Are you looking for Second Chance Credit Card No Security Deposit? If Yes, You have stumbled at the right place.

In this article, we are sharing all the information about Second Chance Credit Card No Security Deposit.

A credit card can be difficult to obtain if your credit is in the dumps. The truth is a credit card can be a valuable financial tool if used regularly and on time to rebuild your credit.

Getting a credit card that helps you restore your credit can be hard if you have a lackluster credit rating, as many cards require a security deposit. There are several good Second Chance Credit Card No Security Deposit available without a security deposit.

Second Chance Credit Card No Security Deposit

Contents

- 1 Second Chance Credit Card No Security Deposit

- 1.1 Second Chance Credit Card No Security Deposit

- 1.2 What is a Second Chance Credit Card?

- 1.3 How Does a Second Chance Credit Card Work?

- 1.4 Who can get Second Chance Credit Card No Security Deposit?

- 1.5 How to Apply for a Second Chance Credit Card

- 1.6 List of Second Chance Credit Card No Security Deposit

- 1.7 Eligibility Criteria for Second Chance Credit Card No Security Deposit

- 1.8 Video Guide for Second Chance Credit Card No Security Deposit

- 1.9 What to Look for When Applying for Second Chance Credit Card No Security Deposit.

- 1.10 Pros and Cons of Second Chance Credit Card With No Security Deposit

- 1.11 Pros

- 1.12 Cons

- 1.13 How to Make the Most of Second Chance Credit Card No Security Deposit

- 1.14 How We Picked Second Chance Credit Card No Security Deposit?

- 1.15 FAQs related to Second Chance Credit Card No Security Deposit

If you are looking for Second Chance Credit Card No Security Deposit, these are the best options:

| Credit Cards | Details |

|---|---|

| Capital One Platinum Credit Card | Learn More |

| Capital One QuicksilverOne Cash Rewards Credit Card | Learn More |

| Mission Lane Visa Credit Card | Learn More |

| Credit One Bank Platinum Visa Credit Card | Learn More |

| Petal 2 "Cash Back, No Fees" Visa Credit Card | Learn More |

The use of credit cards is convenient for many people. Credit card approval is challenging for everyone, especially those with poor credit scores who recently filed for bankruptcy or those carrying large amounts of debt.

The good news is that some Second Chance Credit Card No Security Deposit do not require an upfront security deposit.

Second Chance Credit Card No Security Deposit

Second-chance credit cards are available to borrowers with bad credit who don’t need to put any money down in advance. You can also earn cashback rewards on your eligible purchases with some second-chance credit cards.

Your payments will be reported to the credit bureaus, allowing you to build credit over time. You can also improve your credit score as you make on-time payments, as you can gain access to a higher credit limit.

What is a Second Chance Credit Card?

If you have bad credit, bankruptcies, or financial hardships, a second-chance credit card may be more suitable than traditional credit cards. Obtaining an unsecured or secured credit card with credit-building tools such as access to your credit report or credit score is possible.

These cards can also have higher variable annual percentage rates and more fees. Avoiding some charges, such as annual or foreign transaction fees, may be impossible. The only way to avoid APR is to pay off your credit card balance on time and in full monthly.

You will improve your credit score over time when you use the card responsibly. This means making your payments on time and in full each month. You can qualify for more credit cards, better loan rates, and more. If you are trying to get a credit card for the first time then these Best First Time Credit Card with No Credit History will help you get started on the right foot.

How Does a Second Chance Credit Card Work?

Second-chance credit cards often have extremely high-interest rates and fees to offset the issuers’ credit risk in lending to people with poor credit histories. Users of second-chance credit cards pay a higher price for this privilege. Credit cards generally work the same way as other forms of payment.

Second-chance credit cards have lower credit limits than traditional cards, but credit limits can usually be increased over time as the account holder demonstrates responsible credit usage.

The best second-chance credit cards report activity to all three credit bureaus, even though they may not offer as many benefits as other credit cards. Cardholders can rebuild credit by using their cards responsibly.

Who can get Second Chance Credit Card No Security Deposit?

