Do you want to know how to Pay With eCheck For Online Shopping? Your search ends here.

A credit or debit card is an obvious choice in today’s society. As a result of the rise of PayPal and other digital wallets, checks have mostly disappeared from society. That’s not always the case, though.

Almost everyone associates the word “check” with negative associations. The concept evokes images of slow processing speeds, standing behind someone while they painstakingly write one, and the list goes on.

An e-check is an electronic check that can be used as a form of payment for online purchases. Electronic checks are secure and convenient, just like paper checks. Through this method, individuals and businesses can transfer funds directly from their bank accounts to the seller’s account without using checks or credit cards.

This guide will explain everything you need to know about Pay With eCheck For Online Shopping, what it is, and how it works.

Now, let’s get started.

What is Online Shopping?

Contents

- 1 What is Online Shopping?

- 2 What is A eCheck?

- 3 What is eCheck Payment?

- 4 How Does eCheck Work?

- 5 How Safe Are eChecks?

- 6 eCheck vs ACH: What’s The Difference?

- 7 How To Pay With eCheck For Online Shopping?

- 8 How Long Does An eCheck Take To Clear?

- 9 What Are Other Ways To Deposit An eCheck?

- 10 Benefits of Pay With eCheck For Online Shopping

- 11 How Much Does It Cost To Process An eCheck?

- 12 The Potential Dangers And Drawbacks of eCheck

- 13 Payments Electronic Checks

- 14 FAQs

- 15 Conclusion

An Internet browser searches for goods and services to purchase online or e-shopping. A major appeal of online shopping is that consumers can find and purchase items they need without ever leaving home (which are then shipped to their front door). Today, almost anything can be purchased online, amounting to billions of dollars a year in sales.

What is A eCheck?

eChecks are digital versions of paper checks that enable consumers to pay e-commerce merchants directly from their bank accounts. Just like paying with a debit or credit card, customers can authorize one-time or recurring payments.

In addition to debiting customers’ checking accounts directly, eChecks transfers money directly into online retailers’ bank accounts through payment processors. The ACH network covers Guam, American Samoa, the Northern Mariana Islands, the Virgin Islands, and the United States.

What is eCheck Payment?

Paper checks will likely become obsolete soon for some customers and businesses, despite the fact that some still use them today. The old method of writing and mailing a paper check via snail mail is largely obsolete today, as many people pay all of their bills online. Your money may not be available sooner if you use paper checks since they have a longer hold and processing time.

A paper check can take a long time to clear, so eChecks streamline this process. You won’t have to travel to the bank for frequent deposits with eChecks since you don’t have to physically deposit them.

How Does eCheck Work?

In 2003, President George W. Bush signed into law the Check Clearing for the 21st Century Act, also known as “Check 21.” The federal law greatly expanded the use of electronic check processing by removing legal restrictions that prevented many banks from truncating checks.

The first bank sends the physical check to the second bank involved in the transaction, which also verifies it.

In order to process payments, no matter how much faster eChecks are than traditional checks, the data that needs to be entered remains the same. An electronic check must begin with the customer providing his or her account number, routing information, and authorization.

The acceptance of physical checks is not restricted. However, businesses must enable eCheck payment processing to accept this payment type.

It’s relatively straightforward to break down the eCheck payment process into four steps:

The Authorization

A merchant requires the customer’s consent at this point in order to complete the transaction. A customer can easily approve the transaction with a click of a button through the payment request system of an online payment processor. However, eCheck authorizations can be performed by contract, online form, or even by phone.

The Processing

Payment processors can transfer money between the merchant and the customer as soon as authorization is granted. After authorization, this step is unnecessary because the amount is usually predetermined in the solution. A payment processor that accepts online payments simplifies this process as well. A merchant who does not offer online payment options will have to manually enter the payment and account information into an online form.

