Are you looking for Home Improvement Loans with Bad Credit? If Yes, You have stumbled upon the right place.

In this article, We are sharing all the information about Home Improvement Loans with Bad Credit & Home Improvement Loans with Bad Credit and No Equity.

Homeownership comes with its share of responsibilities, and one of the significant challenges homeowners face is the maintenance and improvement of their properties. Home improvement projects can enhance your home’s comfort, aesthetics, and value.

However, obtaining a loan for these projects can be daunting if you have bad credit. This article delves into the options available for individuals with bad credit looking to secure home improvement loans.

The median credit score of Americans is below 700, which indicates nearly half of the country may be considered subprime borrowers by lenders, i.e., unlikely to repay loans because of poor credit and payment history. The lack of credit may make getting a loan easier for those with bad credit.

The 42% of homeowners who qualify for a home improvement loan may still be able to finance repairs or renovations. The first thing you need to decide is whether or not this is the right solution for you based on your unique financial situation and needs.

What is Home Equity?

Contents

- 1 What is Home Equity?

- 2 How do I Get Equity in My Home?

- 3 What are Home Improvement Loans?

- 4 How Does a Home Improvement Loan Work?

- 5 Secured vs. Unsecured Home Improvement Loans

- 6 What Credit Score is Needed for a Home Improvement Loan?

- 7 Can you Get a Home Improvement Loan with Bad Credit and No Equity?

- 8 How to Get a Home Improvement Loan With Bad Credit?

- 9 Best Home Improvement Loans with Bad Credit

- 10 How to Qualify for Home Improvement Loans with Bad Credit?

- 11 How to apply for a home improvement loan with bad credit

- 12 What Are the Pros and Cons of Getting a Home Improvement Loan?

- 13 How to Choose a Home Improvement Lender?

- 14 Alternatives to a Home Improvement Loan

- 15 How to Compare Home Improvement Loans with Bad Credit?

- 16 FAQs

A homeowner’s equity can be defined as their ownership interest in their home. You can calculate it by subtracting your current mortgage payment from the property’s current market value. Your home might be worth $250,000, but if your mortgage is currently $£150,000, you would have $100,000 in ‘equity.’

How do I Get Equity in My Home?

Increasing your property value or decreasing your borrowing are the two ways to improve your equity. The overpayment of your mortgage can reduce your borrowing costs if affordable. The most expensive credit should always be paid first, however. A successful household income strategy could result in extra cash for mortgage overpayments. A benefit check online will help you make sure you are claiming money that you are entitled to.

You need to improve your property to increase its value. If you would like advice on how to increase the value of your home, you can consult a local and reputable estate agent. It may be possible to spread the cost of home repairs by borrowing to finance home improvements.

What are Home Improvement Loans?

These loans are specifically designed to assist homeowners in renovating or repairing their existing properties. Home improvement loans are sometimes called renovation or house repair loans. There are varying terms and conditions for home improvement loans offered by financial institutions such as banks, non-banking financial companies, and housing finance companies.

How Does a Home Improvement Loan Work?

The majority of home improvement loans are unsecured personal loans. Obtaining one requires you to provide a lender with your financial details, such as your income and debts. You can use the funds for your project (or anything else) if approved, and you’ll get the funds in a lump sum. Depending on the loan amount, repayment periods can span as little as a few months to as many as 10 or 12 years. You will make regular monthly payments until you have repaid the loan.

Secured vs. Unsecured Home Improvement Loans

There are two types of home improvement loans: secured and unsecured. The collateral for secured loans can help borrowers with lower credit scores secure loans, even when their credit score is low. A higher loan amount, a lower interest rate, and a longer repayment period are some of the benefits of these loans. A secured loan requires collateral, while an unsecured loan often has stricter requirements, such as a higher credit score. Loan amounts may be smaller, interest rates might be higher, and repayment terms may be shorter than secured loans.

What Credit Score is Needed for a Home Improvement Loan?

The best home improvement loan with poor credit is typically offered by major lenders to borrowers with a lower risk of default, which means those with good or high credit scores and a proven history of paying back loans, whether they are mortgage loans or credit card statements. The income, education, and unsecured loan terms can also be considered when assessing credit risk.

