Are you interested to know about the $5000 Cash Advance Credit Card? If your answer is yes, you’re on the right page.

The number of places where you can use a credit card is increasing, but there are still some places where you need cash. A cash advance on your credit card can seem like a great solution if you need cash fast. Is it worth it?

A Cash Advance Credit Card is exactly what it sounds like withdrawing money from your card’s credit line using the credit card. There are typically fees and higher interest rates associated with cash advances, which can offer flexibility. Cash advances can also include other types of transactions.

In this article, we will explain how the best Cash Advance Credit Card works and how you can get it.

Now, let’s get started.

What is A Cash Advance?

Contents

- 1 What is A Cash Advance?

- 2 What is A Credit Card?

- 3 What Is A Credit Card Cash Advance?

- 4 Top $5000 Cash Advance Credit Card

- 5 How To Qualify For $5,000 Cash Advance Credit Card?

- 6 The High Costs of A Credit Card Cash Advance

- 7 What is The Best Way To Increase My Credit Limit?

- 8 Alternatives To $5000 Cash Advance Credit Card

- 9 Pros And Cons of Cash Advance Credit Card

- 10 How Much Should You Spend on A $5,000 Cash Advance Credit Card Limit Card?

- 11 FAQs

- 12 Conclusion

Banks or alternative lenders offer short-term loans through cash advances. Many credit card issuers provide cardholders with this service, which allows them to use the available credit to withdraw cash. Borrowers are attracted to cash advances because they offer quick approval and fast funding, but they feature steep interest rates and fees.

What is A Credit Card?

Credit cards are very common nowadays, and they are used for both online purchases and in-store purchases. Credit cards are used to pay for goods and services with the promise to pay back the exact amount later. If you use a credit card for a purchase, you authorize the credit card company to purchase on your behalf.

Your monthly statement will record every purchase you make on your credit card. You will receive a statement listing your transactions and your minimum due at the end of each statement cycle. The minimum payment must be made by the due date – at least 21 days after the statement date.

You can avoid interest charges by paying off your balance in full each month. However, if you carry a balance, you will be charged interest on the remaining balance.

What Is A Credit Card Cash Advance?

Credit card issuers offer cash advances as small, instant loans. The process of applying and waiting for approval is different from traditional loans. Your debit card simply allows you to withdraw funds from an ATM, bank, or credit union. However, unlike with a debit card, you will have to pay interest and fees since you won’t be able to withdraw funds from your checking account. Also, there are Instant Approval Credit Cards With Cash Advance available.

Top $5000 Cash Advance Credit Card

Here are the top $5000 Cash Advance Credit Cards–

Chase Sapphire Reserve

This card is a member of Visa Infinite and one of the top premium credit cards in the world. Its minimum credit limit is $10,000. Taking advantage of the benefits of this card doesn’t come at a steep price – if you travel often, you’ll likely be able to get a much greater return on your investment. Its Sapphire sibling and this card’s credit limit have been quoted in forums as being in the hundreds of thousands.

A premium travel card offering a variety of rewards and elite travel benefits, the Chase Sapphire Reserve boasts a multi-faceted rewards program. Travel and dining bonuses are available with a card that offers redeemed options to maximize your rewards.

With the card’s outsized sign-up bonus, you can earn rewards immediately and enjoy several additional benefits, including an annual travel credit, expedited airport security access, and complimentary lounge access. Travel rewards and benefits may make up for the Chase Sapphire Reserve®’s $550 annual fee.

Capital One Venture Rewards Credit Card

It offers a variety of benefits and a surprisingly low annual fee for a metal Visa Signature card from Capital One. Cardholders earn points that never expire as long as their account remains open. It is not unusual for this card to have credit limits between $30,000 and $50,000. A minimum credit limit of $5,000 can be obtained with the Capital One Venture Rewards Credit Card, but applicants must have excellent credit scores, high incomes, and clean credit histories to qualify.

The card is great for travelers as it offers rewards and benefits related to travel. Card members who spend $4,000 within their first quarter will receive 75,000 bonus miles. A foreign transaction fee is also not charged with this card. You can also access Capital One Lounges at airports with this card, as well as 24-hour travel assistance services and collision damage waiver coverage for auto rentals.

Star One Visa Signature Rewards Card

There is no credit card you will need other than the Visa Signature Rewards Card. The minimum credit limit of $5,000 and excellent credit score make you eligible. It may be limited to Silicon Valley, but Star One is one of nearly 6,000 shared branches where members can bank at partnered credit unions. A CO-OP ATM network has around 30,000 fee-free ATMs available to members.

There is something special about Star One’s checking accounts. They earn interest, have no monthly fees, and reimburse ATM surcharges. However, Star One doesn’t offer the most competitive money market rates and offers a limited selection of share certificates.

