Are you looking for Alaska Airlines Credit Card Limit Increase? If Yes, then you are at the right place.

In this article, We are sharing all the information about Alaska Airlines Credit Card Limit Increase.

Credit cards are convenient ways to pay for purchases, earn rewards, and build credit history, depending on the type of account you open. There are, however, some limitations associated with this flexible financing tool, and one of the most important is your credit limit. You can spend up to the credit limit on your card, and getting too close to it lowers your credit score.

Alaska Airlines Visa credit cards are popular among West Coast flyers and credit card maximizers because they offer a variety of benefits that easily offset the card’s low annual fee ($95). How can you do this if you want to offset the annual fee in more than one way? The Alaska Airlines Visa credit card offers a variety of ways to maximize its value, including earning, redeeming, and maximizing companion fares.

It takes some work to make the most of this card, but it is worth it.

What is an Alaska Airlines Credit Card?

Contents

- 1 What is an Alaska Airlines Credit Card?

- 2 How Does Alaska Airlines Credit Card Work?

- 3 Benefits of Alaska Airlines Credit Card

- 4 Alaska Airlines Visa Card Pros and Cons

- 5 Process for Requesting an Alaska Airlines Credit Card Limit Increase Through Their Website

- 6 How Do You Request an Alaska Airlines Credit Card Limit Increase by Phone?

- 7 How Alaska Airlines Credit Card Limit Increase Automatically by Bank of America?

- 8 Why Increase Your Credit Card Limit?

- 9 How Do You Request a Credit Card Limit Increase?

- 10 Advantages of Increasing Your Credit Card Limit

- 11 Tips for Meeting the Requirements for a Credit Card Limit Increase

- 12 FAQs

Alaska Airlines Credit Card is a partnership between Alaska Airlines and a major credit card issuer that offers a variety of airline-specific benefits. The Alaska Airlines credit card rewards customers with miles on everyday purchases, provides companion fares at a discount, allows prior boarding, and offers exclusive benefits. It is, however, imperative to have a higher credit card limit if you are truly going to take advantage of these benefits.

How Does Alaska Airlines Credit Card Work?

Credit card companies set a limit on how much you can borrow on a credit card account at one time when you are approved for a new card. You have a credit limit of this amount.

A given billing cycle allows you to spend only up to your credit limit on your account. Credit card issuers allow you to charge your account further as you repay the borrowed money (either on your due date or throughout the month). The card issuer may deny additional charges if you reach the maximum credit limit on your account. If you reach the maximum credit limit, you will be asked to pay down the account balance again to avoid additional charges.

You may be approved for transactions that exceed the credit limit if you choose over-limit protection on your account. If you exceed your credit limit more than twice in the next six months, you’ll usually be charged an over-the-limit fee of $25 for the first occurrence and $35 for each additional occurrence.

You may also suffer damage to your credit score or an increase in interest rates if you exceed your credit limit (referred to as penalty interest if the account is in default).

Benefits of Alaska Airlines Credit Card

The Alaska Airlines Credit Card offers the best travel rewards for anyone looking to maximize their travel rewards. Alaska Airlines tickets earn you three miles per dollar spent on them and perks like priority boarding and a companion fare of $99 a year.

A great benefit of this program is that you can earn miles for everyday spending and 1 mile for every dollar you spend on other purchases. Travelers internationally can use the card without incurring foreign transaction fees. The Alaska Airlines Credit Card offers all these benefits, making it an excellent travel rewards card.

Alaska Airlines Visa Card Pros and Cons

Pros

- The Alaska Companion Fare is just $122 annually ($99 fare plus taxes and fees from $23).

- A free checked bag is available on Alaska flights for cardholders and up to six companions.

- If you use your credit card to purchase in flight, you can receive 20 percent back.

Cons

- The airline has a limited route network even though it is a member of the Oneworld Alliance.

- Alaska Airlines recently increased the card’s annual fee from $75 to $95, making it even less practical for occasional travelers.

- The best approval chances will come from a good to excellent credit score.

Process for Requesting an Alaska Airlines Credit Card Limit Increase Through Their Website

Alaska Airlines credit cards can allow you to request an increase in your credit limit online. Following are the steps to follow:

- Use Bank of America’s mobile app or sign in to your online account if you haven’t already.

