Are you looking for the Best 25$ Loan Instant Apps? If Yes, you have stumbled at the right place.

In this article, We are sharing all the information about Best 25$ Loan Instant Apps.

Whether you need a little quick cash or you need to pay off a debt, you don’t have to turn to traditional banks and lenders if you need cash fast. It is possible to get a $25 loan instantly using online apps. You can access money quickly without completing any paperwork, meet the requirements, and pay on time, and you will receive your money when you need it.

Best 25$ Loan Instant Apps

Contents

What Are $25 Instant Loan Apps?

A $25 instant loan app offers small, short-term loans, which are approved and disbursed quickly. The loans are typically approved within a few hours or minutes. The apps offer users the chance to borrow small amounts of money, usually up to $1,000, in case of unexpected expenses or to cover a gap until their next paycheck arrives.

A $25 instant loan application is typically submitted online via an app, and the approval decision is often received within minutes. A prepaid debit card provided by the app or direct deposits into the user’s bank account is usually the two methods for depositing funds after approval. Additionally, some lenders offer loans for self-employed individuals who need proof and income.

The interest rates and fees on $25 instant loans are often higher than those of traditional loans, which means you should only use them in emergencies or when you can afford to repay them within the agreed-upon timeframe. A loan application through an instant loan app should be carefully read and compared to other apps for terms and conditions.

List of 5 Best 25$ Loan Instant Apps

If you need an immediate, small cash advance, you don’t want to spend time researching which loan app will serve your needs best. We compiled the best $25 cash advance instant loan apps so you don’t have to do the hard work.

Our stellar selection of loan apps can meet your financial needs even if you don’t have perfect credit. You don’t need to worry about other lenders approving your direct deposit request. It doesn’t matter if you need to make an urgent bill payment, pay an unexpected car repair, or give a last-minute gift; these top-tier applications have the solution.

Here are the list of 5 Best 25$ Loan Instant Apps –

Dave App

The Dave banking app offers ExtraCash advances for as little as $1 per month with no interest or late fees. The service is a good choice for people who wish to avoid overdraft fees. You can manage your finances more effectively with Dave’s automated budgeting tools.

This app also offers freelancers advice on earning extra money through side hustles. Over 7 million people use Dave daily to achieve their financial goals, and you can join them.

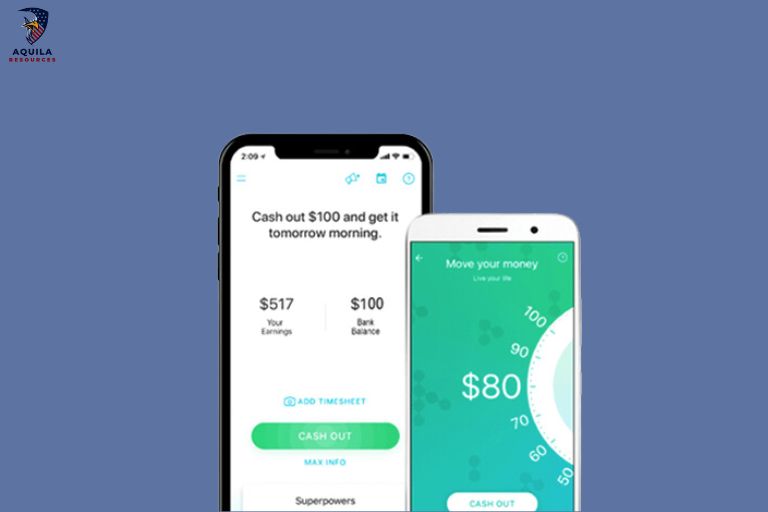

Earnin App

The Earnin concept is revolutionary and effortless. The app tracks earnings precisely and deposits money directly into user accounts after users link their bank accounts, employment information, and working hours. That’s all there is to it.

You can obtain a cash advance from this app for up to $100 daily, with no credit check required. A maximum loan amount of $700 per pay period is automatically deducted from the borrower’s account or debit card on payday – making repayment easy. Earnin, along with other apps, operates on a voluntary tipping system – that way, you can decide how much you want to tip without being charged additional fees.

Earnin is a user-friendly application that offers features such as Balance Shield, Cash Back Rewards, and protection from overdraft charges. A cash advance platform like this is ideal for people looking to borrow a larger amount than other lending platforms offer. The app allows you to request funds two business days before receiving your next paycheck, but funds must be deposited into the same bank account or debit card as the one where your wages are deposited.

Empower App

The Empower application is designed for today’s generation. You can count on them every step of the way, no matter what life throws at you. When you need cash, download the app and get up to $250 as a cash advance.

Your money will be transferred directly to your bank account as a cash advance of up to $250. You can get free instant delivery if you have an activated debit card with an Empower Checking Account. Empower calculates your monthly average direct deposit, recurring direct deposits, and bank account history to determine your eligibility for a Cash Advance.

There is no application process, interest or late fees, or risk associated with a credit check. Once you receive your next paycheck, you reimburse them. You won’t find anything hidden about it. That’s all there is to it.

Chime App

Chime is a leading financial technology company in the U.S., backed by Bancorp Bank and FDIC. They offer short-term loans quickly through direct deposit without credit checks, making them more accessible to all types of people. They also offer interest-free banking services with an easy-to-use interface.

A key feature distinguishing Chime from conventional loan providers is that you can receive your funds immediately after you’ve been approved. A short-term loan can be obtained with the app in a few minutes–most decisions are made within minutes! The convenience of this approach allows for a more efficient and safe borrowing experience.

Cash advances from Chime are available to many consumers, even those with low credit scores. They do not solely rely on credit scores to determine their eligibility.

