Are you looking for the Best Credit Cards for Buying a Car? If Yes, You are at the right place.

In this article, We are sharing all the information about Best Credit Cards for Buying a Car.

Buying a car is a very big decision, which can take a lot of research and planning, including figuring out how to pay for the car. Most people need more cash to buy a new car outright, so they take out an auto loan.

If you are in a position to do so, you may also require a rewards credit card or one with a zero percent introductory APR offer to finance your car purchase. Your credit limit is between $20,000 (Read: Credit Cards with $20000 Limit Guaranteed Approval) and $30,000, so you could receive rewards points and cover the cost of a car.

The decision to purchase a car is one almost everyone must make at some point in their lives. The primary concern you have regarding the car is likely its price. A credit card could be one of your payment options if you want to avoid financing your purchase or paying cash. A credit card that offers rewards on a large purchase like a car can significantly affect how much money you save (or even make).

Do Car Dealers Accept Credit Cards?

Contents

- 1 Do Car Dealers Accept Credit Cards?

- 2 How Can I Buy a Car with a Credit card?

- 3 Top 4 Best Credit Cards for Buying a Car

- 4 Why Would You Purchase a Car With a Credit Card?

- 5 How Do You Purchase a Car With a Credit Card?

- 6 Is Using a Credit Card to Buy a Car a Good Idea?

- 7 How to Use a Credit Cards for Buying a Car?

- 8 Benefits and Drawback of Credit Cards for Buying a Car

- 9 Alternatives to Using Credit Cards for Buying a Car

- 10 FAQs

It depends on the situation. Many dealerships accept credit cards as payment for full vehicle amounts and down payments on car loans, while others don’t. A dealer must pay a credit card processing fee every time it accepts a credit card payment, and these fees typically range from 1% to 3.5%.

The processing fees associated with large purchases can add up quickly. The dealership would have to pay $900 on that one transaction if you bought a $30,000 car with a credit card, and the fee was 3%. The payment options dealerships accept include cash, money orders, personal checks, cashier’s checks, and ACH transfers to avoid hefty credit card processing fees.

How Can I Buy a Car with a Credit card?

Having a plan before using your credit card to purchase a vehicle is important. The interest rates on credit cards are usually much higher than on auto loans, so you should only use your credit card for car purchases if you know how you’ll pay the balance off. If you have the cash to cover the car purchase, you could use a credit card to pay for it. As a result, you will earn huge rewards and be able to pay off your balance before any interest is charged.

If your credit card offers a 0 percent introductory APR, then charging a car to your credit card may also make sense. This would allow you to pay off your car for a limited period without interest and earn rewards. However, you may have to pay some large monthly payments depending on the cost of the car. Your new credit card’s variable interest rate will return as soon as the introductory offer ends.

Top 4 Best Credit Cards for Buying a Car

Here are some of the Best Credit Cards for Buying a Car:

Blue Cash Preferred Card from American Express

A credit card for buying a car does not need to be from a specific brand. You can earn rewards in other areas of your life with a flexible credit card. You can earn competitive cashback rates on regular expenses when you use the Blue Cash Preferred Card from American Express:

- The first $6,000 spent yearly at U.S. supermarkets will earn you 6% cash back.

- You can get 6% back on selected U.S. streaming subscriptions

- Transit refund of 3%

- Gas stations in the U.S. offer 3% back

- All remaining purchases will receive 1% back

CIT Bank and Quontic Bank offer high-yield savings accounts where you can accumulate cash rewards from daily purchases. The FDIC Insurance provides coverage while you wait to buy, and you can earn a competitive interest rate while you do.

You can earn a $250 statement credit after spending $3,000 in purchases on your new Blue Cash Preferred Card from American Express in the first six months. There is no annual fee for the first 12 months, and then it increases to $95 each year for renewals (see Rates & Fees). The fee for foreign transactions is 3%.

Toyota Rewards Visa Credit Card

Toyota Rewards Visa Credit Cards are also popular choices since Toyota is one of the most purchased brands in the country. You can earn 5x points with your purchases:

- Toyota dealerships offer 5x

- Two times for gasoline, dining, and entertainment

- The remaining purchases will be redeemed 1x

The points you earn can be redeemed for purchases of eligible Toyota vehicles. Various other options are available, including service, parts, and accessories. This card has no annual fee but a foreign transaction fee of 3%.

Note: The card issuer has not reviewed this information.

