Do you want to know how to get a $50 Deposit Secured Credit Card without any hassle? Your search ends here.

The reviewed no-annual-fee credit card requires a small deposit, making it available to most people. The good news is that you can get it even if you don’t have stellar credit or bad credit. The card lets you rebuild or build credit on a budget, whether you’re a credit novice or digging yourself out of a rut. You’ll be happy to hear it, so keep reading.

This article will provide you with all the information you need to know about secured credit cards, including how to get a $50 Deposit Secured Credit Card.

It’s time to get started.

What is A Secured Credit Card?

Contents

- 1 What is A Secured Credit Card?

- 2 How Does Secured Credit Cards Work?

- 3 Top Best $50 Deposit Secured Credit Card

- 4 How To Select The Best $50 Deposit Secured Credit Card?

- 5 Can I Get A Credit Card Without a Deposit?

- 6 Alternatives To $50 Deposit Secured Credit Card

- 7 How To Build Credit With A $50 Deposit Secured Credit Card?

- 8 Can You Be Denied A Secured Card?

- 9 Pros and Cons of $50 Deposit Secured Credit Card

- 10 FAQs

- 11 Conclusion

Secured credit cards require a cash security deposit, which sets them apart from regular credit cards. A deposit reduces the issuer’s risk: If you are unable to pay your debt, the issuer can take it from the deposit. Because of this, people with bad or no credit can use these cards.

When you make a $200 deposit, you’re assigned a $200 credit limit, which means you’ll be able to spend $200 after you make the deposit. A credit card can help you build credit so that you can apply for an unsecured card without depositing anything.

Some of the best secured cards allow you to enhance your secured card account directly to an unsecured card. However, some secured cards don’t have an upgrade process, so you have to apply elsewhere and then close the card. A secured card issuer will refund your deposit if you upgrade or close an account in good standing (which means you have been making payments).

How Does Secured Credit Cards Work?

The secured card works the same as an unsecured one after you have paid the initial deposit:

- There are many places that accept credit cards, including online.

- A monthly bill comes to you, and you pay for your purchases. The difference between prepaid and secured cards is below. (Your deposit isn’t used to pay for purchases.)

- The interest you pay on a balance is based on the balance you carry.

- A responsible use of the card and timely payment can help you improve or rebuild your credit.

Secured and unsecured credit cards are offered by most major credit card companies. The average annual fee is $50, but ideally, you should not pay more than that. There are several secured cards with no annual fee among our favorites.

An unsecured credit card may not be an option for you, so a secured credit card may be able to help you improve your credit score. The responsibility of a secured card is no different from that of any other debt or account on your credit report.

Top Best $50 Deposit Secured Credit Card

Capital One Platinum Secured Credit Card

The Capital One Platinum Secured Credit Card offers no annual fee and a security deposit choice of $49, $99, or $200. This credit card reports payments to the three main credit bureaus, allowing you to improve your credit score. Depending on your payment history, you may be able to earn back your deposit and be upgraded to an unsecured card upon paying your bills on time each month. Also, Capital One automatically increases your credit limit after six months of responsible use.

This Capital One Platinum credit card is a good choice for those with limited credit histories or who want to build credit. There is often an annual fee and opening fee associated with cards aimed at this particular market. However, none of these drawbacks are present with this card.

The Capital One website makes it possible for potential customers to check for prequalified offers without affecting their credit. When you submit an application to Capital One, your credit history is checked by all three credit bureaus, which makes prequalification a valuable tool for assessing your chances of approval.

Benefits of Capital One Platinum Secured Credit Card

- There are no hidden fees or annual fees. You can find out in seconds if you’re approved.

- Do you need to build your credit? It may be beneficial to use the Capital One Platinum Secured card responsibly.

- A $200 initial credit line is available with a refundable security deposit of $49

- When you make timely payments with your card, your security deposit could be returned as a statement credit.

- Your credit line will automatically be increased within 6 months without any deposit.

- We offer $0 Fraud Liability, so you don’t have to worry about unauthorized charges.

- Capital One’s CreditWise helps you monitor your credit score. The service is free for everyone.

- Online banking gives you access to your account 24 hours a day, seven days a week, on any device with Capital One’s mobile app.

- Depending on the Capital One product listed on this page, some benefits may be provided by Visa® or Mastercard®. Details are available in the respective Guide to Benefits, as terms and conditions apply.

Pros And Cons of Capital One Platinum Secured Credit Card

Pros

- There is no annual fee

- A refundable deposit of $49, $99, or $200 is required

- Outside the U.S., no fees are charged.

- Changing your payment due date is flexible.

Cons

- Variable APR of high levels

- There is no rewards program.

OpenSky Secured Visa® Credit Card

Checking accounts is usually required to approve secured credit cards. There is no requirement for Secured Visas issued by OpenSky. A money order or Western Union can be used instead of a security deposit to fund your account. As a result, unbanked individuals or those who haven’t opened a checking account can access it. There are no rewards available with the OpenSky® Secured Visa® Credit Card, and the issuer doesn’t offer any great unsecured cards. This card doesn’t require a credit check, so even those with bad credit could qualify. The cost of this service is $35 per year.

