The owner of a business knows that every penny counts. A business credit card can be an effective strategy for getting the most out of business transactions. Several benefits can be derived from business credit cards. You can earn rewards or cash back, earn loyalty points, get travel protections, and track expenses.

We use credit cards daily to pay for necessities and splurges – a convenient and simple way to pay for everything. Additionally, business credit cards can help you pay for expenses related to purchasing supplies and running your business. Business cards offer perks such as earning points or miles, earning cash back, or financing large purchases with a 0 percent introductory APR, just like personal credit cards.

The concept of a business credit card is quite similar to that of a personal credit card: Both allow you to borrow money and repay it over time. Some benefits are associated with business credit cards, such as free employee cards and rewards on common business purchases, such as office supplies.

The benefits of business credit cards are numerous as well. The benefits of business accounts include:

- The ability to separate business and personal finances.

- The ability to build credit for your business by paying on time.

- You may qualify for one regardless of how small or new your business is.

What Is a Business Credit Card?

Contents

- 1 What Is a Business Credit Card?

- 2 How Does a Business Credit Card Work?

- 3 How Do You Get a Business Credit Card?

- 4 Who Qualifies for Business Credit Cards?

- 5 Applying for a Business Credit Card

- 6 Potential Problems When Applying for a Business Credit Card

- 7 5 Reasons to Get a Business Credit Card

- 8 What are the Main Features of Business Credit Cards?

- 8.1 A Business Card May Have a Different Payment Term than a Personal Card

- 8.2 Credit Limits on Personal and Business Cards Differ

- 8.3 Business Cards also Include Rewards.

- 8.4 Business Credit Cards Can Be Obtained Without Registration or Incorporation

- 8.5 Personal Cards are Protected from Liability, but Business Cards are Not

- 9 Benefits and Drawbacks of Business Credit Cards

- 10 How to Use a Business Credit Card Wisely?

- 11 How a Business Card Impacts Your Credit?

- 12 Can You Get a Credit Card With an LLC?

- 13 FAQs

- 13.1 Is a Business Credit Card Right for You?

- 13.2 Can I get a Credit Card with an EIN?

- 13.3 Is It Possible to Use a Business Credit Card for Personal Expenses?

- 13.4 What Information Will I Need When I Apply for a Business Credit Card?

- 13.5 Do Business Credit Cards Build Credit?

- 13.6 Can You Get a Business Credit Card with No Credit Check?

Business credit cards are typically designed for business owners. Business cards are available for small business owners, large company operators, sole proprietors, and everyone. It is optional to have employees or an office.

Business credit cards are generally used to pay for business expenses like purchasing supplies, furniture, or travel. Credit cards should only be used to spend money new businesses have yet to earn or deposit in the bank. Many business cards have some restrictions in their terms and conditions that prevent cardholders from using them for personal expenses.

Business owners need to get a business card so they will have a credit history to use when applying for business loans in the future. The short-term financing offered by some credit cards is useful for large purchases.

How Does a Business Credit Card Work?

A business credit card works similarly to a personal credit card in that you use the card to charge purchases drawn from a line of credit. After the end of each billing cycle, you receive a statement with the total balance and minimum payment due.

You won’t be charged any interest on those purchases if you fully pay your monthly bill. However, if you carry a balance, interest accrues on your balance based on the interest rate on your credit card. Business credit cards are generally more favourable when your business is creditworthy.

While that may be the case, many business cards are charge cards typically paid in full every month. There is generally no credit limit on charge cards. This is one of their main advantages.

Although they are a good choice for established businesses looking to pay for their start-up costs over time, there might be better options for new businesses or those with unpredictable incomes. Charge cards are an ideal option for established businesses with big monthly expenses that must be factored into their budget because there is no spending limit.

Several business credit cards are available without annual fees, though premium cards offer the best sign-up bonuses, rewards, and perks.

How Do You Get a Business Credit Card?

