Are you looking for Best Unsecured Credit Cards with Fair Credit? If Yes, You are at the right place.

In this article, We are sharing all the information about Best Unsecured Credit Cards with Fair Credit.

It is often difficult for people with fair credit to obtain credit when needed. When getting a credit card, you may have many questions about whether you fit this description. People with fair credit are most likely to receive secured credit cards requiring a cash security deposit. However, some unsecured credit cards can help you establish or improve your credit score.

What Is an Unsecured Credit Card?

Contents

- 1 What Is an Unsecured Credit Card?

- 2 What Are Unsecured Credit Cards With Fair Credit?

- 3 Best Unsecured Credit Cards for Fair Credit

- 4 How to Apply for Unsecured Credit Cards with Fair Credit?

- 5 Who Can Get an Unsecured Credit Card with Fair Credit?

- 6 How to Pick the Best Unsecured Credit Card with Fair Credit?

- 7 How To Choose the Best Unsecured Credit Card with Fair Credit?

- 8 What to Avoid with Credit Cards with Fair Credit

- 9 How to Repair Your Credit with a Credit Card?

- 10 Alternatives to Credit Cards for Fair Credit

- 11 FAQs

An unsecured credit card doesn’t require a deposit or collateral to open an account. There are several types of credit cards, but this is the most commonly used.

A person with fair credit poses a high risk to creditors. Applicants with fair credit are denied new cards because they have a greater chance of defaulting than those with higher scores. The purpose of credit cards for people with fair credit is to give them a second chance while protecting the lender from default.

What Are Unsecured Credit Cards With Fair Credit?

Unsecured credit cards for fair credit do not require a cash deposit like secured credit cards. Credit cards are traditional payment methods that can be used for purchases and are charged interest and late fees.

The issuers of unsecured cards with fair credit mitigate their risk by charging high annual percentage rates, steep penalties for late payments, and regular maintenance fees. As a result of the higher cost of using the card, issuers can make more money upfront if a cardholder defaults. A fair credit unsecured card typically has a lower credit limit than a secured card, though normally, it is a higher limit than a secured card.

Best Unsecured Credit Cards for Fair Credit

Here are some of the Best Unsecured Credit Cards for Fair Credit:

Mission Lane Visa Credit Card

The Mission Lane Visa Credit Card could be a good choice if you’re looking for a straightforward, unsecured card that helps build credit. This unsecured credit card for fair credit stands out because it offers a low annual fee of up to $59 and no hidden fees, which are common on subprime cards. Plus, depending on your creditworthiness, you may qualify for a $0 annual fee.

Pros

- No annual fee, based on creditworthiness

- If you pay your bills on time for seven months, your credit limit may be increased

- All three credit bureaus are notified

Cons

- A $59 annual fee (offered through Bankrate; otherwise, $75) exists.

- A $300 credit limit is the minimum starting credit limit

- There are no rewards

Avant Credit Card

A credit card like Avant can be used with bad or fair credit, and you can check if you qualify without worrying about it affecting your credit score. You won’t necessarily be accepted if you’re prequalified, but it’ll give you a good idea of your chances. There are no rewards programs or balance transfer capabilities on this card, and it has a $59 annual fee.

Pros

- All three credit bureaus are notified.

- Increasing credit lines proactively.

- Credit limit of $300 – $3,000.

Cons

- There are no rewards.

- There will be no balance transfers.

- There is an annual fee.

Credit One Bank Platinum Visa for Rebuilding Credit

The Platinum Visa from Credit One Bank is an excellent choice, a popular unsecured credit card for consumers with fair credit. Using this card, you can earn 1 percent cash back on gas, groceries, mobile phones, internet, cable, and satellite TV service purchases. Additionally, you can access your credit score for free, which will help you track your progress in achieving better credit.

It’s important to keep in mind, however, that there’s a substantial downside to cashback. There is an annual fee of $75 for the first year, followed by a fee of $99. Choosing this card for cashback purposes wouldn’t make sense since you would have to spend $9,900 to offset the $99 annual fee. Consider the possibility of a no- or low-annual-fee alternative.