All three major credit bureaus receive reports from the OpenSky® Secured Visa® Credit Card, which is essential to building credit. Your credit limit can also be increased after six months if you graduate with an unsecured credit card.

A $200 minimum security deposit is required, and there is an annual fee of $35. OpenSky® Secured Visa® Credit Card might be a good option if you’ve been having trouble getting approved for other secured credit cards.

Benefits of OpenSky Secured Visa® Credit Card

- No credit check is required to apply. You have no credit risk when you apply!

- Interested in building or rebuilding your credit? A 48+ point improvement is experienced by 2/3 of cardholders who make 3 on-time payments.

- You can increase your $200 credit line without making any additional deposits after 6 months by applying for an unsecured credit line increase.

- You can view your FICO score on our mobile app for free every month.

- Take advantage of the three major credit reporting agencies, Experian, Equifax, and Transunion, to build your credit history.

- Purchases can be made using Apple Pay, Samsung Pay, and Google Pay when you have Apple Pay or Samsung Pay added to your mobile wallet.

- To get a $200 credit line, you must deposit a $200 refundable security deposit.

- It takes less than five minutes to apply with our mobile application.

- Pay on a schedule that works for you with flexible due dates.

- The security deposit can be paid for 60 days with the make partial payments option.

- You can build your credit with OpenSky if you join more than 1.2 million cardholders who have done so

Pros and Cons of OpenSky Secured Visa® Credit Card

Pros

- The process of building a credit history

- There is no credit check required to apply

- APR of 25.64% (variable) is reasonable

Cons

- The annual fee is $35

- Fees associated with foreign transactions

- Rewards are not earned

How To Select The Best $50 Deposit Secured Credit Card?

The $50 Deposit Secured Credit Card for you depends on your User’s needs, which is why it’s important to do your research. People who want to earn money back from their purchases might find cash-back programs beneficial. Other cards may have low-interest rates and fees, making them more appealing to cardholders.

Here are some questions you should ask yourself in order to choose the $50 Deposit Secured Credit Card:

- How do the three main credit bureaus view my shortlisted options?

- Do I feel comfortable with a certain amount of security deposit?

- How much are the annual and recurring fees?

- Can I upgrade my credit limit or get an unsecured card?

- If I make a late payment, do I have to pay a late fee, or does a grace period apply?

Can I Get A Credit Card Without a Deposit?

The majority of credit cards are unsecured and do not require a security deposit. Due to the lack of collateral, secured cards tend to be more difficult to obtain since issuers rely more on your sense of responsibility (and your fear of reprisals) than collateral to motivate timely payment.

There are usually high-interest rates and fees associated with secured credit cards for people with poor credit.

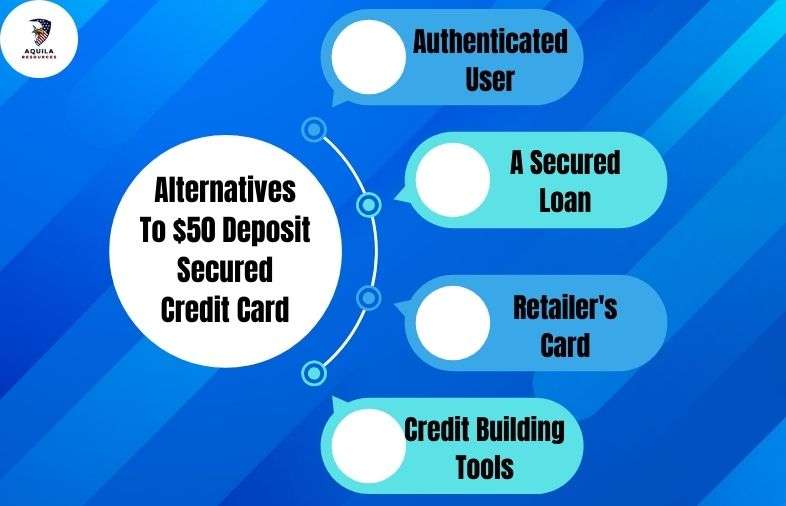

Alternatives To $50 Deposit Secured Credit Card

A $50 Deposit Secured Credit Card is an amazing tool for building your credit score, but it’s not the only option. There are a few alternatives to secured credit cards that are worth considering.

Authenticated User

Sign up for a credit card and become an authorized user. Add yourself as an authorized user to a credit card owned by a family member. Do not take advantage of this opportunity; you may do more damage than just damage to your credit score.

Make sure you have a co-signer. The credit card company may allow you to open a card with a co-signer if you are unable to pay the bill yourself.

A Secured Loan

You can take out a secured loan. A secured loan may be a great option if you need a lump sum of money. The only thing you have to worry about is the interest rate, terms, and conditions of the loan.

Retailer’s Card

You can open a retailer’s credit card. When you have a poor credit score, a retail store card may be more accessible than a regular credit card. Your activity will be reported to the major credit bureaus in an effort to improve your credit rating.

