Are you looking for Florida First Time Home Buyer Programs? If Yes, You are at the right place.

In this article, we are sharing all the information about Florida First Time Home Buyer Programs.

You can be excited when you buy your first home, for sure. However, the process is also filled with a lot of stress-especially money-related stress. There’s no doubt that buying a house is one of the most important purchases you’ll make in your life.

Florida offers a few first-time home-buyer programs to help in-state buyers secure their first mortgages and make a down payment on a home. First-time buyers can take advantage of a few national programs, but we’ll focus on the Florida programs.

The buying of a home is a major and exciting decision that has many benefits, including the ability to build wealth and create stability. First-time homebuyers may find the process complex and overwhelming, especially if unfamiliar with the various rules and regulations associated with the process.

There are specific criteria that determine who qualifies as a first-time homebuyer in Florida, and understanding them can make a big difference. Our goal here is to provide you with a thorough understanding of the definition of a first-time homebuyer in Florida, as well as eligibility requirements, potential benefits, and resources to help you through the process.

This guide will show you how to take advantage of the opportunities available, whether you’re a young professional, a retiree, or a low-income family. Additionally, you may also want to consider Illinois First Time Home Buyer Programs, which offer similar benefits to residents of that state.

What is a First-Time Home Buyer Program?

Contents

- 1 What is a First-Time Home Buyer Program?

- 2 What Is a First-Time Home Buyer Grant?

- 3 What is Florida Housing?

- 4 Who Is Considered a First-Time Homebuyer in Florida?

- 5 Florida First Time Home Buyer Programs

- 6 Who Qualifies For the Florida First Time Home Buyer Programs?

- 7 How to Apply for Florida First Time Home Buyer Programs

- 8 What is The Process After Being Approved for Florida First Time Home Buyer Programs?

- 9 Video Guide for Florida First Time Home Buyer Programs

- 10 National First-Time Homebuyers Programs

- 11 Congress & First-Time Home Buyer Programs

- 12 Closing Cost Assistance Programs For First-Time Buyers

- 13 FAQs

Florida First Time Home Buyer Programs are special incentives and mortgage loans that broaden the pool of prospective homebuyers. The programs are supported by both public and private banks as well as government entities.

The following programs are available to first-time homebuyers:

- Mortgages with a low down payment require a deposit of less than five percent.

- Mortgages that do not require a down payment.

- First-time buyer mortgage loans that offer special interest rate discounts.

- First-time homebuyers may be eligible for loans with more lenient approval criteria.

- The homebuyer’s profession influences the terms of the mortgage.

First-time homebuyers can complete mortgage applications online or in person, and mortgage companies can approve applications within minutes.

What Is a First-Time Home Buyer Grant?

First-time homebuyer grants are monetary awards given to new homeowners during the homebuying process. There are many grant programs available at the federal, state, and local levels, as well as from charitable organizations and housing foundations.

This program does not require first-time homebuyers to repay these grants since they constitute contributions towards homeownership, considered a public good.

A $10,000 grant can increase homeownership rates by up to 34% in an area by making it available to first-time purchasers.

The presence of new homeowners in a neighborhood can have several positive impacts:

- A neighborhood can benefit from increased tax income by funding community improvements and services.

- Businesses in the area can thrive as new homeowners increase their spending.

- Homeownership can establish generational wealth for families since homes increase in value with time.

What is Florida Housing?

Florida Housing offers affordable housing to low-income residents and families in Florida. Various housing assistance programs are available as part of the program, including public housing, Section 8, and HOME programs. Community development initiatives are also available as part of the program.

The Florida Housing Authority offers residents rental assistance, loan and grant programs, and homebuyer assistance to help them find safe, quality, and affordable housing. To improve access to housing for those in need, the organization strives to make it more affordable.

Who Is Considered a First-Time Homebuyer in Florida?

Florida Housing Finance Corporation helps first-time homebuyers and people of low-to-moderate income find affordable housing in the Sunshine State.

Those who have not owned a primary home in three years are considered first-time homebuyers.

There are also first-time homebuyer programs available to repeat buyers in certain areas of the state. The veteran does not necessarily have to be a first-time buyer.

