Are you looking for Best Business Credit Cards with Cashback? If Yes, You are at the right place.

In this article, We are sharing all the information about Best Business Credit Cards with Cashback.

The smartest business owners earn cash back on all their expenses with business credit cards. These cards usually reward business owners with cash-back rewards based on their purchases, which is a nice perk for those who pay their credit card bills on time every month.

The best business credit cards offer cash-back rewards on your business’s usual expenses. Choose a card that is right for your company by considering the fees associated with it, the introductory rate and ongoing APR, the welcome bonus, and other important features. Additionally, you should review the cashback limits when they expire and how you can redeem them.

What is a Business Credit Card?

Contents

- 1 What is a Business Credit Card?

- 2 What are Business Credit Cards with Cashback?

- 3 How Does Business Credit Cards with Cashback?

- 4 Top 5 Business Credit Cards with Cashback

- 5 Capital One Spark Cash Plus

- 6 How To Apply for Business Credit Cards with Cashback?

- 7 Pros and Cons of Business Credit Cards with Cashback

- 8 How Can You Business Redeem Cash Back Rewards?

- 9 How To Choose Business Credit Cards with Cashback?

- 10 What are Alternatives to Business Credit Cards with Cashback?

- 11 Business Cash-Back Credit Cards vs. Personal Cash-Back Credit Cards

- 12 FAQs

They are revolving lines of credit that can be used to cover short-term expenses and build credit for businesses. There are also cards that offer 0% intro APR periods and earn rewards on eligible business-related spending.

A business credit card works similarly to a consumer credit card: If approved, you usually receive a set credit limit. A credit inquiry can affect your credit score if your card issuer reports your credit usage, good or bad. The rewards offered by business cards are often similar to those offered by consumer cards, often in the form of cash back, points, or miles. Many of the best business cards are available to those with good credit, but secured business credit cards can help entrepreneurs rebuild or establish their credit.

What are Business Credit Cards with Cashback?

Business Credit Cards with Cashback are credit cards designed and issued specifically for businesses that earn rewards in cash. It is common for business credit cards to offer lower cash-back rates on general purchases while earning higher cash-back rates on common business expenses such as office supplies. There are often business-related benefits attached to these cards as well.

The use of Business Credit Cards with Cashback helps keep business and personal expenses separate. The primary cardholder of a business credit card may still have to provide personal guarantees if the business doesn’t have enough business credit history or collateral.

How Does Business Credit Cards with Cashback?

The Business Credit Cards with Cashback offers you a percentage back on every purchase you make. Depending on the terms of your card, you’ll earn a different amount. A $100 purchase would earn $1 in cash back if 1% is earned.

All earnings accumulated through your card will be credited to your card’s account for redemption as directed by your card. Depending on the card, you may be able to cash out any amount at any time, while others require maintaining a minimum balance in order to do so. It is usually a credit on a statement or an electronic deposit into a linked account that is redeemed for rewards. It is important to note that cash-back rewards do not represent a discount on purchases. All purchases must be fully paid for.

Top 5 Business Credit Cards with Cashback

Here are the top 5 Business Credit Card with Cashback

Capital One Spark Cash Plus

A business cash-back card from Capital One, the Spark Cash Plus offers 2% back on all purchases. The perfect credit card for businesses that spend over $7,500 annually without worrying about keeping up with multiple bonus categories. You get unlimited 2% cash back on every purchase without tracking bonus categories or spending limits. If you have a flat-rate card with uncapped rewards, you can pretty much do that.

Pros

- Cardholders earn cash back on their primary and employee cards

- Reward points don’t expire

- There are no foreign transaction fees

Cons

- Monthly payments must be made in full

- An annual fee is charged

- Bonus offers with high spending requirements, annual bonus offers

American Express Blue Business Cash Card

American Express Blue Business Cash Card is a business credit card with no annual fee and rewards that pay off over time. Consider this card if your annual spending is $50,000 or less and you want to earn substantial rewards without tracking categories. Up to $50,000 in eligible purchases are eligible for 2% cash back, then 1%.

When you earn cash back, a credit is automatically applied to your statement. There are terms and conditions. Its bonus rewards cap limits its appeal to high-spending entrepreneurs, but those with smaller expenses will find it hard to find a card with a higher flat rewards rate. Your rewards are automatically credited to your account each month.