If you run your own business, you know how important it is to keep track of expenses. You can accomplish this with a business credit card. It is important to have good credit first. The credit score must be high, while the credit limit should be low. Business credit cards may still be available to people with bad credit, but your interest rate will be higher.

A business credit card can be obtained online or from a bank. It’s worth checking with your bank first to see if they offer special deals for businesses. Additionally, you will need to provide your business’s name and address.

Use it responsibly if you’ve been approved for a business credit card. Always make your payments on time, and keep your credit limit manageable. Your business credit score will be improved, and your financial history will be healthy if you do this.

Who Qualifies for Business Credit Cards?

It is almost only possible for a business owner to stay afloat with some form of credit. Credit is often essential for small businesses, whether for inventory, office space, or just day-to-day expenses. You can obtain credit for your business by using a credit card. Who is eligible for a business credit card?

To qualify for a business credit card, you typically need to own a business.

In other words, it means:

- Sole proprietors

- Freelancers

- Small business owners

- Large business owners

- Limited liability companies

- Corporations

All of them will be able to apply for a business credit card. Additionally, you must have good credit to be approved for a business credit card. A business credit card application usually requires your business to have been in operation for at least a year.

The following requirements allow you to apply for a business credit card. A business line of credit can be an important tool for growing your business. Remember to pay your bills on time and use the card responsibly.

Applying for a Business Credit Card

When you apply for a business credit card, the issuer will ask you for information about your business and yourself. Along with your name, address, and Social Security number, you’ll need to provide your company’s tax identification number, name, and business structure, as well as financial information, including sales and profit figures and when and where your business was established.

Potential Problems When Applying for a Business Credit Card

You may encounter a few issues if you are trying to get a business credit card approved. You will probably need a good credit history to get a business credit card, so if your company needs a good credit rating, you may qualify.

The credit limit on your business credit card may be lower than you need to use for your business, even if you are approved for one.

Last but not least, business credit cards have higher interest rates than personal credit cards, so if you carry a balance, it could cost you more in the long run.

