Are you looking for Catalog Credit Cards Guaranteed Approval? If Yes, You are at the right place.

In this article, We are sharing all the information about Catalog Credit Cards Guaranteed Approval.

Developing credit is a challenging process. The process of repairing credit can be just as difficult, if not more so. Lending institutions often only accept good credit applicants or applicants with credit. Catalog cards are great for building your credit history or repairing your credit without requiring a security deposit. The catalog card is what it sounds like. Why should you apply for one? You should know these things.

When your credit history is less-than-perfect, you may be denied a traditional credit card or a loan. Catalog credit cards may be the solution you’ve been looking for. No security deposit is required for catalog credit cards, also called merchandise cards. They offer guaranteed approval and large credit limits. This article aims to explore how catalog credit cards work and what benefits they offer to those with bad or no credit.

If you are looking for Best Catalog Credit Cards Guaranteed Approval, these are the best options:

| Best Catalog Credit Cards Guaranteed Approval | Details |

|---|---|

| Fingerhut Credit Card | Learn More |

| Montgomery Ward Credit Card | Learn More |

| Bank of America Customized Cash Rewards Credit Card | Learn More |

| Southwest Rapid Rewards Plus | Learn More |

| Applied Bank Secured Visa Gold Preferred | Learn More |

What Does Guaranteed Approval Mean?

Contents

- 1 What Does Guaranteed Approval Mean?

- 2 What is a Catalog Credit Card?

- 3 Why Do We Use Catalog Credit Cards?

- 4 How Does Catalog Credit Card Work?

- 5 Some of the Best Catalog Credit Cards Guaranteed Approval

- 6 What are The Eligibility Criteria for Catalog Credit Cards Guaranteed Approval?

- 7 How to Apply for Catalog Credit Cards Guaranteed Approval

- 8 Video Guide for Catalog Credit Cards Guaranteed Approval

- 9 Why Should I Apply For Merchandise Cards or Catalog Credit Cards Guaranteed Approval?

- 10 Why Choose a Catalog Credit Cards Guaranteed Approval?

- 11 Can I Get a Catalog Credit Card For Bad Credit and No Credit Checks?

- 12 Is a Catalog Credit Cards Guaranteed Approval Right For Me?

- 13 What Are Merchandise Cards or Accounts Used For?

- 14 Additional Things to Know About Catalog Credit Cards Guaranteed Approval

- 15 FAQs

A catalog credit card issuer provides a guarantee of approval, implying that the company evaluates applicants’ creditworthiness more leniently. Catalog credit cards with guaranteed approval differ from traditional ones requiring a good credit score. Although guaranteed approval does not mean there are no requirements, it is important to note that there are some. Most applicants are required to provide proof of income, among other things.

What is a Catalog Credit Card?

The catalog credit card lets you borrow up to $1,000 monthly and use it at specific retail chains and stores. You will be approved with an active checking or savings account.

The catalog card is ideal for people whose traditional credit cards, online payday loans, or personal loans have been denied, as well as for people whose employment has been verified and whose credit has been denied.

Catalog credit cards are also called merchandise cards or store cards, and they are very popular for use at gas stations, pharmacies, and even well-known retailers such as Amazon, Best Buy, Walmart, and many others. These cards are known as ‘close loop cards’ or ‘single purpose cards’ because they can only be used with a limited number of retailers and are not affiliated with American Express or Mastercard.

It’s important to remember that merchandise cards may have a small monthly fee, such as $14 per month, but the interest is always 0% if you repay your balance on time. Spend up to $1,000 immediately; you have 25 days to make your first payment before the next one is due.

Why Do We Use Catalog Credit Cards?

A catalog credit card can be a good option for individuals whose credit is poor and who do not qualify for a traditional credit card. The purpose of these cards is to provide consumers with a line of credit that can be used to purchase products from a particular retailer or online catalog. Catalog credit cards may be a viable option for consumers who cannot obtain credit from other issuers but need electronics or other items.