Borrowers with credit scores of 700 or higher are more likely to secure loan approval. The good news is that some lenders will provide loans to individuals with credit scores as low as 580. These lenders offer loans for customers with fair or poor credit scores. However, these loans may have more restrictions.

Can you Get a Home Improvement Loan with Bad Credit and No Equity?

A secured loan without equity may be less attractive than one with equity. Consider considering if you can repay unsecured borrowing over a shorter term. A secured loan may make sense if you borrow up to £15,000 for significant repairs, such as roofs or structural work.

The lender will usually calculate the interest rate for a secured loan based on the amount of equity available in your property. No matter how much you borrow or equity you have, everyone at Lendology receives the same fixed rate of 4%. Contact us today for an informal conversation if you’re considering improving or remodeling your home but are concerned that you may not have enough equity.

How to Get a Home Improvement Loan With Bad Credit?

The following tips may help you qualify for a home improvement loan even if you have bad credit:

- Find a creditworthy co-borrower. When you borrow with a co-borrower, the lender has less risk since they share your financial responsibility for your debt. If a lender accepts co-borrowers, you may get approved with a lower interest rate.

- Try credit union loans. A credit union may offer flexible eligibility criteria for loans to its members. Take a look at the loans available to credit union members or those within their field of membership if you’re a member already.

- Find a lender with flexible credit requirements. A limited credit history or an adverse credit score may not disqualify borrowers from alternative lenders. If you are still looking for minimum credit requirements on a lender’s website, shop around and prequalify to find a loan that fits your needs.

- Before borrowing, pay down your debt. You may be more likely to be approved for a loan if your debt balances are lower. This can help reduce your credit utilization and DTI ratio.

Best Home Improvement Loans with Bad Credit

There are different types of home improvement loans for people with bad credit. This is why you should look at all available options and shop around. If you purchase, compare interest rates, terms, and fees.

OneMain Financial

Many borrowers can apply for credit with OneMain Financial, including those with bad or fair credit. A long application process is associated with the lender’s unsecured loans, which are fairly small. Secured loans are also an option when you are willing to provide collateral. OneMain Financial might be the right choice if you need help finding loans for home improvements with bad credit.

SoFi

A flexible home improvement loan from SoFi lets you borrow up to $100,000 with same-day funding, various repayment terms, and several options. Compared to other companies in the industry, SoFi has a straightforward application process, no fees (not even late fees), and competitive rates.

The Unemployment Protection program offered by SoFi allows you to pause your payments while looking for work for up to three months. You can also get help from a career counselor at SoFI to find a new job during this period so that you don’t miss out on payments while catching up with your payments.

There’s no cosigner option with SoFi, but you can apply as a co-applicant if one of you has better credit than the other. There are live chat features on the site, as well as phone and email support available seven days a week at SoFi.

NetCredit

NetCredit offers loans to those with bad credit, but the rates are higher compared to other lenders. There is an APR of 34.99 percent in New Jersey, for example. In some states, the lender does not charge processing fees and reports to the major credit bureaus.

Upgrade

Upgrade is a great choice for borrowers with fair to bad credit looking to improve their homes. Upgrade pulls a soft credit pull to let you check your rates without damaging your score. Several terms and corresponding payments are available with Upgrade, allowing borrowers to make repayments on their own terms. An origination fee of 1.85% to 9.99% is included in the APRs below. The loan proceeds could be available the next day after Upgrade accepts your application.

Avant

The Avant lender provides loans to people with less-than-stellar credit so that you may qualify with bad credit. The company offers a mobile app to track your upcoming payments and view your payment history. Avant also provides an online chat feature to ask questions and get answers quickly. You can also call Avant’s customer service number if you have any questions. Avant has a quick approval process so that you can get your loan quickly.