Second Chance Credit Card No Security Deposit might be a good option if you have the following:

- If you have poor or fair credit,

- There are a lot of late payments on your record

- There is a bankruptcy on your record

- Multiple accounts are delinquent on your record

It is usually easier to qualify for second-chance credit cards, and once approved, they can be a helpful tool in rebuilding your credit. Second Chance Credit Card No Security Deposit only require security deposits, even though secured credit cards are the easiest to obtain, no matter your credit level. Read this to get Best Unsecured Credit Cards for Bad Credit with No Deposit.

How to Apply for a Second Chance Credit Card

A second-chance credit card application requires the following information: name, address, phone number, proof of income, Social Security number, and any other information the credit card issuer asks for.

Credit card applications are usually submitted online, and the card issuer will contact you if any additional information is required. Some second-chance credit cards also look at other aspects of your financial situation, so you may need to provide bank statements and pay stubs for approval.

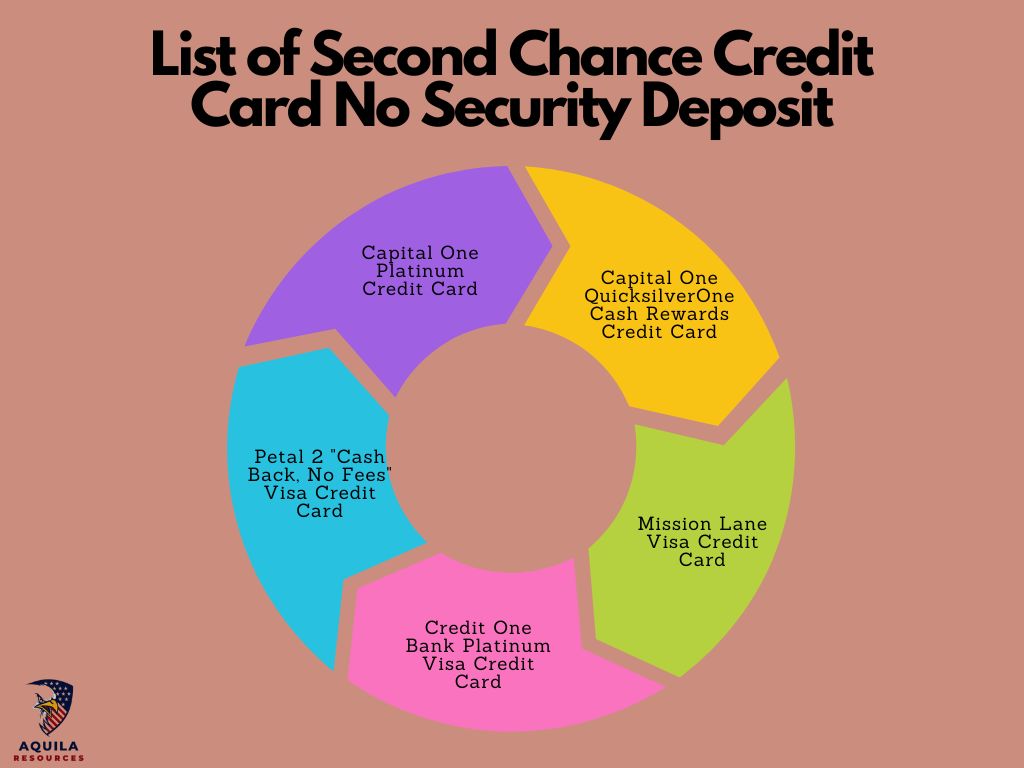

List of Second Chance Credit Card No Security Deposit

The following options are ideal if you need a Second Chance Credit Card No Security Deposit to build credit.

The cards we recommend report your payment history to the three credit reporting bureaus and offer low fees, rewards, and flexible payment options. These are rare in credit cards designed for consumers with bad credit.

Here is the list of List of Second Chance Credit Card No Security Deposit –

- Capital One Platinum Credit Card

- Capital One QuicksilverOne Cash Rewards Credit Card

- Mission Lane Visa Credit Card

- Credit One Bank Platinum Visa Credit Card

- Petal 2 “Cash Back, No Fees” Visa Credit Card

Here is the Details of Second Chance Credit Card No Security Deposit –

Capital One Platinum Credit Card

A credit score of 650 and below would be an ideal candidate for the Platinum Visa from Credit One Bank for Rebuilding Credit. An annual fee of $75 for this unsecured credit card for the first year rises to $99 afterward. Additionally, you can track your progress towards better credit by accessing your score free of charge.

