In the event you plan to withdraw funds from your Acorns account, you might be wondering Is There a Penalty for Withdrawing Money From Acorns Invest. You can make simple investments with spare cash with the Acorns investment app carefree and easy.

If you decide to withdraw money from the app, you will have a few questions that need to be answered.

In this article, we discuss how to withdraw money from Acorns, whether there is a Penalty for Withdrawing Money From Acorns Invest, how it works, and much more.

It’s time to get started.

What Is Acorn Invest?

Contents

- 1 What Is Acorn Invest?

- 2 What Happens If You Withdraw from Acorns?

- 3 Is There a Penalty For Withdrawing Money From Acorns Invest?

- 4 How To Withdraw Money From Acorns Instantly?

- 5 How Long Does it Take To Withdraw Money From Acorns Invest?

- 6 What Are The Tax Implications of Withdrawing Money From Acorns Invest?

- 7 What Happens To My Money When I Make A Withdrawal Request?

- 8 FAQ

- 8.1 Is There a Penalty for Withdrawing Money From Acorns Invest?

- 8.2 How Long Does It Take To Withdraw Money From Acorns?

- 8.3 Is It Safe To Link Your Bank Account To Acorns?

- 8.4 Is Acorns a Roth IRA?

- 8.5 How Much Does Acorns Tax You When You Withdraw?

- 8.6 Is Acorn A Good Investment?

- 8.7 How Safe And Legit Are Acorns?

- 8.8 Can I Withdraw From My Acorn Account?

- 8.9 What Happens If I Withdraw Money From My Acorns Account?

- 9 Conclusion

In its fintech platform Round-Ups, Acorns allows users to automate their investments into a portfolio. It is a fintech company specializing in micro-investing. On behalf of members, Acorns rounds up debit or credit card purchases made on a linked card to the nearest dollar.

Investors may choose from five different portfolios that carry varying risk levels. Robinhood Markets, Inc., Stash Financial, Inc., and Acorns Markets, Inc. are among the fintech companies that cater heavily to millennial investors.

The Acorns platform appeals to millennials and other new investors who aren’t ready to commit a significant amount of capital to their retirement savings. The goal of Acorns is to simplify investing by providing users with the opportunity to invest early and often.

The company’s signature program, Round-Ups, enables members to invest more than $30 per month.

What Happens If You Withdraw from Acorns?

You will receive the money deposited into your linked bank account within 1-5 business days of Withdrawing Money From Acorns Invest. You do not have to pay a fee to withdraw funds from Acorns.

Is There a Penalty For Withdrawing Money From Acorns Invest?

The Withdrawing Money From Acorns Invest does not incur any penalties. It is important to note that withdrawals from Acorns Invest may be subject to penalties under certain circumstances. Although standard withdrawals are free of fees or penalties, there are the following situations to be aware of:

- There will be a $2 withdrawal fee every time you withdraw funds before your Acorns account balance reaches $1,000. There is a $1,000 early withdrawal fee applied to withdrawals below this threshold.

- Early withdrawals or transfers from an Acorns IRA (Individual Retirement Account) may result in tax penalties, including a 10% penalty and income taxation. You should understand the tax implications of withdrawals from an IRA.

- In the case of accounts with balances less than $5,000, Acorns charges a monthly fee of $1. Taking out all the money on a small balance will result in a $1 fee.

As a result, if you remove your investments from Acorns, you won’t be able to take advantage of the platform’s features, such as automatic portfolio rebalancing and investment advice. A tax professional may be able to assist you if you have a specific financial situation.

How To Withdraw Money From Acorns Instantly?

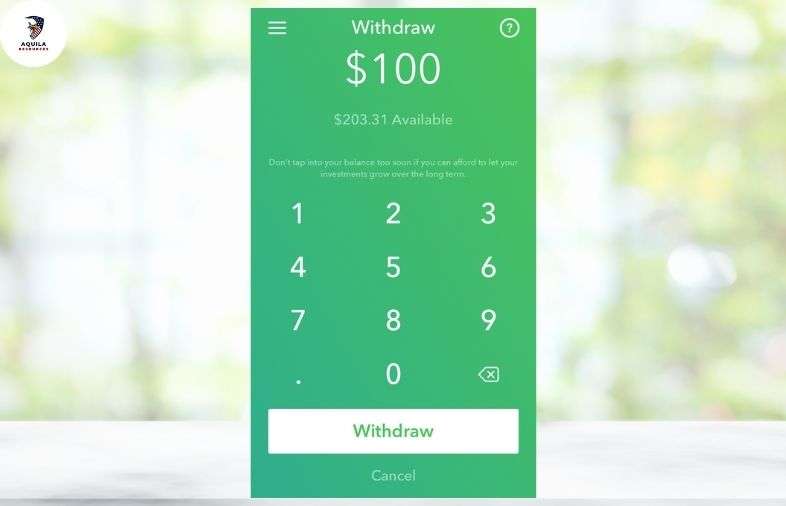

The process of Withdrawing Money From Acorns Invest is simple and can be done instantly. You can do this by following these steps:

- Use the mobile app or the web to log in to your Acorns account.