Florida First Time Home Buyer Programs

The Florida Housing Department offers a few types of loans for first-time homebuyers, including the Florida First program and conventional loans from the HFA. This 30-year, fixed-rate conventional mortgage will require borrowers to pay less in mortgage insurance than comparable federal loans. It is usually possible to combine the loans with down payment and closing cost assistance.

This 30-year, fixed-rate conventional mortgage offers lower mortgage insurance costs than comparable federal programs. It is usually possible to combine the loans with down payment and closing cost assistance programs.

Here are the list of Florida First Time Home Buyer Programs –

Florida Assist Second Mortgage

Through this program, Florida Housing offers a 0% interest-deferred second mortgage that can only be used with a Florida Housing first mortgage to cover down payment and closing costs of up to $10,000.

A second mortgage is not forgivable, but repayment can be deferred until the home is sold, the borrower moves, or the first mortgage is refinanced. Florida First mortgage borrowers must also meet the same requirements.

Pros and Cons of Florida Assist Second Mortgage

| Pros | Cons |

| It can be used to buy a single-family home, a townhouse, a modular or mobile home, a condo, or a two- to four-unit property. | When you use it to purchase a multifamily property, one of the apartments must be yours. |

| There are no monthly payments and 0% interest. | A condo project must be approved before condos can be built. |

| It won’t affect seller-paid closing costs. | If you refinance, sell, or pay off your first mortgage completely, you must pay the entire amount. |

HFA Preferred and HFA Advantage Plus Second Mortgage

A forgivable second mortgage allows participants to borrow 3%, 4%, or 5% of the total loan amount for down payment and closing costs. The loan is forgiven at 20% a year over five years with no payments.

Pros and Cons of HFA Preferred and HFA Advantage Plus Second Mortgage

| Pros | Cons |

| This loan can be used for closing costs or a down payment. | There is a longer period before the loan is forgiven versus a quick forgiveness. |

| There are no monthly payments. | First mortgages from Florida Housing are the only ones that can be used. |

| There are no interest charges. | A loan of 3% to 5% may be less than the $10,000 offered by other programs, depending on your loan amount. |

| It is fully forgivable. |

FL HLP Second Mortgage

A Florida Homeownership Loan Program (FL HLP) offers a 3% interest rate loan for down payment and closing costs up to $10,000. The loan is repaid over 15 years, except when the borrower moves, sells, or refinances, at which point it must be repaid in full.

First-time homebuyers will be assessed a debt-to-income ratio based on the monthly payment associated with this loan.

Pros and Cons of FL HLP Second Mortgage

| Pros | Cons |

| A low monthly payment of $69.06 is available. | The monthly payment. |

| The rate is extremely low when compared to today’s mortgage rates. | You must pay back the entire loan amount if you sell, refinance, stop living in the house or pay off your first mortgage. |

| A 15-year loan has lower interest than a longer loan period. | A monthly payment could impact the debt-to-income (DTI) ratio when calculating your loan application. |

Florida First

The program offers 30-year fixed-rate FHA, VA, and USDA government-backed loans, as well as conventional loans that can be paired with Florida Housing’s down payment assistance and second mortgages.

The mortgage insurance premiums for conventional loans from the housing finance agency may be lower than those for federal government loans. You can purchase single-family homes, townhomes, approved condos, two- to four-unit homes with one unit occupied by you, modular homes, and mobile homes.

Credit scores must be at least 640, and income and purchase price limits must be met in the county where the home is located.

Pros and Cons of Florida First

| Pros | Cons |

| It is compatible with FHA, VA, USDA, and conventional first mortgages. | It is a deferred loan, not a forgivable one. |

| It will be free of origination fees and discount points for buyers. | When you sell, refinance, stop living in the home or pay off the first mortgage, the entire loan amount is due. |

| Interest-free. | The applicant must be employed in a qualifying profession full-time. |

Who Qualifies For the Florida First Time Home Buyer Programs?

Applicants for Florida First Time Home Buyer Programs must meet IRS definitions of first-time homebuyers, which means they haven’t purchased a home before or haven’t owned property in the past three years. Your income must also meet certain limits for the county you’re purchasing in.

Florida Housing offers an online tool that can determine your eligibility for assistance. You must enter your income, how many people are in your household, and what county you prefer to live in. A home’s purchase price must also be below the limits for the county where you plan to buy. A single-family home, townhome, two- to four-unit home (where you reside in one unit), condominiums, or modular homes can be purchased.

