Are you an Apple Pay User and want to know How Long Does It Take To Transfer Money From Apple Pay To Cash App?

The duration of the Transfer Money From Apple Pay to Cash App is crucial for users embarking on this digital financial journey.

Several factors influence the solution to this problem within the transactional ecosystems of both applications. The given article explores the timing, taking into account factors that influence the length of your financial journey from Transfer Money From Apple Pay To Cash App.

Now, let’s dive in.

What Is Apple Pay?

Contents

- 1 What Is Apple Pay?

- 2 What is Cash App?

- 3 Can You Transfer Money From Apple Pay To Cash App?

- 4 How Safe is Cash App?

- 5 How Long Does It Take To Transfer Money From Apple Pay To Cash App?

- 6 How To Transfer Money From Apple Pay To Cash App?

- 7 Things To Consider Before Transfer Money From Apple Pay To Cash App

- 8 Apple Pay vs Cash App: Which Is Better?

- 9 How Can I Transfer the Entire Balance of My Apple Account?

- 10 FAQs

- 10.1 How Do You Add Apple Pay to the Cash App?

- 10.2 What is the Best Way to Get Money Off Apple Pay Without a Credit Card?

- 10.3 How do I Transfer Money From Apple Pay to a Debit Card in My Wallet Instantly?

- 10.4 How Do I Get Money From Apple Pay Without a Card?

- 10.5 How Long Does It Take for the Money to Reach Cash App?

- 11 Conclusion

Apple Pay is a payment service that enables mobile contact payments and digital wallets for Apple devices. In 2014, Apple launched a near-field communication (NFC) service that allows users to make payments from NFC apps on iOS devices or remotely via the internet. The Apple Pay service is marketed as an alternative to cards, including chip and PIN cards and traditional magnetic stripe cards. Apple Pay is currently supported by most major credit and debit cards.

What is Cash App?

Cash App facilitates the sending, receiving, and investing money between individuals. To compete with popular mobile payment apps like Venmo and PayPal, Block, Inc., formerly Square Inc., launched Square Cash in 2013.

The Cash App is not a bank, but rather a platform for financial transactions. The company provides debit cards and banking services through its bank partners. Several banks are partnered with the Federal Deposit Insurance Corporation to insure the balance of your account. The Securities and Exchange Commission registers Cash App Investing LLC as a broker-dealer with the Financial Industry Regulation Authority.

Can You Transfer Money From Apple Pay To Cash App?

You should have money saved in two digital wallets in case of rainy days or financial emergencies. It is still possible to use funds from the other account if one runs out of funds. It’s for this reason that many people use Apple Pay and Cash in tandem. It is easy to make payments and purchases on both platforms every day.

There’s no way to Transfer Money From Apple Pay To Cash App if you’re on a similar bandwagon. However, we aren’t at a dead end. A two-way payment method is still available to Transfer Money From Apple Pay To Cash App.

It is necessary to link one bank account to both accounts. Your bank account will then need to be credited with the funds from your Apple Pay account. Tap the “Add Cash” button in the Cash App to complete the process. The money will be added to your Cash App account once you follow the on-screen instructions. There you have it.

How Safe is Cash App?

Your data and money are secure with Cash App’s cutting-edge encryption and fraud detection technologies. Your information is encrypted before being sent to the Cash App server, regardless of your connection type. Because of this, the Cash App is a very safe way to make payments and transfer funds.

It’s important to keep an eye out for scams, however. There will always be scammers on every platform, no matter how secure the app might be.

How Long Does It Take To Transfer Money From Apple Pay To Cash App?

There are several options and considerations that users can consider to Transfer Money From Apple Pay To Cash App. Cash App user transactions follow the following process and time breakdown:

Transfer Timing

- Money can be transferred between Apple Pay and Cash App within six business days.

- The fee-free option allows you to send money within 1-3 business days.

- There is a fee for instant transfers to your linked debit card.