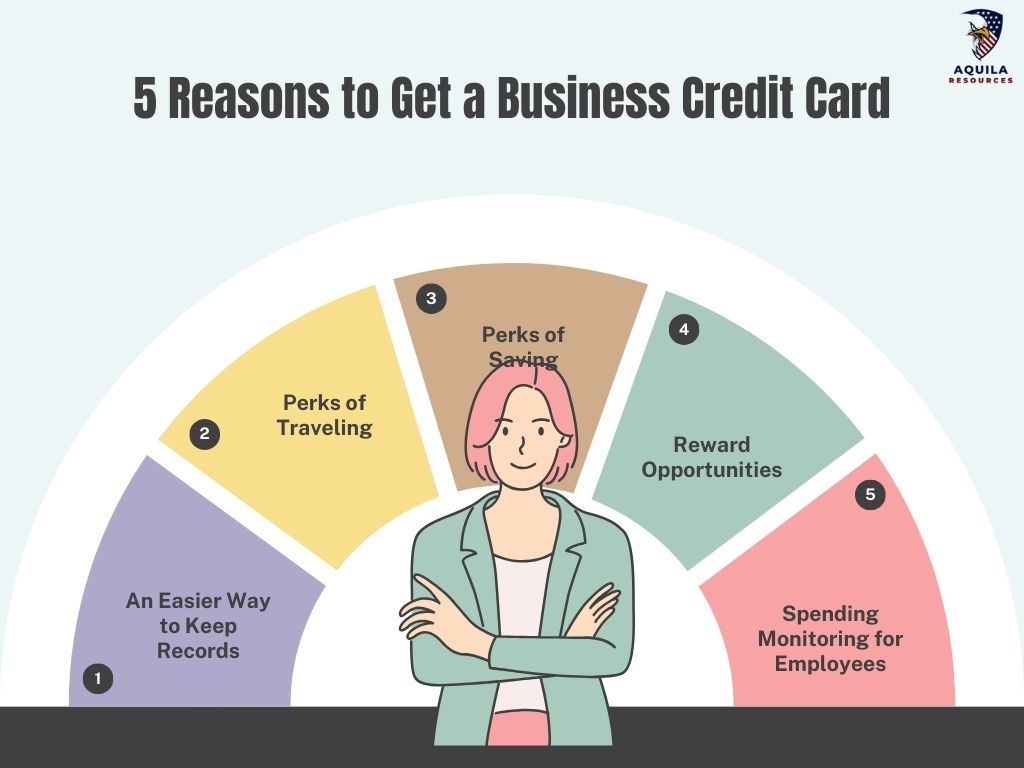

5 Reasons to Get a Business Credit Card

Many businesses choose business credit cards to build their credit rating and increase their credit limits. The following five are also worth mentioning:

An Easier Way to Keep Records

Separating business and personal spending can save a significant amount of bookkeeping time. A tax filing schedule is particularly useful when preparing periodic accounting, applying for a loan, and filing taxes.

Perks of Traveling

Many business credit cards offer airline VIP lounge access, free checked baggage, or discounts on hotel reservations. Some cards offer free companion tickets.

Perks of Saving

A cashback program may offer higher percentages on frequent business expenses such as wireless phone service, office supplies, shipping, and advertising. Business credit cards may also be available with 0% introductory APRs from some lenders. A credit card that rewards you for paying off your balance before its due date may also offer you a higher cashback rate.

Reward Opportunities

The rewards offered to new business credit card accounts are commonly higher at the beginning when a certain spending threshold is met. For example, the first time you spend $10,000 on the card, you could earn 50,000 bonus rewards points. Additionally, gas stations and car rental agencies may offer points multipliers.

Spending Monitoring for Employees

Business credit cards make it easy for employees to make purchases on behalf of the company. You may begin using employee credit cards when your business becomes more financially flexible, has more buying power, and has more personnel. Cashback and rewards point growth can be accelerated, and employee business spending can be better tracked.

What are the Main Features of Business Credit Cards?

You should look for a few key features when choosing a business credit card. Some of these include:

A Business Card May Have a Different Payment Term than a Personal Card

An exclusive business credit card is a type of credit card designed specifically for businesses. Getting a personal credit card with the same features as a business credit card is impossible.

Business cardholders can, for example, take advantage of extended payment terms for large purchases from card issuers. Cardholders can, therefore, pay off their purchases over a longer period without accruing interest.

Business cardholders should contact their card issuer to discuss payment options since payment terms vary depending on the card and issuer.

Credit Limits on Personal and Business Cards Differ

It is also important to note that personal and business credit cards have different credit limits. A business credit card usually has a higher credit limit than a personal credit card. Business expenses are usually higher than those of individuals. A higher credit limit may be helpful if a business owner needs to make large purchases or carry a monthly balance.

However, It is important to remember that if the balance is not paid in full each month, high credit limits can also result in high-interest charges. It is always a good idea for business owners to keep their credit card balances low and to use their cards only for necessary purchases.

Business Cards also Include Rewards.

The rewards on business credit cards are similar to those offered on personal credit cards, such as cashback or travel points. Business credit cards most commonly offer cashback rewards. There are, however, some business cards that offer points redeemable for travel or merchandise. Businesses can save money by giving rewards to their employees.

Rewards are important when choosing a business credit card, but other factors should be considered. When choosing a credit card, a business owner must also consider factors like interest rates, fees, and credit limits.

Business Credit Cards Can Be Obtained Without Registration or Incorporation

Business credit cards are often misunderstood as requiring a registration or incorporation to purchase. The reality is, however, quite different. Credit cards for small businesses are available to sole proprietors and freelancers.

It is only necessary for you to have good personal credit and have been in business for at least a year for your business to qualify. Your business credit card application should be approved if you meet these requirements. The credit you receive from this can help your business grow. Remember to pay your bills on time and use the card responsibly!

Personal Cards are Protected from Liability, but Business Cards are Not

Using a business credit card for your business’s expenses may be an option that appeals to you as a small business owner. There is no doubt that a business card can provide you with significant rewards and benefits, as well as help you keep track of your business expenditures.