- Navigate to the “Account details” page and select “Information and Services“.

- When you are eligible for an increase, you’ll see a button saying, “Request a credit line increase.”

- Provide your annual income, housing payment, and desired credit limit. The occupation and employer of your employer may also be required.

- Make sure your request is reviewed and submitted. Depending on your credit profile, it may take seconds or minutes for us to receive a decision.

- A credit limit increase will take effect immediately if approved. A letter explaining why you are not approved will be mailed within 7-10 business days.

If you don’t increase your spending, requesting an increase in credit limits can lower your credit utilization ratio and help you improve your credit score. Your Alaska Airlines credit card can also improve your purchase power and flexibility for travel or everyday expenditures.

How Do You Request an Alaska Airlines Credit Card Limit Increase by Phone?

If you want to increase your Alaska Airlines credit limit by telephone, contact Bank of America at (800) 732-9194 and enter your card number. To request a higher credit limit, speak with a representative once connected. You will be asked for your income, the amount of the requested increase, and permission to perform a hard pull if needed.

Your credit limit increase decision will be sent immediately or in an email.

It is important to remember that your credit score and payment history may influence a request for an increase, so make sure they are in good standing before requesting one. Alaska Airlines credit card limits can be quickly increased with the right preparation and a straightforward request.

How Alaska Airlines Credit Card Limit Increase Automatically by Bank of America?

A Bank of America credit card holder might be eligible for an automatic credit limit increase. The bank considers your payment history, spending patterns, and creditworthiness when determining whether you qualify.

- A credit limit increase might be automatic if you maintain an account for at least six months and pay your total balance every month.

- The Bank of America card does not guarantee you will receive an increase if you have a good credit score and use it responsibly.

- To maintain your eligibility for an increase in your credit limit in the future, it is important to keep using your credit card responsibly.

Why Increase Your Credit Card Limit?

- Enhanced Spending Power: The increased credit limit on your card allows you to book multiple flights, upgrade your seat, or cover additional travel expenses.

- Accumulating More Rewards: As you maximize your spending capacity, you can earn more miles, eventually accelerating your progress toward free flights, upgrades, and other travel-related rewards.

- Improved Credit Utilization Ratio: An increase in your credit card limit can negatively impact your credit utilization ratio, which refers to how much credit you use compared to the total available. Credit bureaus generally view low utilization ratios as favorable, potentially boosting your credit score.