- Click “Withdraw” under the “Account” tab.

- Click “Withdraw Now” after entering the amount you’d like to withdraw.

- It will take 1-2 business days for the funds to appear in your linked bank account after your withdrawal has been processed.

How Long Does it Take To Withdraw Money From Acorns Invest?

The sale of your shares may be delayed by a two-day “settlement period” per regulatory legislation.

The initial request can be processed on the same day as long as you submit it before 11 am.

As a result, requests that are placed after 11 am will be handled on the next trading day since Acorns needs time to sell your shares.

Once you provide them with the account information, you should receive your funds within 3-6 business days.

What Are The Tax Implications of Withdrawing Money From Acorns Invest?

It is possible to withdraw money from Acorns whenever you want, but early withdrawals or transfers from IRAs before retirement may trigger taxes. It is also possible to owe taxes or face penalties if you withdraw before the age of fifty-nine and a half.

The following types of tax implications apply to withdrawals from acorns:

The Traditional IRA

The withdrawal of funds prior to the minimum distribution age could result in standard income taxes and a 10% penalty.

Simple Employee Pension (SEP IRA)

There is a 10% penalty for withdrawing funds before the minimum distribution age, which is mainly for self-employed individuals.

Roth IRA

Roth IRAs allow you to access your contributions at any time without incurring penalties, but they usually require you to pay income tax as well as a 10% penalty if you withdraw money before the minimum distribution age or before the account has been active for at least five years.

What Happens To My Money When I Make A Withdrawal Request?

Your shares will be sold by Acorns when you request to withdraw from your Invest account. Withdrawals can take up to three business days to be reflected in your bank account.

The request – also known as a “sell order” – will usually be processed the same day if you submit it by 11 am PT on a stock market day. The following market day will be used for selling your shares if you made your request after 11 am PT or on a market day that the market is closed, like a weekend.

Upon receiving your request, we must wait for a mandatory two-day settlement period.

FAQ

Is There a Penalty for Withdrawing Money From Acorns Invest?

Money can be withdrawn from Acorns with penalties. The fee for Withdrawing Money From Acorns Invest before reaching $1,000 in balance will be $2.00 per withdrawal.

How Long Does It Take To Withdraw Money From Acorns?

It typically takes 3 business days for withdrawals from Acorns to reach your designated bank account. The amount will be deducted immediately from your Acorns account, and the withdrawal process will begin. You will receive the withdrawal to your on-file bank after the processing period is over.

Is It Safe To Link Your Bank Account To Acorns?

You can round up your purchases with Acorns to the nearest dollar. After you deposit $5, Acorns invests in ETFs with low expense ratios and charges no fees.

Is Acorns a Roth IRA?

Roth IRAs are defined differently depending on your perspective. Investing in stocks, bonds, and ETFs with Acorns does not qualify as a qualified retirement plan.

How Much Does Acorns Tax You When You Withdraw?

There is no minimum account size and a monthly fee of $1 for the Acorns app. An account minimum is not required, but there is a monthly fee of $1.

Is Acorn A Good Investment?

You can invest your money in Acorns with great success. You’ll soon see those dollar signs piling up when you use these strategies to maximize your investment account.

How Safe And Legit Are Acorns?

What kind of risk are you taking? If Acorns is a scam, these investors lost a lot more than you, representing some of the most respected investors in the world.

Can I Withdraw From My Acorn Account?

It is possible to withdraw money from your Acorn account. You can withdraw funds by tapping the “Withdraw” button in the app. A confirmation of your identity will be required before a withdrawal can be processed.

What Happens If I Withdraw Money From My Acorns Account?

Your investment funds are transferred to your checking account when you withdraw funds from your Acorns account. As of now, you are able to use the money you received within 3-6 business days to purchase anything you like.

Conclusion

An app called Acorns lets users invest spare change in a diversified portfolio of ETFs using their spare change. Acorns users frequently ask if there are any penalties for Withdrawing Money From Acorns Invest.

Withdrawing from Acorns Invest incurs no penalties. Seek List of Banks That Accept ACH Transfer for seamless fund movements.

It is important to keep in mind that selling your investments may incur fees, which will reduce the value of your account. Taking money out of your account before you are 59 1/2 may also incur taxes and penalties.

Add Comment