Are you looking for Burial Insurance For Seniors Over 60? If yes, You are at the right place.

In this article, we are sharing all the information about Burial Insurance For Burial Insurance For Seniors Over 60 & Burial Insurance for Seniors

Most people are not comfortable discussing funerals, burials, and final expenses. There is something morbid about broaching the subject. The only way to ensure that you and your family are covered in case of end-of-life expenses is to purchase burial insurance.

What Is Burial Insurance?

Contents

- 1 What Is Burial Insurance?

- 2 Key Terms Of Burial Insurance

- 3 What is burial insurance for seniors?

- 4 How Does Burial Insurance For Seniors Work?

- 5 How Much Does Burial Insurance for Seniors Cost?

- 6 Best Features Of Burial Policies For Seniors

- 7 The Pros and Cons of Burial Insurance for Seniors

- 8 What Is the Difference Between Life Insurance and Burial Insurance?

- 9 FAQs

A burial insurance policy is a whole life insurance policy with a relatively small death benefit. You will only purchase life insurance enough to cover your final expenses. A final expense insurance policy, a burial insurance policy, and a whole life insurance policy with a smaller death benefit (usually between $5,000 and $35,000) are all the same.

An insurance policy covering burial costs can cover all or part of the cost of your funeral. If you do this, your family won’t have to scramble to pay your final expenses after you pass away. Rather than paying for final expenses out of pocket, they can use death benefits to collect from your burial insurance policy.

Burial insurance with no waiting period provides peace of mind that your loved ones will be financially protected, even if you pass away unexpectedly. This type of insurance pays out a death benefit to your beneficiary, which can be used to cover the cost of your funeral and other final expenses.

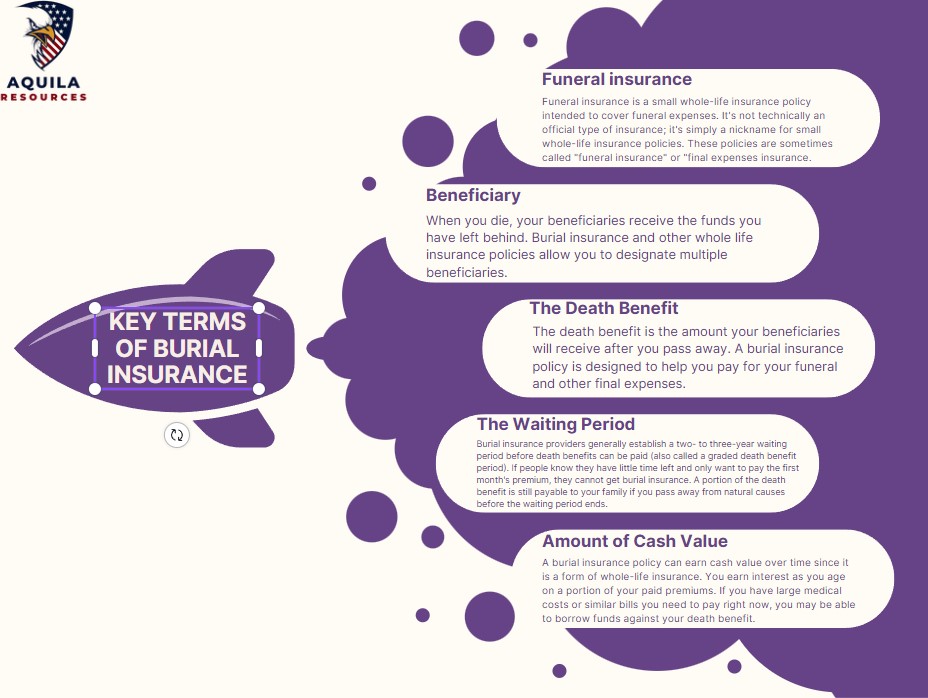

Key Terms Of Burial Insurance

If you are researching it for the first time, you may not be familiar with all of the terminology associated with burial and life insurance. A basic understanding of your policy requires an understanding of some key terms.

- Funeral Insurance. Funeral insurance is a small whole-life insurance policy intended to cover funeral expenses. It’s not technically an official type of insurance; it’s simply a nickname for small whole-life insurance policies. These policies are sometimes called “funeral insurance” or “final expenses insurance.”

- Beneficiary. When you die, your beneficiaries receive the funds you have left behind. Burial insurance and other whole life insurance policies allow you to designate multiple beneficiaries.

