Are you looking for Best Low Interest and 0% APR Credit Card? If Yes, You are at the right Place.

In this article, We are sharing all the information about Best Low Interest and 0% APR Credit Card.

Having a Low Interest and 0% APR Credit Card prevents you from accruing debt. You can repay your borrowed money more quickly if you pay less interest. When saving on interest in the short term, a card with a 0% intro APR period will be your best choice. Ideally, you should find one with a longer introductory interest-free period. It is beneficial in the long run to have a credit card with a low ongoing interest rate if you are inclined to carry a balance most months.

Many 0% APR credit cards offer promotional periods during which you can avoid interest on purchases, balance transfers, or both. Credit cards have higher interest rates than other financial products, but some offer promotional 0% APR periods that allow you to skip interest payments on purchases.

Balance Transfer Cards For Bad Credit can also help you save money on interest charges, but they typically have shorter introductory periods than other 0% APR cards. Some 0% APR cards do not offer rewards or other perks after the introductory period ends, so after that, they may not be very useful.

What Does 0% APR Mean?

Contents

- 1 What Does 0% APR Mean?

- 2 Different Types Of APR

- 3 What Is a 0% APR Credit Card?

- 4 How Do 0% APR Credit Card Work?

- 5 How Do You Qualify for a 0% APR Offer?

- 6 Top 5 Best 0% APR Credit Card

- 7 Pros and Cons of 0% APR Credit Card

- 8 Video Guide For Best Low Interest and 0% APR Credit Card

- 9 Best Ways to Use a 0% APR Credit Card

- 10 How Can You Make The Most of 0% APR Card Offers?

- 11 How To Choose The Best 0% APR Card For You?

- 12 FAQs

The 0% introductory APR allows cardholders to pay no interest on eligible transactions for a specified period. If any balance remains unpaid at the end of the period, it will accrue interest at a regular percentage rate. The 0% introductory APR differs from deferred interest offers because interest is generally not applied retroactively to the purchase date if the offer has expired.

Generally, introductory APR offers are only available for eligible purchases, balance transfers, or both. The 0% introductory APR period on many cards extends beyond one year, with some cards offering it beyond 18 or 20 months. A 0% introductory APR-eligible balance transfer transaction may still carry fees, but typically, there are no fees for using one. There will still be a minimum payment requirement during any introductory 0% APR period.

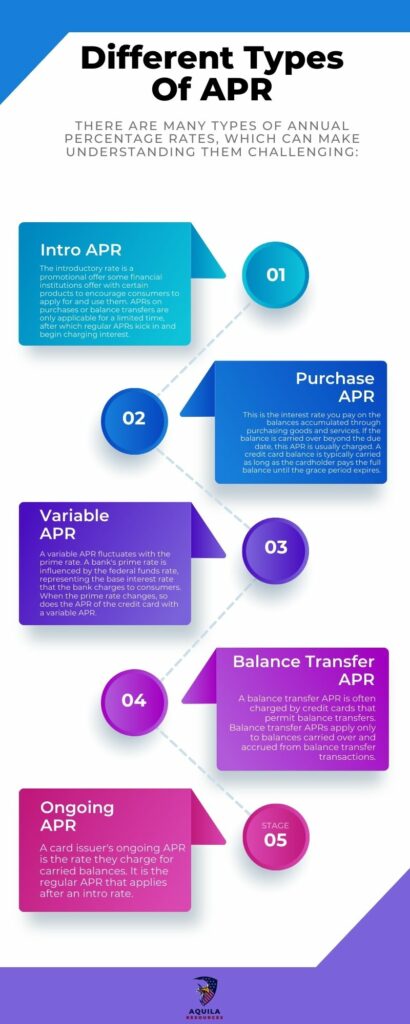

Different Types Of APR

There are many types of annual percentage rates, which can make understanding them challenging:

- Intro APR: The introductory rate is a promotional offer some financial institutions offer with certain products to encourage consumers to apply for and use them. APRs on purchases or balance transfers are only applicable for a limited time, after which regular APRs kick in and begin charging interest.

