Are you looking for Best Business Credit Card for Startup or Small Businesses? If Yes, You are at the right place.

In this article, we are sharing all the information about Best Business Credit Card for Startup or Small Businesses.

The majority of businesses around the world use credit cards to make business payments. As an alternative to cash payments, credit cards also help businesses save money and resources by offering several features, perks, and benefits.

There are many benefits associated with credit cards that can be invaluable for small businesses and startups, in particular. The best business credit card for startup companies can be difficult to find, with many options available in the market. Choosing the right credit card for your small business startup requires careful consideration of your options.

Getting enough funds to cover your expenses is one of the challenges of starting a business. Credit cards for businesses make paying bills easier and allow startups to earn rewards on expenses incurred by their businesses. Using credit cards can also build good credit scores for your business. Founders can start a business even if they have limited business experience.

A sole proprietor can obtain a business credit cards using their Social Security number, even if they have no history of generating substantial revenue. It is important to have the right credit card to support and inspire your startup, regardless of whether you are looking for low-interest rates, cashback rewards, or other perks.

How To Get a Business Credit Card for Startup?

Contents

- 1 How To Get a Business Credit Card for Startup?

- 2 Top 5 Best Business Credit Card for Startup

- 3 How Do Startup Qualify for Business Credit Cards?

- 4 Pros and Cons of a Business Credit Card for Startup

- 5 Importance of Business Credit Card for Startup

- 6 Choosing Business Credit Card for Startup or Small Businesses

- 7 Why Small Business Owners Should Get a Business Credit Card for Startup

- 8 How To Make the Most of Your Business Credit Card for Startup?

- 9 FAQs

Small business credit cards can be difficult to obtain without adequate personal credit for many startups. Most business credit cards require a personal guarantee, which means you will be personally responsible for any debt incurred using the card. If your company becomes insolvent and cannot pay its credit card bills, the legal protections of most company structures will not protect your finances.

When your business is just starting, it may be relatively easy to apply for a business credit card, as long as your credit is in good standing and you have an income to demonstrate you can pay your bills. It may still be possible to qualify for financing without a solid income to assure lenders that a borrower can repay a loan. Still, extra information, such as a projected revenue forecast, may be required.

Business credit cards require a personal guarantee, but you can typically apply online via the issuer’s website if willing to provide one. Several credit cards don’t require personal guarantees or Social Security Numbers, but they are harder to find and may require deposits.

Top 5 Best Business Credit Card for Startup

Start-up credit cards should provide high credit limits, cashback rewards, balance transfers, and travel benefits. The right business credit card will enable you to run your business efficiently and earn rewarding rewards simultaneously.

Here are the list of Top 5 Best Business Credit Card for Startup –

The Blue Business Plus Credit Card from American Express

The Blue Business Plus Credit Card is an excellent option for startups looking to earn rewards without paying a high annual fee. With this card, you earn two American Express Membership Rewards points for every dollar you spend up to $50k a year. You can also transfer 15k Amex points to 20 partners as a welcome bonus.

Depending on your credit score, the card offers 0% APR for the first 12 months.

- Welcome Offer: 15k points

- Annual Fee: $0

- Recommended Credit Score: Good-Excellent

Pros & Cons of Blue Business Plus Credit Card from American Express

Pros:

- Several Transfer Partners

- Earn a Flat Rate on All Purchases

- Offers a Generous Welcome

Cons:

- There are Foreign Transaction Fees

- The Bonus Earning Cap is $50k

Bank of America Business Advantage Travel Rewards World Mastercard Credit Card

Bank of America’s Small Business Credit Card is an excellent choice for companies looking for growth.

You can earn 30k bonus points by spending $3k in the first 90 days after you open the card. You can redeem these points toward travel or dining purchases worth up to $300. In addition, you will earn 1.5 points for every dollar spent on all other purchases. You can earn as many points as you want; the points don’t expire.

- Welcome Offer: 30k points

- Annual Fee: $0

- Recommended Credit Score: Excellent (800 and up)

Pros & Cons of Bank of America Business Advantage Travel Rewards World Mastercard Credit Card

Pros:

- The First Nine Billing Cycles are at 0% APR

- There are No Foreign Transaction Fees

- You Can Earn up to 75% More Points If You have a Business Checking Account

Cons:

- The Majority of Benefits Relate to Travel

- The Introductory APR Period is Short

Chase Ink Business Unlimited Credit Card

Ink Business Unlimited Credit Cards offer no annual fees and unlimited 1.5% cashback rewards, which is ideal for new business owners. Additionally, you can get $900 back when you spend $6k in the first three months after opening a new account.

Ink Business Cardholders can transfer their cashback rewards to Chase Ultimate Rewards, potentially doubling their overall redemption value.

- Welcome Offer: $750

- Annual Fee: $0

- Recommended Credit Score: Good-Excellent

Pros & Cons of Chase Ink Business Unlimited Credit Card

Pros:

- Earn Unlimited Cash Back

- APR of 0% for 12 Months on New Purchases

- Spending Rate for Sign-Up Bonus is Low

Cons:

- There are Foreign Transaction Fees

- Purchases and Travel Costs are Not Protected

- There are no Bonus Categories

Capital One Spark 1% Classic for Business

A business owner with less-than-perfect credit would benefit from this card. Earn cash back on all purchases without paying an annual fee while building your credit score.