- The Death Benefit. The death benefit is the amount your beneficiaries will receive after you pass away. A burial insurance policy is designed to help you pay for your funeral and other final expenses.

- The Waiting Period. Burial insurance providers generally establish a two- to three-year waiting period before death benefits can be paid (also called a graded death benefit period). If people know they have little time left and only want to pay the first month’s premium, they cannot get burial insurance. A portion of the death benefit is still payable to your family if you pass away from natural causes before the waiting period ends.

- Amount of Cash Value. A burial insurance policy can earn cash value over time since it is a form of whole-life insurance. You earn interest as you age on a portion of your paid premiums. If you have large medical costs or similar bills you need to pay right now, you may be able to borrow funds against your death benefit.

What is burial insurance for seniors?

A burial insurance policy makes payments to cover end-of-life expenses in the event of the death of a policyholder. This type of policy is typically whole life insurance with a small death benefit, usually less than $25,000, and it covers the expenses you leave behind after you die.

A burial insurance plan is a whole-life policy that covers you for as long as you pay for it. The rates are fixed so that they won’t fluctuate.

A good burial insurance policy should include the right death benefit to avoid overpaying for your policy. When choosing a burial insurance plan, you should estimate the price of everything you need for the funeral before deciding. Then, after getting a few quotes, think about other expenses that might arise after your death. The outstanding balance on a credit card or a loan, for instance. In most cases, these debts are passed along to your next of kin and often forgotten when planning for your funeral.

It is important to match the expenses to an amount corresponding to your needs after establishing these costs. A wide range of coverage is available in senior burial insurance plans, ranging from $2,000 to $50,000. Your life insurance can cover other final expenses if you want it to since funerals cost $9,000 on average.

How Does Burial Insurance For Seniors Work?

Senior burial insurance, also known as funeral insurance or final expense insurance, is a type of no-medical exam whole-life insurance policy that pays for burial and related expenses after death.

Cash payouts from your life insurance policy will provide your family with the money they need to cover cremation costs, burial costs, funeral service costs, outstanding debts, medical bills, credit card debts, and any other expenses after the death of a loved one. The remaining funds can be used however your beneficiaries choose if the funeral money is not spent all on the funeral.

Burial policies are types of whole life insurance, so their premiums will never increase, their death benefits will never decline, and their cash value will grow forever. There is usually a limit of $50,000 or less to the coverage amounts.

There are many unique aspects to burial insurance policies, including lenient underwriting. Seniors can qualify for a new policy even if they have severe health issues, which is not true with traditional life insurance policies.

There are two types of burial insurance plans for seniors.

- Simplified issue. These plans are the least expensive and can offer immediate peace of mind because the full death benefit pays out starting on day one (no waiting period). You don’t have to take a medical exam to qualify but must answer health questions. These plans are often called “no exam funeral insurance.”

- Guaranteed issue: Commonly referred to as “guaranteed acceptance,” these plans have no health questions because your approval is guaranteed. They have higher premiums than simplified issue policies, and there’s always a two-year waiting period. If you die during the waiting period, the insurance company will only refund your premiums plus a tiny amount of interest. The waiting period does not apply to accidental death.

How Much Does Burial Insurance for Seniors Cost?

The amount you’ll pay in premiums may be as low as $18 per month or as high as $286 per month, depending on your chosen insurance company, age, sex, coverage amount, and overall health. Your rate will be cheaper if you’re in good health and can answer “no” to the health questions on the application.

Some insurers may require a medical exam to qualify, but this isn’t always true. If you’ve had health issues or are taking certain medications, you may be issued a modified or sub-standard plan, and your rates will be higher because of your health.

Best Features Of Burial Policies For Seniors

- Instant approval – There is fast approval for final expense insurance for seniors. The longest time you will ever wait for the application to be approved is just a few business days, but most insurance companies offer instant approval.

- Lenient underwriting – Seniors with pre-existing conditions may still qualify for a guaranteed acceptance policy. There are relaxed underwriting requirements, and only a few health questions are asked of the applicants. No health questions are asked to qualify for guaranteed issue life insurance.

- No medical exam – All funeral insurance companies will not require you to undergo a medical exam. The application process is simplified. That means you only need to answer health questions and don’t even ask for it.

- No health questions – Some burial insurance policies for seniors do not ask health questions. Guaranteed acceptance policies are best for people with severe health conditions.