The Final Step

Your processor will check the credentials once all the necessary information has been provided. As soon as the Automated Clearing House (ACH) Network has verified the transaction, the money is transferred. The ACH Network is also used to process eChecks; however, the fees and processing methods differ between ACH and eCheck payments.

You should also note that many POS systems can be integrated, allowing your customer’s data to be seamlessly transferred from an app or website to your virtual eCheck terminal without requiring re-entry.

Funds Deposit

After the transaction has been successful, the customer’s money is deposited into the bank account. The eCheck transaction is now complete! Transactions are typically confirmed by sending written or electronic receipts to both parties.

How Safe Are eChecks?

E-check is certainly safer than paper checks since they can’t be physically stolen or lost. What about their safety compared to other electronic payment methods?

Actually, yes. Due to the direct customer authorization, you can tell that the payment is legitimate, reducing the likelihood of a chargeback. Unlike wire transfers, ACH payments allow you to reverse them within five days if there is an error.

The ACH network also encrypts every payment so that details cannot be read without a key. If the transaction is intercepted, hackers are prevented from exploiting your personal information.

A third advantage of eChecks is they are less susceptible to fraud than credit card information, which is why subscription businesses can use them to process recurring payments.

eCheck vs ACH: What’s The Difference?

eChecks are classified as electronic funds transfers (EFTs), like ACH transfers. Wire transfers, PayPal payments, and more are all examples of EFT. ACH transfers and eChecks are not the same as wire transfers and PayPal since both of these are processed through the Automated Clearing House. The processing fee for eChecks and ACHs is less than that for wire transfers because they are processed in batches.

The fees associated with eChecks and ACH transactions are also lower than those associated with credit card payments. Checks may have very low processing fees, but they are only pennies in some cases. The ease of accepting and processing multiple payments each month makes them an attractive option for businesses.

However, you may run into this problem if you use a subscription billing model. Relevantly, consulting the “List of Banks That Accept ACH Transfer” can provide insights into alternative solutions, ensuring smooth transaction processes for your billing requirements.

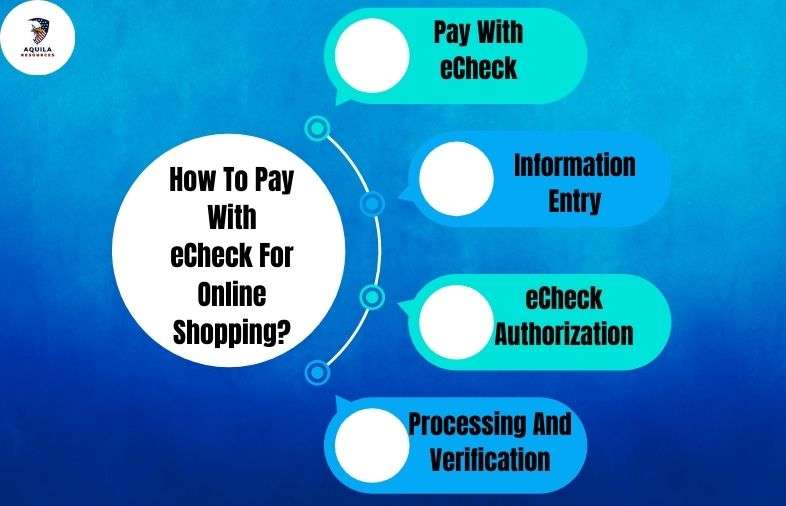

How To Pay With eCheck For Online Shopping?

Pay With eCheck For Online Shopping involves several steps that users typically follow:

Pay With eCheck

The retailer’s website allows users to choose e-checks as a payment method during the checkout process. The option to pay with a credit card or digital wallet is often available alongside this option.

Information Entry

E-checks can be initiated by providing the necessary information after selecting the option. The recipient’s name, the seller’s account number, and the seller’s routing number may be included in this information.

eCheck Authorization

An electronic check payment must be acknowledged by providing consent, usually via a digital signature or checking a box. A user should be aware of and agree to the transfer of funds from their account by this step.

