Are you looking for Best Credit No Money Down Car Dealerships? If Yes, You have stumbled upon the right place.

In this article, We are sharing all the information regarding Best Credit No Money Down Car Dealerships.

The possibility of getting a zero down payment car loan exists and is available to good and bad credit customers alike. It is a matter of getting pre-approved for a bigger loan than you would need with a down payment to get approved for a car without a down payment.

You will have to borrow more money without a down payment, so either you must pay higher payments or your loan term will be longer.

It is typically possible to finance the full cost of a car if you don’t have the cash or the down payment needed. There will, however, be a significant rise in interest rates. A co-signer, an increased credit score, and negotiating the terms can reduce your rates while still getting a car without money down.

A zero-down-payment car loan does not require any down payment from the borrower. These loans are sometimes called ‘100% Finance’ because the bank or lending institution pays for the car’s entire value.

Best credit no money down car dealerships

Contents

- 1 Best credit no money down car dealerships

- 1.1 What is a Best Credit No Money Down Car Dealerships?

- 1.2 Features of Best Credit No Money Down Car Dealerships

- 1.3 How Does a Down Payment Affect the Total Cost of a Car Loan?

- 1.4 List of Best Credit No Money Down Car Dealerships

- 1.5 What do lenders look at when approving zero down payment car loans?

- 1.6 Pros & Cons of Best Credit No Money Down Car Dealerships

- 1.7 FAQs Related to Best Credit No Money Down Car Dealerships

You can avoid owing more money than your vehicle is worth by providing a down payment on a new or used car. It’s still possible to finance a car even if you have bad credit if you don’t have the cash to make a down payment. There is a way to secure no-money-down auto loans, although they are primarily offered to high-credit borrowers.

What is a Best Credit No Money Down Car Dealerships?

It is typical for a bad credit score to fall between 300 and 579. You may be able to finance a car with bad credit if your credit needs improving, but it can be difficult. It costs more to borrow money when you have bad credit because bad credit loans have higher annual percentage rates (APRs).

Down payments are lump sums of money you pay to your lender when you finance a vehicle. A down payment of at least 20% is advisable to ensure the loan is affordable if you follow the 20/4/10 rule. A down payment will also prevent you from getting into an upside-down car loan, where you owe more than the car is worth.

It is important to compare car loan quotes when shopping around for bad credit car loans. Your lender may contact you with up to five loan offers from LendingTree after filling out a single form.

If you are considering financing a car with bad credit, it is important to research and find a dealership specializing in helping people with bad credit. There are some of the best credit car dealerships that accept bad credit.

Features of Best Credit No Money Down Car Dealerships

- Those who choose zero down payment car loans will not be covered for accessories.

- It is essential to have a good credit history to qualify for zero down payment car loans.

- It is possible for borrowers who apply for zero down payment car loans to have to pay loan processing fees.

- Your car loan must be, at most, your net yearly income to qualify for a zero down payment car loan.

How Does a Down Payment Affect the Total Cost of a Car Loan?

In this case, the down payment on a car is the initial payment made toward the purchase of an expensive item. An estimated percentage of the car’s value is typically required, with a car loan covering the remaining balance.

A seller typically requires a down payment to validate your financial credibility. The higher the down payment, the lower the amount of loan you need to obtain, and the smaller the interest rate and EMI amount. The larger the down payment, the more likely you will be to secure a loan and the quicker you can repay it.

What happens when you are unable or unwilling to make a down payment toward a car purchase? A zero-down payment car loan is a great option in this situation.

List of Best Credit No Money Down Car Dealerships

Best Credit No Money Down Car Dealerships are only available if you have good credit, but they tend to come with high-interest rates. Several lending companies offer no-money-down car loans to borrowers with bad or no credit but remember that the starting rates below are typically reserved for borrowers with excellent credit.

Here are the list of Best Credit No Money Down Car Dealerships –

Carvana

The Carvana company offers online car sales and car loans. Getting your car and loan done in one place offers all the convenience of traditional dealerships.

Carvana does not have a minimum credit score requirement, but it does require that customers make at least $4,000 per year and do not have any active bankruptcies. Carvana financing is only available for Carvana vehicles, but once you apply, you have 45 days to decide whether to accept the loan. A co-signer can also cosign Carvana loans.

OpenRoad Lending

There is currently only one option for refinancing your car loan through OpenRoad Lending. Consumers with bad credit can apply for better rates through this lender, which accepts co-borrowers. There are no car loans available for self-employed people through this lender.

You must refinance a vehicle eight years or newer and less than 140,000 miles old. The OpenRoad refinance program allows you to refinance up to 120% of your car’s wholesale value, but borrowers with good credit may qualify for up to 175%.

Capital One

The rates provided by Capital One, one of the largest banks in the United States, are competitive with those offered by other large banks. It offers loan prequalification and preapproval through Auto Navigator, its online auto loan marketplace, for all types of credit.

Capital One’s partner dealers must provide the vehicles to qualify for the program. There must be fewer than 120,000 miles on the car, and it can’t be older than 10 years. There are some instances in which older cars may be accepted, but they must be less than 150,000 miles old.

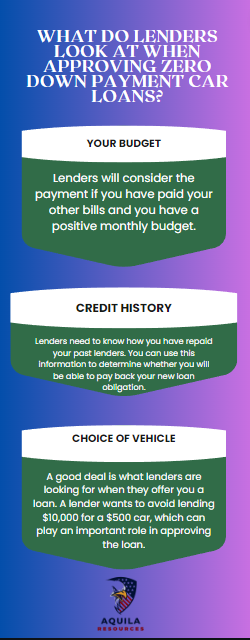

What do lenders look at when approving zero down payment car loans?

Best Credit No Money Down Car Dealerships involve higher financial risk for the lender, so they usually come with higher interest rates. The lenders will typically look at a few things when determining whether someone with bad or no credit is likely to be approved for a vehicle loan:

Pros & Cons of Best Credit No Money Down Car Dealerships

| Pros | Cons |

| You can drive away with a car right away. |

The loan will cost you more in interest over its life.

|

| You can use that money for other expenses instead of putting it down. |

The interest rate will likely be higher.

|

| Credit scores can be improved by making on-time payments. |

Your loan could end up upside down.

|

| The monthly payment will be higher. |

There is no right or wrong answer when buying Best Credit No Money Down Car Dealerships. Choosing what is best for you depends on the pros and cons.

FAQs Related to Best Credit No Money Down Car Dealerships

How to save on a zero-down car loan

The zero-down car loan allows you to take possession of a car upfront in return for making payments later. Try to pay off your term as soon as possible to save money. Try committing to the shortest possible term if you get approved for a no-money-down loan.

Taking out a long-term loan may be tempting, but in the long run, you will likely pay more for it. You should add a few dollars to your monthly payments as often as possible. Your interest payments can be reduced sooner if you repay your loan quickly.

Can I get a car loan with a 500 credit score?

A credit score of 500 may allow you to get a car loan, though it may be smarter to improve it first. Increase your chances of approval if you use a co-signer and offer a large down payment if your credit score is low.

Should I pay the processing fee for a zero down payment car loan?

If you qualify for a zero-down car loan, you must pay the processing fee.

How can I get a car with no down payment?

The car you want to buy may be available without a down payment if you have good credit, trade in with positive equity, or find a great deal.

Add Comment