If you are a student and looking for Student Credit Cards Bad Credit Instant Approval then you are at the right place.

The majority of students who attend college for the first time need better credit. Typically, they would have little credit experience, which is nothing like bad credit. You can lose your credit score by mismanaging your finances, such as not repaying your debts.

If you have a bad credit history, managing your finances can be challenging as a student. Students with bad credit can obtain credit cards that are specifically designed for them. Students can qualify for these credit cards instantly, establishing their credit and solid financial foundation.

This article aims to explain the benefits of Student Credit Cards Bad Credit Instant Approval and to discuss some related considerations.

Student Credit Cards Bad Credit Instant Approval

Contents

- 1 Student Credit Cards Bad Credit Instant Approval

- 2 What are student credit cards?

- 3 Can You Get Student Credit Cards Bad Credit Instant Approval?

- 4 Can students with bad credit get instant approval?

- 5 Top 5 Best Student Credit Cards Bad Credit Instant Approval

- 6 What are the Requirements for Student Credit Cards Bad Credit Instant Approval?

- 7 Video for Student Credit Cards Bad Credit Instant Approval

- 8 What to Look for in Student Credit Cards Bad Credit Instant Approval?

- 9 How do you improve your chances of Student Credit Cards Bad Credit Instant Approval?

- 10 What Can Cause Delays in Student Credit Cards Bad Credit Instant Approval?

- 11 What Happens to My Student Credit Card When I Graduate?

- 12 FAQs

If you are looking for Student Credit Cards Bad Credit Instant Approval, these are the best options:

| Credit Card | Details |

|---|---|

| Capital One Quicksilver Cash Rewards Credit Card | Learn More |

| Discover it Student Cash Back | Learn More |

| Bank of America Customized Cash Rewards Credit Card for Students | Learn More |

| Discover It Secured Credit Card | Learn More |

| OpenSky Secured Visa Credit Card | Learn More |

What are student credit cards?

The student credit card is a vital financial tool for students as they establish their credit history and build their credit scores. The approval process for a student credit card can take as long as several weeks because most banks and lenders require young adults to show proof of income, establish credit, and have a bank account.

However, there are some student credit cards that are designed for students with no income or credit history. These cards often have lower credit limits and higher interest rates, but they can be a great way to start building your credit.

Getting your loan quickly and virtually instantly is still possible if all eligibility requirements are met. The approval process can take just a few minutes with banks that provide online applications, and you can get your results almost immediately.

Can You Get Student Credit Cards Bad Credit Instant Approval?

You can get credit cards with instant approval if you are a student with bad credit. The cards listed above do not require a minimum credit score, and you can apply online in just a few minutes, although there is no guarantee that you will be approved.

Student credit cards with bad credit that are easily approved for are normally secured cards. These cards require little or no credit history or a good credit score, so they are ideal for students and young adults.

The deposit amount usually reflects the credit limit on the secured credit card. The higher the deposit, the higher the credit limit. The lenders are glad to issue credit cards to people with bad credit because this reduces their risk. A complete application that meets all other requirements and meets all other requirements will be approved quite quickly.

The cards allow you to build credit with on-time payments to move on to unsecured cards with higher limits later. It is easier and more rewarding to apply for unsecured credit cards if you have a reasonable amount of credit.

Can students with bad credit get instant approval?

It is still possible for students with bad credit to get an instant approval for a credit card. However, it is important to note that the card issuer’s criteria and your specific financial situation may determine whether instant approval is available to you. Credit card applications that are approved instantly receive a decision within minutes or seconds.