Catalog credit cards benefit individuals with poor credit histories by offering them access to credit lines that they might not otherwise be able to obtain. The credit requirements for these cards are usually more lenient. There are even some that don’t require a credit check.

How Does Catalog Credit Card Work?

Catalog credit cards are unique because they allow you to shop at a catalog or online store run by a retailer, such as Walmart or Target, by making purchases on the Card.

The majority of catalog credit cards are tied to one retailer or a group of retailers, in contrast to traditional credit cards, which can be used anywhere. Their website allows consumers to shop for various products, from fashion to electronics to home goods and much more, all from the comfort of their homes.

Generally, these cards have a more lenient approval process than major credit cards, which makes them ideal if you have a poor credit history. These loans are great for those establishing credit for the first time or trying to improve their credit scores.

Some of the Best Catalog Credit Cards Guaranteed Approval

Here are Some of the Best Catalog Credit Cards Guaranteed Approval

Fingerhut Credit Card

The Fingerhut Credit Card can only be used at Fingerhut. The credit limit is determined by the creditworthiness of the applicant and the amount of purchases and payments made on the account each month.

There is no annual fee associated with the Card. Furthermore, there are no monthly or one-time fees associated with it. Furthermore, all three major credit bureaus receive reports from this Card. There is a regular interest rate of 35.99% on the Card.

Montgomery Ward Credit Card

You can use the Montgomery Ward Credit Card at Montgomery Ward to purchase. You may have a lower credit limit if you have a good credit history and recent account activity. An annual fee of $0 is charged on the Card. There are no one-time or monthly fees, either. Using the Card, you will also receive credit reports from the 3 major credit bureaus.

A catalog card with a bad credit score should only be considered if you frequently shop at the store where the Card is associated. You should build credit if you are serious about it.

Bank of America Customized Cash Rewards Credit Card

The Bank of America customized cash credit card is worthy of our attention. You can be sure that a secured credit card from one of the major credit bureaus will have many interesting offers. There is also a huge cashback bonus with this card. For example, you can earn 3% cashback at gas stations, 2% at grocery stores, and 1% on everything else.

Southwest Rapid Rewards Plus

The annual fee of this card is high. This card is still a good option for earning bonuses and rewards due to its many bonuses and rewards. As a cardholder, you can earn up to 100,000 bonus points that can help improve your credit score.

Applied Bank Secured Visa Gold Preferred

It has no credit check and minimum credit score requirements, so you do not have to worry about credit approval. It is a great way to borrow money because you do not have to worry about your credit. In addition, it sends automatic credit reports to the three major bureaus.

What are The Eligibility Criteria for Catalog Credit Cards Guaranteed Approval?

Here are the Eligibility Criteria for Catalog Credit Cards Guaranteed Approval –

- You must be at least 18 years old

- A resident of the United States or Canada

- An account with a checking or savings balance

- Part-time or full-time employment

- There is no credit check

- Accepts bad credit

How to Apply for Catalog Credit Cards Guaranteed Approval

You must make informed decisions to ensure you choose a catalog credit card that matches your financial needs and goals. The following tips will guide you through the application process:

1. Select The Right Catalog Credit Card: Make sure your catalog credit card is right for your financial needs and situation. It is important to compare different factors between the various programs, such as interest rates, credit limits, fees, payment terms, and other conditions. It ensures you’ll select a card with the most reasonable features based on a rigorous comparison.

2. Credit Self-Reporting: A catalog credit card’s payment history is no longer automatically reported to the major credit bureaus. If you made timely payments on these cards, your payment history was reported to your credit bureau, which would positively impact your score. This practice, however, changed last year. Catalog credit card holders now have the option to manage their credit reports more actively. The ability to self-report allows you to show your responsible credit behavior, even though the card issuer no longer automatically reports it to you. A credit score can be used to gain more control of your financial profile and help you make progress toward improving your financial situation.

