Are you looking for the Best High-Limit Business Credit Cards? If Yes, You are at the right place.

In this article, We are sharing all the information about the Best High-Limit Business Credit Cards.

Your business can benefit from the right high-limit business credit card by giving them the purchasing power they need to operate efficiently while sometimes offering valuable rewards and perks. You can often find higher credit limits with business credit cards than consumer cards – and we’ve gathered several options for various needs where you can score a high limit.

There is no guarantee that your credit limit will be high. It is important to note that issuers will determine your limit based on your ability to repay the charges you make on the card when approving your application.

What are Business Credit Cards?

Contents

- 1 What are Business Credit Cards?

- 2 How Do Business Credit Cards Work?

- 3 What are the Best High-Limit Business Credit Cards?

- 4 How To Get High-Limit Business Credit Cards?

- 5 Best High-Limit Business Credit Cards

- 6 How Do You Apply for High-Limit Business Credit Cards?

- 7 How Do Business Credit Cards Determine Limits?

- 8 How to Choose High-Limit Business Credit Cards?

- 9 How to Use High-Limit Business Credit Cards Responsibly?

- 10 Which High-Limit Business Credit Cards is Right for You?

- 11 How to Maximize High-Limit Business Credit Cards?

- 12 Should You Get High-Limit Business Credit Cards?

- 13 FAQs

A business credit card can provide fast and convenient capital for any business need. Credit cards can provide a bridge between cash outlays and payments received by a customer. Business owners can use credit cards to pay for the initial setup of their organization, along with expenses such as signage, inventory, and advertising. Business credit cards can be used to acquire capital assets, such as machinery, furniture, or electrical equipment. Your business can generate income and pay off the balance during this time.

How Do Business Credit Cards Work?

The business credit card works like a consumer credit card: Upon approval, a credit limit is assigned, which serves as a maximum spending limit. Your available credit decreases whenever you make a purchase, and as you pay off the purchase, it increases. Credit card issuers report your credit usage, good or bad, to credit bureaus, and your credit score may increase or decrease depending on the information reported. Business cards can also come with rewards, such as cashback or travel miles, similar to consumer cards.

Some business credit cards also require a personal guarantee from the business owner. Business credit card debt is legally binding, so the owner is personally responsible if the business fails to repay the debt.

What are the Best High-Limit Business Credit Cards?

A high-limit business credit card allows businesses with high-volume and expensive expenses to earn substantial rewards at reasonable annual percentage rates (APRs). Consider whether a card with a preset spending limit and cashback rewards or points rewards would be most beneficial for your business. Businesses not qualifying for regular business credit cards are advised to apply for charge cards or secured credit cards.

Business credit cards are a smart move if you have a lot of monthly expenses, especially if your company has multiple locations. The best business credit cards are those with high limits, so you can earn significant rewards and keep your business expenses separate for tax purposes.

Moreover, some business credit cards have added benefits that streamline business operations – such as extended warranties, free employee cards, and purchase protection. Several of the best high-limit business credit cards even offer 0% intro APRs for a limited time, which allows you to pay large purchases off over time without interest.

How To Get High-Limit Business Credit Cards?

A high-limit business credit card is typically only available to well-qualified businesses. You’ll need to demonstrate your business’s track record of responsible use and payments before getting a loan for that much money. The approval of your application may also depend on other strong financial data, such as revenues, assets, or experience in the industry.

The best thing to do if you want to apply for a loan but don’t think you’ll have high approval odds is to improve your business credit before applying. Alternatively, if you are already eligible to apply, ensure your application contains the most up-to-date numbers and information to enable you to stand out.

Best High-Limit Business Credit Cards

Capital One Venture X Business Credit Card

The Capital One Venture X Business card provides business owners with various travel benefits. When you book hotels or rental cars through Capital One Travel, you’ll earn 10X miles. The portal also earns 5X miles on flights booked through it. The card earns an unlimited 2X miles on other purchases, which is a great rate compared to other business cards.

Even though the card carries a $395 annual fee, card members can quickly offset that cost by utilizing its many travel benefits – like the $300 Capital One Travel statement credit. There’s also an annual statement credit of up to $100 toward the fees associated with TSA PreCheck or Global Entry and 10,000 bonus miles each year on the account anniversary. This credit card has no preset spending limit, which is great for business owners who need a high-limit credit card.

