Are you looking for Loans for Self Employed with No Proof and No Income? If yes, you are at the right place.

In this article, We are sharing all the information about Loans for Self Employed with No Proof and No Income.

The use of personal loans is often a quick fix for people in need of money to cover unexpected expenses or large purchases. You will usually have to prove that you can repay the personal loan by verifying your income. It can challenge some borrowers, such as those who are unemployed, self-employed, or retired.

There are loan options without requiring proof of income, but they are often risky and expensive. You can find out more about personal loans without income verification, as well as alternatives, by reading on.

Loans for Self Employed with No Proof and No Income

Contents

- 1 Loans for Self Employed with No Proof and No Income

- 1.1 What Is a No Income Loan?

- 1.2 Are there Loans for Self Employed with No Proof and No Income?

- 1.3 What documents are needed to apply for Loans for Self Employed with No Proof and No Income?

- 1.4 Types of Loans for Self Employed with No Proof and No Income

- 1.5 How to Apply for Personal Loans for Self Employed with No Proof and No Income?

- 1.6 List of Platforms for Loans for Self Employed with No Proof and No Income

- 1.7 Pros and Cons of Loans for Self Employed with No Proof and No Income

- 1.8 Is it possible to get Loans for Self Employed with No Proof and No Income with bad credit?

- 1.9 How to Get Cash Loans Without Proof of Income Online?

- 1.10 FAQs related to Loans for Self Employed with No Proof and No Income

If you want Payday Loans Credit Score 400 Guaranteed Approval And No Telecheck or Loans for Self Employed with No Proof and No Income then Cash loans are the best option that have many benefits that don’t require proof of income but are also expensive and risky.

A loan application’s proof of income (POI) component must often be understood. It is common for people to think that income comes only from regular employment.

What Is a No Income Loan?

If you want to know about Loans for Self Employed with No Proof and No Income then first you should know about No income loan. There is no requirement for proof of income, such as pay stubs, tax returns, or bank statements, with a no-income loan. There is probably no loan type more closely associated with mortgages than this one. These home loans played a key role in the housing crisis of the early 2000s, which led to the Great Recession.

The low-interest rates and risks associated with no-income loans discourage many lenders from taking them out. You may have to accept less-than-ideal terms if you are denied a loan because you cannot prove your income.

Are there Loans for Self Employed with No Proof and No Income?

Some loans will not require income verification, relying on collateral or a guarantor. It may be worth considering putting assets up for collection if you fail to make repayments if they can be seized without damaging your company or freelancing business. It’s also worth considering a guarantor willing to cover costs if you can work out a suitable deal.

It’s important that company owners and freelancers feel comfortable applying for loans. Many repayment options are available for businesses and entrepreneurs at all stages of their business lives, from startups to successful company ownership. If you want to find the right loan, you’ll have to do some research.

What documents are needed to apply for Loans for Self Employed with No Proof and No Income?

A loan application will require you to submit certain documents depending on where you are applying. Your personal and financial information will be requested in the following categories:

Documents Needed for Loans for Self Employed with No Proof and No Income –

- Identity proof with a photo

- Income proof

- Photo of yourself

- Residence proof

- Proof of residency

- Address proof for your office

- Existence of proof of a business

- A statement from the bank

- The business plan

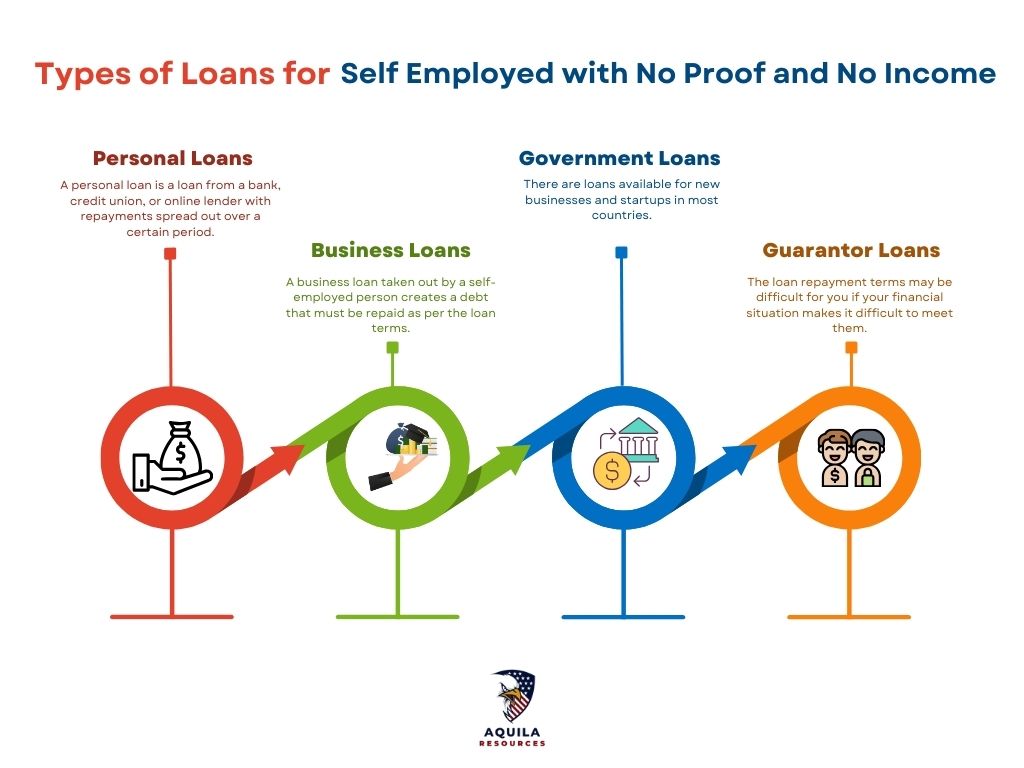

Types of Loans for Self Employed with No Proof and No Income

Self-employed workers can obtain a variety of loans. However, you will have limited options and will have to meet certain conditions. A salary at a full-time job is easier to demonstrate than proof of your income and financial situation. Generally, lenders want evidence that you can repay the loan.

- Personal loans

- Business loans

- Government loans

- Guarantor loans

Several types of business loans are available, depending on the nature and size of your business. You can fund your business in a variety of ways, and each will offer different repayment conditions. You can decide which is best for you by understanding each of them.

Personal Loan for the Self-Employed

A personal loan is a loan from a bank, credit union, or online lender with repayments spread out over a certain period. A personal loan’s non-discretionary nature is often what makes people want them. It is common for debtors to use personal loans for debt consolidation, which involves taking out loans to cover other unpaid debts. The majority of personal loans are unsecured, as opposed to other loans that typically require collateral, such as property.

The lenders determine your debt-to-income ratio, credit history, and cash flow instead of looking at your assets. Those not qualifying for an unsecured loan because of their credit may be offered secured or co-signed loans. The collateral you provide for these loans can help you secure the loan.

Business Loans for the Self-Employed

A business loan taken out by a self-employed person creates a debt that must be repaid as per the loan terms. Your loan will likely be larger than that taken out by a freelancer or self-employed individual, based on your company’s financial stability and needs.

Government Loans for the Self-Employed

There are loans available for new businesses and startups in most countries. The grants are especially helpful for young businesses since they encourage new businesses and provide generous lump sums.

Guarantor Loans

The loan repayment terms may be difficult for you if your financial situation makes it difficult to meet them. You can arrange for a guarantor. Guarantor loans allow borrowers to select someone to pay their debt if they cannot. Guarantors are also known as sureties. There is usually a requirement that your guarantor is over 18 years old and resides in the same country where your business is located.

They will likely need a good credit history and a substantial income to cover their expenses. Your guarantor may have to pay extra fees if you are frequently late on your payments. Lenders hire guarantors for several reasons, ranging from providing extra assistance when their income is insufficient to support those with poor credit histories.

How to Apply for Personal Loans for Self Employed with No Proof and No Income?

If you want to apply for a personal loan, you have all the options available. It is possible to apply both online and offline. There are several ways you can submit your application:

- Online Application: It is simple to apply for a loan by visiting the bank’s website and providing your personal information. The login ID and credentials you use for Internet Banking can also be used for this application.

- Visit the Branch: If you need a loan, visit the bank branch with all the required documents and submit them.

- Over the Phone: The customer service representatives will assist you in obtaining a loan.

List of Platforms for Loans for Self Employed with No Proof and No Income

If you apply for Loans for Self Employed with No Proofs and No Income listed below, you must provide proof of your income, though you can include any recurring income you have. The loan differs from one you would get from a bank or credit union.