Pros

- The most popular spending categories will receive 1 percent cash back

- You can access your credit score for free

- Your credit report won’t be impacted by prequalification.

Cons

- The credit limit can be as low as $300

- The annual fee is $75 for the first year and then $99 ($8.25 monthly) afterward.

Capital One Platinum Credit Card

Capital One Platinum Credit Card helps people with fair or limited credit build credit through responsible use. The eligible cardholders will automatically be considered for a higher credit line in as little as six months. There are no annual or foreign transaction fees, and Eno, the Capital One assistant, gives account alerts and provides emergency card replacements.

Unlike the Capital One QuicksilverOne Cash Rewards Credit Card, the card lacks a rewards program offered to consumers with the same credit scores. The app also offers no noteworthy perks, which might not matter to you if building credit is your main goal. You can use the card for in-store purchases using tap-to-pay technology, and you can enroll in autopay to have your credit card payment made automatically each month.

Pros

- Unsecured option for those with less-than-perfect credit.

- The credit line will automatically be increased after six months for eligible cardholders.

- There is no annual fee and no foreign transaction fee.

Cons

- There is no rewards program included.

- It charges a rate of 30.74% per annum (variable).

Capital One QuicksilverOne Cash Rewards Credit Card

A Capital One QuicksilverOne Cash Rewards Credit Card earns 5% back on hotels and rental cars booked through Capital One Travel, a website operated by the issuer. All other purchases earn 1.5% back. With this card, a rotating bonus category or spending limit won’t be necessary, and rewards aren’t capped.

The annual fee is $39, but you get benefits such as anti-fraud protection and free credit monitoring from CreditWise from Capital One. Capital One’s mobile app also provides account management, enhanced security, and 24/7 customer service.

This card requires at least fair credit to be approved. Credit can be built, and a higher limit can be earned through responsible usage. Your credit line could be increased in six months if the issuer automatically reviews credit lines.

Pros

- Get unlimited 5% cash back when you reserve a hotel or rental car through Capital One Travel and unlimited 1.5% cash back on everything else.

- If you qualify for a higher credit limit after six months, you might qualify for a higher one.

- If your transaction is processed outside the U.S., you will not be charged a foreign transaction fee.

Cons

- A $39 annual fee applies to the Capital One QuicksilverOne Cash Rewards Credit Card.

- Purchases, balance transfers, and cash advances are charged a 30.74% APR (variable).

- Unlike many other rewards credit cards, there is no sign-up bonus on the Capital One QuicksilverOne Cash Rewards Credit Card.

How to Apply for Unsecured Credit Cards with Fair Credit?

Here’s how you can apply for Unsecured Credit Cards with Fair Credit –

- Make sure there are no errors on your credit reports.

- Find a card that suits your needs. You can find suggestions for good cards on the list above.

- If the company offers preapproval, check its website before applying. Then, you’ll know whether your application will be approved.

- Make sure you read the terms and conditions.

- Visit the company’s website to apply. If you fill out an application, your credit score may be lowered slightly since issuers usually perform hard inquiries at this stage.

- The best way to establish good habits is to use your card properly as soon as you receive it.

Who Can Get an Unsecured Credit Card with Fair Credit?

Unsecured credit cards for fair credit are designed to help people with trouble qualifying for regular cards get approved. The approval requirements on these cards are lower, so even people with fair credit may qualify. The good thing about them is that they can help you rebuild or establish your credit, but they often come with drawbacks, such as high-interest rates and fees.

The benefits of unsecured credit cards for fair credit include:

- Have a fair FICO score (669 and below)

- Want to establish a credit history

How to Pick the Best Unsecured Credit Card with Fair Credit?