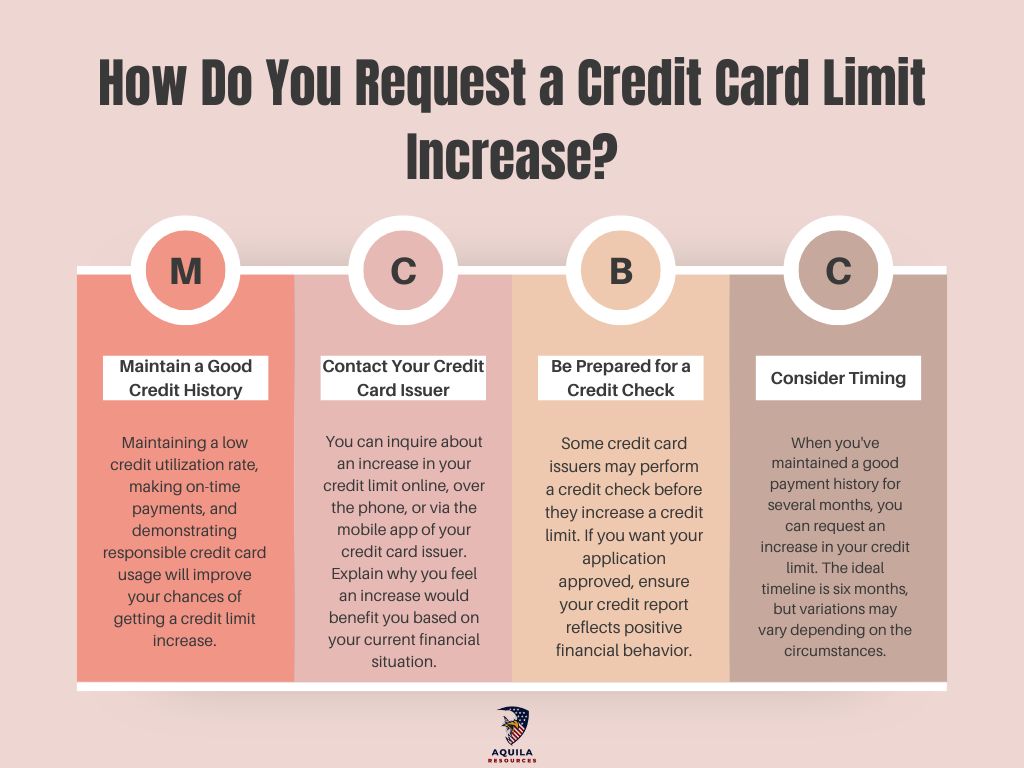

How Do You Request a Credit Card Limit Increase?

- Maintain a Good Credit History: Maintaining a low credit utilization rate, making on-time payments, and demonstrating responsible credit card usage will improve your chances of getting a credit limit increase.

- Contact Your Credit Card Issuer: You can inquire about an increase in your credit limit online, over the phone, or via the mobile app of your credit card issuer. Explain why you feel an increase would benefit you based on your current financial situation.

- Be Prepared for a Credit Check: Some credit card issuers may perform a credit check before they increase a credit limit. If you want your application approved, ensure your credit report reflects positive financial behavior.

- Consider Timing: When you’ve maintained a good payment history for several months, you can request an increase in your credit limit. The ideal timeline is six months, but variations may vary depending on the circumstances.

The Alaska Airlines Credit Card can help you achieve your travel dreams, and an increase in your credit limit can make them even more real. You can enhance your purchasing power, accumulate more rewards, and elevate your overall travel experience if you follow these steps, maintain good credit habits, and effectively communicate your needs to the credit card issuer. Responsible credit usage and timely payments are crucial when it comes to demonstrating your creditworthiness and obtaining a higher credit limit.

Advantages of Increasing Your Credit Card Limit

There are several advantages to increasing the credit limit on your credit card, although it may seem overwhelming at first. As a result, your credit score can be improved by reducing the utilization rate on your credit card. The higher your credit limit, the more you can spend without maxing out your credit card, making it easier to pay off your balances and proving to lenders that you are responsible.

Additionally, a higher credit limit can allow you to make larger purchases without needing to apply for further credit. You should, however, remember that higher credit limits come with a higher risk of overspending, so be careful not to charge more than you can afford to pay off each month. The use of a credit card limit increase can be a smart financial move, provided it is done responsibly.

Tips for Meeting the Requirements for a Credit Card Limit Increase

It’s possible to increase your chances of obtaining a credit card limit increase by doing the following things. To begin with, be sure to pay your credit card bill every month on time and in full. You will be more likely to qualify for a credit limit increase if you consistently demonstrate that you are a responsible borrower and can handle your payments. A low credit utilization ratio is also important. Ideally, keep it below 30%.

You can do this by maintaining a low balance relative to your credit limit on your credit cards. You can also speak with your credit card issuer directly about an increase in your credit limit. They can offer some advice or give you more information about the process. It is possible to gain financial flexibility and increased chances of approval by following these tips and taking a measured approach.

FAQs

How to Unlock Alaska Airlines Credit Card Limit Increases to Maximize Your Travel Potential

Alaska Airlines Credit Cards can enhance your Alaska Airlines travel experience if you are a frequent traveler and loyal customer. It offers a variety of benefits, rewards, and perks that enable you to earn miles and take advantage of exclusive benefits. Depending on your credit card limit, you can maximize these benefits to the fullest extent possible.

Is a Credit Limit Set Monthly or Yearly?

When you open a new credit card account, your credit card issuer determines your credit limit. Those credit limits aren’t set for a predetermined period, and the card issuer can increase or decrease them anytime.

Credit card companies may automatically raise your credit limit if you maintain a low balance, pay on time, etc. Credit card companies might only consider changing your borrowing terms once you request an increase in your credit limit.

What is the Credit Limit for the Alaska Airlines Visa Card?

Alaska Airlines Visa Cards typically offer credit limits between $5,000 and $15,000. In addition to your income and credit history, your credit limit can be higher or lower than that range. Some cardholders have credit limits below $5,000; others have secured credit limits exceeding $25,000.

Add Comment