They offer personal loans for nearly every credit score and partner with lenders who offer bad credit loans. The interest rate, monthly payment, and loan term will be provided by any online lender willing to assist you. It is possible to receive multiple loan offers within minutes of submitting your application and to receive the money within one business day after you do so.

Here are the List of Platforms for Loans for Self Employed with No Proof and No Income –

MoneyMutual

The more sources of income you have, the more likely you will be approved for a loan with MoneyMutual. You can receive multiple loan offers within minutes after submitting your loan application; you will only need a few minutes to complete the application.

The MoneyMutual lender network maintains one of the largest online lender networks, so your income may meet the requirements of several lenders. It also ensures you get the best possible deal from lenders competing for your business.

CreditLoan

The CreditLoan.com site helps consumers with bad credit loans find an option that fits their needs and budget. A loan can be closed within hours, and money can be received by the next business day for approved applicants.

You can even get money into your account faster with some lenders on the CreditLoan.com network. A fee will be associated with this service, which will vary depending on the lender you choose.

CashUSA

CashUSA.com partners with various lenders nationwide to offer consumers with bad credit instant personal loans. Whether you choose an unsecured or secured loan, your interest rate and monthly payment will be competitive.

You can pay off these installment loans over several months by making monthly payments. You will make a set number of payments depending on the loan amount and what the lender offers.

PersonalLoans

There are two unique divisions within the PersonalLoans.com network of online lenders. A loan program for applicants with good credit is available, while a loan program for people with bad credit is also available. The structure of this loan application ensures that only lenders who are prepared to work with you will receive your application.

This is important to remember since it means you will save valuable time filling out loan applications. As soon as you submit a loan request, multiple loan offers may be sent to you in a matter of minutes.

SmartAdvances

The SmartAdvances.com website offers cash advance and emergency loan options and accepts various income sources. A monthly income of at least $1,000 is required to qualify, regardless of whether you receive benefits, work, or are self-employed.

If you want to improve your chances of approval, include all your regularly occurring sources of income in your application. Lenders must know you can comfortably make monthly payments without stressing your finances.

Pros and Cons of Loans for Self Employed with No Proof and No Income

Here are the Pros & Cons of Loans for Self Employed with No Proof and No Income –

| Pros | Cons |

| Provide relatively quick access to cash. |

Fees and interest rates are high.

|

| Establish a path to approval without income. |

Limit the amount you can borrow.

|

| Make it easier for borrowers with income sources that are less traditional to borrow. |

Payback is required quickly.

|

| For approval, you may need a co-signer with good credit. |

Is it possible to get Loans for Self Employed with No Proof and No Income with bad credit?

The income you receive as a self-employed person can fluctuate, and there may be a lack of need for moral stability when you are starting, making it difficult to qualify for a loan. When someone has a bad credit history or lacks financial stability, they are given a bad credit loan.

Many institutions offer loans to people with bad credit, a blessing for the self-employed. If the conditions aren’t met, these loans are flexible and charge minor fees if the loan amount isn’t repaid. The loan’s interest rate will also depend on your credit score rating.

How to Get Cash Loans Without Proof of Income Online?

Most consumers believe a loan can only be obtained if employed. That’s no longer the case because of the growth of online lending and increased competition among lenders.

A lender partnering with an online lending network, such as the ones listed above, will consider other forms of income besides a traditional paycheck. Unemployment may not prevent you from qualifying for a loan.

Since you have flexible credit score requirements, you will spend less on these loans than on cash loans with proof of income. The loan will also not require you to put up valuables as collateral.

How to Secure a Loan if You’re Self-Employed?

You should check out all the possible lenders when applying for a loan. You may find a loan that fits your needs in several major areas.

Can I Get a Loan If I’m Unemployed?

The loan may be approved if you have sufficient income from other sources despite being unemployed.

It is important for lenders to know that you can make your weekly or monthly payments without over-stretching your current budget. If you are applying for a loan, you must provide proof of income to the lender during the underwriting process. It is possible to prove your benefits by providing bank records, invoices, check stubs, or other official documentation.

Is There a Limit on Instant Loans without Income Proof?

There is no set limit for instant loans, as they vary from lender to lender and are determined by many factors, such as your credit score, repayment capacity, and income.

Add Comment