Are you looking for Business Credit Cards with No Annual Fee? If yes, You are at the right place.

In this article, we are sharing all the information about Business Credit Cards with No Annual Fee.

The business credit card with no annual fee is the same as a credit card, offering small business owners the tools they need such as Best Business Credit Card for Startup or Small Businesses, such as simplified purchase tracking and earning rewards on employee spending without paying membership fees monthly or annually.

You can choose from a wide selection of business credit card with no annual fee today, whether you have just started your business or you’ve been around for a while. Best Business credit cards can help you reward yourself for everyday purchases, and they can also help your business grow if they’re used correctly.

What is Business Credit Cards with No Annual Fee?

Contents

- 1 What is Business Credit Cards with No Annual Fee?

- 2 Why Choose the Best Business Credit Cards with No Annual Fee

- 3 Top 5 Best Business Credit Cards with No Annual Fee

- 4 Benefits of a Business Credit Card with No Annual Fee

- 5 Tips on Choosing the Best Business Credit Cards with No Annual Fee for You

- 6 Rewards and Discount Options for Business Credit Cards with No Annual Fees

- 7 How Can You Maximize Your Business Credit Cards with No Annual Fee?

- 8 Can I Get Business Credit Card Without an LLC?

- 9 Which Business Credit Cards Only Require EIN?

- 10 FAQs

- 11 What is a Business Credit Cards with No Annual Fee?

- 12 Do All Business Cards Have Annual Fees?

Business credit cards with no annual fee allows you to use it for life without ever paying a fee. Despite being essentially free, they have an APR. Carrying a balance to a subsequent billing cycle will result in interest charges. There are usually other fees associated with business credit cards that don’t charge annual fees, such as balance transfers (Read: 5 Best Balance Transfer Cards For Bad Credit), cash advances, foreign transactions, late payments, and overuse of credit.

Why Choose the Best Business Credit Cards with No Annual Fee

By choosing a business credit cards with no annual fee, you are assured of consistent savings and can redirect funds to important areas. An attractive business credit card with no annual fee also offers rewards and cash back.

A business card’s fee charge is one of many factors to consider when choosing the right Card. To choose the right card, assessing each card’s full benefits and determining which is most appropriate for you are important. Some cards don’t charge transaction fees, while others feature superior expense management capabilities.

Top 5 Best Business Credit Cards with No Annual Fee

The number of business credit cards with no annual fee is limited. Most of the companies do have annual fees, but several don’t. There is no perfect credit card. However, a few options may work for you and your business.

Here are the top 5 Best Business Credit Cards with No Annual Fee –

The Blue Business Plus Credit Card from American Express

Those looking for a simple yet rewarding credit solution for their small businesses should consider the Blue Business Plus Credit Card from American Express. This business card does not charge an annual fee, making it budget-friendly and perfect for businesses with significant expenses almost daily. A solid rate of Membership Rewards points is earned on business purchases, up to a generous yearly cap, before the rate drops.

Pros & Cons of The Blue Business Plus Credit Card from American Express

Pros

- No annual fee

- Purchases at an intro APR

- All purchases earn flat-rate rewards

- Various redemption options are available

- Suitable for small businesses

Cons

- Balance transfers have no intro APR

- Fees associated with foreign transactions

- Amex Travel charges a fee for transferring points and booking flights

Chase Ink Business Unlimited Credit Card

Chase Ink Business Unlimited Credit Card offers 1.5% cash back on all purchases and a $0 annual fee, making it an elite business credit card. If you spend $6,000 within the first three months of opening your account, you will also receive a bonus of $900.

Chase Ink Business Unlimited may be a good option if you qualify for those rewards and have a credit score of at least 700. Small business owners with good or excellent credit are encouraged to apply, and we recommend 700+ to have a decent shot of getting approved.

Pros & Cons of Ink Business Unlimited Credit Card from Chase

Pros

- There is no membership fee

- Purchases with 0% intro APR

- The bonus of $900 for initial rewards

Cons

- Balance transfers have no intro APR

- A balance transfer fee is charged

- Fees for foreign transactions

- Credit must be good or excellent

Ink Business Cash Credit Card

Ink Business Cash Credit Card provides impressive rewards for common business expenses, making it a smart choice for small businesses. The introductory APR offer on purchases, the lack of an annual fee, and the noteworthy welcome offer make it highly beneficial.