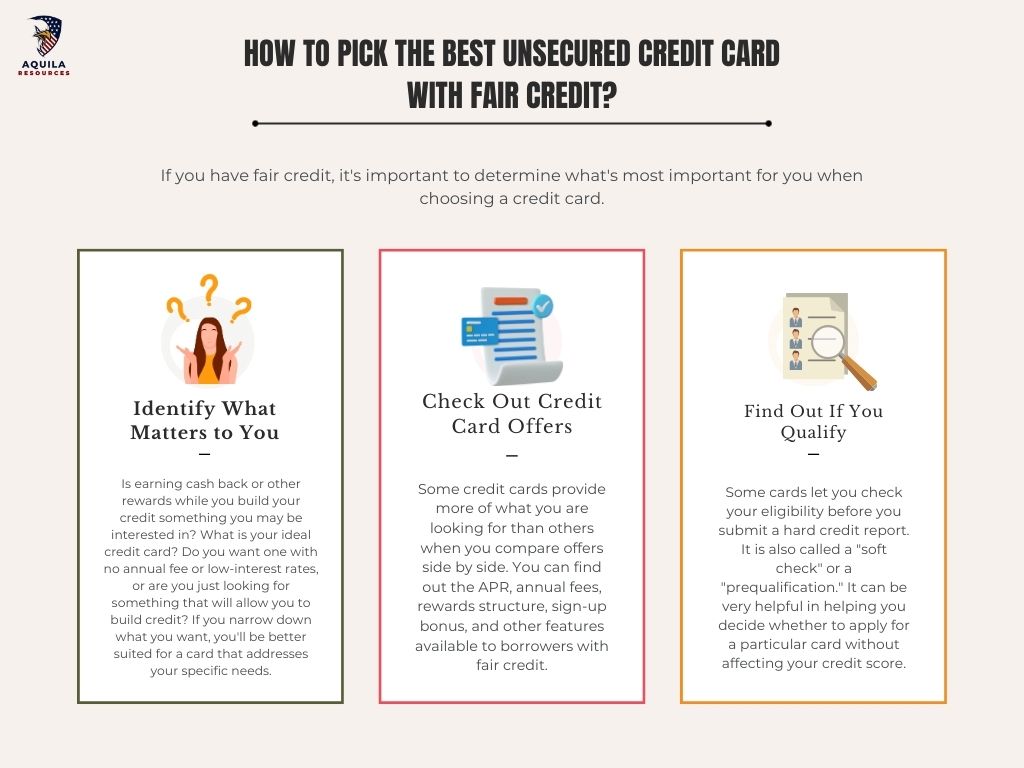

If you have fair credit, it’s important to determine what’s most important for you when choosing a credit card.

Identify What Matters to You

Is earning cash back or other rewards while you build your credit something you may be interested in? What is your ideal credit card? Do you want one with no annual fee or low-interest rates, or are you just looking for something that will allow you to build credit? If you narrow down what you want, you’ll be better suited for a card that addresses your specific needs.

Check Out Credit Card Offers

Some credit cards provide more of what you are looking for than others when you compare offers side by side. You can find out the APR, annual fees, rewards structure, sign-up bonus, and other features available to borrowers with fair credit.

Find Out If You Qualify

Some cards let you check your eligibility before you submit a hard credit report. It is also called a “soft check” or a “prequalification.” It can be very helpful in helping you decide whether to apply for a particular card without affecting your credit score.

How To Choose the Best Unsecured Credit Card with Fair Credit?

To find the best unsecured credit card for fair credit, follow the steps below.

Know Your Credit Score

There are a lot of cards on this list that are designed for people with bad credit. You can decide more on who might be approved for which cards once you know your credit score. Applying is always a good idea, even if your credit score is bad. Many credit cards for bad credit holders won’t affect your credit score for prequalification, so it’s worth getting one. One of the major credit bureaus can provide you with your credit score.

Evaluate Your Credit Options and Spending Habits

What is the purpose of getting a credit card? Will it help you rebuild your credit or be used for a large purchase? Do you plan to pay off your card immediately, or will you carry a balance? There are a lot of factors to consider when choosing an unsecured credit card. It is important to consider things like APRs, credit limits, and annual fees.