Credit Building Tools

A credit-building debit card may be more suitable for you if you aren’t interested in committing to a credit card (even a secured one). Two of the three major credit bureaus receive reports from the Extra Debit Card about on-time and late payments. You could qualify for a new credit card within a year if you are consistently on time with your payments, and your credit score could improve your chances of getting a mortgage and auto loan.

How To Build Credit With A $50 Deposit Secured Credit Card?

A positive credit history is possible when your credit card company reports your payments and account activity to the three major credit bureaus. A few tips for building credit are listed below:

Timely Payment

Paying your bills on time is the most important way to improve your credit score. Regardless of whether you are able to pay the full amount, at least pay the minimum amount. The most detrimental thing you can do to your credit score is to make late and missed payments.

If you forget the due date, make the payment as soon as possible. Many issuers won’t report a late payment to the bureaus until you’ve been behind 30 days or more. Set up an automatic payment option to make on-time payments and avoid expensive late fees and interest (most issuers provide this option).

Reduce Your Utilization

You should then examine your credit utilization, which is how much credit you’re using. When your credit card is nearly maxed out, lenders will see you as a greater risk, affecting your credit score. It is a good rule of thumb to keep utilization between 30% and 40%. A $200 credit card with a $60 limit should never have a balance greater than $60 at any given time.

Don’t Apply For Too Many Credit Cards

Avoid applying for new credit too frequently, in addition to your payment history and utilization. Credit applications trigger hard inquiries, which are checks of your credit report by the prospective lender. There may be a few points knocked off your credit score with every hard inquiry. You can also reduce the average age of your accounts by opening new cards. Your credit score will be increased if you have fewer recent inquiries and older accounts on average.

Credit Check

Your credit report should be reviewed carefully to see if there are any old debts in collections or errors. Credit building can be greatly aided by a secured credit card, but removing blemishes from your credit report is also vital. Your issuer might be able to help you catch payments and suspicious activity on your credit report if you take advantage of their credit scoring and credit monitoring tools.

Can You Be Denied A Secured Card?

It’s possible! There is a good chance that your application will be accepted, but acceptance is not guaranteed. The following tips will help you avoid getting your application denied:

Secured Cards Prequalify

There are several credit card issuers that allow you to prequalify for their secured cards. Your credit score won’t be affected by this step because you won’t need to undergo a credit check. It’s important to remember that even if you prequalify, the issuer will not guarantee your acceptance.

Credit Cards Without Credit Checks

You don’t need to worry about getting your credit card pulled when you use the OpenSky® Secured Visa® Credit Card. The program offers the highest acceptance odds for subprime borrowers.

Find A Co-signer

You will have a greater chance of acceptance if you have a co-signer with good credit. Instead of paying a security deposit, you might as well apply for a high-quality, secured credit card. Many issuers may not allow a co-signer.

If the issuer denies your application, you must receive a notice describing the reasons for the denial, such as low income or the inability to verify your identity. You should use the notice as a resource since it points out the issues that need to be corrected before reapplying.

Pros and Cons of $50 Deposit Secured Credit Card

Pros

- An annual fee is not charged by many

- Bad credit unsecured cards tend to have clearer terms

- It is possible to earn cash back with some

- Credit scores as low as fair or poor

- There is a full refund of the security deposit

- It is accepted everywhere credit cards are accepted

- Contribute to the building of credit history by reporting to credit bureaus

Cons

- A security deposit is required

- APRs are often high

- It is possible to require membership in a credit union or military service

- Cardholder perks are fewer than those offered by good and fair credit cards

FAQs

What is The Average Interest Rate For Secured Cards?

A secured credit card’s average annual percentage rate in July 2023 was 22.37%, but the exact rate will depend on the credit card issuer.

What is A Secured Credit Card?

When you open a secured credit card account, you have to make a cash deposit as a security deposit. Since secured credit cards protect the issuer from losing money if you do not pay, they are an amazing option for people with bad credit or no credit history.

Do I Get My Deposit Back With A Secured Credit Card?

The secured card deposit will be returned to you if you close the account in good standing – that is, if you have paid the balance in full. A refund of your deposit should also be available if you upgrade your account to an unsecured card from the same issuer.

Do I Need A Secured Credit Card?

Those with poor or bad credit, or no credit at all, will benefit most from secured credit cards. We recommend looking at our list of the best credit cards if you already have good credit. A secured credit card might be a good option if you’re having trouble getting approved for an unsecured card due to your poor credit.

Do Secured Credit Cards Have Annual Fees?

The fees charged by some secured cards are the same as those charged by unsecured cards, while others do not. This Discover it® Secured Credit Card comes with no annual fee. It is important to understand the fees associated with any card before applying.

Conclusion

A $50 Deposit Secured Credit Card is a great way to rebuild your credit if you don’t qualify for the biggest credit card welcome offers.

The process of qualifying for a $50 Deposit Secured Credit Card is easier, but it involves a deposit upfront. The interest rates on secured cards can also be higher than those on traditional cards, and they offer fewer rewards than traditional cards. As a result, a secured credit card isn’t usually the best long-term credit card solution, but it’s an excellent tool for managing your credit history and establishing a relationship with a bank.

Add Comment