How to Apply for Florida First Time Home Buyer Programs

The Florida Housing website contains an interactive tool called the Homebuyer Loan Program Wizard that can be used to determine your eligibility for Florida First Time Home Buyer Programs. A list of approved lenders by location is provided by the Wizard tool, but Florida Housing is not a lender.

First-time buyers should compare interest rates, fees, and other costs among lenders to find the most affordable loan, especially since they may be unfamiliar with the mortgage lending process.

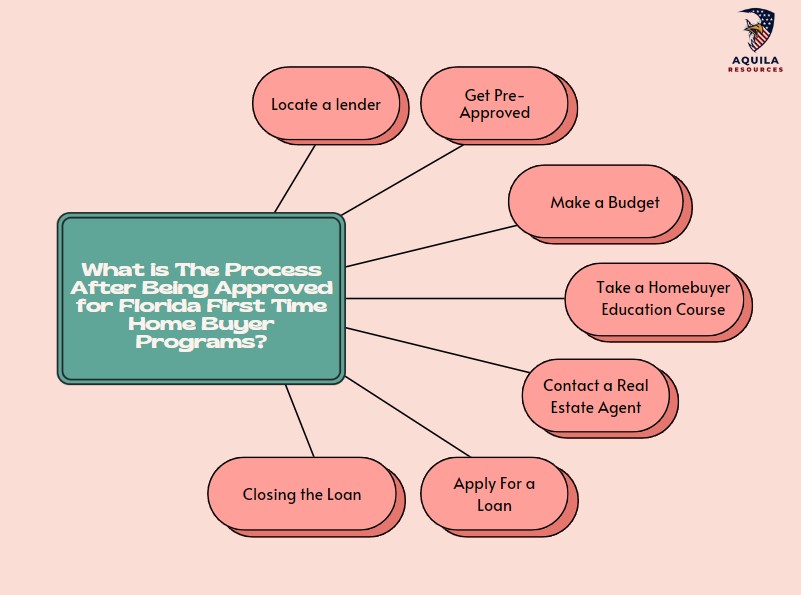

What is The Process After Being Approved for Florida First Time Home Buyer Programs?

The seven steps to getting a mortgage after you’ve been approved for a homebuyer program are:

- Locate a lender: A Florida Housing-approved lender will help you find a home once approved for a homebuying program. Find a lender using the Homebuyer Loan Program Wizard.

- Get Pre-Approved: A lender can assist you in getting pre-approved for a mortgage after you’ve found one. Lenders will grant you a mortgage pre-approval based on your credit score and history if you meet specified criteria. If you are pre-approved, you appear to be a more serious buyer to sellers, making you more attractive to them.

- Make a Budget: The first thing you’ll need to do is determine what kind of house you can afford. You can get advice on homebuying from your lender and determine what you can afford.

- Take a Homebuyer Education Course: A lender-approved education course is required before you can enroll in Florida homebuyer programs.

- Contact a Real Estate Agent: A realtor can show you homes in your price range and help you find the perfect one for you and your family. They will prepare your purchase offer, assist you with appraisals and inspections, and submit your offer on your behalf.

- Apply For a Loan: After your offer has been accepted, you will submit a formal loan application to your lender. The government requires documents like a photo I.D., tax returns, W-2s, bank statements, and proof of assets.

- Closing the Loan: The closing process includes signing final documents and paying closing costs, such as the down payment, appraisal, and title search. Your lender may cover some or all of these costs depending on the type of homebuyer program you applied for. You’ll become a new homeowner as soon as you sign the paperwork.

Video Guide for Florida First Time Home Buyer Programs

National First-Time Homebuyers Programs

Several first-time homebuyer programs are available nationwide for those looking to buy their dream house. Visit HUD’s website for helpful information. According to the HUD website, one of the most important things they do is help people become homeowners.

The U.S. Department of Housing and Urban Development offers free counselling for those worried about their eligibility for home ownership, as well as programs for teachers, firefighters, law enforcement officers and others that offer discounts on homebuying costs.

Here are some of the most common national housing loans:

- FHA loans. Those with low credit scores may benefit from this program. A FHA down payment starts at 3.5% of the purchase price for people with a credit score of 580 or higher. The FHA requires a down payment of 10% if your credit score is below 580. Mortgage insurance is required for the life of an FHA loan.

