Reloadable Prepaid Cards With No Fees options allow you to save more of your money for what matters most.

You can deposit, store, and spend your money for free rather than pay fees.

You should keep in mind that every prepaid card comes with a different fee structure. There may be a charge for what’s free on one card when it’s free on another. A few cards offer free reloads using specific methods – but third-party services may charge if you use them.

Here, we will provide you with all the information regarding Reloadable Prepaid Cards With No Fees, how to use them, the pros and cons of using Them, and much more.

Let’s get started.

What is A Prepaid Card?

Contents

- 1 What is A Prepaid Card?

- 2 How Does Prepaid Card Work?

- 3 What Are Reloadable Prepaid Cards?

- 4 How Reloadable Prepaid Cards Work?

- 5 Top Reloadable Prepaid Cards With No Fees

- 6 Eligibility Requirements For Reloadable Prepaid Cards With No Fees

- 7 How To Choose The Best Reloadable Prepaid Cards With No Fees?

- 8 Pros And Cons of Reloadable Prepaid Cards With No Fees

- 9 Where Can I Use My Reloadable Prepaid Cards With No Fees?

- 10 Reloadable Prepaid Cards Vs Credit And Debit Cards

- 11 How Does Reloadable Prepaid Cards Affect My Credit Score?

- 12 How To Manage Your Money With Reloadable Prepaid Cards?

- 13 FAQs

- 14 Conclusion

Prepaid cards can be used for purchases and bill payments, just like credit cards and debit cards. The difference is that, like a gift card, a prepaid card is loaded with money in advance. The prepaid card can be referred to as a prepaid debit card, prepaid credit card, pay-as-you-go card, or a stored-value card.

It is usually possible to purchase prepaid cards at banks or retail stores, such as grocery stores and drugstores. There are two types of cards: ones with a fixed balance and those with the option to load money onto the cards. The card can be used until the balance is depleted. The card will run out of money once it runs out of money, so you will have to reload it before you can make any more purchases.

A prepaid card’s functionality is similar to that of a traditional credit card. Depending on the type, you can use it to make purchases at point-of-sale systems or withdraw cash from ATMs.

How Does Prepaid Card Work?

The majority of prepaid cards work in the same way as credit cards and debit cards. There is one major difference between prepaid cards and credit cards: prepaid cards aren’t tied to a bank account. Therefore, It is necessary to load money onto one to use it. You may have to pay fees to use or activate prepaid cards.

What Are Reloadable Prepaid Cards?

Reloadable Prepaid Cards allow you to load money onto the card periodically, which you can then spend as you wish. Before getting one, consider these key differences between reloadable debit cards and regular bank debit cards.

How Reloadable Prepaid Cards Work?

Reloadable Prepaid Cards, also called debit cards, are cards that you can use to make purchases. These products are available at grocery stores, pharmacies, convenience stores, and other retailers. A debit card issued with a bank account differs from this type in that the money is drawn from that account.

Your bank may provide a debit card when you open a checking account to facilitate purchases and ATM withdrawals. You can use your debit card to withdraw money directly from your bank account.

Top Reloadable Prepaid Cards With No Fees

Brink’s Armored Account

Brink’s Armored prepaid cards are issued by Netspend and include Mastercard benefits. Brinks Armored Prepaid lacks many common advantages, such as virtual card numbers, that Visa cards offer on base cards. However, Brinks’ overdraft protection option and additional savings account option can make up for this. Working with Brinks is safe and secure, so you can rest assured that your deposits are safe. The following methods of reloading the Brink’s ArmoredTM Account are free:

- The direct deposit method

- Load check for mobile

- An online bank transfer from a linked account

A small fee will be assessed for cash reloads at Netspend reload locations and expedited mobile deposits. The merchant accepting your payment will charge this fee, not your credit card company.

PayPal Prepaid Mastercard®

This is another card on this list that works on the Netspend Network, so the fees will be similar. It is nice to be able to immediately transfer money between your card account and PayPal account at any time.

