Rewards Plus Credit Card

Pros:

- You can earn 2 points per dollar on Southwest purchases and 1 on all eligible purchases.

- Forty thousand points after you spend $1,000 in the first 3 months.

- No annual fee.

- No foreign transaction fees.

- Early boarding on Southwest flights.

- 25% anniversary points bonus.

Cons:

- The points you earn with the Southwest Rapid Rewards Plus Credit Card can only be redeemed for Southwest flights.

- The welcome bonus requires you to spend a significant amount of money quickly.

Video for Best Credit Cards That Pull TransUnion

Store Credit Cards That Pull TransUnion?

The department store credit cards businesses use to establish credit for their customers vary depending on their preferences.

Here are some department stores Credit Cards That Pull TransUnion credit reports:

- The Home Depot Consumer Credit Card

- Capital One Walmart Rewards Mastercard

- Capital One Walmart Rewards Mastercard

What is TransUnion Credit Score used for?

The TransUnion credit score is used by lenders and financial institutions to determine your creditworthiness. Credit scores numerically represent your credit history and help lenders determine the likelihood that you will repay your loan or credit card debt.

It is important to note that many organizations use TransUnion credit scores to assess your creditworthiness and financial stability. Paying your bills on time and maintaining a low credit utilization rate can improve your credit score, which can help you qualify for better loan terms, lower interest rates, and more opportunities.

How Do You Know Which Card Bureau an Issuer Uses?

The major card issuers have all claimed to check a borrower’s credit report with all three credit bureaus. In most cases, however, they will pull a single credit report when applying for a card and may use one bureau more than another. Likewise, credit card companies do not disclose specific information about this kind of data because they consider it proprietary.

It’s also important to note that the bureau used by a card issuer only becomes known after an application is denied. A credit card issuer does not have to tell you what credit bureau it used on your application if it approves. Upon rejection of your application, you will receive an adverse action notice from the issuer that will identify the bureau that made the decision.

Credit Cards that Provide $1000, $2000, $3000, $5000, $10000 & $20000 Limits Guaranteed Approval

Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

Here are the 7 Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit

- Initial Step Platinum Premier is Mastercard

- CapOne Secured Mastercard

- Citigroup Protected Card

- Early Step Platinum Premium Mastercard

- Wells Fargo Secured Card

- OpenSky Protected Visa Card

- Milestone Gold Mastercard

Note – Read Our Detailed Article on Guaranteed Approval Credit Cards With $1000 Limits For Bad Credit And No Deposit that will help you choose the best card.

Credit Cards with $2000 Limits Guaranteed Approval

Here are the 5 Credit Cards with $2000 Limits Guaranteed Approval

- Capital One Platinum Credit Card

- Surge Platinum Mastercard

- OpenSky Secured Visa Credit Card

- Capital One Quicksilver Secured Cash Rewards

- Reflex Platinum Mastercard

Note—Read Our Detailed Article on credit cards with a $2000 limit guaranteed approval, which will help you choose the best card.

Credit Cards with $3000 Limits Guaranteed Approval

Here are some credit cards with a $3000 limit guaranteed approval:

- Capital One Secured Mastercard

- OpenSky Secured Visa Credit Card

- First Progress Platinum Elite Mastercard Secured Credit Card

- Total Visa Unsecured Credit Card

- Milestone Gold Mastercard

Note—Read Our Detailed Article on credit cards with a $3000 limit guaranteed approval, which will help you choose the best card.

Credit Cards with $5000 Limits Guaranteed Approval

Here are the 4 Credit Cards with $5000 Limits Guaranteed Approval

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Capital One Venture Rewards Credit Card

- Capital One Venture X Credit Cards

Note—Read Our Detailed Article on credit cards with a $5000 limit guaranteed approval, which will help you choose the best card.

Credit Cards with $10000 Limits Guaranteed Approval

Here are the Best 5 Credit Cards with $10,000 Limits Guaranteed Approval

- American Express Platinum Card

- Ink Business Cash Credit Card

- Bank of America Premium Rewards Credit Card

- Chase Sapphire Reserve

- Chase Freedom Unlimited

Note – Read Our Detailed Article on credit cards with a $10000 limit guaranteed approval that will help you

Credit Cards that Provide $20000 Limit Guaranteed Approval

Here are some credit cards with a $20000 limit guaranteed approval:

- Chase Sapphire Reserve

- American Express Gold Card

- Ink Business Preferred Credit Card

- Capital One Venture X Rewards Credit Card

- Chase Sapphire Preferred Card

Note—Read Our Detailed Article on Credit Cards with a $20000 Limit Guaranteed Approval, which will help you choose the best card.

FAQs for Credit Cards That Pull TransUnion

Are There Specific Credit Cards That Pull TransUnion?

The credit card industry may rely increasingly on TransUnion. Still, a credit card issuer can pull information from multiple credit bureaus or use a different bureau for every application.

Which Banks Only Use TransUnion?

Banks do not perform a credit check on a potential credit applicant exclusively based solely on TransUnion data. Most banks and credit card companies gather their information from multiple sources instead. However, some banks rely more heavily on TransUnion than others, such as Amex, Chase, Citi, Capital One, US Bank, and Fifth Third Bank.

Is It Possible to Build Credit Solely with TransUnion Data?

The three major credit bureaus are considered by lenders and creditors when determining credit scores, so building credit only with TransUnion data is impossible. The best way to maintain a good credit profile is to inform all three bureaus.

Which Credit Cards Use Transunion?

All the credit cards listed above use Transunion.

Add Comment