Wells Fargo Active Cash Card

The Wells Fargo Active Cash Card offers unlimited 2% back on every purchase, so it’s simple to calculate your earning potential. Redeeming your purchase rewards with a $1 minimum redemption requirement is possible. Expenses associated with this card are also covered up to $600 if you pay your monthly bill with the card (subject to a $25 deductible).

When new Wells Fargo Active Cash Card users make $1,000 in purchases during the first three months, they can earn a $200 cash rewards bonus. The bonus cash rewards will appear redeemable within one or two billing periods after earning them. An annual fee is not charged, but foreign transactions are subject to a fee of 3%.

Chase Freedom Unlimited

The Chase Freedom Unlimited is a versatile rewards card with no redemption minimums and earns points and cash back as you use them. As long as you earn at least 1.5% on purchases with this credit card, obtaining a car loan might be the best choice.

You can earn 5% back on your card purchases:

- Travel purchases made with Chase Ultimate Rewards earn 5%

- Delivery and dining services are eligible for a 3% discount

- A 3% discount is available at drugstores

- The rest of your purchase will be charged at 1.5%

Earning 1.5% back on non-bonus spending increases your earning potential by 50% compared to cash back or travel rewards cards that only give 1% back.

The redemption value of your rewards points is 1 cent per point. Rewards can be redeemed for cash back, award travel, and gift cards. If you wish to buy your next ride with rewards, deposit them into a dedicated account. There is no annual fee but a fee of 3% for foreign transactions.

Why Would You Purchase a Car With a Credit Card?

When you use your credit card to purchase a car, you can benefit from points or rewards more broadly. Cash is the most common way to purchase a car, but borrowing money is also an option. The 0% interest credit card may save you money if you purchase a car through a dealership that offers 0% APR financing. The average credit card offers 0% APR for 24 months or less.

Credit cards are only useful when they can earn you a nice chunk of points. A car purchase can make it super easy to earn a welcome bonus if you sign up for a credit card with a bonus and spend the minimum.

How Do You Purchase a Car With a Credit Card?

You’re at the right place if you’d like to receive a solid 2% to 4% reward on your car purchase.

There are a few expectations we should set up front, however. The fees associated with accepting credit cards threaten the profits a car dealer is looking to make from you. There may be some limitations on the acceptance of credit cards by dealerships. It is common to see dealers only allow you to use a credit card for the down payment, but others may only accept some.

Even though your mileage may vary, you should always negotiate the price of the car and then use a credit card to pay for it.

Is Using a Credit Card to Buy a Car a Good Idea?

If you are planning to buy a car using a credit card, here are a few things to keep in mind:

- Amount. A credit card’s maximum limit depends on the card, but it is usually around $5,000 or less. It is possible to use cards with high enough limits to finance the entire car, but most of the time, you will be limited to smaller cars or purchases you can make with the card.

- Restrictions on Dealerships. You should ask the finance manager whether a credit card is an option before purchasing a vehicle. The dealership may also charge additional fees (up to 4%), which can eat into your reward points, even if they accept credit cards.

- Cost of the Vehicle. The purchase of a vehicle may only sometimes be a good idea, even if you can put most or all of it on a credit card since balances that carry over from month to month will accumulate interest (except during a 0% intro APR period). Because of this, your total purchase price can be increased by hundreds or even thousands of dollars.

- Credit Score Impact. A high credit utilization rate can negatively impact your credit score if you carry a balance from month to month and keep a high balance overall on your card.

Finding a dealer who accepts credit cards as payment is possible, but the risk of high credit utilization and interest accumulation on a large balance may be challenging. Nevertheless, you can outweigh some disadvantages by choosing a card that offers 0% APR for a limited period and rewards for purchases.

Credit card APRs are typically much higher than auto loan rates, so using a credit card should only be done if you intend to pay off the balance in full before interest accrues.

How to Use a Credit Cards for Buying a Car?

The following steps should be taken before you use your credit card to purchase a card:

- Check with Your Credit Card. It is important to make sure the purchase goes through, especially if you have recently applied for a credit card. Ensure you are aware of your credit limit and any other restrictions you may have on the purchase or earning rewards. Also, notify your issuer in advance, as large and unusual transactions, like vehicle purchases, are likely to be flagged as suspicious.

- Find a Dealer. Some dealerships don’t accept credit cards, so you’ll need to research to find one that does. Check if there are any fees associated with using a credit card. Be open to other financing options if you find one that works better. Expect the dealership to push its financing options on you.