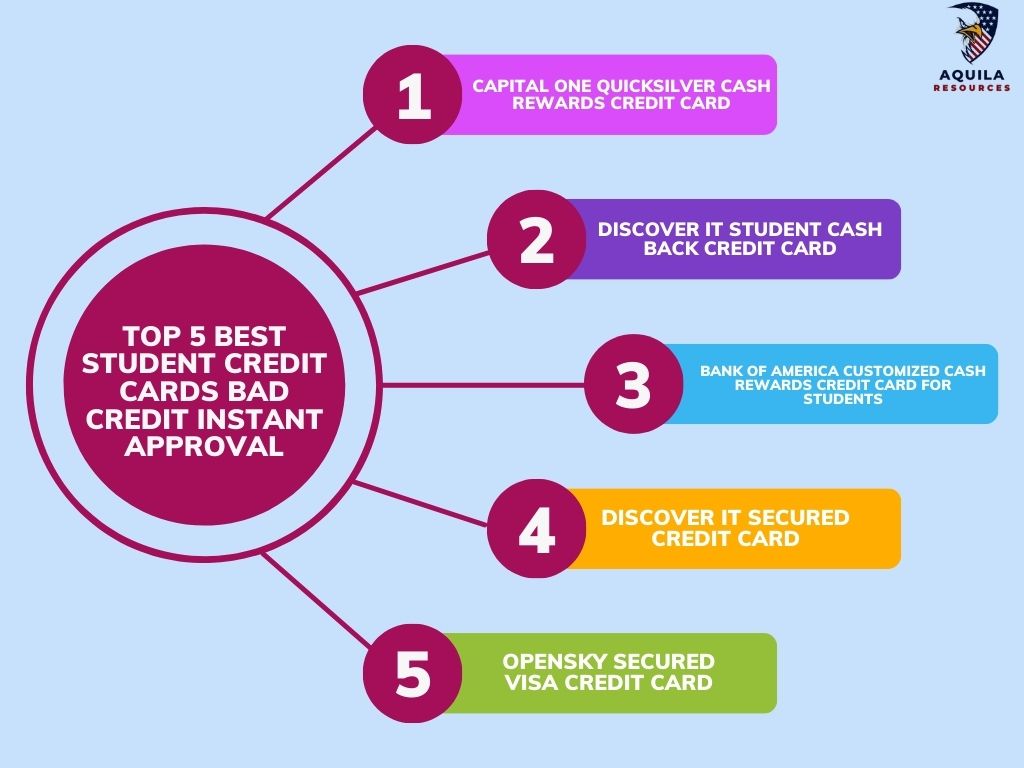

Top 5 Best Student Credit Cards Bad Credit Instant Approval

It is possible to build a positive credit history with a student credit card with bad credit at a low cost. Students with bad credit scores are very unlikely to get student credit cards, which generally require limited credit or better to be approved. For students with bad credit, however, there are other credit cards to consider, most of all secured ones.

The following list includes the best Student Credit Cards Bad Credit Instant Approval and their fees, benefits, and eligibility requirements.

Capital One Quicksilver Cash Rewards Credit Card

If you are a student with a less-than-stellar credit score, the Bank of America Unlimited Cash Rewards is a good option for you. There is no annual fee, and there are no foreign transaction fees. You will also earn unlimited 1.5% cash back on all purchases when you use the card.

Additionally, you receive $50 when you spend $100 in the first three months and 10% cash back on Uber and Uber Eats purchases. If you refer family and friends who get approved for a card, you can get up to $500 a year.

You can use Capital One’s online pre-approval tool to see if you qualify for a card within minutes, which only requires a soft credit check.

Pros & Cons of Capital One Quicksilver Cash Rewards Credit Card

Pros

- Cashback of 1.5% on all purchases

- There is no annual fee

- No foreign transaction fees

- Rewards never expire

Cons

- High-interest rate potential

- Up to $40 late payment fee

Rates & Fees of Capital One Quicksilver Cash Rewards Credit Card

| Fee | Amount |

|---|---|

| Annual fee | $0 |

| APR | 16.49% - 26.49% variable |

| Introductory APR | 0% for 15 months on purchases and balance transfers |

| Balance transfer fee | 3% of the balance transferred |

| Cash advance fee | Either $3 or 3% of the amount of each cash advance, whichever is greater |

| Foreign transaction fee | None |

Discover it Student Cash Back Credit Card

Discover It is one of the most popular credit card lenders with cashback rewards and bonuses among students. This program is ideal for college students since it does not require a minimum credit score or an annual fee.

Students can get credit cards processed as quickly as possible through an online application, which can be done immediately. You should use the email address associated with your school to speed up the process.