- V.A. loans. The U.S. Department of Veterans Affairs offers V.A. loans to veterans, their spouses, and other military members. Some of them do not require downpayments or mortgage insurance.

- USDA loans. There is no down payment required for people who live in rural areas, and income requirements vary from region to region. There are other requirements for borrowers with credit scores below 640.

Congress & First-Time Home Buyer Programs

Congress introduces legislation to assist renters in becoming homeowners every session to show its support for first-time home buyers.

Congress is expected to present two essential bills in the current session: a tax credit and a cash grant.

The $15,000 First-Time Home Buyer Tax Credit

The government offers tax credits to encourage specific behaviours, such as home ownership. Home buyers have a major victory this year with the $15,000 First-Time Home Buyer Tax Credit proposed by the IRS.

First-time homebuyers can claim up to $15,000 in tax rebates for purchases made after December 31, 2020, with this program, which was modelled after the 2009 version. The federal government also offers a credit for home improvements and upgrades that homeowners may claim as a federal tax deduction.

The $25,000 Down Payment Toward the Equity Cash Grant

The $25,000 Down Payment Toward the Equity Cash Grant or Down Payment Toward Equity Act provides first-generation home buyers with a cash grant of up to $20,000 and buyers from economically and socially disadvantaged backgrounds with an additional $5,000 learn about $5000 First Time Home Buyer Grant.

You can use the grant money for a down payment, closing costs, or real estate taxes, as well as for discount points to reduce your mortgage rates. Congress is expected to reintroduce the Down Payment Toward Equity Act in its current session, even though it has yet to become law.

Closing Cost Assistance Programs For First-Time Buyers

A closing cost assistance program covers all or a portion of a home buyer’s closing costs, including title insurance, transfer taxes, and mortgage fees.

There is an updated list of programs available on the website of the National Council of State Housing Agencies, which prospective buyers can access. There are, however, certain criteria that buyers must meet, such as credit and income thresholds, and the homes they buy must meet minimum safety and quality standards.

Down Payment Assistance Programs (DPA)

State and local governments often offer first-time home buyers cash grants to assist in their pursuit of homeownership. These grants are distributed on a first-come, first-served basis.

Various grants are available from $500 to $50,000 to help with mortgage closing costs, reduce mortgage rates, or provide down payment assistance.

A home buyer is usually eligible for these grants if their income falls within the lower two quartiles of their area and if they have a minimum credit score.

Search for “housing assistance” or “housing grants” on your municipal website to find housing grants and programs in your area. Review the requirements for down payment assistance programs on the website.

Down Payment Loans

A non-profit or community organization gives a down payment loan to replace a home buyer’s down payment with borrowed funds. The interest rate for these loans is usually in the one-percent range, and they are amortized over 30 years, so payments are extremely low.

Your municipal housing administration can provide information about down payment loans in your area.

Down payment loans are unavailable in all mortgage programs, so buyers should check with their lenders before applying.

Deferred Mortgages

The term “deferred mortgage” refers to mortgages that allow borrowers to defer repayment until their home is sold or refinanced.

Municipalities and foundations provide the programs and can provide up to $25,000 in funding for first-time buyers who meet certain qualifications, such as having an income below the local average and an on-time payment history.

FAQs

How Do These Programs Work?

First-time homeowners can obtain 30-year, fixed-rate first mortgages through Florida’s first-time homebuyer programs. You must have a credit score of at least 640, work with a participating mortgage lender, and complete a homebuyer education course to qualify for this program.

How Much Down Payment Assistance Could I Receive in Florida?

There are different down payment assistance programs, and you may receive enough financial assistance to cover your entire down payment, along with some closing costs.

What is the Average Age of First-Time Homebuyers in Florida?

The average age of Florida homebuyers is 57, compared to 47 nationally. It is still being determined what the average age of Florida’s first-time homebuyers is, but the average age nationwide is 33.

Is There a First-Time Homebuyer Tax Credit in Florida?

Florida Housing does not participate in Florida Housing’s first-time homebuyer mortgage tax credit certificate program. It is still possible to receive a tax credit of up to $2,000 for mortgage interest paid through some local housing finance agencies.

Add Comment