Some disadvantages to using a business credit card include a need for more liability protections. Businesses can’t be protected from liability for fraud in the same way that consumers are.

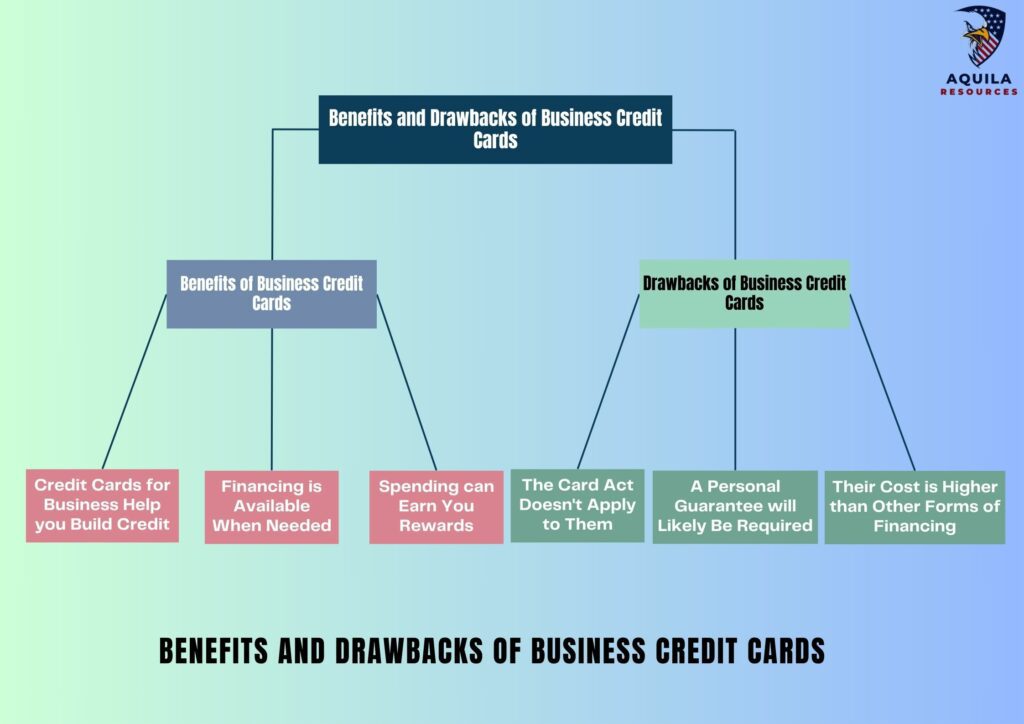

Benefits and Drawbacks of Business Credit Cards

Benefits of Business Credit Cards

Credit Cards for Business Help you Build Credit: Business credit bureaus receive payment history information from business credit card issuers. Building a credit history and strengthening your business credit score can be achieved by making early or on-time payments.

Financing is Available When Needed: It is possible that your business sometimes needs more cash in the bank to keep up with day-to-day expenses and stock up on inventory. When it’s slow season, you may find purchasing what you need with a credit card easier if the card offers 0% APR for the introductory period.

Spending can Earn You Rewards: Business travel cards offer perks such as airline miles, access to airport lounges, and hotel points. A cashback business credit card offers you a percentage back – whether across the board or in specific categories – typically in cash or credit at the end of each statement period.

Drawbacks of Business Credit Cards

The Card Act Doesn’t Apply to Them: New protections for credit card users have been created by the Credit Card Accountability, Responsibility and Disclosure Act of 2009 (Card Act), such as limits on credit card fees and sudden changes in interest rates. The rule only applies to business credit cards, which means interest rates can change without warning, and you may encounter fees you aren’t accustomed to.

A Personal Guarantee will Likely Be Required: Personal guarantees ensure that the card issuer will receive payment if your business cannot pay back the balance. Late payments can affect your business and personal credit, so keeping track of it is important. Personal guarantees are not required on all business credit cards.