Transfer Options

- You can conduct day-to-day transactions using Apple Pay and Cash App. Within 1-3 business days, users can confirm a fee-free transfer with Face ID, Touch ID, or a passcode.

- Transferring funds instantly to linked debit cards is available for users in a hurry at a fee. There may be a two-step process involved in transferring Apple Pay funds to Cash App. Cash App transfers can reach the bank in minutes, unlike Apple Pay instant transfers, which can take up to 30 minutes.

How To Transfer Money From Apple Pay To Cash App?

As we mentioned above. You won’t be able to transfer funds directly between these two platforms at the moment, but you can do it anyway! The process is a little more complicated than clicking a button.

First Step – Transfer Money from Apple Pay to your Bank Account

In order to complete this transaction, follow these steps (keep in mind that the time needed to process the transaction can be between one and three business days).

The iPhone Wallet app is required to use Apple Pay, which is known for its efficiency.

The app must be installed on your device, and your debit card must be linked to the app.

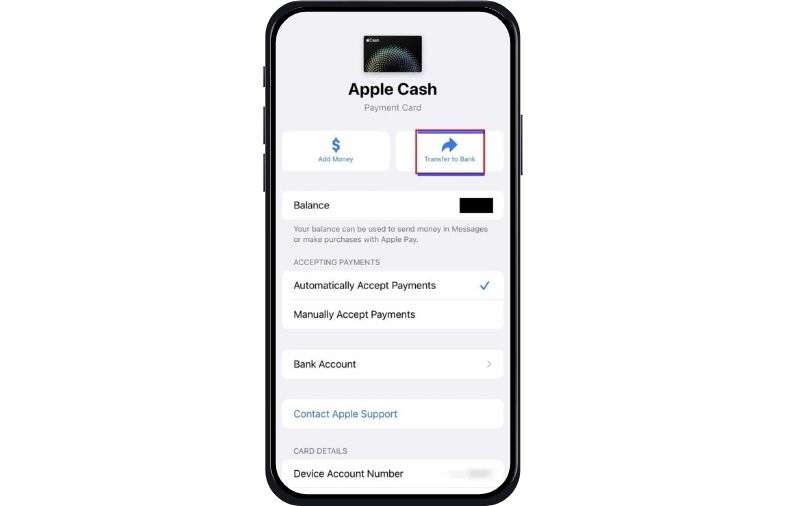

Select “Transfer to Bank” under the Apple Cash card in the iPhone Wallet app. Select your Apple Cash card from the Wallet & Apple Pay section of Settings, then tap Transfer to Bank.

- The amount to be transferred can either be sent as an instant transfer (for a small fee) or can take 1-3 business days to be processed.

- Use a passcode, Face ID, or Touch ID to confirm the transaction.

- As soon as the transaction is completed, the funds will be credited to the bank account.

Second Step – Transfer Money From Bank Account To Cash App

Your Cash App account now has money in it. Your Cash App account can be funded by following these steps.

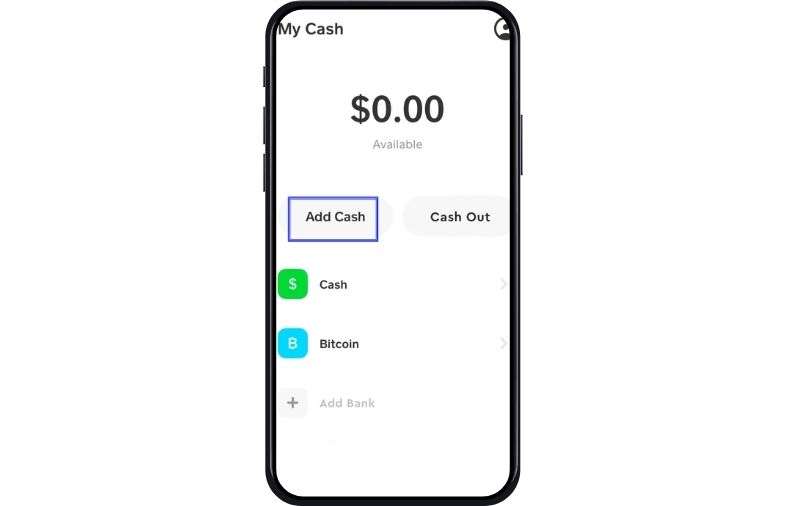

- Tap Cash to open it.