3. Understand Interest Rates: Several catalog credit cards on our site don’t have an interest rate (APR), so check them carefully. It is important to know that variable-rate credit cards may have a low introductory APR, but the rate can vary based on changes in the Primary Rate. It is often wiser to lock in a rate at an affordable price when the option is available. Understanding how interest rates or the lack thereof can impact your financial decisions depends on how you review the terms and conditions of the catalog credit card you are considering.

4. Don’t Spend Beyond Your Credit Limit: A credit card overdraft charge, a declined transaction, and possible damage to your credit history can all result from exceeding your credit limit. Keep your account within the limits or caps your credit card company sets.

5. Be sure to read the fine print: Ensure you have read the fine print of the credit card program you chose before signing your contract. This step ensures you are well-informed about the terms and conditions associated with the catalog credit card. By doing so, you will avoid any regrets later on.

Video Guide for Catalog Credit Cards Guaranteed Approval

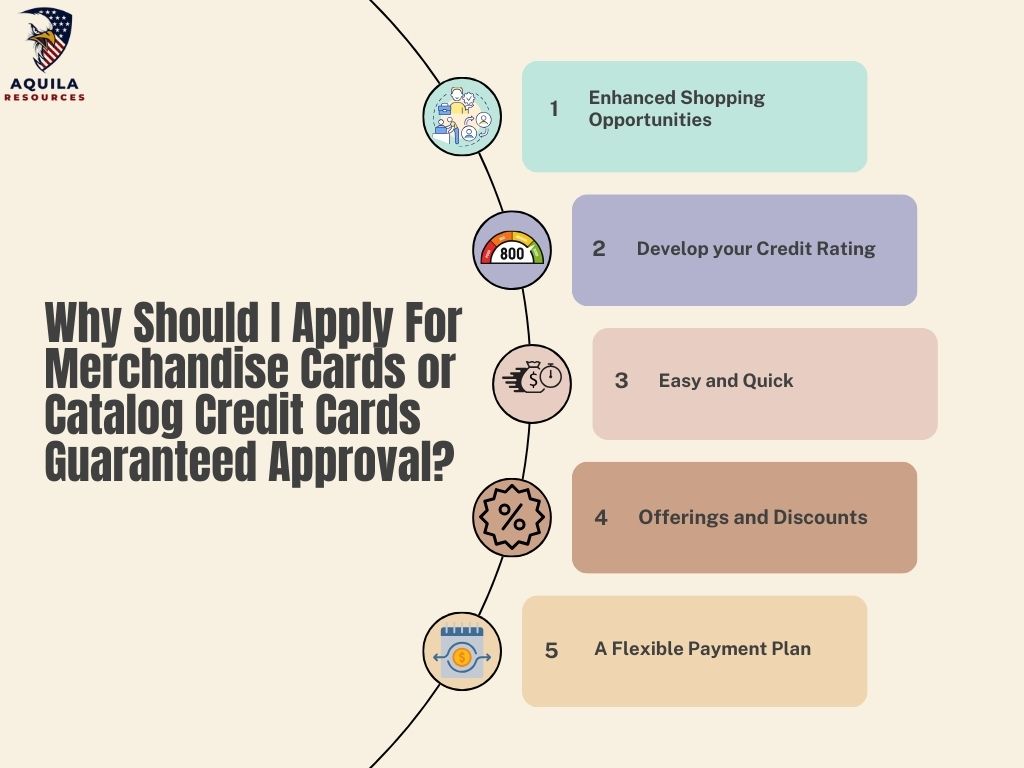

Why Should I Apply For Merchandise Cards or Catalog Credit Cards Guaranteed Approval?

Enhanced Shopping Opportunities: The catalog credit card allows consumers to access the catalogs of their selected retailers. Their access to these items allows them to purchase items they might not have been able to afford otherwise.

Develop your Credit Rating: A catalog credit card can be a stepping stone to better credit for individuals with poor or no credit. A positive credit score can be built over time by making timely payments and using credit responsibly.