- Purchase APR: This is the interest rate you pay on the balances accumulated through purchasing goods and services. If the balance is carried over beyond the due date, this APR is usually charged. A credit card balance is typically carried as long as the cardholder pays the full balance until the grace period expires.

- Variable APR: A variable APR fluctuates with the prime rate. A bank’s prime rate is influenced by the federal funds rate, representing the base interest rate that the bank charges to consumers. When the prime rate changes, so does the APR of the credit card with a variable APR.

- Balance Transfer APR: A balance transfer APR is often charged by credit cards that permit balance transfers. Balance transfer APRs apply only to balances carried over and accrued from balance transfer transactions.

- Ongoing APR: A card issuer’s ongoing APR is the rate they charge for carried balances. It is the regular APR that applies after an intro rate.

What Is a 0% APR Credit Card?

Credit cards with 0% APR offer an introductory period without finance charges on purchases, balance transfers, or both. Credit cards or other loans typically charge double-digit interest rates, so removing finance charges can be a welcome relief. A lower interest rate means more money you can put towards paying off your debt.

How Do 0% APR Credit Card Work?

Credit cards with 0% introductory APRs can give you the option of making purchases and transferring balances without paying interest. There is a difference between issuers in terms of the time, but most of the time varies between 12 and 21 months.

The introductory period continues to require monthly payments, but if you choose to carry a balance into the next month, interest won’t be charged. You must pay off any remaining balance once the intro period ends to avoid interest charges at your new APR.

Fortunately, the interest is not retroactive. In this example, if your Card has a $1,000 balance at the end of the intro period, you will start paying interest when your intro period expires. There is no deferred interest, as with some TV ads advertising no-interest purchases. If you keep circling your credit card balance, you will see your balance increase rapidly since credit cards use compound interest.

How Do You Qualify for a 0% APR Offer?

Most 0% introductory APR cards are available to those with excellent or good credit scores. You will need to be capable of making regular, on-time minimum payments and unlikely to default on your balances if lenders are going to refrain from charging you interest on carried balances for any period. The better your income and credit, the more likely you will be approved for an APR of 0% for a credit card.

If you apply for a credit card, check your credit to ensure everything runs smoothly. The best thing you can do before applying for a new credit card is to improve your credit.

Top 5 Best 0% APR Credit Card

Here are the top 5 Top 5 Best 0% APR Credit Cards –

Citi Simplicity Card

If you want to have no APR for the longest period possible, Citi Simplicity Card is the best option. The intro APR on balance transfers is 0% for 21 months, with no late fees or penalty APRs. A 0% interest rate is also offered on purchases when an account is opened for 12 months.

Rewards: None

Welcome offer: None

Annual fee: $0

Pros & Cons of Citi Simplicity Card

| Pros | Cons |

| There is no annual fee. | There are no rewards or welcome offers |

| Liability for unauthorized charges is zero. | There is a four-month deadline for transferring balances |

| You can set your due date. | Balance transfers after four months are subject to a 5% fee |

U.S. Bank Visa Platinum Card

A card like this may be a good choice if you are concerned about having a long 0% APR period for both purchases and balance transfers. It offers 0% intro APR on balance transfers for 18 billing cycles. There are no rewards or welcome offers, however.

Rewards: None

Welcome offer: None

Annual fee: $0

Pros & Cons of U.S. Bank Visa Platinum Card

| Pros | Cons |

| There is no annual fee | It doesn’t earn rewards |

| APR 0% for 18 billing cycles on balance transfers | There is no welcome offer |

| Cell phone insurance worth $600 | There is a high variable APR |

Chase Freedom Unlimited

The Chase Freedom Unlimited offers generous cash back, a low introductory APR, and a welcome offer among the best 0% APR credit cards. It offers unlimited matched cash back. After the first year, Chase will automatically match all your cash back! You can earn as much cash back as you want. A 15-month 0% APR on balance transfers and a 15-month 0% APR on purchases are also available.

Rewards: Cash back rewards on Chase Ultimate Rewards purchases are unlimited – up to 5%, 3%, and 1.5%, respectively.