Processing And Verification

The financial institutions involved in e-check transactions verify and process the transactions upon authorization. A traditional check is used to debit the buyer’s account and credit the seller’s account.

How Long Does An eCheck Take To Clear?

A bank representative can provide you with a precise timeline for how long it will take for eCheck payments to clear and be deposited into your account. It may take some banks a day or two to process the payment, while others can process it the same day. You’ll have to decide whether you can wait a day or two before processing payment or if you need it immediately.

Besides the higher processing fee, one advantage of eCheck payments is that checking account info does not change as often as credit card info. Your business’s overall revenue will increase by reducing the chances of a payment not going through.

What Are Other Ways To Deposit An eCheck?

A company’s bank account can be automatically credited with an eCheck after following the above procedure. To deposit an eCheck, you can also follow the steps below:

- Follow the instructions provided when you receive an eCheck notification to retrieve it.

- Once retrieved, the eCheck can be printed out. Like digital tickets for concerts, flights, or other events, an eCheck can also be printed as a physical copy.

- When you use the physical version of your electronic check, you can deposit it like a standard check. It only takes a few minutes to deposit the check.

Benefits of Pay With eCheck For Online Shopping

The adoption of eChecks can provide significant benefits to both businesses and customers. These benefits include:

- Payments such as mortgages, rent, or insurance premiums can be sent or received more cost-effectively with an eCheck than with a credit card transaction.

- EChecks also offers the advantage of speedy delivery to your business bank account. There is usually a day or two delay before the funds are available.

- A company’s eCheck is directly deposited into its bank account, not into a merchant’s account. Electronic checks, however, allow you to use the money right away since it is sent directly to your business bank account. Your company’s bank account receives credit and debit card payments, which are held in your merchant account until settlement. You might experience a disruption in your company’s cash flow due to these funds not being available immediately.

- eChecks can be processed without a merchant account. Those who are having difficulty getting merchant accounts may find this particularly useful. Businesses with high-risk exposure often apply for merchant accounts, but traditional banks generally reject them to reduce their risk exposure. It is virtually always considered high risk when determining a company’s risk level by Mastercard’s MATCH list and may benefit from eCheck processing, even though there are many factors to consider.

- An eCheck can be used to pay an unlimited amount. Credit and debit card transactions and daily spending limits may apply to credit and debit cards, but eChecks are only limited by the amount in the customer’s checking account. A company that sells expensive products or services might benefit from offering electronic check payment options.

- Increase the number of sales. Internet merchants are most likely to accept electronic checks as an alternative payment method. The checkout page of 30% of eCommerce websites already accepts electronic checks.

- Over 95% of households in the US have bank accounts and can send electronic checks to you.

- Save sales that would otherwise be lost. You can also accept electronic checks if your credit card is declined.

- Your customers’ bank accounts are debited automatically when you send electronic checks. Pay on time, and don’t wait for a check to arrive in the mail.

- E-checks increase sales and income by increasing customer payment options.

- Buyers are expected to be able to pay in multiple ways at checkout. E-checks are already a familiar payment method for most Americans, who use them to pay their household and utility bills.

- Having electronic checks available at the checkout gives your business an edge over competitors. You don’t want to risk losing a sale unnecessarily.

- Electronic checks virtually eliminate the need to prepare and mail invoices for customers. They can also reduce accounts receivable management costs, bank fees, and administrative costs.

How Much Does It Cost To Process An eCheck?

A flat fee is usually associated with eCheck payments, typically around 1%. If you’re assessed a flat fee, you’ll typically pay between $0.25 and $1.50 per check. It is typically more affordable to use an eCheck than any other payment option. A business with a high level of risk may incur higher prices.