Analyze the Benefits and Drawbacks

The next step is to decide which option is right for you based on your understanding of your options. Is the annual fee worth it if you get cashback? What are the benefits of dealing with low limits when building credit? This is a decision only you can make.

Read the Fine Print

Make sure you read all the terms and conditions of the card before you decide to use it. Understanding all fees, including the annual fee, late fees, foreign transaction fees, and introductory or sign-up fees, is essential. Find out what the APR is (and whether there is a promotional APR).

Determine whether any preapproval processes will affect your credit score and whether any increases in credit limits will affect your credit rating. After you know everything there is to know about the card, it is time to apply.

What to Avoid with Credit Cards with Fair Credit

There is no such thing as a perfect credit card, especially for credit cards designed specifically for those with fair credit. Here are some things to avoid:

High Fees and APRs

The fees on some cards may be necessary, but others charge excessive fees without offering much in return. There are credit cards that offer competitive APRs or minimal annual fees.

Rewards Cards that Don’t have Good Redemptions

Occasionally, you’ll see a card offer that claims to offer travel rewards, but when you read the fine print, you’ll find that the redemptions are limited.

Carrying a Balance

The card should be paid off in full every month. This is so important that it deserves to be repeated multiple times. You cannot reach your financial goals if you carry credit card debt. Don’t purchase it if you can’t pay it off in full.

Applying for Any Card

Make sure you carefully choose the card(s) you apply for. The more credit applications you make, the lower your credit score and the less likely you will receive approval.

How to Repair Your Credit with a Credit Card?

When it comes to repairing your credit with a credit card, there is no easy solution, but the following tips will help you get the best results quickly.

- Make Sure You Pay Your Bills on Time: The most important factor affecting your FICO score is your payment history, so paying all your bills promptly is important. On-time payments can play a vital role in credit scores, while late payments can severely harm your score.

- Maintain a Low Credit Card Balance: Consider your credit utilization ratio when calculating your FICO score. Keeping your balance below 30% of your available credit is best to achieve the best results. You should keep your balance under $90 if your credit limit is $300.

- As Soon as Possible, Ask for a Higher Credit Limit: It is possible to lower your utilization rate by getting a higher credit limit if you carry a balance. A credit line increase is a good idea if you are eligible anytime. However, when you have increased your card limit, charge only what you can afford.

Alternatives to Credit Cards for Fair Credit

There are other ways to get financing than using a credit card.

- Personal Loans: An installment loan issued by a lender is a personal loan. If you request an amount, your credit will be checked, and the amount will either be approved or denied. Some lenders offer soft credit checks that won’t affect your score.

- Payday Loans: The purpose of a payday loan is to provide you with short-term financing that you pledge to repay when your next paycheck arrives. A payday loan’s high APR makes it a last resort and a predatory loan, as they are very expensive.

- Home Equity Loan: Home equity loans and Home Equity Line of Credit (HELOC) can be obtained if you own a home with significant equity. Because you are putting up your home as collateral, you get much lower interest rates than a credit card.

- Title Loans: You may be able to get a loan against the value of your vehicle if you own it outright. There is also a high cost associated with these loans.

- Private Lending: There is more than just the bank of mom and dad to turn to for money. You may also be able to find private lenders.

FAQs

Is It Possible to Get an Unsecured Credit Card with Fair Credit?

The answer is yes; you can get an unsecured credit card even if you have Fair or poor credit. All of these credit cards are designed for individuals with bad credit. You can rebuild your credit with these unsecured cards, even if they don’t offer many rewards and may include fees.

How can I Get Approved for a Credit Card with Bad Credit?

If you have a bad credit history, you should only apply for credit cards designed specifically for people with that credit history. These cards can be approved even if they require a security deposit or a considerable annual fee.

Is There a Limit on an Unsecured Credit Card?

The limits on unsecured credit cards vary—and the limits on unsecured credit cards for bad credit are lower. Those with bad credit will typically have unsecured credit cards with credit limits of $300 to $3000, depending on their creditworthiness.

Add Comment