- Weigh the Risks. There are many benefits to using a credit card that offers rewards and a 0% intro APR, but there are also risks, including high ongoing APRs, credit limits, increased credit usage, and risks to your credit score. Prioritize the benefits over the risks.

- Create a Payback Plan. Set up a repayment plan to avoid accruing interest, especially if you take advantage of 0% introductory introductory APR offers.

The following are some advantages of using your credit card to purchase a new car.

Benefits and Drawback of Credit Cards for Buying a Car

Here are the Benefits and Drawback of Credit Cards for Buying a Car –

10 Benefits of Credit Cards for Buying a Car

Here are the Benefits of Credit Cards for Buying a Car–

Interest Rates are Lower

A credit card’s interest rate is relatively low compared to other forms of credit, such as personal loans and auto loans. The result is that using a credit card for car financing is the best and cheapest option.

No Associated Fees

Another benefit of using a credit card to purchase a new car is that you will have to pay less interest. You don’t need to worry about any fees or other charges associated with your credit card. Thus, it is the best method for paying off credit cards since it will limit your costs.

Preapproval is Not Required

Any bank or finance company will require prior approval before giving you a loan. However, you will be preapproved for the loan if you have a credit card. You only need to check your credit score for a car loan to ensure you qualify.

Additional Protection

When you purchase a car with a credit card, you get an assurance that your purchase will be protected further. The use of a credit card goes hand in hand with it. Hence, this is an excellent way to finance a car.

The Zero Percent Credit Card Program

There are numerous credit cards with long 0% credit card offers. The owner can pay off his debt with a fixed monthly payment. This means you can take advantage of the same without paying interest.

No Additional Fees

You can save on other loan categories by avoiding additional charges compared to your credit card purchases.

Earn Rewards or Cash Back

Your new car purchase can earn you cashback rewards when you use your credit card to spend a lot of money. Additionally, you can earn other reward points that you can store and use at your discretion.

No-Interest Pre-Closure

Pre-closure of the monthly installments is possible without any charges if you can pay off the remaining car loan amount.

Minimum Monthly Installment

You can use your credit card to buy a car. The EMI for your car will only consist of a minimum monthly installment.

These are some major advantages of using a credit card to buy a car. As we move forward, let’s discuss the potential drawbacks of financing a car with a credit card. Here are some disadvantages of purchasing a vehicle on a credit card that might change your mind.

10 Drawbacks of Credit Cards for Buying a Car

Here are the 10 Drawbacks of Credit Cards for Buying a Car –

Impact Your Credit Score

The credit card number you provide with every inquiry for a new car is used to check your eligibility. Due to this, your credit score could be affected negatively.

Your Card Can Be Locked

If you do not pay the amount, your credit card’s limit will block your account. Therefore, the card may only be able to be used after that.

Balance Transfer Cannot Be Guaranteed

There is no guarantee that you will be able to transfer balances to the credit card used for the credit card. While you may not be able to pay for your car purchase in full using your credit card, you could still make a down payment.

Reverse Rate

Many credit cards charge revert rates. Cash advance interest rates are much higher than credit card interest rates, typically charged when using a credit card.

Annual Fee

Additionally, credit cards charge an annual fee. There is a very high annual fee for this. A cardholder who pays the amount annually will end up paying a lot.

Addition of Up-Front Cost Over Time

Credit card use while buying a new car might result in an additional upfront cost over time if one uses a credit card.

Fewer Options Available

You should know that only some card dealers accept credit cards for payment. The available options in the market are thus very limited, making selection difficult.

Surcharge for Credit Cards

A credit card user will occasionally have to pay the surcharge amount when using the card. Thus, the purchaser may be burdened with more financial obligations. It should not be necessary to charge any hidden fees.

Cash Advance Fees

The extra cost of withdrawing cash against a credit card to pay for an automobile might be incurred if you withdraw cash against the card. The fees charged by a credit card for cash withdrawals will increase once you withdraw money from the card. Credit cards are rarely used to withdraw cash, so people tend to only withdraw cash from them if there is a high emergency.

Credit Card Fraud

Credit cards are commonly used to purchase a car but have some serious drawbacks. The use of credit cards can be fraudulent in certain cases. Many people deem buying a car with a credit card risky because they are afraid of using it.

