Are you looking for Instant Payday Loans Online Guaranteed Approval? If Yes, You are at the right place.

In this article, We are sharing all the information about Instant Payday Loans Online Guaranteed Approval.

A financial challenge can make figuring out how to make ends meet difficult. This is where a guaranteed approval instant payday loan can be a lifesaver. They can provide financial support due to their easy application process and speedy approval.

A payday loan can help you bridge the gap between your next paycheck and some unexpected expenses, such as medical bills and car repairs. Furthermore, you can be assured of getting help when you need it with our guaranteed approval policy.

Financial help can be obtained quickly and easily through loans. These loans can be approved within minutes, making them a great option for those who need money fast. The application process is simple, and you can immediately get the money you need.

A short-term loan can help you cover an unexpected bill or repair for a short period. Online payday loan guaranteed approval allows you to access funds instantly, so you don’t have to wait around for days for your application to be processed.

Getting instant payday loans online with guaranteed approval is possible for various reasons. The application process is quick and easy, and the funds will be sent to your account within days or weeks instead of months.

What is an Instant Payday Loan?

Contents

- 1 What is an Instant Payday Loan?

- 2 How Does a Quick Payday Loan Work?

- 3 Is it Easy to Get a Guaranteed Payday Loan?

- 4 How do I Qualify for Instant Payday Loans Online Guaranteed Approval?

- 5 Top 5 Instant Payday Loans Online Guaranteed Approval

- 6 Video For Instant Payday Loans Online Guaranteed Approval

- 7 How to Choose the Right Lender for Instant Payday Loans Online Guaranteed Approval?

- 8 Types of payday loans

- 9 Alternatives of Instant Payday Loans Online Guaranteed Approval

- 10 FAQs

- 11 Conclusion

Several different names can be given to instant payday loans. Deferred deposit loans, cash advance loans, post-dated check loans, check advances, and check advances are all terms used to describe this type of loan. It is important to find a financial institution that offers this type of loan to obtain one.

The internet has made applying for an instant payday loan easier today. Most who benefit from this credit are those who apply online for their loans, compared to those who walk into a lender’s store.

There is no difference between applying in person at a lender’s branch or online. The amount you want to borrow and your personal and financial data must be provided. Some stores and online destinations charge a fee for their services. A payday loan can be deposited into your bank account or paid in cash.

How Does a Quick Payday Loan Work?

A payday loan is often the best solution for unexpected expenses. Take the example of a car that breaks down without enough money. Payday loans can be used to cover the repair costs.

Your promise when you receive the loan is that you will pay it back within a short period of time. It is common for people to write a check to show they will repay the loan. You must also pay an extra fee in addition to your loan. The loan usually has to be repaid within two weeks. A penalty may be imposed if you fail to do so.

Is it Easy to Get a Guaranteed Payday Loan?

Payday loans with guaranteed approval rates range from 97% to 100%. When you need money fast, this is the most reasonable option since the interest rate is relatively higher than other types of loans. The amount you can borrow will depend on the amount you can borrow and the flow of transactions into and out of your checking account. For example, you can borrow more if you receive direct deposits into your account more often.

Personal loans for bad credit instant approval are a great option for people with bad credit who need money fast. These loans typically have higher interest rates than traditional personal loans, but they are easier to qualify for. The amount you can borrow will depend on your income, credit history, and other factors.

How do I Qualify for Instant Payday Loans Online Guaranteed Approval?

Instant Payday Loans Online Guaranteed Approval are easy to qualify for if you meet the following requirements:

- You must be at least 18 years old

- You must have a valid identification card

- You must be a U.S. citizen or a permanent resident

- Ensure your checking account is active

- Establish a steady income source

It is also important to note that state laws and policies concerning payday loans may vary. You can get the loan without any problem if you meet all the requirements.

Unlike other types of loans, there is no credit score requirement for payday loans. It is possible to qualify for the loan even if you have a bad credit score.