Pros & Cons of Discover it Student Cash Back

Pros

- Credit scores are not required

- There is no annual fee

- There are no foreign transaction fees

- Three major credit bureau reports

- A security deposit is not required

- Purchases and transfers with 0% APR

Cons

- Charges of $41 for late payments

- Fee of $41 for returned payments

- Fees of $10 or 5% for cash advances

- Comparatively low acceptance abroad

Rates & Fees of Discover it Student Cash Back

| Fee | Amount |

|---|---|

| Annual fee | $0 |

| APR | 18.24% - 27.24% variable |

| Introductory APR | 0% for 6 months on purchases and 10.99% for 6 months on balance transfers, then the standard purchase APR applies |

| Balance transfer fee | 3% of the balance transferred |

| Cash advance fee | Either $10 or 5% of the amount of each cash advance, whichever is greater |

| Foreign transaction fee | None |

Bank of America Customized Cash Rewards Credit Card for Students

Bank of America’s Customized Cash Rewards credit card does not charge an annual fee and offers attractive rewards, which makes it a good choice for students. These credit Cardholders are eligible for a 0% intro APR for 18 months, after which they will be charged a variable APR between 17.99% and 27.99%.

This credit Cardholder earns 3% cash back on purchases made in gas stations, dining establishments, online shopping, travel agencies, home improvement stores, and drugstores. All the purchases earn you 1% cash back. Grocery stores earn 2% cash back. The cash rewards you earn never expire.

When you purchase $1,000 within 90 days of opening the account, you’ll receive a $200 cash bonus. It takes a few minutes to complete a pre-qualification online, and you’ll be able to receive an instant decision.

Pros & Cons of Bank of America Customized Cash Rewards Credit Card for Students

Pros

- There is no annual fee

- You can earn up to 3% cash back on your purchases

- A cash reward never expires

- 18-month intro APR of 0%

Cons

- Foreign transaction fee of 3%

- There are late fees

- Regular APR is high

Rates & Fees of Bank of America Customized Cash Rewards Credit Card for Students

| Fee | Amount |

|---|---|

| Annual fee | $0 |

| APR | 18.24% - 28.24% variable |

| Introductory APR | 0% for 15 billing cycles for purchases, and for any balance transfers made within 60 days of opening your account. |

| Balance transfer fee | 3% of the balance transferred |

| Cash advance fee | 3% of the amount advanced |

| Foreign transaction fee | 3% |

Discover It Secured Credit Card

A Discover It Secured Credit Card is a great option for students with no credit history. All three credit bureaus are updated for the card, so you earn rewards while building your credit. There is no annual fee, foreign transaction fee, or annual percentage rate (APR) above 27.99%.

New cardholders receive unlimited cashback during the first 12 months of card membership. Your gas station and restaurant purchases earn you 2% cash back every quarter up to $1,000. Then, you’ll receive 1% cashback.

Pros & Cons of Discover It Secured Credit Card

Pros

- There is no annual fee

- Get 2% cash back on purchases

- Six-month intro balance APR of 10.99%

- Credit scores are not required to apply

- There are no foreign transaction fees

- Seven-month automatic account review

Cons

- A $200 security deposit is required

- The late fee is up to $41

- Fees after the introductory period of up to 5%

Rates & Fees of Discover It Secured Credit Card

| Fee | Amount |

|---|---|

| Annual fee | $0 |

| APR | 28.24% Variable APR |

| Security deposit | Up to $2,500 |

| Balance transfer fee | 3% of the balance transferred |

| Cash advance fee | Either $10 or 5% of the amount of each cash advance, whichever is greater |

| Foreign transaction fee | None |

OpenSky Secured Visa Credit Card

OpenSky Secured Visa Credit Cards are an excellent option for students with bad credit who need help qualifying for secured cards. Application is risk-free, and all three major credit bureaus receive payment information.

This card has an ongoing APR of 22.14% and a foreign transaction fee of 3%. This card also has an annual fee of $35. While this card doesn’t come with a credit history and is difficult to qualify for, it is relatively simple to get, especially for students without credit histories.

Applying online is very simple and takes only a few minutes. The application does not require a credit check or a bank account, but the security deposit is $200.