Pros

- Travel perks that are both valuable and practical

- The welcome offer is valuable.

- Rewards redemption options that are flexible

- Spending limits are not set.

- A free employee card with a customizable spending limit

Cons

- Even though the business card fee is easily offset, it is high.

- A balance cannot be carried and must be paid off each billing cycle.

- Minimum spending requirements may be challenging to meet.

- A redemption for cash back reduces the redemption value by half.

Ink Business Preferred Credit Card

The Ink Business Preferred Credit Card, which has an annual fee of $95 per year, is an excellent option for business owners interested in earning flexible rewards points and having a high limit. As soon as you open the account, you’ll receive 100,000 bonus points, which can be redeemed for $1,000 in travel through Chase Ultimate Rewards. In addition to earning 3X points, you will earn 1X points when you make purchases directly through social media or search engines — such as travel, shipping, internet, cable, or phone services. All other purchases will earn you 1X points.

You can earn flexible rewards with this card. By redeeming them through the Chase Ultimate Rewards portal, you can get 25 percent more value, transfer them to Chase airline and hotel partners, earn cash back, get gift cards, or buy eligible merchandise. Other benefits include trip interruption and cancellation insurance, collision damage waivers for auto rentals, extended warranties, purchase protections, cell phone protections, and free employee cards, among others.

Pros

- The annual fee is low.

- Exceptional welcome bonus

- Extremely flexible rewards with solid earning rates

- Travel rewards with Chase Ultimate Rewards are worth 25 percent more.

- Employee cards are free.

Cons

- Minimum spending requirements are high for welcome bonuses.

- There is a greater focus on travel benefits than business benefits.

- There is a limit of $150,000 in bonus category rewards per year.

Capital One Tap Business Credit Card

Capital on Tap Business Credit Card offers 1.5 percent cash back on all purchases, a credit limit of $50,000 (based on creditworthiness), and a welcome offer of $200 cash back after spending $15,000 in the first three months of account opening. And you won’t have to pay an annual fee for this.

The application for this card will not affect your credit score – even temporarily. This card uses a soft pull of your business and personal credit files, while nearly all credit cards pull your credit report when you apply, temporarily lowering your credit score. The Capital on Tap Business card is a good option for people with good to excellent credit scores who want to avoid a short-term score drop when applying for a mortgage or other loan.

Pros

- Cash back of 1.5 percent on all purchases

- Up to $50,000 credit limit based on creditworthiness

- Transaction fees are neither annual nor foreign.

- Credit scores are not affected by applying

Cons

- A considerable margin inflates APRs for high-end cards.

- There are limited perks and benefits available.

- The average welcome bonus requires a high minimum spending.

- Organizations that are sole proprietorships or nonprofits are not eligible.

Ink Business Cash Credit Card

A business card that rewards spending in your most frequent spending categories may be a good choice for your business. Ink Business Cash Credit Card offers 5 percent cash back at office supply stores and internet, cable, and phone service providers (up to $25,000 in combined purchases per year, then 1 percent). Additionally, you can earn 2 percent cash back at gas stations and restaurants (up to $25,000 in combined purchases) and 1 percent cash back on all other purchases.

This card has no annual fee, and you’ll earn $900 in cash back after spending $6,000 on it within the first three months of opening your account. You can look forward to various benefits when renting a car for business, including primary auto rental insurance, purchase protection, extended warranty coverage, and free employee cards.

Pros

- There is no annual fee.

- A valuable welcome bonus awaits you.

- APR is 0% for the first 12 months on purchases

- The Chase Ultimate Rewards program provides flexible redemption options.

- An annual-fee-free card with generous benefits

Cons

- Businesses with higher expenses will likely exceed $50,000 in annual spending across bonus categories.

- All business types may not be able to benefit from bonus rewards.

- Fees for foreign transactions are 3 percent.

- Balance transfers do not have an introductory APR

Capital One Spark Cash Plus

This Capital One Spark Cash Plus card offers a flat 2 percent cash back on all purchases. Additionally, Capital One Travel offers 5 percent cash back on hotel and rental car bookings. If you spend at least $150,000 during the year, you can have your $150 annual fee refunded. You can pay your balance in full at the end of your billing cycle since the card is a charge card. There is no predetermined credit limit to worry about.