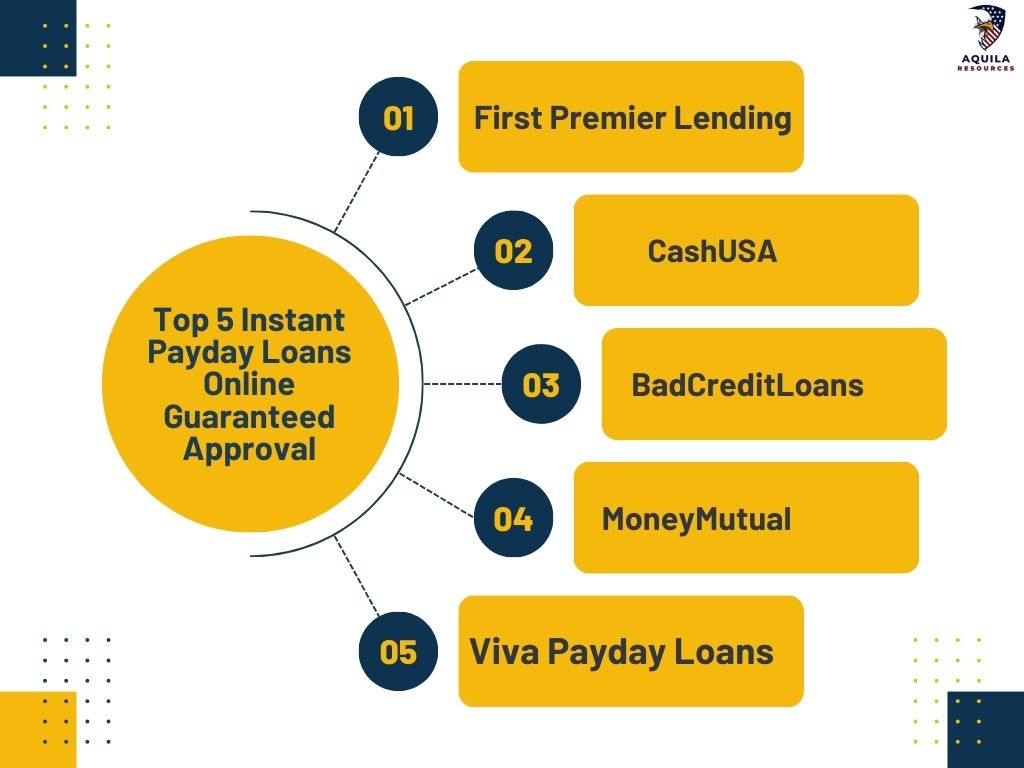

Top 5 Instant Payday Loans Online Guaranteed Approval

Instant payday loans online guaranteed approval are short-term loans that promise quick access to funds with a high probability of approval, often within minutes of application. These loans are typically marketed as a solution for individuals facing unexpected financial emergencies.

Here are the top 5 Instant Payday Loans Online Guaranteed Approval–

First Premier Lending

Regarding payday loans, First Premier Lending is the best choice. Using First Premier Lending’s marketplace, borrowers can find lenders who can provide them with money quickly. All kinds of emergencies can be addressed with online loans from First Premier Lending, including unexpected car repairs, home improvement projects, and vacations.

Online loan marketplaces such as First Premier Lending offer you many choices of direct lenders within their network, giving you a better chance of getting approved and receiving funding quickly. In addition, all credit types, including those with bad credit, are welcome.

The loan amounts offered by First Premier Lending range from $100 to $20,000. Your checking account could be credited with money the same day you complete their short loan request form.

CashUSA

It doesn’t matter if you have medical bills that still need to be paid or if you must repair your car, you need your payday funds as fast as possible. CashUSA created the fastest online loan platform available with this in mind.

Your application can be submitted in minutes through the lending platform. CashUSA will verify your credentials after receiving your contact information, loan amount, and financial details. You can receive funding without worrying about your credit report with a soft pull, unlike a hard credit pull.