PayPal prepaid cards accept the following free deposit methods:

- Using PayPal to transfer money

- The direct deposit method

- The mobile check load

- A bank account linked to an online transfer

The card does not charge customers peruse but instead charges them a monthly fee. You should definitely pay monthly if you plan to use this card for all of your spending. One of the best aspects of this card is that it offers its users cash-back rewards for using it.

Bluebird® American Express® Prepaid Debit Account

A Bluebird® American Express® Prepaid Debit Account does not charge monthly fees, foreign transaction fees, card transaction fees, overdraft fees, or inactivity fees. You can also pay your bills online for free, withdraw cash from an ATM for free, and reload your card at no cost if you:

- At any Family Dollar location, you can add money to your account

- Mobile load check

- The direct deposit method

- A linked bank account can be used to make online transfers

This American Express prepaid debit card is FDIC-insured and offers virtually no fees. The account works almost like a checking account, making it a useful alternative for consumers without bank accounts. The family-friendly money management tools offered by Bluebird may appeal even if you already have a bank account.

Serve American Express Prepaid Debit Account

You can add money to your Serve American Express Prepaid Debit Account in several ways without incurring any fees. The 7-ELEVEN network offers free reloads at more than 45,000 locations, including CVS®, Dollar General®, Family Dollar, Rite Aid®, Walmart, and participating 7-ELEVEN store locations. There are several other ways to reload for free, including:

- Some third-party fees are associated with in-network reloads (please refer to the locations above.)

- The direct deposit method

- A mobile check capture solution by Ingo®

- Money can be transferred from a linked checking or savings account

- You can transfer money by linking your American Express charge account (cash advance fees may apply)

This American Express-issued card, universally accepted, aligns seamlessly with “Money Transfer Apps That Accept American Express,” facilitating global transactions with utmost professionalism and reliability.

Using either a prepaid or traditional debit card on a daily basis should have no noticeable difference.

You can access your American Express Serve account online through a web browser or an app. Although this account does not have traditional brick-and-mortar locations, you can manage everything through the website.

Travelex Money Card

Travelex Money Cards are designed to help travelers protect their money while on the road without the need to carry traveler’s checks.

MasterCard International Incorporated issues this card, which can be used to add cash to your Travelex account online, by phone, or through the Travelex Mobile App. You can also conduct a free account linkage or mobile check deposit or purchase other currencies over the phone with a surcharge.

NetSpend® Visa® Prepaid Card

The NetSpend Visa Prepaid Card follows a relatively consistent fee structure across its broad portfolio of prepaid cards. You can enjoy free reloads via this industry-standard card, as well as handy budgeting options:

- The direct deposit method

- Mobile load check

- A linked bank account can be used to make online transfers

If you receive regular direct deposits into your card account, you can reduce or eliminate your monthly account maintenance fee.

Eligibility Requirements For Reloadable Prepaid Cards With No Fees

Reloadable Prepaid Cards are available with various eligibility requirements. Make sure you meet these requirements before you choose the right one for you.

- Anyone over 18 can purchase Reloadable Prepaid Cards. Depending on the card issuer, additional qualifications may be required, including proof of identity and address.

- Most reloadable prepaid cards require a driver’s license or passport to verify your identity. A utility bill or bank statement will also be required as proof of address. These documents protect your money and account.

- Please read all the terms and conditions before applying for a reloadable prepaid card and make sure you qualify. If you fail to meet every requirement outlined, your application may be declined.