The program offers 1% cash back rewards on eligible gas, grocery, mobile phone, internet, cable, and satellite TV purchases. You should also remember that this card has a variable interest rate of 28.99%, which is a high rate. Your best bet for avoiding APR is to pay your monthly bills in full.

Capital One Platinum Credit Card Features–

| Feature | Details |

| Card | Platinum Visa from Credit One Bank for Rebuilding Credit |

| Eligibility | Credit score of 650 and below |

| Fees | Annual fee of $75 for the first year, then $99 annually. |

| APR | Variable APR of 28.99% |

| Rewards | 1% cash back rewards on eligible gas, grocery, mobile phone, internet, cable, and satellite TV purchases |

| Other benefits | Free credit score access |

Capital One QuicksilverOne Cash Rewards Credit Card

The QuicksilverOne credit card from Capital One is also intended for people with fair credit and does not require a security deposit. The Capital One Platinum card, however, offers unlimited 1.5% cash back every time you make a purchase.

This card has a $39 annual fee, but its cashback rewards and other benefits, such as a free Uber One membership for six months, might make it worth it. Spending $500 monthly will earn you $90 yearly in cashback rewards. Like the Capital One Platinum card, there is a high APR and a $40 late fee.

Capital One QuicksilverOne Cash Rewards Credit Card Features –

| Feature | QuicksilverOne |

| Card | Capital One QuicksilverOne Cash Rewards Credit Card |

| Rewards | Unlimited 1.5% cash back on every purchase |

| Eligibility | Fair credit |

| Fees | Annual fee of $39 |

| APR | Variable APR of 26.49% to 29.99% |

| Late fee | $40 |

| Other benefits | Free Uber One membership for six months |

Mission Lane Visa Credit Card

The Mission Lane Visa Card doesn’t offer any rewards compared to others on this list. The program does offer free credit-building resources and allows you to automatically apply for a larger credit line after as little as seven months. Also, you can find out if you’re prequalified before applying, so you know whether you’re likely to be approved.

It’s important to charge only what you can afford to pay back each month with the Mission Lane Visa since the APR varies from 26.99% to 29.99%. The fee includes an annual fee of $59 and a late fee of $35. There is also a foreign transaction fee of 3%.

Mission Lane Visa Credit Card Features –

| Feature | Details |

| Card | Mission Lane Visa Card |

| Rewards | None |

| Eligibility | Fair credit |

| Fees | Annual fee of $59, late fee of $35, foreign transaction fee of 3% |

| APR | Variable APR of 26.99% to 29.99% |

Credit One Bank Platinum Visa Credit Card

A Platinum Visa From Credit One Bank helps rebuild credit by offering 1% cash back on your everyday purchases, including gas, groceries, internet, cable, and more. Credit One Bank also lets you choose a payment due date that’s convenient for you – and you can change it anytime.

No security deposit is required, but there is an annual fee of $75 for the first year of use. A monthly fee of $8.25 will be charged after that. After that, it will be $99 annually. This card also comes with a high variable APR.

Credit One Bank Platinum Visa Credit Card Features –

| Feature | Details |

| Card | Platinum Visa from Credit One Bank |

| Rewards | 1% cash back on eligible purchases |

| Eligibility | Fair credit |

| Fees | Annual fee of $75 for the first year, then $99 annually. Monthly fee of $8.25. |

| APR | Variable APR of 26.99% to 30.99% |

Petal 2 “Cash Back, No Fees” Visa Credit Card

A Petal 2 Visa credit card issued by WebBank offers higher cashback rates if you make on-time payments. If you make an eligible purchase, you will earn 1% back. The additional 0.5% cash back you can earn after 12 on-time payments will increase your cashback potential to 1.5%. Additionally, select local small businesses and select merchants to offer 2% – 10% cashback.

There are no fees for annual payments, foreign transactions, or late payments with the Petal 2 Visa. If you fail to pay on time, you won’t receive the higher cashback rate. A fair or average credit score is usually enough to qualify for this card — Petal may also consider your financial history in addition to your credit history.