- The coverage is permanent – Burial policies for seniors are whole-life policies locked in for the duration of the policy. You are covered for life, and the coverage cannot decrease; it does not expire at any age. The premiums are leveled and do not increase.

- It has a cash value component – Burial insurance policies for seniors are a whole life with a cash value that grows over time. The cash value can be used to pay for premiums. It acts as a safety net to ensure the policy never lapses from nonpayment.

- Fast payout – There is a quicker claims payout with burial insurance for seniors. The claim will be paid within a week after receiving the proper paperwork.

- Small value options – Burial policies for seniors are offered at small face value. You can buy as little as $1,000, so you can buy as much or as little as you need.

- Portability – The payout for funeral insurance for seniors is in cash upon the insured’s death. The beneficiary will receive the full face amount of the policy, and they can use it as a final expense.

- Many insurance company options – Many carriers offer seniors burial policies. More and more insurance companies are offering insurance because more than 10,000 people are turning 65 each day. All of those are competing for your business, which drives the prices of premiums down.

The Pros and Cons of Burial Insurance for Seniors

Pros About Burial Insurance

| Pros About Burial Insurance | |

| A higher age limit | There may seem to be an uphill battle for seniors regarding getting burial insurance. The insurance provider won’t want to provide a policy to an older applicant if they have fewer years to pay their premiums. Many funeral homes and insurance companies offer age limits between 50 and 85 years of age (with some offering even higher limits). A person who is more than a decade into retirement can still acquire burial insurance. |

| Insurance premiums are affordable | A burial insurance policy with a death benefit of $100,000 or more will have much lower premiums than a life insurance policy. If you plan for your final expenses, you don’t need to make major changes to your lifestyle or budget. |

| Choices based on your health | There is still an option for a guaranteed burial plan, regardless of your health status, if you are denied a simplified one. You can find a plan covering final expenses if you fall within the age bracket. |

| Intuitive application process | Most burial insurance providers ask very few health-related questions, even though you can be turned down for coverage because of your health. A health exam is optional for many of them. A senior’s application process is now made even easier by this. |

Cons About Burial Insurance

| Cons About Burial Insurance | |

| The waiting period can prevent full payouts | If you purchase a plan with a waiting period, your beneficiaries will not receive your full death benefit until you outlive the waiting period. Generally, your beneficiaries will only receive some or all of what they have paid into the policy if you die within the period (usually two to three years after you buy the plan). This may or may not cover your funeral costs. |

| Providing no financial security to beneficiaries | Your beneficiaries will not receive long-term financial assistance from burial insurance. You will be covered for the expenses associated with your funeral and other final expenses if you use it. It is unlikely that there will be a large amount of money left. Burial insurance isn’t a good investment for your loved ones unless you have other assets to leave to them before you pass away. |

| There is less value for what you pay | At first glance, a burial insurance plan might seem like a great value because of its low premiums. A larger term or whole life insurance policy offers a better value when you compare the monthly premium to the death benefit. A burial insurance policy, for instance, would cost $50 per month for $5,000 in death benefits (plus accrued cash value), while a standard whole life insurance policy would cost $200 per month for $200,000 in death benefits. According to this example, the burial insurance plan provides more than 10 times the value of the larger, more expensive life insurance policy. |

What Is the Difference Between Life Insurance and Burial Insurance?

Life insurance and burial insurance are the same. Generally, life insurance provides beneficiaries with higher death benefits that go beyond expenses for funerals when they are referred to as life insurance. If you compare the cost of premiums to the death benefits of larger-term or whole-life policies, you will find they offer better value.

The cost of a whole life insurance policy with a death benefit of $250,000 may be $100 more per month than burial insurance with a death benefit of $10,000, for example. Term or whole life insurance is better if you have extra money and want to provide financial support to your beneficiaries after you’re gone. A burial insurance policy may be a good option to keep your monthly expenses minimal.

FAQs

Is Burial Insurance Worth It?

A burial insurance policy will help you prepare for the final day, which we will all face one day. Ensuring that everything is taken care of will prevent your family from experiencing financial difficulties.

What are some of the benefits of having burial insurance?

A burial policy allows you to choose a final resting place. It gives your loved ones peace of mind that your funeral and burial expenses will not be your family’s responsibility.

Who qualifies for burial insurance for seniors?

The guaranteed acceptance policy is available to everyone between 45 and 85. You should keep in mind that all guaranteed issue policies require a two-year waiting period. Only your premiums plus interest are refunded if you die during the waiting period.

Add Comment