It is a matter of paying off your balance in full every month so you won’t face high APR charges. There are no category restrictions on cash back. Cashback is available on every purchase, regardless of the category. Employees are also eligible for free cards. The rewards do not expire, and the cashback can be redeemed anytime.

There will be expenses for every new business, but obtaining a credit card cannot be easy when your credit is just fair. The Capital One Spark 1% Classic* is ideal for those with credit scores. Additionally, you’ll receive 1% cash back.

- Welcome Bonus: N/A

- Annual Fee: $0

- Credit Score: Good (670-739), Fair (580-669), Limited (579 and below)

Pros & Cons of Capital One Spark 1% Classic for Business

Pros:

- There is No Foreign Transaction Fee

- Tools to Manage Business Spending

- Credit Scores of Fair, Average, or Limited may Qualify

Cons:

- There is No Welcome Bonus

- There are no Bonus Reward Categories

- There is No-Intro to APR

Chase Ink Business Cash Credit Card

Chase Ink Business Cash Credit Card ranks among the best in the market for welcome bonuses. You can earn $900 cash back after making $6,000 purchases within the first 3 months of your new account. Those purchases would have cost your business 12.5% extra in cash back.

A bonus rewards program for office supply stores and internet, cable, and phone service providers is also a great option for small businesses making regular purchases from these providers.

The Ink Business Cash card offers a 0% intro APR on new purchases for the first 12 months, after which the APR is 18.49% – 24.49% variable. There are also no-cost employee cards and purchase protection, extended warranty protection, travel protection, and extended warranty protection.

- Welcome Offer: $750

- Annual Fee: $0

- Recommended Credit Score: Good-Excellent (670-800)

Pros & Cons of Chase Ink Business Cash Credit Card

Pros:

- Among the bonus-earning categories are office supplies, internet, phone, and cable services

- On purchases of $25k or more at gas stations and restaurants, you can get 2% cash back

- All other purchases earn 1% cash back

- Compatibility with Chase Ultimate Rewards

Cons:

- Cap on bonus earnings ($50k per year)

- There are foreign transaction fees

- The Chase 5/24 rule applies

How Do Startup Qualify for Business Credit Cards?

The application process for business credit cards should be fine for well-funded startups, and startups seeking operating capital should not use a credit card – other financial products offer much better rates than business credit cards. A business credit card still offers convenience and protections that can be useful to startups, and although the entry barrier to getting one may be higher, it’s not impossible.

To qualify for small business credit cards, startups provide their owners’ guarantees. This assures that regardless of future business success, the owner will remain responsible for repaying the debt. The chances of approved business credit cards are better for borrowers with good personal credit since a credit card’s guarantee is based on creditworthiness.

Pros and Cons of a Business Credit Card for Startup

Business credit cards allow you to keep business expenses separate from personal expenses and streamline bookkeeping. The rewards on these cards are particularly generous for business expenses and higher welcome bonuses.

Higher minimum spending requirements with business card welcome bonuses are also possible. You may still be asked for your credit report when applying for a business credit card.

Pros

- Separates expenses for business and personal use

- Popular business purchases earn bonus rewards

- Offers with a larger welcome bonus

- Manage spending and add employee cards easily

Cons

- The minimum spending requirements to earn an introduction bonus are usually higher

- The hard pull of your credit report (usually)

Importance of Business Credit Card for Startup

Convenience

Business credit cards are a much more convenient payment method than checks or cash. Using credit cards, you won’t have to carry chequebooks or cash. A business credit card also makes controlling expenses much easier.

Greater Flexibility

You can greatly improve your spending flexibility with an available business credit card. The credit line offered by your business credit card can be used in emergencies when you are out of cash and must make a payment.

Build Company Credit

You can build a good credit score for your business the more you use a credit card and repay the credit you have accessed. Your credit score will be very helpful if you need to apply for any loans or funding in the future.

Separate Personal and Business Finance

A dedicated business credit card makes keeping your finances separate from your business finances easier. Consolidating all your business expenses for tax calculation becomes particularly important during tax season.

Capital Access Increased

Business credit cards also increase a business’s access to capital by offering them a credit line. As long as businesses have a balance of debt and equity, they can always access debt financing. Business credit cards allow businesses to access debt financing more easily and efficiently.

Improved Cash Flow Management

Credit cards can be a useful tool for managing cash flows in a business. You can log and record your payments instantly when you use business credit cards. Using this information, you can track your organization’s outgoing funds in real time.