Welcome offer: This special offer offers unlimited matched cash back. Chase will automatically match your first year’s cashback! It is possible to earn unlimited cash back.

Annual fee: $0

Pros & Cons of Chase Freedom Unlimited

| Pros | Cons |

| There is no annual fee | The 0% APR period on some cards is longer. |

| There are several bonus cashback categories | The cashback rates on some alternatives are higher. |

| Get 1.5% back on non-bonus purchases | Foreign transaction fee of 3% on U.S. dollar transactions |

| APR of 0% for 15 months on purchases | |

| Earning a welcome offer requires low-spending |

Blue Cash Everyday Card from American Express

Blue Cash Everyday Cards from American Express are a great option for most Americans. You can earn 3% back in three categories: gas, groceries, and online purchases, up to $6,000 annually. With the Card, you can also earn a 0% APR for 15 months (Rates and fees), receive a Disney bundle credit of $84 and a Home Chef credit of $180 in the first six months, along with $200 cash back.

Annual fee: $0

Rewards: The rewards program offers 3% cash back on gas, groceries, and online purchases up to $6,000. The limit resets every year, so there is an overall limit of $18,000 per category. The cashback rate for all other purchases is 1%

Welcome offer: Get $200 in statement credits after spending $2,000 on your new Card in the first six months.

Pros & Cons of Blue Cash Everyday Card from American Express

| Pros | Cons |

| There is no annual fee. | A very high spend is required to earn the welcome offer |

| The first $6,000 in purchases will earn you 3% back at gas stations, supermarkets, and online retail purchases, and then 1% back on all the rest. | A cashback rate of 1% outside of bonus categories can be earned |

| With your Blue Cash Everyday Card, you’ll get $7 back each month when you use it to purchase Disney+, Hulu, or ESPN+ for $12.99 or more each month. There is an enrollment requirement. | There is a cap on bonus categories |

| 15-month 0% on purchases |

Capital One VentureOne Rewards Credit Card

A travel card with no annual fee may be a good choice if you are okay with booking through Capital One Travel. This Card provides five miles per dollar spent on Capital One travel plus 1.25 miles per dollar spent on all other purchases. A 0% introduction to purchases and a 0% introduction to balance transfers is also available.

Annual fee: $0

Rewards: The program offers five miles per dollar spent on travel booked through Capital One Travel, plus one mile per dollar spent on all other purchases.

Welcome offer: N/A

Pros & Cons of Capital One VentureOne Rewards Credit Card

| Pros | Cons |

| There is no annual fee | There are no additional benefits, such as cell phone insurance and trip cancellation coverage, that you can find with some competitors |

| Capital One offers five miles per dollar on travel | The APR increases from 19.99% to 29.99% (variable) |

| All other purchases earn 1.25 miles | Credit must be good or excellent. |

| Balance transfers for 15 months at 0% intro rate |

Pros and Cons of 0% APR Credit Card

Pros

- The Gift of Time: The main purpose of 0% APR credit cards is to give you time to pay off your debt. It is best to choose an intro offer that is 18 months or longer.

- Interest Savings: When you transfer or purchase a loan with a 0 percent introductory APR, you could save hundreds of dollars in interest charges.

- Low Monthly Payments: Paying off a balance during the introductory period for several months can result in lower monthly payments.

- Credit Score Improvements Over Time: Managing your debt responsibly can boost your credit score and demonstrate to lenders that you are a low-risk borrower.

Cons

- You Could Lose Your Introductory APR Period: Missing a payment on your new 0% APR credit card could cause the issuer to change your standard interest rate.

- Impact on Credit Score. The process of applying for a new credit card involves a hard credit inquiry on your credit report, which in turn lowers your credit score temporarily. A hard credit inquiry drops off your credit report after a year.

- Fees for Balance Transfers. Credit card issuers charge a balance transfer fee, usually 3% or 5% of the transferred balance. It might be an issue if you’re trying to pay off your debt.

- Introductory APR Offers Don’t Last Forever. Introductory APR offers end soon. The ongoing APR set by your card issuer will then take effect if you still have a balance on your Card.