- From the app, click the Money tab.

- Click on Add Cash

- Add Cash to the Cash App by selecting the amount.

- Click on Add

- With your Touch ID and PIN, you’ll confirm the transaction.

I think that’s all. Your Cash App account should receive the money pretty quickly, and you can use it however you like. The Apple Pay to Cash App transfer process may be repeated as often as possible.

Things To Consider Before Transfer Money From Apple Pay To Cash App

The Cash App and Apple Pay need to work together to facilitate efficient and timely money transfers. A few of them are listed below:

- Make sure your transfer needs are urgent. Transfers that take 1 to 3 business days may not be subject to fees. The importance of speed and cost cannot be overstated.

- You can transfer money using Apple Pay if you have a Cash App card. This integration allows you to spend without a physical card, which may affect what platform you choose for specific transactions.

- You must verify and link your bank account correctly. Inaccuracies or incomplete bank information may cause a delay in the transfer process.

- Find out what transaction limits Apple Pay and Cash App impose. Maintaining these limits ensures smooth, uninterrupted transfers.

- Ensure your internet connection is consistent and reliable before initiating a transfer. This reduces the frequency of transaction interruptions.

Apple Pay vs Cash App: Which Is Better?

There are two highly popular e-wallets, Cash App and Apple Pay, that allow easy payment between individuals, and they both come with options to store physical cards as well. It is important to note that they are two different organizations, so some of their services may not overlap. Check out the comparison between Apple Pay and Cash App.

| Feature | Apple Pay | Cash App |

| Download Fee | Free | Free |

| Transaction Fees | Some types free | Many types free |

| Money Sending | To other US users | To US and UK users |

| Mobile Payments | Yes | Yes |

| Physical Card | Yes | Yes |

| International P2P Payments | No | No |

| Device Compatibility | Apple devices only | Apple and Android |

| Additional Services | Payment services only | Payment, crypto, investments |

How Can I Transfer the Entire Balance of My Apple Account?

It is possible to transfer as much as $10,000 per transaction – or up to the amount of your Apple Cash balance if it is under $10,000 – and as much as $20,000 per week with Apple Cash.

There is a minimum transfer amount of $1 for Apple Cash transfers. The transfer is available only for accounts located in the United States. You must have a U.S.-based Mastercard or Visa card linked to the account for instant transfers.

FAQs

How Do You Add Apple Pay to the Cash App?

Cash app and Apple Pay are both e-wallets, not banks, so you can’t withdraw directly because they are both e-wallets. Cash App cards can also be added to Apple Pay for easy mobile spending.

What is the Best Way to Get Money Off Apple Pay Without a Credit Card?

Apple Pay can only be set up with a debit or credit card. Prepaid cards can also be used without a debit or credit card.

How do I Transfer Money From Apple Pay to a Debit Card in My Wallet Instantly?

Apple Pay can be used to transfer money to your bank account or debit card via the Instant Transfer option within the Wallet app.

How Do I Get Money From Apple Pay Without a Card?

To set up an Apple Pay account, you will need either a debit card or a credit card. In the absence of a card, prepaid cards can also be used.

How Long Does It Take for the Money to Reach Cash App?

You may need to wait three business days for your Apple Pay funds to show up in your Cash App account after you transfer funds from your bank account. There is an option to speed up the process for a fee.

Conclusion

Cash App users can still Transfer Money From Apple Pay To Cash App through a two-step process despite being unable to do so directly. Your Apple Cash card balance can be deposited into your Cash App account via your bank account. The money can be added to your Cash App account and spent however you like through the Add Money on Cash App Card feature.

Add Comment