DCU Visa® Platinum Credit Card

A low interest rate and minimal fees make the DCU Visa Platinum Credit Card the best choice for credit card holders. Since DCI Visa Platinum has no rewards, intro APR offers, or a stack of monetary perks other than favorable rates and fees, it might not offer much value for people. DCU Visa Platinum Credit Card is only available to members of DCU Federal Credit Union (DCU). This card offers little rewards, but it advertises a low APR, which makes it an attractive choice if you plan on carrying a balance.

DCU Visa Platinum offers an industry-low APR for long-term debt repayment, but a 0 percent balance transfer offer may be a better offer for paying off short-term debt on a current credit card.

How To Qualify For $5,000 Cash Advance Credit Card?

You can increase your credit limit in a few different ways.

High Credit Score

Several factors determine an applicant’s credit card limit, including his or her credit score, credit history, and income. The higher your credit score, the higher your credit line on an unsecured credit card.

Good Credit History

To get a higher credit limit on your card, you need to maintain good credit habits and maintain a clean credit history. The reason for this is that credit card issuers perform credit checks to determine whether there has been a history of adverse credit, like high debt levels, frequent late or missed payments, or bankruptcy.

Consistent Income

A credit card company’s credit limit is also determined by several other factors, such as income and debt-to-income ratio. Your regular income is important to getting a higher credit line. Companies differ in terms of their minimum credit income requirements. If you are unsure of the minimum requirements, you can check the company’s website or contact them directly.

Secured Credit Card

The best credit cards for getting higher limits are secured credit cards. It doesn’t matter whether you have good credit or not. This is because they require a security deposit as collateral, which reduces lending risks. The company consideration requires applicants to make a security deposit equal to $5,000 and meet its minimum age and residency requirements before providing a $5,000 credit limit.

Authorize Yourself

Authorized users can become credit card holders on someone else’s card if they cannot get their own card with high limits. The card limit is the same for authorized users as for primary card holders. Authorized users may also be allowed to set spending limits by the respective banks.

Consider Debit or Prepaid Cards

The amount you deposit on a debit card account can be used to make purchases. Using it does not require borrowing money since you can simply use the funds you have already put in the account. You cannot build credit with these cards since there is no credit or lending involved.

The High Costs of A Credit Card Cash Advance

A Cash Advance Credit Card is appealing because you can obtain quick cash with your credit card through an ATM when you need it. However, the cost of PIN punching should also be considered before you begin.

A Cash Advance Credit Card charges you in two directions as soon as you receive them. A fee is associated with the cash advance transaction itself, generally ranging from 3% to 5% of the amount advanced.

Similarly to regular purchases, cash advances accrue interest and a transaction fee. However, the grace period for cash advances is not the same as that for regular purchases.

As soon as you complete the transaction, interest will begin to collect on the cash advance. Even if you pay back all the money you drew when you get your statement, you’ll still have to pay interest on the cash advance.

A cash advance costs more than a purchase or balance transfer, so interest accrues immediately and is charged at a higher rate. There can easily be 5% to 10% more interest charged on a credit card cash advance than on a normal purchase using the same card.

What is The Best Way To Increase My Credit Limit?

The following methods can help you increase your Cash Advance Credit Card credit limit.

- Existing card members can normally request a credit limit increase online through the bank’s website or app. An increase in income or a better credit score may be sufficient conditions.

- Getting an increase can be accomplished by contacting your credit card issuer. The person on the other end of the phone may ask you a few questions regarding your job before they can approve your request.

- When customers have built enough credit by responsibly using their previous cards, some credit cards automatically increase their credit limit. To build a good credit score for an upgrade, you should practice good credit habits by making on-time payments and never skipping a payment. Additionally, credit utilization rates should be kept low, at or below 30%.

- Get a part-time job to boost your income. Getting a part-time job is one way to do this. You may be able to increase your credit limit this way. You can also obtain your household’s income from others if you have access to it.

- Credit bureaus can be used to report rent payments. Paying rent on time can improve your credit history, leading to a positive history that will allow you to increase your credit limits quickly. Payments for utility bills can also be reported.

- To increase your total borrowing capacity, you can apply for another card. To increase your available credit to $5,000, you can get a second card that offers a similar credit line to the one you currently have, allowing you to borrow a maximum of $2,500.

- If you become an authorized user, someone else can authorize your card. Your card limit will be combined with the limit on the other card you have been added to, giving you access to both limits.