Easy and Quick: Catalog credit cards allow you to purchase online without a major credit card. The service is especially helpful for those who may not qualify for credit cards online or do not wish to use their regular credit cards.

Offerings and Discounts: Some catalog credit cards offer exclusive discounts, promotions, and offers to cardholders. Various discounts and financing options are available, from percentage discounts to interest-free terms.

A Flexible Payment Plan: A catalog credit card may offer flexible payment plans, allowing consumers to spread their payments over a manageable period. Especially if you are purchasing a larger item, this can be beneficial.

Why Choose a Catalog Credit Cards Guaranteed Approval?

Catalog cards are an excellent choice for people with bad credit, limited credit histories, or no credit histories. What are the benefits of catalog store cards? Three reasons why you should consider a catalog card:

Avoid Multiple Rejections

It is impossible to find a credit card that offers guaranteed approval. The applicant might need help getting a secured card with a low credit score.

There are many catalog cards available that are easy to qualify for no matter what your credit score is, such as the Freedom Gold Card and Group One Platinum Card. The benefits of getting one of these cards include avoiding frustration and the potential side effects of repeated rejections.

Despite not being a significant factor in calculating a FICO Score, the number of credit inquiries on your credit report does influence it. Credit scores can be lowered by applying too many times quickly. Get Boost Platinum, Freedom Gold, or Group One cards with excellent approval odds to make building credit easy.

Ensure Financial Responsibility

It is important to have good financial habits to build credit. An individual with excellent credit has a track record of consistently making on-time payments and spending responsibly. Building this reputation requires time and effort. A catalog store card allows those with bad credit to demonstrate their financial responsibility.

Approximately 35% of your FICO Score comes from your payment history, making it the most important factor. Your credit score can rise significantly if you use your Card on time each month. Consequently, additional credit cards, loans, or mortgages may be considered by other lenders in the future.

Flexible Payment Options

Catalog cards offer different payment options than traditional credit cards. Some Cards offer 0% APRs on purchases. Getting rid of interest charges on purchases can help you reduce your monthly payments when your credit is being repaired.

Can I Get a Catalog Credit Card For Bad Credit and No Credit Checks?

A catalog credit card is suitable for those with bad, poor, or no credit and those seeking loans without credit checks.

More than any other financial product, there is a very high approval rate for the products, and you must have a checking or savings account and proof of income to be eligible. The product is, therefore, accessible to many Americans and Canadians who are denied traditional loans due to their credit ratings.

Is a Catalog Credit Cards Guaranteed Approval Right For Me?

There’s something dangerous about catalog credit cards since they seem too easy and too good to be true. Besides, how do you find a bad credit loan guaranteed approval, even if nobody verifies your employment or credit record?

The catalog cards make their money by charging small membership fees to members, starting at $14 a month, and by charging late and default fees.

So a merchandise account can be good for you if:

- Usually, shop at the same store every few months or every month – maybe it is for your kids, your home, the gas station, the pharmacy

- You have good financial management skills and can keep your balance low without falling behind

- If you can afford to pay down the balance monthly, you will receive 0% interest

- If you would like to enjoy 30 days before you have to make a payment for furniture or presents, this is an ideal offer for you.