Pros

- There is no annual fee

- Reward rate that is high

- Introductory APR period

- Earnings in cash

Cons

- Limits on bonus rewards spending

- Credit must be good or excellent

Ink Business Unlimited Credit Card

The Ink Business Unlimited Credit Card offers flat-rate cash back on all spending and an introductory APR that can help you save money on interest. With unlimited flat-rate rewards (1.5% cash back), an introductory APR period of 18 months, and a whopping $750 bonus cash back after $3,500 in purchases in the first three months, the Ink Business Unlimited® Credit Card is a triple threat.

Pros

- There is no annual fee

- Introductory APR period

- There is no cap on rewards

- The bonus offer is for new cardholders

Cons

- There are no bonus categories

Ink Business Cash Credit Card

The Ink Business Cash Credit Card boasts lucrative earning categories, along with rewards caps. The annual fee is not an issue, so you don’t have to worry about spending enough to get even with the card. Those who spend in business-like areas-especially those who spend less than $50,000 a year, benefit from this card.

Cash rewards are 5% for office supply stores, 2% for gas stations and restaurants, and 1% for everywhere else. For your first $25,000 in combined purchases per year, you get 5% cash back on internet, cable, and phone services, 2% for gas stations and restaurants, and 1% for everything else.

Pros

- There is no annual fee

- APR intro period

- Bonus offer for new cardholders

Cons

- Credit must be good or excellent

- Outside of bonus categories, low-rate

- Limits on bonus rewards spending

Bank of America Business Advantage Customized Cash Rewards Mastercard credit card

Business Advantage Customized Cash Rewards Mastercard from Bank of America is an excellent cash-back credit card for small businesses. It offers generous rewards in multiple categories that small businesses will find useful. The card becomes best-in-class if the cardholder has an existing relationship with Bank of America or Merrill and has achieved the Platinum level in the Preferred Rewards program.

Pros

- There is no annual fee

- A high reward rate

- Bonus offer for new cardholders

- Bonus categories that rotate

Cons

- Credit must be excellent

- Rewards that are complicated

- Fees for foreign transactions

- Limits on bonus rewards spending

- Rewards are limited to certain customers.

How To Apply for Business Credit Cards with Cashback?

The process of applying for a business credit card is similar to that of applying for a personal credit card. There are a variety of pieces of information required by these forms, including the name of the business, tax ID, incorporation status, annual revenue, among others. A majority of issuers offer convenient online application forms, but you may also be able to apply by calling your chosen issuer.

Pros and Cons of Business Credit Cards with Cashback

A cash back rewards credit card can be a worthwhile investment for your business. There are, however, some disadvantages to these cards as well.

Pros of Business Credit Cards with Cashback

- When cardholders spend money, they earn cash rewards.

- Many cards offer various category-based earning options; applicants will likely find a card that fits their business’ spending habits.

Cons of Business Credit Cards with Cashback

- Credit cards with cash back often have higher standard interest rates.

- There are some cards that restrict how much cash back can be earned each year.

- There is no discount with cash back – cardholders must redeem their cash back at a later date.

How Can You Business Redeem Cash Back Rewards?

Business credit card statements also contain rewards earnings for the statement period. Cash back rewards can typically be redeemed in the following ways:

- Depositing Cash Into Your Bank Account: Whenever you earn money, a checking account is automatically credited with it.

- Getting Statement Credit: If you choose this option, your rewards are applied to your statement balance, which reduces the amount you owe.

- Using Your Credit Card’s Portal to Redeem Other Rewards. Through your credit card issuer’s website, you can use your cash back rewards to purchase travel or other special rewards, including gift cards. There are times when redeeming rewards this way will get you more, though credit card issuers have different rules.

It is important to read your card agreement, so you know what redemption options you have. The way you receive your cash back may sometimes be up to you, but it won’t always be.

How To Choose Business Credit Cards with Cashback?

- Choose Between Bonus Categories and Flat-Rate Rewards. If you spend a lot of money in areas like office supply stores or dining, a credit card that offers more points may be more suitable. If your spending is evenly spread across multiple categories, you may earn more if you use a credit card with a high flat-rate reward rate.

- Compare Welcome Bonuses. To determine if your business qualifies for bonus offers, find out how much it spends each month on average. Based on that information, choose bonuses appropriate for your average spending style.

- Look for Cardholder Benefits You Want: Business credit cards with benefits like extended warranties and purchase protection may be the best choice for you.

- Select the Method of Redemption: There are different ways to earn cash back with business cards. Some programs allow you to redeem points for statement credits or a check in the mail, while others offer gift cards, travel, merchandise, or other options. It’s important to ensure that any cards you’re considering offer the redemption options that you’re looking for.