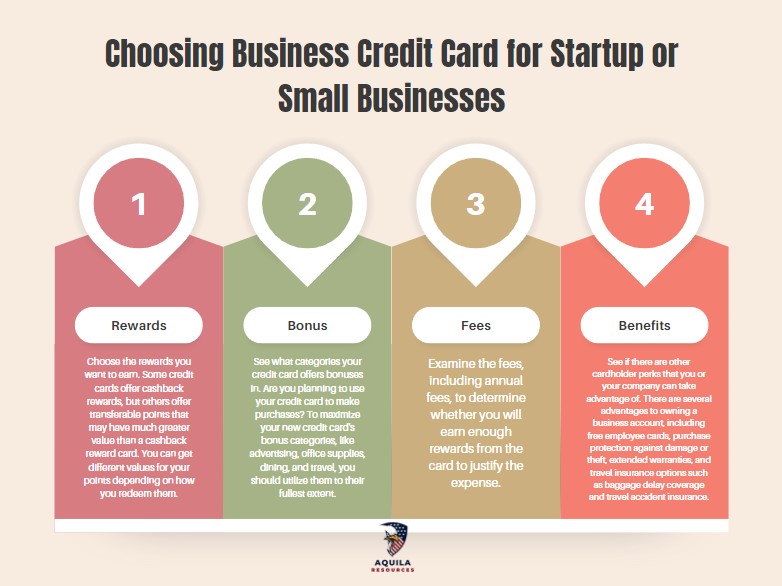

Choosing Business Credit Card for Startup or Small Businesses

When it comes to earning rewards for business purchases, there are a lot of credit cards to choose from, but some cards are more beneficial than others.

Here are some questions you should think about before Choosing Business Credit Card for Startup or Small Businesses –

- Rewards: Choose the rewards you want to earn. Some credit cards offer cashback rewards, but others offer transferable points that may have much greater value than a cashback reward card. You can get different values for your points depending on how you redeem them.

- Bonus: See what categories your credit card offers bonuses in. Are you planning to use your credit card to make purchases? To maximize your new credit card’s bonus categories, like advertising, office supplies, dining, and travel, you should utilize them to their fullest extent.

- Fees: Examine the fees, including annual fees, to determine whether you will earn enough rewards from the card to justify the expense.

- Benefits: See if there are other cardholder perks that you or your company can take advantage of. There are several advantages to owning a business account, including free employee cards, purchase protection against damage or theft, extended warranties, and travel insurance options such as baggage delay coverage and travel accident insurance.

Why Small Business Owners Should Get a Business Credit Card for Startup

For several reasons, using a small business credit card can make sense for small business owners. The requirement that business transactions be made with a separate credit card is essential for bookkeeping. Many business credit cards offer free employee cards with customizable spending limits.

Small business cards can help you run your business efficiently and reward you for your efforts. You can earn bonus rewards, miles or points for everything from internet services to online advertising with the top business cards. These cards also often have other benefits, such as credit for software expenses or insurance for travel-related expenditures.

How To Make the Most of Your Business Credit Card for Startup?

Business credit cards provide convenience and rewards but offer several other useful features to help you handle your business finances.

- Earn Rewards: If your business purchases anything, you should apply for a business credit card with bonus rewards. Using a credit card that earns rewards on gas only makes sense if your business doesn’t involve any form of transportation. Still, you can earn rewards on your spending on office supplies with a business credit card that offers high cashback rewards.

- Don’t Mix Business and Pleasure: Personal purchases should be made with other forms of payment, and personal credit cards should not be used for business purchases. A business credit card can help separate business and personal finances if doubts exist about your business’ legitimacy and independence.

- Benefits: Benefit from your business credit card to the fullest extent possible. The extended warranty benefits offered by your business credit card may allow you to save thousands on repair and replacement costs if you use the card to purchase new equipment.

- Intro APR Offers: A small business credit card also offers the opportunity to finance large purchases without paying interest during the length of the offer. However, if you plan to pay down balances before the introductory APR period ends, you should ensure that you are prepared. Interest begins to accrue immediately once the introductory period ends.

- Employee Cards: Credit cards for small businesses often offer employee cards at no additional charge. Your business’ credit card spending can be rewarded through these employee cards so that you can maximize your rewards.

FAQs

How Can I Finance a Business Startup with a Credit Card?

If you are starting a business, we don’t recommend using a credit card for financing. A 0% introductory APR may be useful for existing businesses with regular cash flow to fund equipment or supplies purchases. However, unproven businesses should not rely on credit cards for funding—instead, they should apply for business operating loans or other forms of credit with lower interest rates.

Can You Get a Business Credit Card with Your EIN?

A corporate credit card can only be obtained by incorporated businesses generating large amounts of revenue, so you probably can’t get a business credit card with only your EIN. You must provide your Social Security number to qualify for most business credit cards.

Can I Use a Business Credit Card for Personal Expenses?

Several reasons lead to the opinion that mixing business expenses could be better. To start, you’ll have more work to do regarding your taxes. Additionally, your consumer protections on your credit card may not apply to your business credit card.

The more personal expenses you put on your business card, the sooner you reach your credit limit, which can hurt your credit score. A business credit card for personal expenses would also violate your cardholder agreement.

Can a Newly Formed LLC Get a Business Credit Card?

Most new businesses, including LLCs, can apply for business credit cards for LLC if the owner has strong personal credit. The LLC owner will, however, likely still need to sign a personal guarantee to qualify – so if your business cannot pay its creditors, you’ll be liable.

Add Comment