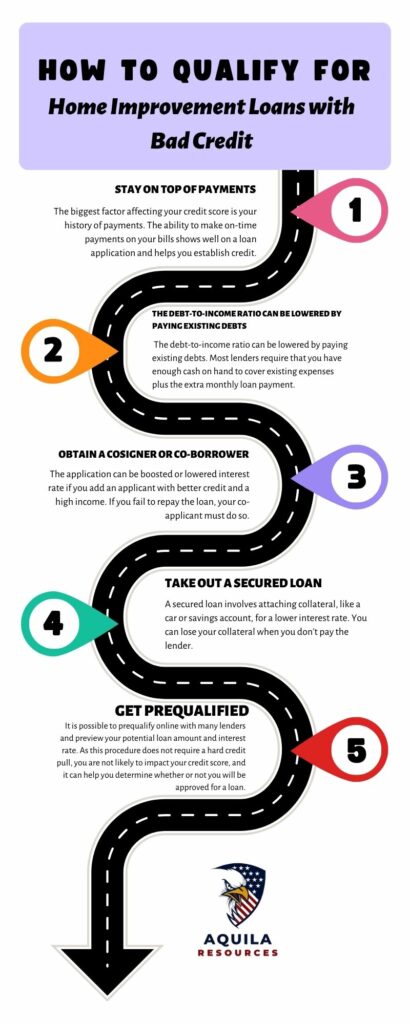

How to Qualify for Home Improvement Loans with Bad Credit?

The credit score plays a major role in whether you qualify for a personal loan, but you can improve it.

- Stay on top of payments. The biggest factor affecting your credit score is your history of payments. The ability to make on-time payments on your bills shows well on a loan application and helps you establish credit.

- The debt-to-income ratio can be lowered by paying existing debts. Most lenders require that you have enough cash on hand to cover existing expenses plus the extra monthly loan payment.

- Obtain a cosigner or co-borrower. The application can be boosted or lowered interest rate if you add an applicant with better credit and a high income. If you fail to repay the loan, your co-applicant must do so.

- Take out a secured loan. A secured loan involves attaching collateral, like a car or savings account, for a lower interest rate. You can lose your collateral when you don’t pay the lender.

- Get prequalified. It is possible to prequalify online with many lenders and preview your potential loan amount and interest rate. As this procedure does not require a hard credit pull, you are not likely to impact your credit score, and it can help you determine whether or not you will be approved for a loan.

How to apply for a home improvement loan with bad credit

- Determine how much you would like to borrow and how long you would like to borrow it for. You should also determine how much you can pay each month – and how long you can pay it back.

- You can use a tool like Zoopla to estimate the value of your property if you are looking for a secured loan. You must subtract the amount due on your mortgage from the figure. You will get a rough idea of how much equity you have in the property, which can be used to determine how much you can borrow.

- Make sure you explore all your options. Ensure your credit score is free of soft searches and eligibility checkers before applying. It is possible to search many lenders simultaneously using price comparison websites. All our loans can be compared, and you can receive a quote before you apply.

- The next step is to apply for the loan through the lender’s website or mobile app once you’ve found the deal you will likely be approved for. Unsecured loans can be approved quickly, and if you’re successful, you will receive the funds in your bank account shortly.

- There will be a delay in the process for secured loans. You must provide additional documentation regarding your home and the property’s valuation. The lender will assist you through this process and, in most cases, keep you updated every step of the way.

Note – Securing financing for home improvements with bad credit can be challenging, but options exist, from government assistance to specialized personal loans. This financial flexibility also extends to recreational upgrades like above-ground swimming pools. By understanding these avenues, homeowners can enhance their living spaces and quality of life, turning dreams into reality.

What Are the Pros and Cons of Getting a Home Improvement Loan?

| Pros | Cons |

| A secured loan can provide you with access to funds more quickly than an unsecured loan | A home improvement loan can have a higher interest rate than a secured loan |

| Payments are predictable and fixed each month | A change in your financial situation could lead to a default |

| There is no need to put up collateral, such as your home or car | If you are unsure how much you’ll need, you should draw from a line. |

How to Choose a Home Improvement Lender?

You need to take many things into account when considering home improvement loans.

The following factors should be considered when evaluating each potential lender:

- Annual Percentage Rate (APR). The annual percentage rate (APR) is the cost of the loan, including interest and fees. This calculator can help you determine how much you’ll have to pay if you borrow the money.