Their Cost is Higher than Other Forms of Financing: Consider a business line of credit or a business loan if you need to finance large expenses. There is a greater difficulty qualifying for those products than for business credit cards, but their interest rates typically are lower.

How to Use a Business Credit Card Wisely?

It’s important to use a business credit card responsibly. The following tips will help you:

- Business credit cards should only be used for business expenses. You can keep track of your spending and avoid using personal funds for business purposes if you do this.

- Make sure you pay off your balance each month. You can avoid interest charges and maintain a good credit score if you do this.

- Make sure you keep track of your spending. Maintaining a budget and avoiding overspending will help you stay on track.

- Keep your payments up to date. It would help if you did this to maintain a good credit score.

These tips can help you maximize your business credit card and stay on top of your finances.

How a Business Card Impacts Your Credit?

The issuer will assess your creditworthiness and the likelihood of paying back what you charge with a business card by looking at your credit history and credit score.

It’s important to issuers that there’s somebody responsible if your company cannot repay its debts – or if it goes out of business. Thus, you’ll probably be required to sign a personal guarantee to demonstrate your responsibility if your business can’t repay debts.

A business credit reporting company receives the report from most business card issuers. The major consumer credit bureaus also receive information from issuers like Capital One and Discover. Check your credit card agreement if you want to know who is reporting your debts and payments.

Business credit cards can help you build your business credit score, which can help you discover bigger credit lines and other business loans to grow your business – even if your credit is not great.

Can You Get a Credit Card With an LLC?

Credit cards can help you build your business credit, as you may have heard. When your business is organized as an LLC, what are your options? Does your LLC qualify for a credit card? or can you get Business Credit Cards for LLC?

There is no doubt that you can, but what you need to know first is a few things. Your business credit card issuer might need your Tax ID number before you can approve your application. This is because they need to verify your legitimacy as a business entity.

It is also possible to be required to provide a personal guarantee if your LLC has been operating for less than two years, which means you will be personally liable for the debts incurred by the LLC.

You can use a business credit card like any other to make purchases and withdraw cash from ATMs. However, It is important to remember that any debt the LLC incurs will be its responsibility. It’s best to avoid using a credit card if you need clarification on whether your LLC can handle the payments.

FAQs

Is a Business Credit Card Right for You?

A business credit card can be useful for companies of all sizes. Whether you run a small business with multiple employees or are a solopreneur with a side gig, you may qualify for a business credit card.

Can I get a Credit Card with an EIN?

Yes. Getting a credit card with an EIN is possible. There are a couple of business credit cards I use regularly. The best credit card for your business is a business credit card.

Is It Possible to Use a Business Credit Card for Personal Expenses?

The use of a business credit card for personal expenses is possible. It is not recommended to do so, however. The reason is that you may need help to keep track of your expenses when you use your business credit card for personal expenses. As a result, overspending can occur, potentially jeopardizing the financial stability of your business.

Your credit score can also be damaged if you use your business credit card for personal expenses. The best thing you can do is keep your business and personal finances separate. It is better to use your credit card for personal expenses instead of your business credit card if you need to use a credit card for personal expenses.

What Information Will I Need When I Apply for a Business Credit Card?

The application process for a business credit card requires some basic information about your business. The information you provide here includes the name and contact information of your business and your tax identification number. You will be required to provide financial information as well as your annual revenue and monthly expenses.

Do Business Credit Cards Build Credit?

There are several ways in which a business credit card can help build credit. A business credit card can help you improve your credit score by paying the balance in full each month and on time.

If your credit score is good, you will be able to get better rates on loans and credit lines in the future. A business credit card can also increase your credit score since it typically has a higher credit limit than a personal credit card.

You can also save on travel and office supplies with certain business credit cards that offer rewards and perks. Credit cards can help build good credit when used wisely.

Can You Get a Business Credit Card with No Credit Check?

The answer is yes; you can apply for a business credit card without a credit check. Credit scores and credit limits with no credit check business credit cards are lower than

Add Comment