Does PayPal Credit Affect Credit Score? If you want to know the answer of this question then you are at the right place.

In this article, we are sharing all the information about the question Does PayPal Credit Affect Credit Score.

The credit score often serves as a tangible representation of your financial health. There have been times when we have been concerned about the state of our credit scores. Many factors affect your credit rating, so it can be difficult to keep track of them all. There is often some question about how certain financial platforms, such as PayPal, influence your credit score.

The PayPal Credit program provides users with ease and flexibility when making online purchases and paying over time. The increasing use of digital financial solutions has led to more consumers wondering how services like PayPal Credit affect their credit scores. The purpose of this article is to explore the intricacies of PayPal Credit and address and Does PayPal Credit affect credit scores?

What is PayPal?

Contents

- 1 What is PayPal?

- 2 What is PayPal Credit?

- 3 How Does PayPal Credit work?

- 4 What Are the Benefits of PayPal Credit?

- 5 Does Paypal Credit Affect Credit Scores?

- 6 How Does PayPal Credit Affect Credit Score?

- 7 PayPal Credit Factors that can Affect Your Credit Score?

- 8 How to be Safe When Using Online Payments?

- 9 FAQs

PayPal is an online payment tool used by over 403 million people around the world. PayPal does not affect your credit score, which is good news for those who enjoy its ease of use. This is because PayPal will not pull your credit when you use their platform; in fact, it won’t share any of your financial information.

PayPal works by instantly wiring money from your bank account to the account of the seller you’re purchasing from, just like other online purchasing tools. A credit check is not required for this, just as it is not required for purchasing groceries or paying rent.

A PayPal Pay in 4 installment payment plan, which allows you to pay in installments using your credit card, also does not require a credit check or appear on your credit report. A PayPal account appears on your credit report in only a few circumstances.

What is PayPal Credit?

PayPal Credit is similar to most other credit cards. PayPal Credit works similarly to a bank account, except that it’s attached to your PayPal account. In addition, PayPal Credit is not based on physical cards but on digital cards. However, users can sign up for PayPal Mastercards, which are physical debit cards.

Opening a PayPal Credit account for anyone with a PayPal account is possible. Signing up for PayPal Credit is usually straightforward for users with good credit scores (700+). The minimum credit line for PayPal Credit accounts is $250.

How Does PayPal Credit work?

A PayPal Credit account functions similarly to a credit card account, except that it can only be used where PayPal accounts are accepted. You are paying with PayPal Credit, not PayPal, and the money is not from your account. Instead, you are paying with a bank account or another credit card.

The hard inquiry made by PayPal will affect your credit score as with other lines of credit. PayPal credit card holders receive digital cards instead of physical cards mailed to them. Details are available on PayPal’s Credit profile. You may receive a higher credit limit based on your credit score if you have a minimum credit limit of $250 when you open your account.

What Are the Benefits of PayPal Credit?

If PayPal Credit users use their accounts responsibly, they can enjoy several benefits.

A PayPal Credit account is like any other line of credit in that it offers flexibility on spending to responsible spenders. PayPal Credit accounts also feature the following unique features:

- Easy access to funds due to a direct link with a PayPal account

- PayPal account checkout option makes it convenient and fast

- Your card cannot be lost or stolen since there is no physical card

- A PayPal Credit purchase of $99.00 is interest-free if repaid in full within six months

- When it comes to lost or fraudulent orders, PayPal offers good protection

- There is no annual fee associated with PayPal Credit

Does Paypal Credit Affect Credit Scores?

You will lose credit score points if you apply for PayPal Credit. This is because every time you apply for credit, such as car finance, your credit score is affected.

PayPal works with a bank that evaluates and audits your application. Your credit report will be kept for two years following this investigation, which may result in a few points being deducted. Credit agencies have been receiving information from PayPal Credit since 2019. Your credit score may be adversely affected if you miss a payment or are late in repaying what you owe, resulting from it being noted on your credit report.

PayPal Credit approval does not guarantee you won’t undergo a background check. This change will make Mortgages, loans of any kind, or any credit more difficult in the future. Applying for multiple loans in a short period will substantially impact your credit score, even though one hard check will have a minor impact.

Note: Individuals with Best Credit Cards for 500 Credit Score often seek suitable credit cards. Certain cards are designed for this group, offering tailored benefits. When considering options like PayPal Credit, responsible usage is key. Timely payments and careful management ensure such services don’t harm credit scores. This way, those with a 650 credit score can use these options wisely, improving their financial status.