The Chime loan app offers unprecedented convenience regarding the loan process. The account is seamlessly integrated into your existing savings account-so you don’t have to worry about costly late fees or manual transfers! Additionally, Chime offers customers the flexibility to control their finances according to their needs with multiple repayment options, such as splitting payments across various paychecks.

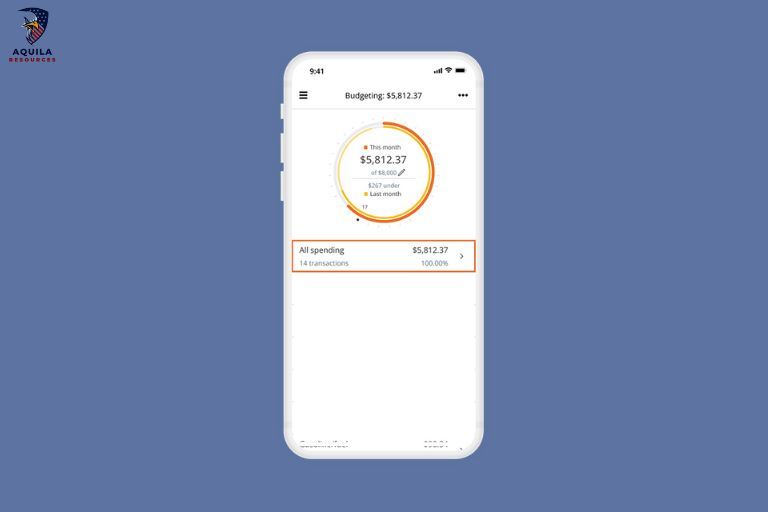

Cleo App

Cleo is your AI pal who manages your money. Maintain a budget, save money, and track your expenses. It can be downloaded from the App Store and Google Play. Once you download the app and register for a free account, you can ask Cleo anything from your balance to if you can afford a coffee, which will calculate for you. Explore data-driven insights, graphs, and personalized updates.

Let Cleo do the work, as it automatically puts your spare change aside, sets you a budget, and helps you stick to it. You can qualify for a $100 spot check if you upgrade to Cleo Plus to avoid going into overdraft. It is $100 given to you without a credit check and interest.

Pros and cons of loan apps

The fees associated with loan apps may seem small, but they can accumulate quickly and do not recommend paying for early access to earnings. However, financial experts say these apps need more sustainable, long-term solutions, such as when you need to cover car repairs or unexpected travel expenses.

If you plan to use a cash advance app, take the time to consider its pros and cons.

| Pros | Cons |

| Fast Cash in an Emergency: You can use some apps to deposit funds into your checking account instantly – but you should know that they usually charge an additional fee. |

Fees May Apply for Overdrafts: The majority of apps require you to connect your bank account before they can withdraw money. Some companies claim they avoid triggering an overdraft but can’t guarantee it. In the case of Empower, which causes overdraft fees, the company will refund them upon request.

|

| An Overdraft Fee may be Less Expensive: An advance will likely be cheaper than an overdraft fee if you choose between an advance and an overdraft fee. A typical app fee is under $10, but a bank overdraft fee can reach $35. |

The Costs Add Up: Although cash advance apps are generally cheaper than payday loans, subscription fees, fast-funding fees, and optional tips can add up.

|

| There is No Credit Check: Apps that offer cash advances do not check users’ credit scores, so you could still qualify even if you have a low score. Credit bureaus will only affect you if you repay the advance because cash advance apps do not report repayment history. |

It May Lead to Repeated Borrowing: Using apps to cover regular expenses can lead to a debt cycle if you keep borrowing from your next paycheck.

|

How To Choose The Best $25 Loan Instant App?

- It is important to consider several factors when selecting the best 25 loan instant app. A good reputation and good customer reviews should be the first criteria borrowers look for when choosing apps. You can do this by checking the app store ratings and reviews or visiting online review sites.

- A second step to finding the most affordable option is to compare the interest rates and fees charged by different apps. If the app has a strict repayment schedule or additional fees, read the fine print and understand the terms.

- The third factor to consider is whether the app meets all eligibility requirements and how it processes applications. Some apps can have strict income and credit score requirements, while others may have a more flexible application process.

- Additionally, borrowers should opt for apps with strong security and privacy policies to protect their personal and financial information. A licensed app is one that is regulated by state authorities or an industry association.

In addition to ensuring that they are working with a reputable and secure lender, borrowers can carefully consider these factors before choosing the best 25 loan instant app for their needs and budget.

How to Get the Most Out of a $25 Loan App?

It can be convenient to cover small expenses with a $25 loan with an instant application without worrying about long-term debt. It is important to research which option will give you the best value because these types of loans are typically linked to interest rates. It’s important to understand the terms and conditions associated with these apps before signing up.

It is also important for individuals to maintain financial discipline and make sure their loan repayment plans are realistic. Failure to repay loans can result in costly penalties. A $25 loan application might provide a greater benefit if you look for discounts or other offers to reduce the overall cost.

If you need a small amount of cash quickly, you can get a payday loan online with no credit check. However, it’s important to compare the terms and conditions of different lenders before you borrow money, as these loans can be expensive.

FAQs

Is getting a $25 loan with an instant loan app easy?

The process is straightforward, and you don’t need a high credit score to qualify. Applying for funding can be done in a few minutes online, and funds can be spent the same day if you choose to use online applications that connect lenders and investors.

Can I get a loan of 25 dollars as soon as possible?

You can choose which checking account you’d like the money transferred to and which lender you want. Many lenders offer instant loans for a small fee and send them out the same business day.

Can I borrow 25 dollars without a bank account?

This loan, however difficult to obtain, is possible if you find a lender willing to make it. You have a better chance of success if you find an offline lender in your city since all online applications require you to provide a checking account.

Add Comment