- The fees. Your lender may charge an origination fee, late fees, prepayment fees, or other fees that will be deducted from your loan disbursement. If you’re looking for lenders with few or no fees, it’s worth your time.

- Total loan amount. Choose a lender who can provide you with the exact amount you need. Only borrow what you need.

- The loan term. Ensure that your fixed monthly payment will be comfortable to afford before you sign a loan agreement.

- Discounts. You may qualify for a lower interest rate if you enroll in automatic payments, apply with a cosigner, or borrow from your current bank.

- Funding speed. When you need the money quickly, select a lender who can fund you quickly. The majority of lenders offer same-day or next-day funding.

- The ease of application. It is not the most important factor, but complicated applications from lenders can be off-putting. It is easy to apply with the best lenders.

- Customer service. It is hoped that you will never need customer service. If you need customer service, ensure the lender provides convenient hours and channels (online, phone, etc.).

- The lender’s reputation. You can better understand what the lender is like by checking out what other borrowers have to say. The number of horror stories about lenders is a warning sign, even though mixed reviews are common for lenders.

- Requirements for borrowers. You need more credit scores to get your top pick. If you have less-than-perfect credit, ensure you complete the prequalification process every time you compare loans.

Alternatives to a Home Improvement Loan

A home improvement project can be funded in a variety of ways.

- The home equity loan. The equity you’ve built in your house can be used to borrow a lump sum from these home equity loans.

- HELOC (Home Equity Line of Credit). They are revolving lines of credit that allow you to borrow just what you need and repay what you borrow later. They are useful for ongoing projects. Secured by your home, they are similar to home equity loans.

- The cash-out refinance. You replace your current mortgage with a new one for a larger amount than what you owe on the old one and keep the difference as cash.

- Credit card. A credit card may help you finance home improvements if your credit is sufficient. You may not want to choose this option since interest rates on credit cards are often higher than those on other types of credit.

- Financing for contractors. Finance programs are available from some contractors through their partners. Contracts are typically paid directly to the contractor by the lender.

How to Compare Home Improvement Loans with Bad Credit?

Home improvement loans can be a good option if you want to use something other than your equity or credit cards on the project. If you have bad credit, be prepared to pay high-interest rates.

The following features make bad credit home improvement loans worth comparing.

APR

Annual percentage rates include all fees the lender charges when calculating a loan. The range of APRs varies from 6% to 36%, but borrowers with low credit scores may be charged the highest rate. APR is a useful tool for comparing personal loans and other financing options.

Monthly payments

You can preview the monthly payment of a home improvement loan at different interest rates and repayment terms with a home improvement loan calculator. You can determine what kind of loan offer you need based on your budget.

Repayment terms

The repayment terms for bad credit home improvement loans typically range from one to seven years, but some lenders offer fewer options. The monthly payments will be lower on a longer-term loan, but the interest costs will be higher; find a balance between the two.

Fast funding

Some lenders claim they can fund a loan the same day you apply, while others say they can fund it in less than a week. Consider a lender that offers fast funding if you need to pay for an urgent repair or an ongoing project.

FAQs

How Big of a Home Improvement Loan can I Get?

Lenders offer loans starting at $500 and up to $100,000, ranging from $600 to $100,000. If you plan to apply for a loan, consider the amount you can afford before applying. Don’t take out a loan you can’t afford to repay since late payments, missed payments, and interest charges will also be added.

What Is a Home Improvement Loan?

A “home improvement loan” is typically an unsecured loan used for home improvements, though it can also be used to describe any loan used for home improvements. The use of home equity loans or lines of credit (HELOCs) for funding home improvement projects is an example.

Can I Get a Home Improvement Loan with Bad Ccredit and No Equity?

The answer is yes; borrowers with bad credit and no equity can get a home improvement loan. A home improvement loan is an unsecured personal loan that does not require a mortgage. Your credit score, debt, income, and loan amount all play a part in getting approved for a home improvement loan.

Can I Get a Home Improvement Loan with Bad Credit?

Even if you have bad credit, it is still possible to qualify for a home improvement loan. A clean credit report, a cosigner, and prequalification with multiple loans will increase your chances of getting a good rate.

Add Comment