With every sign-up, you will also get a chance to earn a one-time cash bonus of up to $3,000: $1,500 after spending $20,000 within the first three months and an additional $1,500 after spending $100,000 within the first six months. Several card benefits include roadside assistance, virtual card numbers, free employee cards, and no foreign transaction fees.

Pros

- Cash back of 2 percent on all purchases

- The credit limit is still being determined since it’s a charge card.

- Welcome bonus of great value

- Benefits of free employee cards that also earn cash back

- Annual fee refunded if you spend more than $150,000

Cons

- The $150 annual fee is higher than many other business cards.

- The minimum spending requirement for the welcome bonus is very high.

- Charge cards must be repaid in full every billing period, or penalties will apply.

How Do You Apply for High-Limit Business Credit Cards?

- Choose the Right Card for You: Consider the rates and fees of the card, the rewards, and whether the firm reports to business credit bureaus. Only apply for a few credit cards once, which will negatively impact your score.

- Complete the Application Form: Most applications can be completed online, and you will be asked for personal and business information to determine your creditworthiness. Among the items you will be required to provide are your tax identification number, your Social Security number, your business contact information, your income, and your business income and expenses. It would help if you had a personal credit score of at least 670 to qualify for most business credit cards.

- Please Wait for Approval: The approval process may take several days for some companies, while it may be instant for others. A secured business credit card may be a better option than an unsecured line of credit if you have yet to be approved for an unsecured credit card.

How Do Business Credit Cards Determine Limits?

Your business credit card issuer determines your credit limit based on your ability to pay. Several factors may affect providers’ decisions when evaluating this standard, including:

- Your income and debt.

- Score of your credit.

- The credit history of your business.

- The annual income of your business.

- Monthly credit card spending estimates for your business.

A high-limit business credit card can be obtained by understanding and improving these factors before applying. Try providing the issuer with additional business information if the issuer approves the card with a lower limit than you want.

How to Choose High-Limit Business Credit Cards?

There can be a lot of information about business credit cards. It is important that you carefully consider your options before applying. The following points should be taken into account:

- The Majority of Lenders Won’t Publish Credit Limits: It will be unknown to you what credit limit you’ll be assigned once approved. You must only guarantee a high-limit business credit card after applying, so you should apply sooner rather than later. Make sure you find a card that has the features and benefits you are looking for so that it will be the best fit for you.

- Beware of Your Credit Utilization Rate: The maximum amount of credit you can spend on your business card shouldn’t consistently exceed 30% of the total amount available. A credit utilization rate under 30% shows that you’re a responsible cardholder who isn’t overextended – this may affect your credit score.

- Make it Count: Ensure you choose a credit card that provides you the most benefits if you use a high credit limit to its full potential. Take advantage of welcome bonuses and introductory rates of 0% for an extended period. Choose rewards and benefits that will provide the longest-term value for your organization.

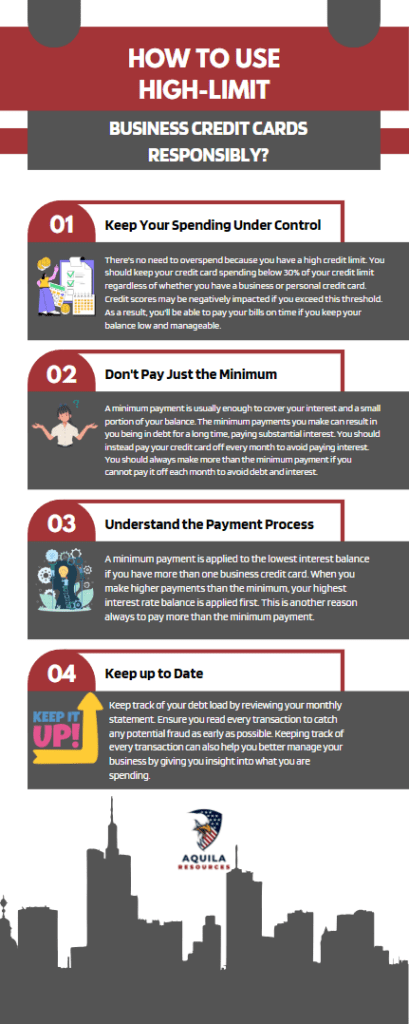

How to Use High-Limit Business Credit Cards Responsibly?