Petal 2 “Cash Back, No Fees” Visa Credit Card Features –

| Feature | Details |

| Card | Petal 2 Visa credit card |

| Issuer | WebBank |

| Cashback rate | 1% on eligible purchases, increasing to 1.5% after 12 on-time payments |

| Additional cashback | 2%-10% at select local small businesses and select merchants |

| Fees | None for annual payments, foreign transactions, or late payments |

| Eligibility | Fair or average credit score |

Eligibility Criteria for Second Chance Credit Card No Security Deposit

The following factors and benefits should be considered before applying for Second Chance Credit Card No Security Deposit.

The following should be done before applying for Second Chance Credit Card No Security Deposit –

1. Verify the requirements and terms of the account.

2. Be aware of your credit score recommendation, which could be low, fair, good, or excellent.

3. Choose a card with a lower credit requirement if you need a second chance.

There may be additional requirements, such as proof of income, in order to qualify.

Video Guide for Second Chance Credit Card No Security Deposit

What to Look for When Applying for Second Chance Credit Card No Security Deposit.

Here’s What we should look for before applying for Second Chance Credit Card No Security Deposit –

Pros and Cons of Second Chance Credit Card With No Security Deposit

Pros

- No Security Deposit Required: No security deposit is required to open an unsecured second-chance credit card.

- Rebuild Credit: Using a second-chance credit card responsibly and making on-time payments can help you rebuild your credit.

Cons

- There are high fees: There are often fees associated with second-chance credit cards, such as annual fees or late payment charges.

- Lower Credit Limits: Second-chance credit cards usually have lower credit limits than traditional credit cards.

- No or Low Rewards: Credit cards for second chances usually earn no rewards or low rewards compared to other credit cards.

How to Make the Most of Second Chance Credit Card No Security Deposit

Ensure you take full advantage of the opportunity to build your credit as soon as you get your card.

There are several things you can do to help –

| Tip | Explanation |

| Maintain a positive payment history |

This is the most important factor in determining your credit score. Pay your bills on time and in full each month to show lenders that you are a responsible borrower. You can set up an automatic payment plan to ensure that your payments are always on time.

|

| Don’t max out your card every month |

Your credit utilization rate is the percentage of your credit limit that you are using. A high credit utilization rate can hurt your credit score. Try to keep your credit utilization below 30%. If you have a high credit utilization rate, you can lower it by making several monthly payments or paying off your balance before the due date.

|

You’ll have the chance to improve your credit over time as you practice these good credit habits, improving your chances of getting a better credit card or a loan with more favorable terms down the road.

How We Picked Second Chance Credit Card No Security Deposit?

It is possible to get a second chance credit card that does not require a security deposit but will charge you various fees, including an annual fee. The interest rate on some cards is high, and you cannot use them everywhere, making it difficult to use them regularly.

The credit cards we selected have good rewards and accessibility features, and we focused on those offering reasonable features. It is, however, important to take the time to investigate multiple options before choosing the best one for you.

Secured credit cards may be easier to qualify for despite their higher interest rates than second-chance cards despite their easier qualification requirements. It may be easier to open a secured card if you need help with an unsecured one.

How Can I Get Approved for a Credit Card with No Money Down?

If you don’t want to put any money down on your credit card, consider an unsecured card. It is important to remember that these cards come with higher interest rates, so be sure to pay off your balance regularly.

What Credit Score Do I Need to Get a Second Chance Credit Card?

A lower credit score is required for most second-chance credit cards. Generally, second-chance credit cards have fewer approval requirements than traditional credit cards since they are a tool for repairing your credit. It is important to note that sometimes these cards have higher fees, interest rates, and other limitations. You can boost your credit score when you pay your balance in full each month and make small purchases with the card.

Which Credit Cards Require Security Deposits?

A security deposit is often required for secured credit cards. The deposit serves as your credit line. This deposit protects you if you cannot pay your credit card bill. Most secured credit card issuers also require a minimum security deposit. It is necessary to pay the minimum for a credit card to be issued, and you may be able to increase your credit limit over time.

Add Comment