If facing a financial crisis, you can also avoid soaring interest rates with CashUSA. CashUSA, for example, charges average APRs between 5.99% and 35.99% on payday loans, well within the limits of most major lines of credit, including credit cards and bank loans.

A CashUSA loan can help you pay for medical bills, student loans, or credit card debt between $500 and $10,000. Furthermore, the repayment process is stress-free. CashUSA will even handle your loan repayment via deduction from your account, including any fees that might be applicable. Automatic repayment allows you to avoid late fees and missing payment deadlines.

BadCreditLoans

BadCreditLoans knows you might only be eligible for emergency loans if your credit score is good. Online lenders created a user-friendly marketplace where borrowers with poor credit can compare payday loan rates, repayment terms, and insurance policies.

BadCreditLoans is similar to ClearViewLoans, but it can connect you with payday loan providers who can fund your loan and give you cash when needed. If you apply on the BadCreditLoans website, your request will be shared with multiple lenders, and you may be able to get up to $10,000 in bad credit loans.

BadCreditLoans offers an encrypted online application that takes just five minutes to complete. Send us your contact details, debt information, and assets information, and let us know how much money you would like to borrow. The BadCreditLoans network of lenders will review your application after you submit it.

MoneyMutual

MoneyMutual offers instant payday loans online with guaranteed approval. A fast and reliable loan can be obtained through their secure online platform. Thanks to a dedicated team of professionals, customers can access funds through MoneyMutual’s secure and convenient system.

Instant payday loans online guaranteed approval are provided by their service, which is transparent and trustworthy. The MoneyMutual loan solution is a great choice for anyone seeking a reliable loan.

MoneyMutual’s reputation as one of the premier providers of guaranteed approval payday loans online makes it stand out from the rest. MoneyMutual offers a simple and secure application process to help you quickly get the money you need. In addition to maintaining your information’s safety and confidentiality, their customer service team is available 24/7 to assist you whenever needed.

Viva Payday Loans

The Viva Payday Loans team partners with some of the best lenders in California to provide affordable online payday loans with APRs as low as 5.99%. Through a hassle-free online application process, you can find a lender that suits your situation free of charge and apply from anywhere. You can take out a loan between $100 and $5,000, with repayment terms ranging from 2 to 24 months.

Video For Instant Payday Loans Online Guaranteed Approval

How to Choose the Right Lender for Instant Payday Loans Online Guaranteed Approval?

It is important to understand the various terms and features of Instant Payday Loans Online Guaranteed Approval before choosing them.

Here are some key factors to consider if you are looking for the best Instant Payday Loans Online Guaranteed Approval.

Payday Loan Interest Rates (APR)

It is crucial to compare the annual percentage rate (APR) since it represents the cost of borrowing over a year. There is no distinction between the interest rate and the APR. The lower the annual percentage rate, the less expensive the personal loan generally is, but you should also take other factors into account.

Fees and Additional Costs

You should pay close attention to all associated fees, such as origination, service, late, and rollover fees. Payday loan rates may be higher than they appear initially due to hidden fees some online lenders charge.

Amounts of loans

There are different loan amounts available from different payday lenders. If you are seeking money from an online payday lender, make sure the amount you need is available. Be careful not to borrow more than you need to meet your immediate needs to avoid further financial strain.

Lengths of loan terms

Short repayment terms are usually associated with payday loans online, often a couple of weeks or until you get paid the next time. Some online lenders, however, offer repayment options that are more flexible, including repayment plans that are scheduled over time. The personal loan term should be aligned with your ability to repay it.

Funds Transfer and Loan Approval Speed

A quick approval process and quick funds transfers to your account will be important if you need funds immediately. You can get an online personal loan the same day or the next day.

Transparency

The importance of transparency cannot be overstated. It is important to choose an online lender who discloses all loan terms, including interest rates and additional fees, in an easy-to-understand manner. If you sign a loan contract, you should ensure that you have read all of the terms and conditions.