Pros & Cons of OpenSky Secured Visa Credit Card

Pros

- There is no credit requirement

- No need for a bank account

- Qualifying is easy

- All three major credit bureaus are notified

Cons

- The annual fee is $35

- A $200 security deposit is required

- Fees for foreign transactions are 3%

Rates & Fees of OpenSky Secured Visa Credit Card

| Fee | Amount |

|---|---|

| Annual fee | $35 |

| APR | 22.39% Variable APR |

| Security deposit | $200 minimum, $3,000 maximum |

| Balance transfer fee | 3% of the balance transferred |

| Cash advance fee | 5% of the amount of the advance (minimum fee $6) |

| Foreign transaction fee | 3% of each transaction in US dollars |

What are the Requirements for Student Credit Cards Bad Credit Instant Approval?

The marketing of credit cards to young adults under 21 years of age is subject to different rules because of laws regarding this group.

It will be necessary to have a few pieces of information, financial resources, or others’ assistance. In most cases, you’ll need the following:

A cosigner, authorized user, or joint applicant may be required if you have different income sources and are between 18 and 21 years old.

Video for Student Credit Cards Bad Credit Instant Approval

What to Look for in Student Credit Cards Bad Credit Instant Approval?

How do you improve your chances of Student Credit Cards Bad Credit Instant Approval?

- Examine your credit report. Please look at your credit report before applying for a student credit card, and make sure it is free of errors or discrepancies that could negatively impact your credit score. Verify all information and dispute any inaccuracies.

- Choosing the right card. You may be eligible to apply for student credit cards even if you have bad credit. Students should look for cards designed specifically for them and offer benefits such as a lower interest rate, no annual fee, and rewards programs. Ensure that your needs are met by comparing the terms and conditions of various credit cards.

- Accurate information. Ensure the information you provide on the credit card application is accurate and true. An application can be denied due to inaccuracies. You will be asked about your income, employment status, and education.

What Can Cause Delays in Student Credit Cards Bad Credit Instant Approval?

Several reasons can cause a delay in the approval of Student Credit Cards Bad Credit Instant Approval –

- An incomplete application: You will only be approved if you provide all required documentation and information.

- Authentication failure. It is possible for card issuers to need help to verify the information you provide, like your social security number. It is likely due to a typing error that can often be corrected easily and relatively quickly. It can also be difficult to get approval if you fail to verify income, and credit card providers may ask you for additional information to ensure that your card can be responsibly paid.

- Low credit score. Some credit card decisions depend on other factors when you are close to the borderline. A delay in processing your application can also result from this.

- Card demand is excessive. There are times when many people apply for a card when there is a new offer or a new economic card altogether. It may slow down your approval process if the issuer needs to focus on the existing approvals before proceeding with new ones.

What Happens to My Student Credit Card When I Graduate?

The student credit card cannot be used after graduation from college. Your card issuer may offer you a replacement card or transfer you to one of its unsecured credit cards if you maintain a good repayment record while in school.

Your new card will typically have an annual fee different from your student card. After graduation, you are not required to stay with the same issuer, so you should review all your options before deciding.

The best cards that bear the Visa, Mastercard, American Express, or Discover logos should be available if you have built a good credit score during your undergraduate years.

It may be a good idea to have multiple rewards credit cards with complementary benefits, such as a cashback card and a credit card with travel rewards. The more cards you have, the more value you will get from your purchases.

Travel rewards credit cards, for example, offer travel benefits and high cashback rates on other purchases, such as gasoline or dining out. You can choose whether or not to keep your student card, but your issuer wants to retain a substantial portion of its customers.

FAQs

Can I get a student credit card with no credit history?

Some credit card companies offer student credit cards specifically for individuals who do not have credit histories. The purpose of these cards is to help students establish credit for the first time.

What score do you need for a student credit card?

Credit scores of at least 690 are typically required for good interest rates and decent rewards. Getting a credit card that doesn’t require good credit scores may be higher, and you may have to pay a security deposit, which serves as your initial credit limit.

What credit card can I get with no credit?

Many issuers offer credit cards to those who need credit. Student cards are available without credit checks, such as those listed above. Secured credit cards are also available to those with no credit. However, anyone without credit can also get a credit card and build a credit history by becoming an authorized user on someone else’s account or asking a trusted relative or friend to co-sign.

Add Comment