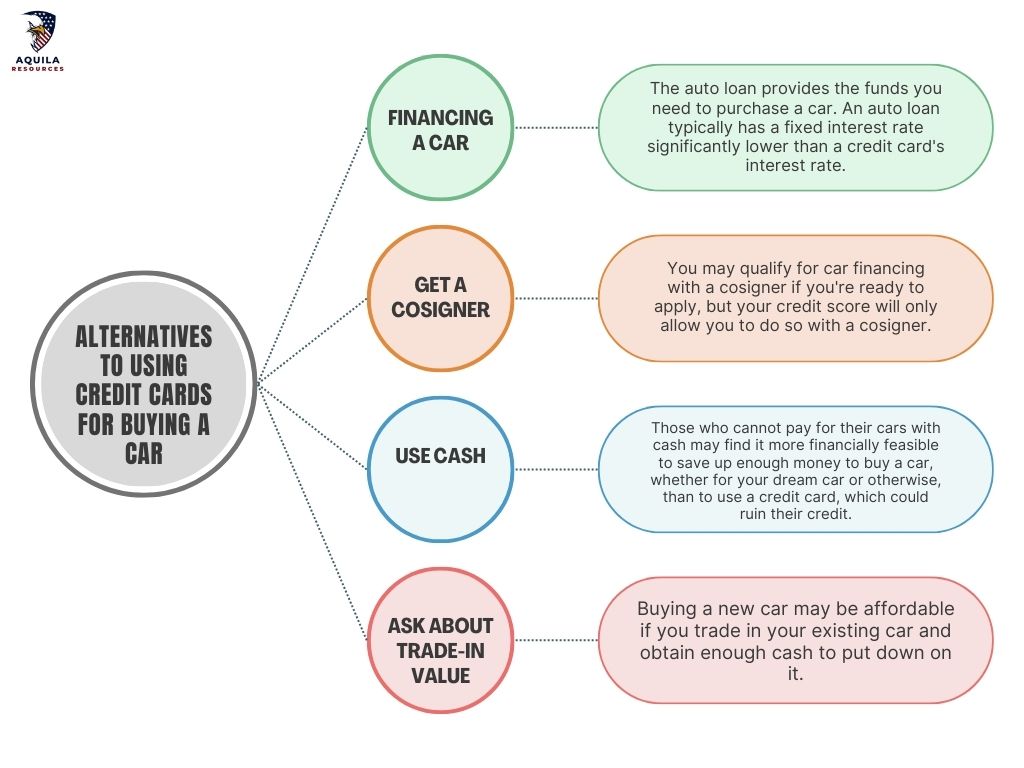

Alternatives to Using Credit Cards for Buying a Car

The benefits of using a credit card to buy a new car will depend on your financial situation, including whether you get a tempting sign-up bonus or a 0% APR period. The downside is that if you have a little money but want to buy a car, you will also be in a lot of debt. There are other options you can choose. The following are a few alternatives of Credit Cards for Buying a Car:

- Financing a Car: The auto loan provides the funds you need to purchase a car. An auto loan typically has a fixed interest rate significantly lower than a credit card’s interest rate. There may be lenders who will work with you if you have bad credit and are hesitant about car financing.

- Get a Cosigner: You may qualify for car financing with a cosigner if you’re ready to apply, but your credit score will only allow you to do so with a cosigner. Your goal is to find someone with good credit who offers a low-interest rate so you can increase your chances of qualifying for a loan. Cosigners could be family members, partners, or close friends willing to take responsibility.

- Use Cash: Those who cannot pay for their cars with cash may find it more financially feasible to save up enough money to buy a car, whether for your dream car or otherwise, than to use a credit card, which could ruin their credit.

- Ask About Trade-In Value: Buying a new car may be affordable if you trade in your existing car and obtain enough cash to put down on it. It would help if you never gave up on trying to sell your car, no matter the value.

FAQs

Can You Use a Credit Card for a Car Down Payment?

Yes, absolutely! The down payment can usually be paid with a credit card at almost all dealerships. It is possible to pay for an entire car with a credit card at some locations, but it will depend on the location.

Does Buying a Car Affect Your Credit Score?

It does not matter whether you purchase a vehicle with a credit card or with an auto loan; it can impact your credit score. You can lose up to a few points if both trigger a hard pull on your credit report. Your credit utilization and payment history can also be affected by your credit habits.

Do Car Dealers Care About Credit Scores?

Yes, a good credit history indicates that you’re responsible with your credit and can afford the vehicle you’re interested in buying. The interest rate on your loan could be lowered if your credit score is good or excellent.

Add Comment