How Does PayPal Credit Affect Credit Score?

Most PayPal Credit users need a good credit score to qualify. However, PayPal Credit can negatively impact your credit score if you are not careful. Several factors can affect your credit score if you use PayPal Credit.

An official PayPal Credit application requires a full credit check, called a hard pull. Your credit score will not be adversely affected by one hard pull. They do appear on your credit report and can accumulate over time.

It can damage your credit score if you miss payments or accumulate negative balances on your line of credit. PayPal Credit reports to all three major credit bureaus. Therefore, PayPal Credit activity can be reported on your credit report.

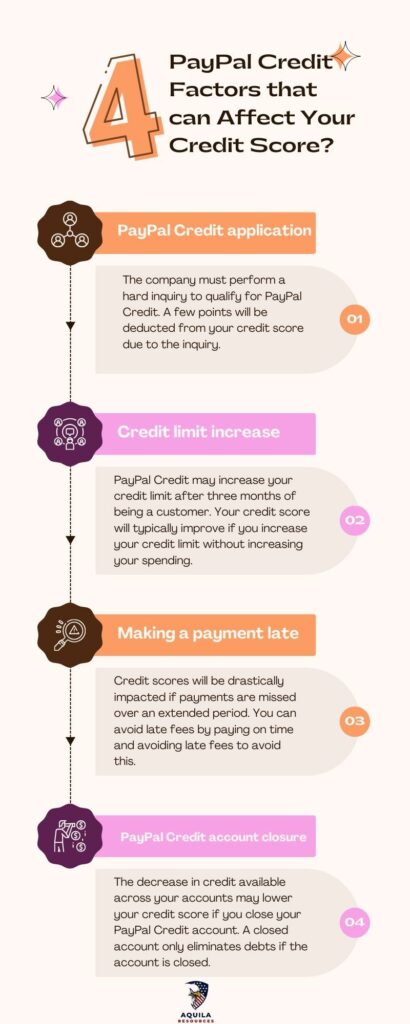

PayPal Credit Factors that can Affect Your Credit Score?

PayPal Credit can impact your credit in several ways, just as other credit cards and lines of credit do.

How to be Safe When Using Online Payments?

Despite PayPal not having an impact on your credit score, it is still important to be vigilant when using any online payment option. If you’re sending or receiving payments through your mobile device or online, here are some tips to keep in mind:

- Ensure that the right person receives or receives your money. If you make a mistake, you may only see that money again if the money is sent to the right person. Some online merchants do not accept responsibility for money sent to the wrong person.

- Register for fraud alerts. A hacker can steal your credit card information or even your whole account from an online payment platform, even though stealing it from an online merchant isn’t as easy as swiping your wallet. Ensure your account is protected by two-step verification and fraud alerts on money transfer platforms in order to avoid being hacked.

- Verify the amount you’re paying. You don’t want to send someone $300 when you meant to send $30 when you typed in an extra “0” during an online payment. Ensure you are sending the correct amount by checking the price owed.

- Don’t send money to strangers. If you purchase goods or services online through PayPal or another service, be cautious and do not habitually send money to someone you do not know.

- Paying with personal information is not a good idea. Indeed, most online payment platforms (including PayPal) won’t reveal sensitive information to senders, including your credit card number. However, you should limit your sharing of your information on these platforms. Don’t share more than your email address and phone number on your account; only share your address with trusted people.

FAQs

Can PayPal Credit help you build credit?

Using PayPal Credit responsibly can assist you in building your credit. You can establish a favorable credit profile by making timely payments and using PayPal Credit responsibly. PayPal Credit reports to credit bureaus so that timely payments can increase your credit score.

A budget must be created and adhered to, all payments must be made on time, and you must regularly monitor your credit utilization rate to stay within it. Using PayPal Credit responsibly can qualify you for lower interest rates and fees on future credit products.

Does a PayPal debit card affect your credit score?

There is no need to worry about your credit score being affected by a PayPal debit card. The funds you use for purchases with a debit card come from your checking account, so you don’t have to borrow money to do so.

How Can I Improve My Credit Score while Using PayPal Credit?

Your credit score can be improved by using PayPal Credit responsibly. It is important to make all your payments on time and pay at least the minimum payment whenever possible so you can demonstrate that you are a responsible borrower capable of managing your finances.

Establishing a positive credit history is another benefit of using PayPal Credit. Even though PayPal Credit can be beneficial when used responsibly, credit scores can be negatively affected if you miss payments or carry a balance.

Add Comment