Process and requirements for applying

Ensure the application process is convenient and easy when looking for the best online payday loans. Is there a lot of documentation required? Does the application have to be submitted in person or online? Choosing a lender whose application process is straightforward depends on understanding what is required.

Flexibility and Payment Options

The repayment process for payday loans is usually flexible, including grace periods and extended repayment plans. If you cannot pay off your loan by the due date, such features can be helpful.

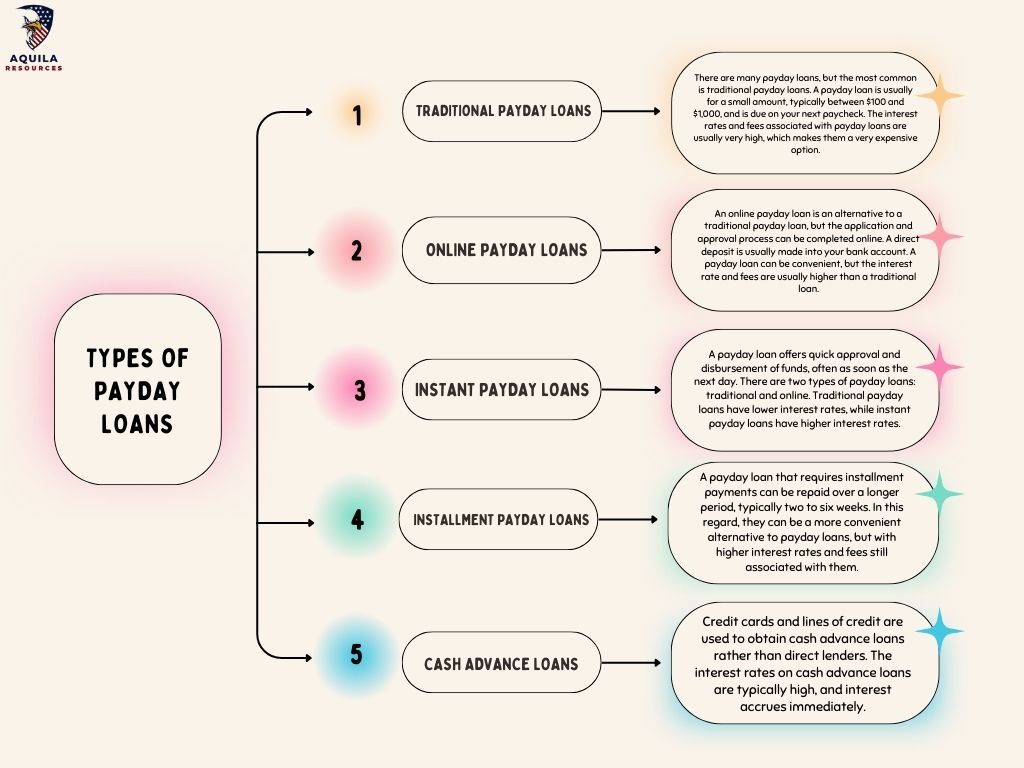

Types of payday loans

A payday loan can have many features and terms, each with unique characteristics. There are several types of payday loans, including:

- Traditional payday loans. There are many payday loans, but the most common is traditional payday loans. A payday loan is usually for a small amount, typically between $100 and $1,000, and is due on your next paycheck. The interest rates and fees associated with payday loans are usually very high, which makes them a very expensive option.

- Online payday loans. An online payday loan is an alternative to a traditional payday loan, but the application and approval process can be completed online. A direct deposit is usually made into your bank account. A payday loan can be convenient, but the interest rate and fees are usually higher than a traditional loan.

- Instant payday loans. A payday loan offers quick approval and disbursement of funds, often as soon as the next day. There are two types of payday loans: traditional and online. Traditional payday loans have lower interest rates, while instant payday loans have higher interest rates.

- Installment payday loans. A payday loan that requires installment payments can be repaid over a longer period, typically two to six weeks. In this regard, they can be a more convenient alternative to payday loans, but with higher interest rates and fees still associated with them.