Video Guide For Best Low Interest and 0% APR Credit Card

Best Ways to Use a 0% APR Credit Card

Using credit cards that offer no interest on purchases and balance transfers can be a big saving for consumers wishing to reduce interest charges when they carry a monthly balance. Using a 0% APR card works best based on your circumstances but generally falls into one of three categories:

- A 0% APR card lets you make large purchases like an iPhone or workout equipment over time with no interest charges, giving you more time to pay it off.

- You can pay off debt faster and cheaper if you transfer your balance to a card that doesn’t charge interest for up to 20 months.

- A card with no interest on balance transfers and new purchases can help you pay off large expenses and old debt simultaneously.

To avoid interest, pay the minimum payment and the balance in full by the end of the intro period.

How Can You Make The Most of 0% APR Card Offers?

A credit card that charges no interest can be an exciting tool at your disposal, even if it is only a temporary benefit. When using 0% APR cards, it’s important to remember that the free ride won’t last forever, and you’ll still have to make payments throughout the promotion period.

- Keep Up With Minimum Payments: You may lose your 0% rate if you fail to pay on time or if you pay less than the minimum. If your account is late for more than 60 days, you might have to pay a late fee, and your balance may accrue interest at a penalty APR. Your credit score can also be affected by late payments.

- Understand How Payments Work: A payment above the minimum is applied first to the balance with the highest interest rate. Any amount you pay over the minimum due of your 0% APR credit card will usually be applied to the cash advance balance first. Cash advances are best avoided due to high-interest rates, fees, and no grace period.

- Consider Other Costs as Well: Some 0% APR cards have an annual fee or a balance transfer fee, usually between 3% and 5%.

- Make a Plan: You should shop for 0% APR cards about three weeks before making a large purchase if you know it will be a large purchase. The approval process takes a few days, and the Card can arrive in the mail in about a week and a half.

- Find Out When Your Offer Expires: It’s important to know when your introductory period ends so you can pay off your balance before that happens. If your credit card company provides a payment date, you can take full advantage of your interest-free offer.

How To Choose The Best 0% APR Card For You?

If you’re looking for a way to lower your debt or reduce interest charges, a zero-interest card may be what you’ve been looking for. You’ll benefit more from your Card if you know what you’re using it for.

When choosing a card with a 0 percent intro APR offer, keep the following factors in mind –

- Ensure The Intro Period Is Long Enough. Make sure you can pay off the balance before the intro period ends if you need a long time to pay off debts or finance a large expense. When you need more than a year to pay off a credit card balance, a card with 12 months of zero percent APR may not be your best option.

- Make Sure You Check The Card’s Fees. Most credit cards whether it is secured credit cards or unsured credit cards charge an annual fee and offer an introductory APR period. There is also usually a 3 percent to 5 percent balance transfer fee added to your total balance transfer amount when transferring your balance. If you are planning to apply for a credit card, make sure you have a clear understanding of all the fees involved before you do.

- Consider The Card’s Value After The Intro APR Period. APR periods on some cards are lengthy, but they do not come with any other benefits or rewards, making them almost worthless after the intro period. It is possible to get an introductory APR rate that is shorter on cards with rewards, but they are still earning points, miles or cash back. If you plan to pay off a balance before the end of the period, you should decide if you want the rewards credit cards‘ long-term value but a shorter APR period.

FAQs

What Credit Score is Required For 0% APR Credit Cards?

The majority of 0% APR credit cards are reserved for consumers with good credit scores of 670-739 or excellent scores of 740 and higher. Low credit scores below 580 or fair credit scores between 580 and 669 may preclude you from qualifying for 0% APR cards.

What’s the Longest 0% APR Offer You Can Get?

There is a 21-month introductory 0% APR on the longest credit card purchase offer. The 0% interest rate on balance transfers also lasts the longest. It is possible to find a credit card with a promotional rate for both purchases and balance transfers, but the length of time is often different.

It is possible for a credit card to offer a 0% APR on purchases for only 12 months but has a 21-month promotional period for balance transfers.

Add Comment