There is a common trap traders fall into when they focus just on rates and ignore other significant costs. The following additional expenses should be taken into consideration:

- Monthly fee

- ACH return fee

- Setup fee

- Payment gateway fee

- Chargeback fee

- Monthly minimum fee

- Expedited processing fee

- Batch fee

- Refundable deposit

- Equipment fee

- Check verification

- High ticket surcharge

- Check guarantee

The Potential Dangers And Drawbacks of eCheck

People may encounter some drawbacks to accepting eChecks despite their numerous advantages, including:

Payment Method Slower

The process of getting customer authorization for an eCheck can be more difficult and time-consuming than accepting debit or credit cards. The money may not appear in an online retailer’s bank account for three to five days after they deposit an eCheck. In contrast, money transferred via online payment services is usually available within minutes, such as with Venmo and PayPal. However, the process of processing eChecks is faster than that of processing paper checks.

Weekends And Holidays Are Not Processed

Weekends and holidays are not suitable for processing eChecks because they are dependent upon ACH processing. Merchants who deposit eChecks on the Friday before Monday bank holidays may need to wait a week for the money to appear in their bank account. It may take until Thursday for a business to see funds from an eCheck deposited on Monday.

Transaction Limits

ACH transactions are frequently limited by banks, and some banks also impose transaction limits on specific transactions. Identifying whether banks support the types of transfers that organizations need to make can help organizations operate more efficiently.

eChecks Can Bounce

Various factors can cause an eCheck to bounce for a customer. The bank account number or routing number may be incorrect, or the customer may not have sufficient funds.

It can take a long time to deal with an eCheck that bounces. Further, merchants may be hit with chargeback fees or may not even receive payment for their goods and services.

Online merchants can mitigate bounced checks by using a check verification service to ensure that the customer has an accurate routing number and an active bank account.

Payments Electronic Checks

An eCheck payment processor can accept an eCheck for any products or services your business sells. Your client will pay with an eCheck if he/she opts to do so. Credit cards have become the most popular means of payment in the modern world. Your customers like to pay with credit and debit cards, so you can discover that most of them do so.

It’s important to note that merchants regularly utilize eCheck processing when ticket sizes exceed standard sizes. In the case of a wholesale supplier who cannot process a $30k transaction with their credit card processor, eCheck might be a viable alternative.

The ability to accept electronic checks may allow your customers to pay you in more ways. There will still be some transactions in which you might profit, even if only a small percentage of your clients use eChecks for payment.

FAQs

How Safe Is an eCheck Compared to a Credit Card?

The use of an eCheck is safer and more secure than using a debit card. Since eChecks feature authentication, encryption, duplicate detection, and digital signatures, they are highly secure. The features of eChecks make them less likely to be compromised than paper checks or debit cards. The reason for this is that when you pay, you must have a credit card or debit card on hand.

How Long Do eChecks Take To Process?

The processing of an eCheck usually takes three to five business days. When you pay on a Friday, your payment won’t be processed until after the weekend. The order is expected to be processed by Wednesday at the latest.

What is The Time it Takes For An eCheck Payment To Clear?

An eCheck payment should clear within three to five days if there are no issues with available funds or customer verification. The processing time for international eChecks can take as long as ten business days.

How Do I Pay Online With eCheck?

As soon as that has been confirmed, you can pay with eCheck: The payee sends you an online form to complete. The amount of your payment, as well as your checking account number and routing number, are entered. Your checking account will be withdrawn from your checking account once you click “Submit.”

Can I Use PayPal As An eCheck?

EChecks are used when you pay for services or goods using your bank account directly through PayPal. You should keep in mind, however, that eChecks via PayPal can take longer than usual to process.

Do Banks Send eChecks?

The answer is usually yes, but you may have to sign up for it as an add-on service, which may not be available in every country. Online shopping can be made easier with PayPal, one of the most common payment methods used by customers.

Conclusion

When you pay with eCheck for online shopping, you can be sure that your information is secure and convenient. Businesses and individuals can electronically transfer funds from their bank accounts using e-checks, improving their financial control and eliminating the need for physical checks or credit cards. Various industries have turned to e-checks as a convenient, cost-effective, and secure method of conducting online transactions.

Add Comment