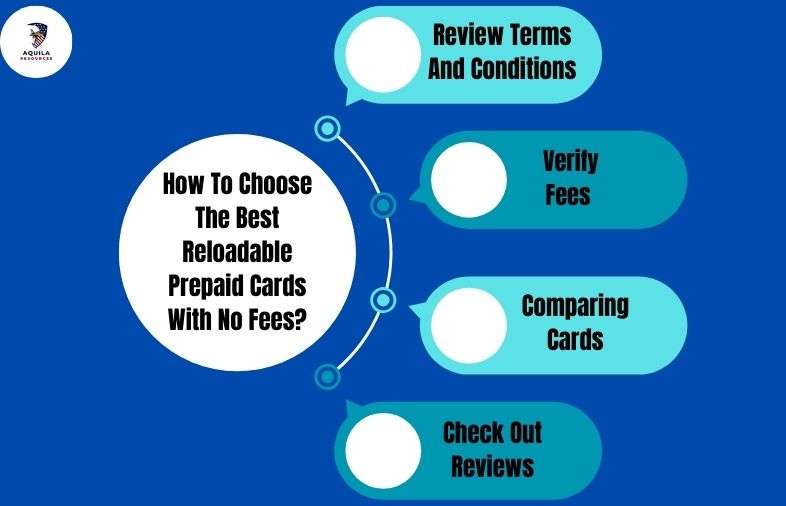

How To Choose The Best Reloadable Prepaid Cards With No Fees?

Review Terms And Conditions

Reloadable Prepaid Cards’ terms and conditions are crucial for making sure that you are getting the best product possible. The fine print on a credit card will give you a complete understanding of all fees, interest rates, and other details. Make sure you read it carefully.

It is also important to be aware of any limitations or restrictions associated with the card. Read all the terms and conditions carefully because some cards may have hidden fees. A thorough review of the terms and conditions can help you understand how the card works before you sign up.

Verify Fees

When choosing a reloadable prepaid card, consider the fees associated with it. There can be a wide range of fees between cards, so doing your research is important.

Reloadable prepaid cards are often associated with fees that cover activation, monthly service, loading, reloading, ATM withdrawals, and balance inquiry fees. Ensure that you are aware of all potential fees associated with the card by reading all the terms and conditions.

You may need to decide whether you are willing to pay these fees to use the card. If the fees are excessive, consider the features.

You should consider the features of the reloadable prepaid card when selecting one. There are many features offered by different credit cards, such as bonus points, cash-back rewards, travel benefits, and more.

You should read the terms and conditions carefully to understand the features offered and how they work. Check the fine print on your card to determine whether there are any eligibility requirements for certain features. Before selecting a card, you should also check whether you will be charged additional fees for certain features.

A card that offers online access to balances and transactions is also important to consider. You can keep track of your spending and balance online if you have access to the Internet. A few cards allow you to set up account alerts so that you are notified whenever you make a transaction or your balance falls below a specified level.

You should also ensure that the card provider offers excellent customer service. You can find customer service ratings and reviews to see how other users have experienced the company’s service. When you need assistance understanding features or troubleshooting issues, good customer service can make all the difference.

Comparing Cards

Comparing Reloadable Prepaid Cards is always a good idea when searching for the best reloadable prepaid cards. You should compare the features and fees each offers and ensure they are right for you.

First, learn about the different types of cards available, such as debit and credit cards, and their features. Consider prepaid cards that offer the services you need, as they vary greatly in features. It may be useful to have a credit card that offers cash back or one that allows international use. A special benefit or discount associated with the card should also be considered.

Check Out Reviews

The best Reloadable Prepaid Cards should be selected after reading reviews. There is no better way to learn about a particular card than to read what other people have experienced when using it. Reviews are useful for learning more about fees, customer service, and other features before making a purchasing decision. It is also important to note that reviews include information about how the card performs in various situations, like online purchases and international transactions.

A consumer website or forum is a good place to find reviews about particular Reloadable Prepaid Cards. You can also find out what customers have said about the product on the card issuer’s website. Additionally, people often post their opinions and experiences on social media, which is a great source of reviews.

Pros And Cons of Reloadable Prepaid Cards With No Fees

Reloadable Prepaid Cards have numerous pros and cons. Consumers should be aware of both factors when deciding if they are right for them.

Pros

- Prepaid cards have some advantages over cash. If a card registered with an issuer is lost, the full balance can be recovered.

- It is convenient to use prepaid cards. Similar to bank debit cards, they can usually be used anywhere that accepts credit or debit cards.

- A credit check is not necessary to get a prepaid card, so you do not have to worry about your credit history if you use one.

- The availability of prepaid cards is widespread, both in stores and online.

- A credit card can be used to make online purchases.

- It is important to check the terms of your card as some do have overdraft capability and associated fees; nevertheless, most prepaid cards do not allow you to spend more money than you have prepaid, making overdrafts less of a problem.