You can also offer its benefits to your employees without additional charges. Keeping an eye on the foreign transaction fees and repaying promptly after the initial offer period will help you avoid high interest rates.

Pros & Cons of Ink Business Cash Credit Card

Pros

- Cashback on categories specific to businesses

- An attractive welcome offer

- There is no annual fee

- Purchases with introductory APR

- An additional employee card is free

Cons

- There is limited reward potential in non-bonus categories

- Charges for foreign transactions

- There is a cap on cash-back rewards

Bank of America Business Advantage Travel Rewards World Mastercard credit card

It’s a great no-annual-fee travel credit card that you can use for business purposes. Using the Bank of America Business Advantage Travel Rewards World Mastercard® allows you to redeem your points without airline and hotel credit card restrictions. It pays solid rewards on every purchase and gives you broad redemption flexibility.

Pros & Cons of Bank of America Business Advantage Travel Rewards World Mastercard credit card

Pros

- There is no annual fee

- There are no blackout dates for travel

- You can earn 3x points when you travel

- Bonus points for new customers

Cons

- Non-travel rewards are low

- 0% APR for a short period

- There is no 0% APR on balance transfers

Capital One Spark Cash Select for Excellent Credit

Businesses wanting to save on their purchases can use Capital One Spark Cash Select for Excellent Credit card. Capital One Spark Cash Select offers unlimited 1.5% cash back on all purchases made with all Capital One credit and debit cards and 5% cash back on hotels and rental cars booked through Capital One Travel.

The first three months of using the service can also earn you a bonus of $750. You may get fewer perks with this Card than other no-annual-fee business credit cards, but it may be the right choice for your business if you want a simple option.

Pros & Cons of Capital One Spark Cash Select for Excellent Credit

Pros

- There are no membership fees

- Purchases with 0% intro APR

- There is no foreign exchange fee

- All purchases earn 1.5% cash back

Cons

- There is no initial reward bonus

- Balance transfers do not have an intro APR

- High APR regularly

- Credit must be good or excellent

Benefits of a Business Credit Card with No Annual Fee

Business Credit card with no annual fees can benefit businesses of all sizes. The first benefit of these cards is that they’re used for qualifying for new businesses. Most are only for companies with recently established credit, so you do not need a stellar credit rating to qualify.

A Business Credit Card with No Annual Fee is an excellent way for your business to build credit because it doesn’t cost anything. There will be no need to find a way to offset the cost of the Card. You can earn cashback on purchases now instead of paying in the future to qualify for savings.

Tips on Choosing the Best Business Credit Cards with No Annual Fee for You

There are many cards out there that don’t charge annual fees but still offer a variety of benefits. The best business credit cards with no annual fee for you will be based on the following criteria:

- Get to Know Your Spending Habits: It is important to recognize your spending habits before choosing a no-annual-fee credit card. Several credit cards offer boosted reward rates when you spend in certain categories. The Card that gives you the best value for your money will depend on your spending category.

- Decide on the Reward Structure You Prefer: Some cards offer higher reward rates than others. Some cards offer specific rewards based on the Card. A credit card could offer rewards only in cashback, whereas another card could offer rewards in the form of travel points. Ensure you know exactly what rewards you’re looking for from your Card.

- Assess the Card Rewards Value: Usually, cards with an annual fee offer more desirable benefits. Sticking to a card without an annual fee is the best option if you’re still uncomfortable with an annual fee or if the rewards associated with a card with no annual fee fit your lifestyle.

- Consider Whether Perks Matter to You: A card with an annual fee usually offers more generous reward rates and more useful perks. Those who want unique card perks, such as travel rewards or statement credits, will also want to compare annual fee cards.

- Plan Your Payment Strategy: Are there any chances of you carrying a balance? Choose a card that offers an introductory APR if this is the case. An intro APR offer can help finance a large purchase even if you plan to pay your bill in full each month. You must pay off your balance before the intro period ends. Credit cards generally have higher interest rates than personal loans or lines of credit, which you may need to carry a debt for longer.