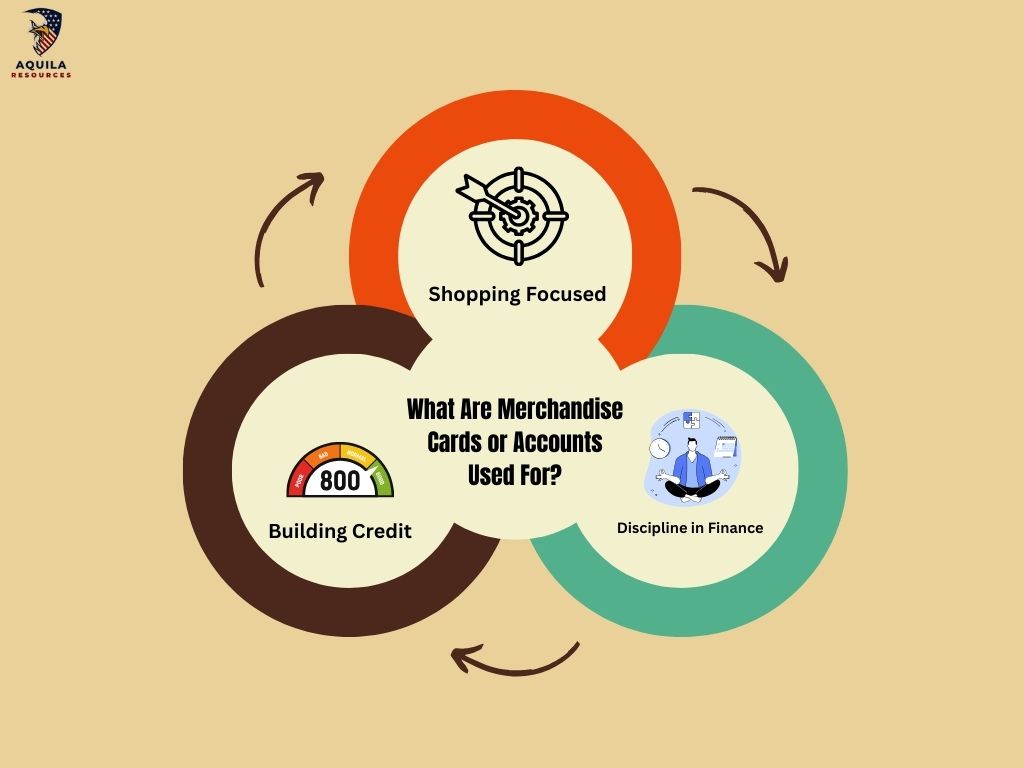

What Are Merchandise Cards or Accounts Used For?

The purpose of merchandise cards is to allow cardholders to purchase exclusively from the retailer’s catalog or online store. Credit cards with limitations operate similarly to these accounts but with certain restrictions. The advantages of merchandise cards over major credit cards include:

Building Credit: Merchandise cards are similar to regular credit cards in that they contribute to one’s credit history and credit score. Payment on time and responsible credit management can positively affect creditworthiness.

Shopping Focused: The purpose of a merchandise card is to encourage consumers to shop within a specific retailer’s offerings. Using this method can assist individuals in budgeting their spending and avoiding unnecessary purchases.

Discipline in Finance: Merchandise cards encourage financial discipline by limiting purchases to a particular catalog or website. Using a credit card means cardholders are less likely to purchase impulsively at various retailers.

Additional Things to Know About Catalog Credit Cards Guaranteed Approval

A catalog or merchandise card usually has a minimum qualification requirement. The applicant must also have an active checking or savings account and proof of income. The majority of them do not require credit checks.

The cards do not belong to any card network like Visa or MasterCard. There are store cards that are only valid for purchases within their affiliated catalogs. A catalog card might come with lots of fees that will take away a lot of your credit limit.

FAQs

Are Catalog Credit Cards Legit?

There is a great deal of regulatory oversight, and they have been around for decades. Customer loyalty can increase, and rewards (Read: Best Rewards Credit Cards for You) and discounts can be offered at specific stores if customers register with the brand. People with poor credit who need to purchase can benefit greatly from it. If you go into default, the fees will start to mount, so you should keep an eye on your balance.

Do They Come With No Fees?

Credit cards offered by catalogs offer 0% percent interest on all purchases, provided the balance is paid off each month in full. Nonetheless, it would help if you remembered that there is a membership fee, a default fee, and interest charged when you are in arrears at 29.9% APR, which is similar to the cost of bad credit loans and cards.

How Many Catalog Store Cards Can I Have Open?

Although it is recommended to have only a few open cards, there is no rule against it. Many credit cards make you rely heavily on credit, which can be off-putting for potential lenders and banks. The average person has five credit cards, either store cards or normal cards.

Add Comment