- Examine Annual Fees. Last but not least, compare business credit cards according to their annual fees and other fees. It’s important to ensure you’re getting ample rewards and cardholder benefits in exchange for paying an annual fee.

What are Alternatives to Business Credit Cards with Cashback?

There is no doubt that business credit cards can offer a lot of value, but they aren’t the best solution for every business. There are entrepreneurs who need credit cards to cover expenses that exceed their credit cards’ limits, who carry a balance for long periods of time, or who simply have poor credit. There are several alternatives to business cards, including:

Business Loans: Small business loans can provide larger loan amounts at lower interest rates than business credit cards.

Business Lines of Credit: Good or excellent credit may qualify for higher credit limits on business lines of credit than on business credit cards.

Personal Credit Cards: You may not receive all the benefits of business credit cards, but you are at least protected against fraud with a personal card, and it may have a longer introductory interest rate.

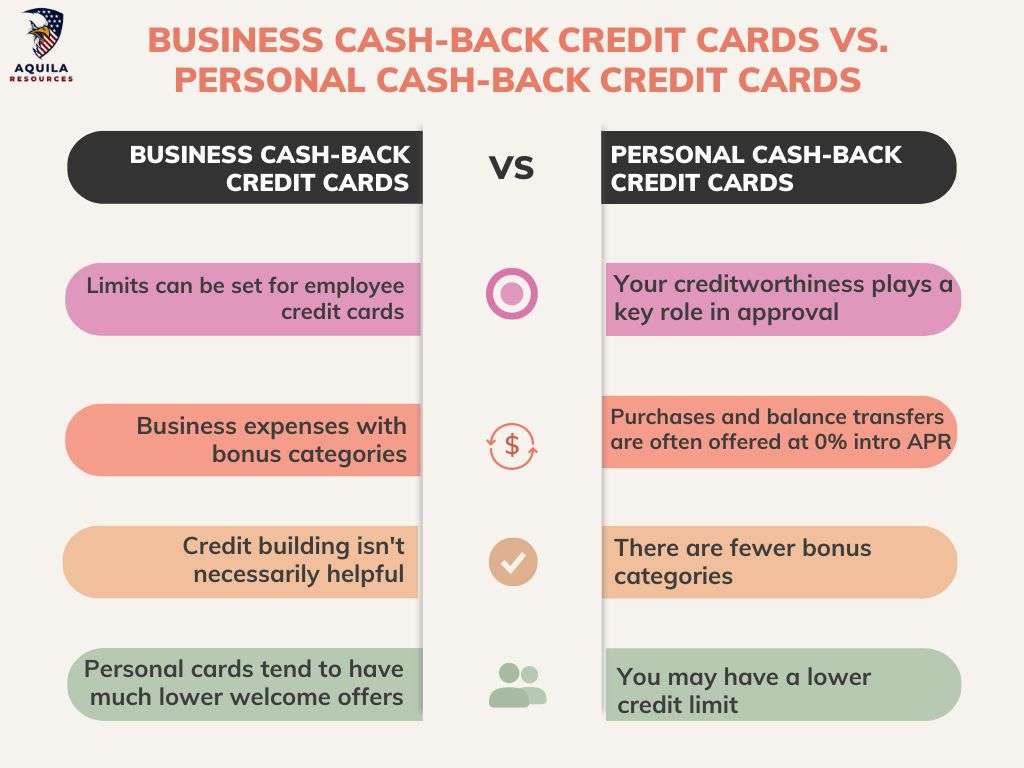

Business Cash-Back Credit Cards vs. Personal Cash-Back Credit Cards

FAQs

How Can I Use My Cash Back Rewards?

The cash back you earn can be used as a statement credit, a direct deposit into your eligible bank account, or a check. Some cards even allow you to redeem your rewards for travel, gift cards, or merchandise. You may have the option to accumulate rewards over time and choose when to use them, or you may have them automatically applied to your statement. Make sure you read the fine print to find out if your rewards are valid.

Is Cash Back on a Business Credit Card Taxable?

Credit card cash back rewards are viewed as rebates on purchases rather than income. As a result, businesses do not have to pay taxes on cash back. If certain credit card rewards are considered earned income, your business may receive a 1099 for reporting your annual taxes. Make sure your business taxes are filed and paid as required by your tax advisor.

What are the Benefits of Using a Cash Back Business Credit Card?

You can earn cash rewards on business credit cards using a simple rewards structure, which usually gets applied to your billing statement, saving you money on business expenses. Furthermore, you can maximize rewards since various cards that offer cash-back rewards on various spending categories are available on the market.v

Add Comment