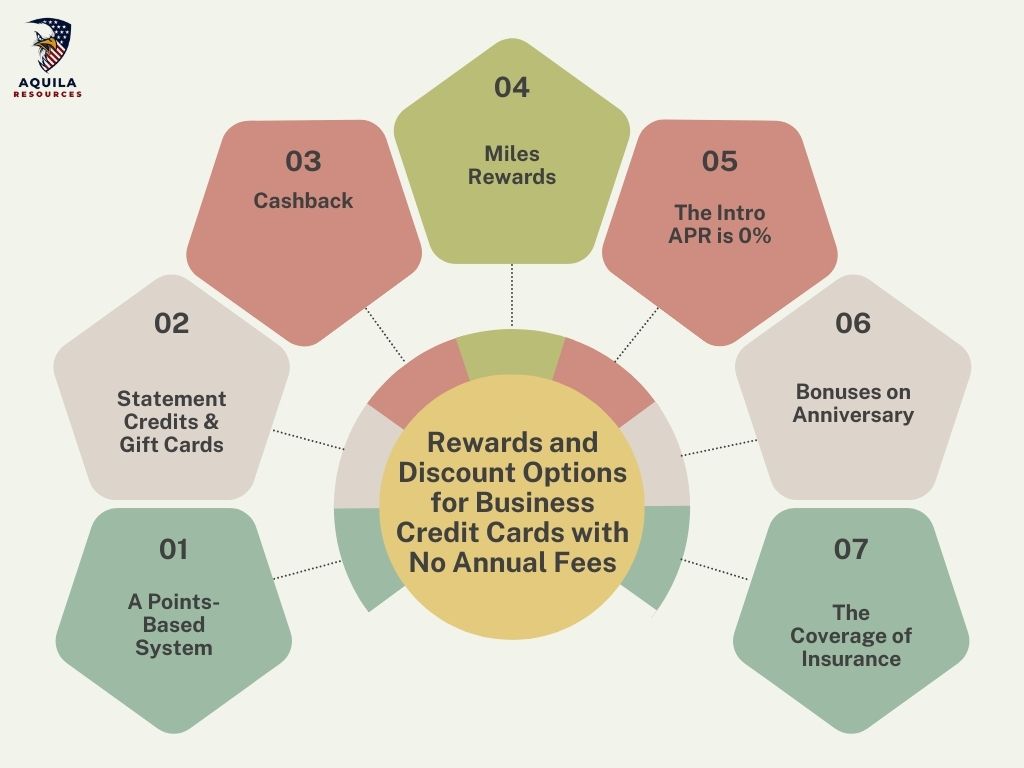

Rewards and Discount Options for Business Credit Cards with No Annual Fees

Those who choose the best business credit cards with no annual fees will also get good rewards programs. There are a variety of rewards credit cards on the market, and you are likely wondering how each one works. Listed below are the rewards you may receive from your credit card.

A Points-Based System

The points system awards points based on the amount or percentage spent. A certain credit card might offer one point for every dollar spent on everyday business purchases but three points for streaming services or ridesharing. Each card issuer offers a different reward rate, conversion rate, and redemption option.

You earn points instead of dollars when you earn rewards points. Points vary in value depending on what they are redeemed for. The value of 40,000 points becomes one cent if you redeem them for a $400 flight. The point value will double to two cents if you can find another flight for $800. These points can redeem various items, including gas gift cards, travel purchases, merchandise, cash back, or charitable contributions.

Several cards offer sign-up bonuses or welcome offers that allow cardholders to earn bonus points. When you open your account, you must meet a spending requirement within a certain period. You could, for instance, earn 50,000 points for spending $5,000 in the first 3 months after your account was opened.

Statement Credits & Gift Cards

Gift cards, statement credits, and other rewards are often offered by credit cards to cardholders. If you use your credit card, you may receive a $50 welcome bonus and 5% on your next purchase from a popular e-commerce site. You may also receive a 1-3% discount when using your Card at gas stations, phone services, and office supply stores.

Your account will be credited with money after you make specific purchases, allowing you to reduce your account balance.

Cashback

The cashback rewards system is fairly straightforward. The cash you get back from your Card will be a percentage of your purchase each time you use it. For instance, let’s say our cashback rate is 1.5%. If you spend $100, you will receive $1.50 in rewards. Prepaid gift cards, bank deposits, or credit balances are all ways of redeeming these rewards.

Many cashback credit cards offer you extra savings. Check if your Card offers extended warranties, return guarantees, purchase protection, or lower-than-advertised prices. You should check your cards for the specific terms of these extra perks.