- Cash advance loans. Credit cards and lines of credit are used to obtain cash advance loans rather than direct lenders. The interest rates on cash advance loans are typically high, and interest accrues immediately.

Alternatives of Instant Payday Loans Online Guaranteed Approval

Financial emergencies often require you to take out payday loans online, so it’s understandable that you’d consider it. There are, however, high-interest rates and fees associated with these cash advance loans, and they can result in a cycle of debt. Online payday loan platforms are just some of the alternatives available. Some are less expensive and less risky than online payday loan platforms.

The following are some Alternatives of Instant Payday Loans Online Guaranteed Approval:

Personal Loans

Personal loans may be used for various reasons, such as debt consolidation, home improvement, medical expenses, vacations, and even debt consolidation. Personal loans are unsecured loans, so they are not protected by collateral.

Personal loans without collateral are more affordable than secured loans like mortgages or auto loans. The interest rates on personal loans are generally lower than those on credit cards and payday loans. A fixed repayment schedule, ranging from a few months to several years, makes budgeting easier.

Credit Card Cash Advances

Credit card cash advances are withdrawals from ATMs against a cardholder’s credit limit from a credit card. The advantage of this option is quick access to funds, but there are usually high-interest rates, instant interest accrual, and additional fees associated with it.

The interest accumulation period is usually shorter on credit card purchases than on regular purchases. In an emergency, credit card cash advances are typically only considered a last-resort option because of these costs.

Employer Payroll Advance

A payroll advance is a loan taken out of a future paycheck by an employer. Employers may offer this option, but not all do, and the amount you can borrow may be limited. Fast cash loans often have high fees, so you’ll want to ensure it’s right for you before applying.

Community and Nonprofit Programs

In many communities, the local nonprofit and charity organizations offer emergency financial assistance for things like rent, utilities, and groceries. The money can help you through a short-term crisis without causing you to go into debt, while they usually cannot cover large expenses.

P2P Lending

A peer-to-peer lender matches borrowers with investors using an online platform that facilitates peer-to-peer lending. A P2P loan does not require a financial institution as an intermediary, unlike traditional loans from banks or credit unions. There are often lower interest rates, simpler application processes available to borrowers, and faster funding.

Credit Union Payday Alternative Loans (PALs)

PALs are Payday Alternative Loans (PALs) from credit unions, offering lower interest rates than traditional payday loans. If you want to apply for this type of loan, you must be a member of the credit union, and sometimes, you must be a member for a certain period.

FAQs

What are payday loans most commonly used for?

Using a payday loan online is common to cover immediate financial needs that cannot be met by any other means.

There are many types of emergency expenses, such as medical bills, car repairs, and urgent home maintenance. It is common for payday loan companies to assist individuals in bridging the gap between paychecks for necessities, such as rent, utilities, and groceries.

A cash advance loan is generally not recommended for long-term financial solutions or non-urgent expenses because of its high-interest rate and short repayment term.

What are the eligibility requirements for instant payday loans online with guaranteed approval?

There are various eligibility requirements for instant payday loans online with guaranteed approval. Still, most lenders require that applicants be at least 18 years old, have a valid ID, provide proof of income, and have an active bank account. Some lenders may have additional requirements, so it’s important to read their terms and conditions carefully.

How quickly can I get an instant payday loan online?

Your payday loan application process and the lender’s approval time may affect how fast you receive an online loan. If the lender approves, you can receive the funds in your account the following business day or within a few hours.

Can I get an instant payday loan with bad credit?

There is a possibility of getting an instant payday loan with bad credit. The interest rates and fees associated with loans for bad credit may be higher than those associated with traditional loans.

Conclusion

Payday loans can offer a quick financial solution for individuals facing unexpected expenses, but they also come with significant risks and drawbacks. To make an informed decision and choose the right lender for an instant payday loan online, it’s crucial to weigh the benefits against the potential pitfalls and conduct thorough research.

Add Comment