A high-limit business credit card can be an effective financial tool for growing your business, but misuse can damage it. Ensure your business credit card works by following the best practices listed below.

- Keep Your Spending Under Control: There’s no need to overspend because you have a high credit limit. You should keep your credit card spending below 30% of your credit limit regardless of whether you have a business or personal credit card. Credit scores may be negatively impacted if you exceed this threshold. As a result, you’ll be able to pay your bills on time if you keep your balance low and manageable.

- Don’t Pay Just the Minimum: A minimum payment is usually enough to cover your interest and a small portion of your balance. The minimum payments you make can result in you being in debt for a long time, paying substantial interest. You should instead pay your credit card off every month to avoid paying interest. You should always make more than the minimum payment if you cannot pay it off each month to avoid debt and interest.

- Understand the Payment Process: A minimum payment is applied to the lowest interest balance if you have more than one business credit card. When you make higher payments than the minimum, your highest interest rate balance is applied first. This is another reason always to pay more than the minimum payment.

- Keep up to Date: Keep track of your debt load by reviewing your monthly statement. Ensure you read every transaction to catch any potential fraud as early as possible. Keeping track of every transaction can also help you better manage your business by giving you insight into what you are spending.

Which High-Limit Business Credit Cards is Right for You?

Deciding what’s most important to you as you compare credit cards with high limits is important. Before applying for a credit card, you should keep a few things in mind.

Compare Rewards Programs

If you’re considering a business card, it should offer rewards you’d like to earn. The points can be redeemed in different ways, such as cashback, airline miles, hotel points, or flexible points that can be redeemed in multiple ways. Choose a card with rewards that you can use by comparing the rewards programs of several of the top cards on your list.

Rates and Fees to Consider

You should also consider the interest rates and fees. For a limited time, you can get a 0 percent intro APR on purchases with cards offering 0 percent intro APR. Annual fees are also a factor to consider, as business credit cards that offer the best rewards rates and perks typically charge higher fees.

Examine Cardholder Benefits Carefully

The last thing you need to do is decide which cardholder perks interest you the most. You may need free employee cards for your employees, or you travel frequently and need rental car coverage, travel insurance, or luxury travel perks. A card that offers extended warranty coverage and loss protection on items that already come with a manufacturer’s warranty may be a good idea if your business spends a lot of money on equipment.

How to Maximize High-Limit Business Credit Cards?

The following tips can help you make the most of your business credit card:

- Get the most out of your business credit card by using it for all expenses related to your business.

- You can earn a welcome bonus with your card if you meet the spending requirements within the specified time frame.

- Keep track of expenses with the expense-tracking features offered by your business credit card, such as transaction reports and year-end spending summaries.

- Avoid paying interest by paying your bill in full each month. Interest will easily wipe out rewards you earn when you pay your bill in full.

Should You Get High-Limit Business Credit Cards?

Business credit cards can help you manage your cash flow and earn rewards or cash back if you operate a small company. A high-limit business card can be particularly useful for business owners either experiencing high monthly expenses or planning to finance a big-ticket purchase.

A business card can also provide additional benefits to your business, such as travel protections, extended warranties, and free employee cards.

There might be other features on your card that matter more to you than a high limit, such as rewards or 0% APR. You can also find a broader selection of business cards that could benefit your business by checking out our list of the best business credit cards.

FAQs

Are High-Limit Business Credit Cards Worth It?

You can charge meaningful transactions on your business credit card without worrying about overspending if your card has a high limit. A business credit card with a high limit may also offer rewards programs, benefits, or no annual fee, providing you with the right features while still providing you with capital.

Which High-Limit Business Credit Cards is Right for You?

Discover the best high-limit business credit card for your needs by comparing rewards programs, interest rates, fees, and card member benefits.

Using a business credit card for business expenses, meeting the minimum spending requirements for the welcome bonus, using expense-tracking features, and paying your bill every month in full will help you maximize the benefits.

How Do I Get High-Limit Business Credit Cards?

A credit card application must be submitted as with any other credit card. It is typically possible to do this online on the issuer’s website. If your business has one, a number of items will be required from you, including your name, your business name, your social security number, and your annual revenue.

It is important to note that business cards usually require a personal guarantee, which means you are responsible for any charges on the card even if the business does not succeed. You will suffer a credit score ding if you default.

Add Comment