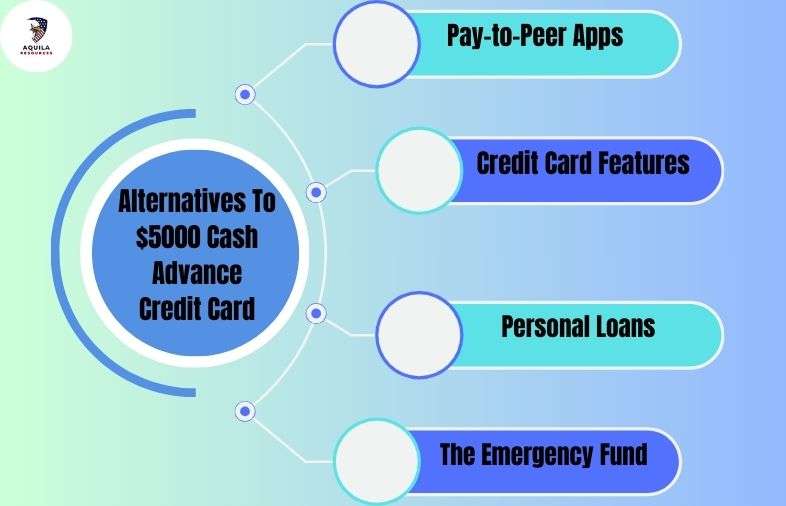

Alternatives To $5000 Cash Advance Credit Card

It’s not always the best idea to use a Cash Advance Credit Card for your financial situation. You may want to consider some of these alternatives first.

Pay-to-Peer Apps

Apps that facilitate peer-to-peer payments allow friends and family members to make instant payments. If you use an app like Zelle, you can easily send cash from your account directly to others—maybe to the friend you’re splitting dinner with.

Remember not to use peer-to-peer payments if you want to exchange money with strangers. Using apps like Zelle with people you know is safe since payments can’t be reversed once they’re sent.

Credit Card Features

It may be more affordable to borrow credit than to take out a cash advance with some credit card companies. You can send money without fees to friends and family through peer-to-peer payment apps, for example. Check with your credit card issuer for details on whether your card offers this feature and whether you can use peer-to-peer apps.

Personal Loans

It is a good idea to consider personal loans instead of a Cash Advance Credit Card, especially if you need a large amount of money. A cash advance typically has a higher interest rate, longer repayment term, and lower borrowing limit than a bank loan. They are also easier to repay since they are installment loans.

An increasing number of companies offer personal loans to their customers through their credit cards. The interest rate on these loans is usually lower than your credit card’s rate, and you don’t have to fill out a new application. Personal loans from credit unions typically offer the best rates and terms, so shop around.

The Emergency Fund

This type of savings account is used to cover unexpected, essential expenses. An emergency fund provides a safety net in case you lose your job, wreck your car, or get sick. Your emergency fund needs to be used only for real emergencies, and if you dip into it for anything else, you should build it back up when the crisis has passed.

Pros And Cons of Cash Advance Credit Card

Getting a Cash Advance Credit Card is convenient because it’s fast and available everywhere. However, there is a price to pay for that convenience. Here are some things to remember before taking out a payday loan.

Pros

- Obtain an emergency loan as soon as possible

- Pay for expenses with cash rather than credit

- No additional approvals are required

- Accessible at any ATM, bank, or credit union

- Easily withdrawn as cash or deposited as a check

Cons

- Significant fees (usually around 5%)

- Interest rates on cash advances are high

- APR for purchase is high

- Interest is not graced

- Your credit limit may not be accessible

- If your card does not permit cash advances, you will need to apply for a cash advance credit card

How Much Should You Spend on A $5,000 Cash Advance Credit Card Limit Card?

It’s recommended to keep your credit utilization rate below 30% to maintain a positive credit history and a good credit score. You should spend no more than $1,500 per month on a card with a $5,000 credit limit.

The lower your credit utilization, the easier it will be for you to access better borrowing opportunities in the future since lenders consider those individuals to be less risky. Having good control over your expenses will allow you to be seen as someone who avoids overspending.

FAQs

What is A Cash Advance Credit Card?

Cash advances are cash advances made with your credit card. An ATM cash advance is when you withdraw cash using your credit card (which requires a PIN). Cash advances are also possible when you receive convenience checks through the mail, which offer cash from your credit card.

Can You Watch Cash From A Credit Card At An ATM?

ATM cash advances require your credit card PIN, but you can get them at an ATM.

What Fees Come With A Cash Advance Credit Card?

Most payday loan lenders charge a percentage fee on the advance amount and interest on the advance until it is repaid. Additional fees may apply if you are late in making a payment or borrow over your limit.

Conclusion

The Cash Advance Credit Card option on your credit card may seem convenient if you don’t have cash on hand. Credit card purchases are typically more expensive than those made with other types of cards. This is why you should be aware of what constitutes a cash advance, how they work, and what potential costs you may incur.

Add Comment