- Prepaid cards (such as the Direct Express debit card used for Social Security payments) can be used to receive an income tax refund from the IRS or government benefits.

- There are some employers who offer prepaid cards in place of paychecks.

- There is no restriction on the use of prepaid cards abroad.

Cons

The following are several major disadvantages of prepaid cards:

- It is important to consider the fees associated with prepaid cards when choosing a card.

- Credit history cannot be built or established through prepaid cards.

- Prepaid cards, a relatively new financial tool, are still being developed, and government regulations and consumer protections are still being developed.

Where Can I Use My Reloadable Prepaid Cards With No Fees?

Reloadable Prepaid Cards come with an expense, but they may be an excellent money management tool for consumers under certain circumstances. They can be used for a variety of purposes.

- The prepaid card can be used much like a checking account, with the ability to deposit checks, get cash from an ATM, and pay bills online or in person.

- Cardholders are able to pay with plastic even if they do not qualify for a credit card.

- The use of a prepaid card may eliminate the need to carry cash while on vacation.

- Reloadable Prepaid Cards may make it easy for parents to send money to their college students while they are away from home. The card could even be loaded regularly with money.

- The use of prepaid cards for online shopping can be convenient for consumers.

- Prepaid cards help control spending because the card cannot be used once the funds have been used up.

- The government provides prepaid cards for taxpayers instead of direct deposit for their tax refunds.

Reloadable Prepaid Cards Vs Credit And Debit Cards

Prepaid cards, debit cards linked to checking accounts, and credit cards at a point of sale are similar. However, their financial management differs significantly.

- Future transactions on a prepaid card will be declined if its balance runs out.

- Purchases should be planned in advance to ensure the card has enough funds.

- A prepaid card does not offer credit.

- Reloadable Prepaid Cards often have fees associated with their use, like activation fees, deposit fees, and ATM transaction fees.

- Prepaid card payments cannot be canceled once they have been made

- Prepaid cards cannot be used to build credit – if you want to build credit, you should consider secured credit cards

How Does Reloadable Prepaid Cards Affect My Credit Score?

Your credit score will not be affected by a prepaid debit card since it has no associated line of credit. All loans and credit cards that require regular repayment are reported to the credit bureaus by banks and lenders.

Credit scores measure your ability to manage debt and recurring bills, including whether you pay on time and the amount of the outstanding balance.

Your credit history will not reflect a debt incurred by a prepaid card.

How To Manage Your Money With Reloadable Prepaid Cards?

It can be difficult to avoid fees with prepaid debit cards, but sometimes, doing a little research can help. Prepaid cards, for instance, can meet nearly any financial need since they come in a wide variety of low—and no-fee options.

However, remember that while prepaid cards may seem like a great way to manage money, they’re not the best option; you’ll generally have to pay some fees, either monthly or per transaction. It is important that you read the cardholder agreement to understand the exact fees that will be charged with the card.

Prepaid debit cards don’t build credit, so if you’re looking to improve your credit score, you’ll probably want a credit card instead. Even those with bad credit can find good credit-building cards as long as they manage them responsibly.

FAQs

Do I Need An ID To Get A Prepaid Debit Card?

Most retailers usually require a form of identification before they issue them. You may need to provide proof of your name and address, your Social Security number, your date of birth, or your Taxpayer ID number.

Do Reloadable Prepaid Cards Issue Statements?

Basically, no. Because Reloadable Prepaid Cards don’t provide a statement of transactions, the user is responsible for maintaining a record of spending.

Will A Prepaid Card Affect My Credit Score?

The use of a prepaid card does not affect your credit score since it is not linked to a line of credit. However, you will not be able to improve your credit rating with them.

Can I Start Using My Prepaid Card Immediately?

The first time you use Reloadable Prepaid Cards, it usually needs to be activated. It will be necessary to load funds onto the card once it is activated.

Conclusion

The popularity of Reloadable Prepaid Cards Is increasing among consumers. They are another money tool available to help people manage their finances. It can be very helpful to use them in certain situations. However, there is an additional expense and a certain amount of risk associated with them. Research your options and choose the best prepaid card for your needs if and when you find one that works for you.

Add Comment