There are credit cards that offer flat cashback rates on everything, but there are also those that offer higher cashback rates on bonus categories. They might offer you 1% cashback on all purchases but 5% on all travel purchases booked through their website.

Miles Rewards

The reward system of miles is similar to the reward system of points. Every dollar you spend earns you miles that serve as travel currency. A business credit card that earns miles enables companies to redeem them for travel rewards, such as discounted flights, lounge access, seat upgrades, hotel stays, and other expenses.

Frequent flyers often choose travel category cards offering additional miles. You’ll need to log in to your card issuer’s account to use miles to book a flight or hotel stay. Several travel cards allow cardholders to transfer points to travel partners if they need to book with a different airline.

The Intro APR is 0%

No-annual-fee credit cards usually offer a 0% introductory interest rate for the cardholder’s first billing cycle. The introductory period usually lasts one calendar year after the account is opened, but it can be as long as twenty-one months. All purchases and transactions made during this period will be interest-free.

The 0% intro APR rate may also be applied to balance transfers on some no-annual-fee credit cards. Make sure you check the terms. You’ll be charged a variable APR percentage after the 0% intro APR period ends.

Bonuses on Anniversary

You will receive an anniversary bonus every time your account reaches its anniversary year. The Card should be reactivated every 12 months after you have opened it. You may receive bonus cash, travel rewards, or additional reward points.

The Coverage of Insurance

Using credit cards to book a car rental may qualify you for insurance coverage. Your Card may provide a more comprehensive insurance policy than the rental company offers. Depending on their coverage, they may provide rideshare protection or reimbursement for delayed flights.

How Can You Maximize Your Business Credit Cards with No Annual Fee?

Business Credit cards with no annual fees can be helpful additions to your wallet if used properly. The following tips can help you make the most of your Business Credit Cards with No Annual Fee:

- Pay Your Monthly Balance in Full and on Time: Your no-annual-fee card’s low cost and low credit utilization will remain in your favour if you keep your spending under control to pay your balance in full each month.

- Combine the No Annual Fee Card with a Rewards Card: A no-annual-fee credit card is worth pairing with a card with an annual fee, but that rewards you more.

- Upgrade the Card While it is Open: A no-annual-fee card you keep open can improve your credit utilization ratio and length of credit history by keeping the Card open without paying an annual fee.

Can I Get Business Credit Card Without an LLC?

Businesses without LLC structures can receive credit cards. Sole proprietors and freelancers can apply for many small business credit cards for Business Credit Cards for LLC. Typically, you will have to prove that you earn money independently. If you do not have a business tax ID number, you must use your Social Security number to apply.

Which Business Credit Cards Only Require EIN?

There are many unsecured credit cards for business, secured credit cards, and corporate cards that don’t require social security numbers to apply. Some providers may ask for your Social Security Number as well, but they won’t use it & won’t check your credit. Consider a corporate card if you only need your EIN such as these Startup Business Credit Cards with EIN Only and want your Social Security number.

FAQs

What is a Business Credit Cards with No Annual Fee?

An annual fee-free business credit card does not charge annual fees for business credit cards. Other costs are associated with these cards, including interest on purchases that you can avoid by paying off your balance in full and foreign transaction fees, balance transfer fees, and late payments. Read this if you want to know What is a Business Credit Cards and How Does a Business Credit Card Work?.

Do All Business Cards Have Annual Fees?

No. The annual fee on cashback credit cards for businesses are usually waived. Credit cards for businesses and corporate cards are often subject to the same restrictions.

On the other hand, credit cards from hotels and airlines almost always charge annual fees. The same is true for many business travel cards. Lucrative rewards, such as hotel stays and airline credits, often offset the annual fees on these cards.

Is It Better to Have No Annual Fee?

The benefits and features of credit cards with annual fees are greater. Even so, this does not automatically make these cards ‘better’ because ‘you should select a card that suits your needs. Also, remember that you can deduct the charges associated with your credit card as a business expense.

What are the Benefits of Cards That Don’t Charge an Annual Fee?

A credit card with no annual fee can be advantageous for consumers who wish to earn rewards on purchases without paying an annual fee. Those who seek to take advantage of the cards pay annual fees.

Should You Get Business Credit Cards with No Annual Fee?

Choosing a business credit cards requires consideration of many factors, including the annual fee. A card’s annual fee may allow you to earn more rewards in some cases, as well.

Add Comment